FameEX Weekly Market Trend | July 11, 2024

2024-07-11 19:27:40

1. BTC Market Trend

From July 8 to 10, the BTC spot price swung from $54,260.34 to $59,351.05, a 9.38% range. Recently, significant statements from the Federal Reserve (Fed) and the European Central Bank (ECB) included:

1) On July 10, Fed Chair Jerome Powell stated that the labor market has fully rebalanced and inflation is not the only risk they face. Significant labor market weakening could justify a rate cut. He noted current policy is restrictive and U.S. debt is unsustainable. The Fed aims to gain more confidence in inflation and will avoid signaling any timing for rate cuts. He noted that the Fed does not need inflation below 2% to consider rate cuts. While inflation has decreased, prices remain high, making very low interest rates unlikely.

2) On July 9, ECB Governing Council member Klaas Knot stated that there would be no rate cut in July, but a rate cut might be considered in September.

3) On July 10, ECB Executive Board member Fabio Panetta emphasized that there should not be excessive concern over inflation in the services sector and wage growth. He reiterated that recent data and forecasts support a gradual reduction in borrowing costs.

HashKey Capital June Report included the following:

1. The total market cap of the crypto market dropped by 7% due to negative news and a lack of catalysts. However, the adjusted total value locked (TVL) increased by 6.7%, surpassing the market cap decline.

2. Active wallet numbers for Bitcoin and Ethereum rose by 26% and 34%, respectively, with over one million users now holding at least one Bitcoin.

3. Activities on L2 and L3 networks significantly increased, and Bitcoin’s trading range in June was between $60,000 and $64,000.

4. Despite declining centralized exchange (CEX) volumes, decentralized exchanges (DEX) had their best performance in three months. Overall, despite the weak market performance in June, several positive indicators show a stable crypto market foundation and potential for future growth.

The German Federal Criminal Police (BKA) has recently begun transferring thousands of Bitcoins from its custody wallet to various cryptocurrency exchanges, indicating an intention to sell these Bitcoins. The wallet’s Bitcoin holdings have reduced to 23,788 coins. Lennart Ante, co-founder and CEO of Blockchain Research Lab, noted that the sale by German law enforcement is not an investment strategy but a standard procedure for disposing of seized assets in criminal investigations. Additionally, analysis revealed that the sale was not conducted by the German government itself but by the state of Saxony in eastern Germany. The Saxony Attorney General’s Office is responsible for liquidating seized assets, and this sale aligns with routine procedures, albeit on a larger scale than usual. Typically, assets seized can only be transferred or sold with a judge’s approval, and proceeds go into the state budget. In this case, while this procedure doesn’t require judicial approval, states can request emergency sales, especially when assets risk rapid depreciation or storage challenges.

According to the CME FedWatch Tool, the market expects the Fed to initiate its first rate cut in September, followed by another cut in December. By the end of 2025, the Fed’s benchmark rate is expected to be between 3.75% and 4%, with 28% of market participants anticipating a range of 3.25% to 3.75%. The current U.S. federal benchmark rate is 5.25% to 5.5%.

According to The Block, the Republican National Committee in its 2024 U.S. election platform supports multiple crypto policy measures beneficial to digital asset companies and holders. As per an official document released by Donald Trump’s campaign team on Monday, the Republican agenda titled “Make America Great Again” pledges to end what it describes as “illegal and un-American crackdowns” on the U.S. crypto industry. The agenda also promises to “defend Bitcoin mining rights”, allows cryptocurrency holders to self-custody their tokens, and opposes the creation of a central bank digital currency (CBDC). The document states, “We will defend the right to transact freely without government surveillance and control.”

The 2024 U.S. presidential election is scheduled for Tuesday, November 5, 2024, it will also include the election of all 435 House seats and 33 Senate seats to form the 119th United States Congress.

Matthew Sigel, Head of Digital Asset Research at VanEck, stated that over $6 trillion in inheritance might flow into cryptocurrencies over the next 20 years. A study by Bank of America predicts that by 2045, Gen X, Millennials, and future generations will inherit $84 trillion from older generations and Baby Boomers. To achieve the influx of $6 trillion into crypto, young American investors aged 21-43 would need to inherit $42 trillion from the Baby Boomers and allocate 14% of their funds annually towards crypto investments.

The study indicates that young, aggressive investors in this age group allocate 14% of their funds to cryptocurrencies, compared to 12% and 17% allocated by conservative investors of the same age range. Bank of America emphasizes that “the most conservative group holds the highest average exposure to cryptocurrencies”. In contrast, investors aged 44 or above have minimal crypto allocations in their portfolios. The research also found that 28% of investors aged 21-43 believe cryptocurrencies offer the greatest growth opportunities.

