FameEX Weekly Market Trend | May 13, 2024

2024-05-14 07:15:05

1. BTC Market Trend

From May 9 to May 12, the BTC price swung from $60,235.31 to $63,450.21, a 5.34% range. Cardano founder Charles Hoskinson released a video on the X platform accusing Biden of harming the US cryptocurrency industry. In recent years, the Biden administration has restricted access to bank accounts, tightened regulatory oversight by the Securities and Exchange Commission (SEC), and recently implemented regulatory policies that obstruct legislative processes related to cryptocurrency. On May 11, Trump declared his support for cryptocurrencies, criticizing the Biden administration. If Trump were to win the presidential election this year, market expectations would likely drive this bull market cycle and Bitcoin prices to continue rising. On May 10, the EU considered incorporating cryptocurrencies into a €12 trillion investment market, a move whose impact could surpass that of US ETFs.

On May 13, CME’s “FedWatch” revealed that the probability of the Fed maintaining interest rates in June is 96.5%, with only a 3.5% chance of a 25 basis point cut. Looking ahead to August, the likelihood of unchanged rates is 74.6%, with a 24.6% chance of a cumulative 25 basis point cut and only 0.8% probability of a cumulative 50 basis point cut.

In summary, considering the annual timeframe as the unit for long-term investment, coupled with the upcoming launch of a US Ethereum ETF, potential rate cuts in the US, and a potential Trump victory, this cryptocurrency bull market is likely to continue into next year. What sets this bull run apart is the substantial influx of new funds into the crypto market (including US and Hong Kong Bitcoin ETFs, as well as the upcoming US Ethereum ETF and European investment market funds). The key factor driving BTC’s continuous rise is the sustained influx of incremental funds, as BTC’s price and the required incremental capital have a nonlinear relationship. This is the fundamental logic behind BTC’s spot price in this bull market not being capped at $73,718.41.

Viewing the medium-term investment horizon from monthly to yearly, the months of March, April, and May represent the mid-term oscillation phase of the bull market. Short-term investment refers to holding and related transactions within a week to a month, while the market analysis report provided here falls into the category of ultra-short-term investment services. Ultra-short-term trading is highly challenging due to its inherent volatility, underscoring FameEX’s commitment to providing top-notch service to its clients backed by solid research capabilities.

From May 9 to May 12, according to the daily chart, BTC spot prices displayed minimal volatility as predicted last Thursday. It’s unlikely that significant fluctuations will occur on May 13 and May 14. However, the release of US economic data on Wednesday, May 15—including April’s non-seasonally adjusted CPI, April’s seasonally adjusted CPI, April’s non-seasonally adjusted core CPI, and April’s core CPI—could lead to market movements if results deviate significantly from expectations. Crafting corresponding ultra-short-term trading strategies and managing positions accordingly is advised.

Mike McGlone, a Bloomberg Intelligence strategist, stated a decline in the Bitcoin/gold cross index compared to the S&P 500. Following a record influx of funds into US spot Bitcoin ETFs in January, the subsequent decrease in fund inflows might impact risk assets. While benchmark cryptocurrencies hit highs in the first quarter of this year, Bitcoin has yet to surpass its peak compared to gold and the S&P 500 in 2021.

Technical analysis suggests a high probability of BTC spot prices declining to around $54,000 in May or June, with buy orders at $52,800 still advisable. Those with moderate positions might consider placing short-term bottom-fishing buy orders at around $54,050 and $50,100. If market panic ensues, prices could potentially drop below $50,000. Subsequently, BTC spot positions acquired below $61,550 can be gradually sold with limit orders at $77,500, $72,500, and $67,200. Following the release of US economic data on Wednesday, if the cryptocurrency market surges, those who bought below $61,550 could secure at least a 9.18% (67200/61550-1) profit. Even in the event of minor or continued narrow-range consolidation, maintaining a relaxed mindset is key, as significant market movements will gradually realize profits from our buy and sell orders.

The Bitcoin Ahr999 index of 1.2 is below the DCA level ($66,140) but over the buy-the-dip level ($40,500). Therefore, it may be a good time to put the dollar-cost average into mainstream cryptocurrencies.

2. Perpetual Futures

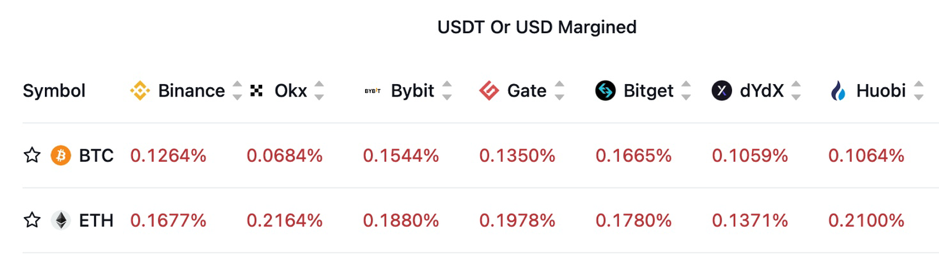

In general, the 7-day cumulative funding rates for the popular coins across major exchanges are positive, indicating that long leverages are relatively high.