This finding indicates that cryptocurrency investment ranks as the second most popular investment among young investors, just behind real estate and private equity, favored by 31% and 26% of young investors, respectively. In contrast, only 4% of investors aged 44 or above believe cryptocurrencies offer the most growth opportunities, ranking it second. Bank of America notes that the differences between young and older investors regarding cryptocurrency or private investments “go beyond allocation”, highlighting fundamental shifts in investment preferences.

The study highlights that 72% of young investors believe traditional stocks and bonds no longer offer above-average returns, compared to only 28% of older investors. Bank of America suggests that young investors’ interest in crypto may be linked to its inherent uncertainty.

The Nasdaq Composite Index in the US stock market has hit consecutive all-time highs for 7 days, while the correlation between cryptocurrency and gold prices has weakened over the past 30 days. From July 11 to July 14, if the daily candlesticks for BTC continue to be heavily influenced by the overall trend of global asset classes, there is a slightly higher probability of a continued minor uptrend for a few more days. As for ETH, the sell orders at $4,700 and buy orders at $2,500, along with the BTC sell orders at $72,500 and $77,500, and buy orders at $42,950, do not need to be canceled; it is advisable to remain cautious and observe the market.

2. CMC 7D Statistics Indicators

Overall market cap analysis, source: https://coinmarketcap.com/charts/

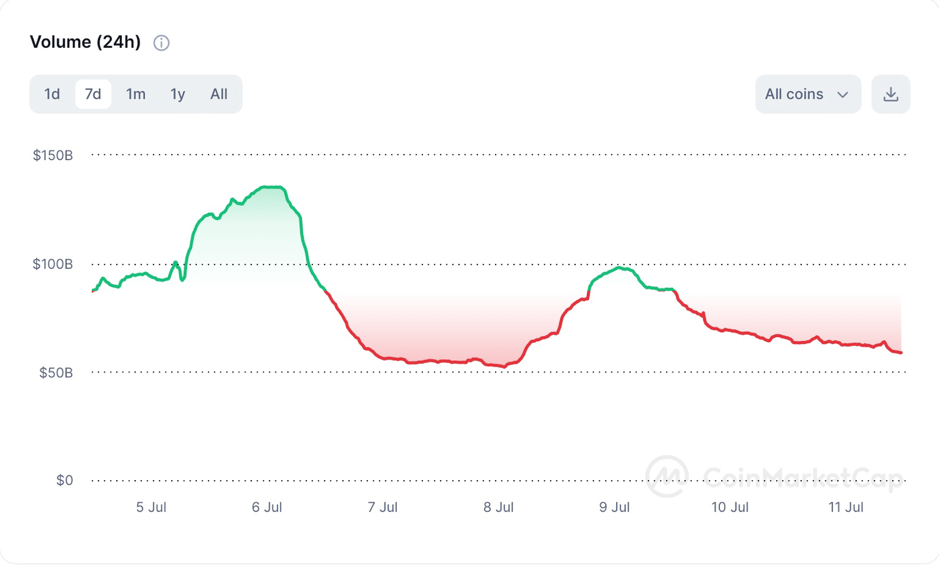

24h trading volume, source: https://coinmarketcap.com/charts/

Fear & Greed Index, source: https://coinmarketcap.com/charts/

3. Perpetual Futures

In general, the 7-day cumulative funding rates for the popular coins across major exchanges are positive, indicating that long leverages are relatively high.

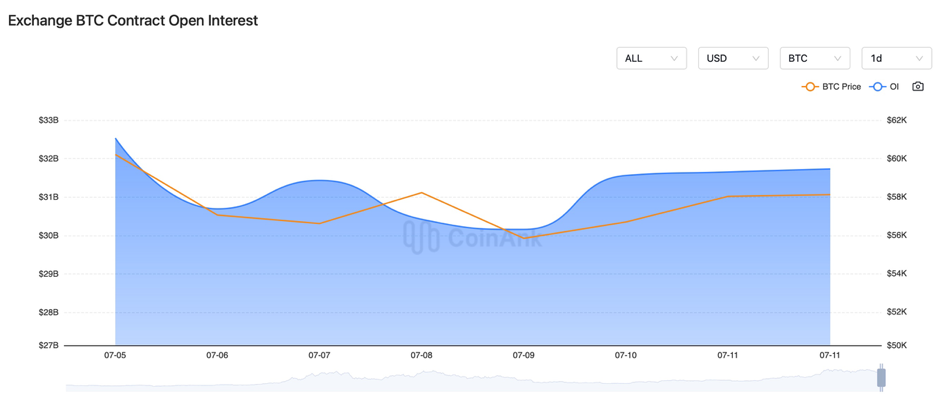

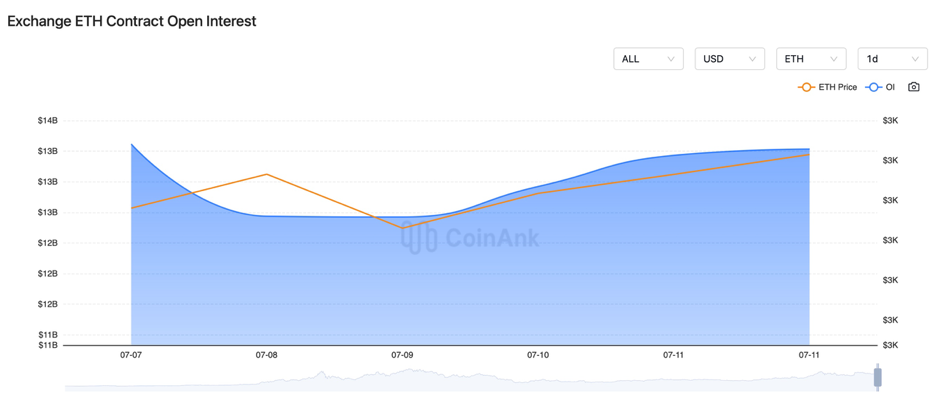

Recently, the BTC and ETH contract open interest has been gradually increasing, indicating a slight easing of overall market sentiment in the crypto market.

Exchange BTC Contract Open Interest:

Exchange ETH Contract Open Interest:

Note: All the above information is provided for reference purposes only and should not be construed as specific investment advice.

4. Industry Roundup

1) On July 8, Boerse Stuttgart Group announced the expansion of its market data services, incorporating ESG data for cryptocurrencies.

2) On July 8, Bitstamp stated that it would complete the distribution of Mt.Gox compensation as soon as possible.

3) On July 8, Revolut’s CEO planned to raise several hundred million dollars by selling part of the company’s shares.

4) On July 8, Thai police arrested scammers using a fake program called Tidex to deceive cryptocurrency users; Thailand’s Prime Minister would announce digital wallet registration on July 24.

5) On July 8, Solana client Firedancer planned to launch a $1 million bug bounty program starting July 10.

6) On July 8, Guiyang, Guizhou Province, China, planned to purchase patented technology services for combating virtual currency crimes.

7) On July 9, Japanese Finance Minister Taro Aso stated that he closely monitors discussions at the Bank of Japan meetings and with bond market participants to prevent excessive rises in yields and inflation.

8) On July 9, Bank of England Committee Member Haskell expressed concern over the persistently tight labor market and preferred to keep rates unchanged until more certainty emerges.

9) On July 9, Banque de France and the Hong Kong Monetary Authority announced cooperation on wholesale Central Bank Digital Currency (wCBDC).

10) On July 9, a certain CEX returned over $200 million worth of Bitcoin to the German government address, possibly due to unsuccessful sales within the target price range. The German government has sold more than half of the confiscated cryptocurrency assets.

11) On July 9, ECB Executive Board member Panetta stated that the EU regulatory framework MICAR defines electronic money tokens (EMT) and asset reference tokens (ART) as means of payment and exchange.

12) On July 9, Dubai Customs launched a blockchain platform to enhance operational transparency.

13) On July 9, the Crypto Fear and Greed Index dropped to 27, the lowest level since January last year.

14) On July 9, the tokenized U.S. Treasury market exceeded $1.8 billion, of which BlackRock’s BUIDL fund exceeded $500 million.

15) On July 9, it was announced that Nishad Singh, a former executive of FTX, is scheduled to be sentenced on October 30, while another co-founder, Gary Wang, will be sentenced on November 20.

16) On July 9, Circle revealed that Euro stablecoin EURC would be introduced into Base.

17) On July 10, the U.S. Technology Alliance Chamber of Progress urged Biden to support cryptocurrency regulation before the election to attract young voters. Biden’s adviser Anita Dunn and many industry executives participated in the crypto roundtable.

18) On July 10, the head of Goldman Sachs’ digital assets revealed their plan to launch three tokenization projects by the end of the year.

19) On July 10, the Chairman of the US CFTC stated that the uniqueness of encryption technology forces the CFTC to re-evaluate network security. 70-80% of cryptocurrencies do not constitute securities; the Illinois court has confirmed that BTC and ETH are digital commodities.

20) On July 10, US intelligence officials broke the news that Russia attempted to support Trump in the 2024 election.

21) On July 10, Peel, Chief Economist of the Bank of England, stated that the Monetary Policy Committee is paying attention to the persistence of inflation, with some indicators showing the risk of inflation rising;

22) On July 10, the minutes of the Fed’s discount rate meeting indicated that all regional Feds voted in May and June to keep the discount rate unchanged.

23) On July 10, according to Elliptic, the Cambodia Huione Guarantee was suspected of money laundering and has marked hundreds of related crypto addresses.

24) On July 10, the survey results showed that 60% of respondents in Taiwan will increase their allocation of virtual assets in the future.

25) On July 10, XAI, IMX, APT, DYDX, GLMR, IO, and ENA were unlocked this week, with a total release value of more than US$170 million.

Disclaimer: FameEX makes no representations on the accuracy or suitability of any official statements made by the exchange regarding the data in this area or any related financial advice.