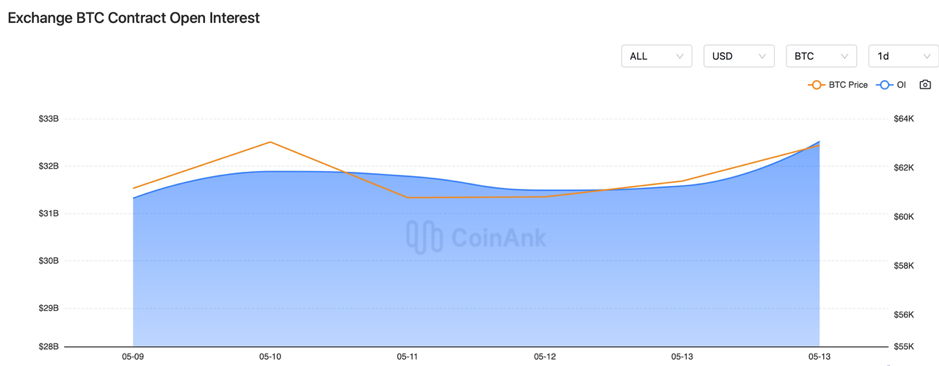

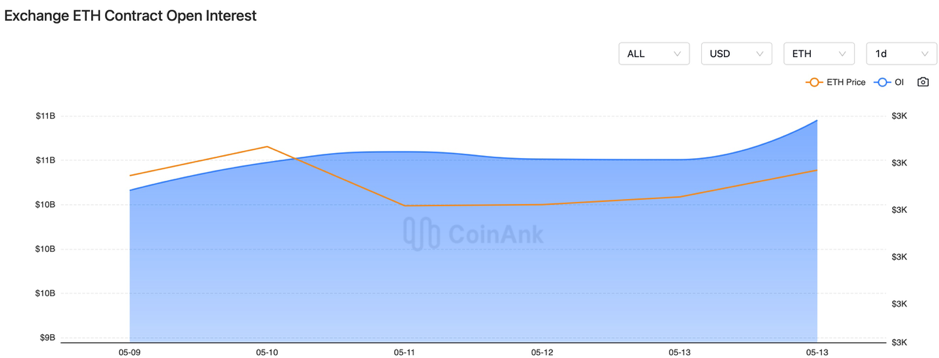

In the recent period, a slow climb has occurred in both BTC contract open interest.

Exchange BTC Contract Open Interest:

Exchange ETH Contract Open Interest:

Note: All the above information is provided for reference purposes only and should not be construed as specific investment advice.

3. Industry Roundup

1) On May 9, a US SEC commissioner stated that there are significant disagreements within the leadership regarding cryptocurrency regulation.

2) On May 9, Collins, a Fed official, suggested that achieving the 2% inflation target may require an economic slowdown, and prolonging rate stability could slow economic growth.

3) On May 10, European Central Bank meeting minutes hinted at potential monetary policy easing in June if additional evidence confirms mid-term inflation prospects included in March forecasts.

4) On May 10, the cryptocurrency trading volume in April dropped to $6.58 trillion, marking the first decline in seven months.

5) On May 10, the EU was reported to consider integrating cryptocurrencies into a €12 trillion investment market, potentially surpassing the impact of US ETFs.

6) On May 10, data showed most cryptocurrency market indicators declined in April, with on-chain total transaction volume dropping by 30.5%.

7) On May 10, ECB Vice President Guindos anticipated inflation to return to the ECB’s 2% target by mid-2025, with future rate cuts depending on wage changes and financial market reactions.

8) On May 10, South Korea’s Bitcoin “kimchi premium” steadily decreased since mid-April, currently at 1.54%, down from its March peak of 11.44%.

9) On May 10, Cardano’s founder accused the Biden administration of stifling the US cryptocurrency industry through various regulatory measures, citing actions such as restricting bank account access, bolstering SEC regulatory efforts, and recent regulatory policies hindering cryptocurrency-related legislative processes.

10) On May 10, Mastercard, Visa, JPMorgan, and other financial institutions explored tokenized asset settlements.

11) On May 10, JPMorgan suggested that if the SEC rejects a spot Ethereum ETF, it may face legal challenges and ultimately lose.

12) On May 11, Fed officials conveyed the following views: Bosstick still believed the Fed would lower interest rates this year; Bauman emphasized the need for maintaining policy stability for a longer period; Logan suggested it’s premature to consider rate cuts now; Kashkari noted that the threshold for raising rates again is high but not ruled out; and Goolsbee stated that given rising inflation, it is necessary to wait and observe policy conditions.

13) On May 11, Bloomberg analysts predicted the SEC might reject Ethereum spot ETF applications on May 23.

14) On May 11, Trump voiced support for cryptocurrencies and criticized the Biden administration.

15) On May 12, Solana’s on-chain DEX recorded a trading volume of $9.533 billion over the past 7 days, ranking first with a 7-day increase of 26.26%.

16) On May 12, it was expected that APT, STRK, AEVO, and ARB would unlock next week.

Disclaimer: FameEX makes no representations on the accuracy or suitability of any official statements made by the exchange regarding the data in this area or any related financial advice.