FameEX Weekly Market Trend | July 15, 2024

2024-07-15 11:08:55

1. BTC Market Trend

From July 11 to 14, the BTC spot price swung from $56,537.9 to $60,370.28, a 6.78% range. Over the past four days, significant statements from the Federal Reserve (Fed) and the European Central Bank (ECB) included:

1) On July 11, Fed Chairman Powell stated readiness to lower interest rates if needed, independent of political considerations. Reducing the balance sheet remains a significant ongoing effort. Short-term neutral interest rates have increased, and their impact will be evaluated in the year-end monetary policy assessment, with tightening policies impacting real estate.

2) On July 12, Fed’s Daly suggested early easing of monetary policy. Based on comprehensive data, there may be a need to adjust monetary policy, appropriately to cut interest rates 1 or 2 times this year. Mousalem noted recent inflation progress, expressing optimism that inflation could reach 2% by mid to late next year. Gurzbi started considering a rate cut or series of cuts, no need to panic about unemployment. There is a need to see progress in housing inflation. June CPI indicated inflation on the path to 2%.

3) On July 11, ECB Governor Villeroy suggested that the French economy is performing well but remains fragile; uncertainty shocks are replacing inflation shocks, and France cannot continue to expand its deficit.

On July 11, the United States reported that June’s seasonally adjusted core CPI rose 3.3% year-on-year, slightly below expectations of 3.4% and unchanged from the previous month. The month-on-month core CPI, adjusted for seasonal factors, increased by 0.1%, below the expected 0.2% and unchanged from the previous month. The overall inflation in June cooled, further boosting confidence among Fed officials that a rate cut may be imminent. Data from the Bureau of Labor Statistics showed core CPI, excluding food and energy costs, rose by 0.1% from May, marking the smallest increase since August 2021. The year-on-year increase of 3.3% was the lowest in over three years. Economists suggest core measures are more reflective of underlying inflation trends than overall CPI. Overall CPI, dragged down by falling gasoline prices, declined by 0.1% from the previous month and decreased by 3% year-on-year, the first drop since the outbreak of the COVID-19 pandemic.

On July 12, the United States announced another sale of weapons to Taiwan, prompting China to impose retaliatory measures against U.S. defense firms and senior executives. Six companies listed in China's “countermeasure list”, including Anduril Industries, Naval Tactical Systems, Pacific Defense Solutions, AEVEX Aerospace Corporation, LKD Aerospace, and Pinnacle Technologies, will have their assets frozen in China.

China also released financial data for the first half of the year: M2 money supply increased by 6.2% year-on-year, while M1 money supply decreased by 5%. The cumulative increase in social financing was 18.1 trillion yuan, down by 3.45 trillion yuan compared to the same period last year. Renminbi loans increased by 13.27 trillion yuan, and Renminbi deposits increased by 11.46 trillion yuan.

From July 15 to July 17, the BTC spot price followed trends in major global asset classes. It may gain on July 15 and 16, with sideways fluctuations likely on July 17. The recent attack on Trump is expected to increase the likelihood of a Republican victory in the upcoming U.S. presidential election, thus boosting BTC prices during this period.

For sell orders placed at $4,700 and buy orders at $2,500 for the ETH spot and for sell orders set at $72,500 and $77,500, with buy orders at $42,950 for the BTC spot, all you need is to wait for the price to reach target levels, allowing for profitable trades on recent large price differentials. It remains uncertain if this upward trend will push BTC spot prices to $72,500, as the previous high was $71,844.41, just $655.59 below the recommended sell order at that time.

2. CMC 7D Statistics Indicators

Overall market cap analysis, source: https://coinmarketcap.com/charts/

24h trading volume, source: https://coinmarketcap.com/charts/

Fear & Greed Index, source: https://coinmarketcap.com/charts/

3. Perpetual Futures

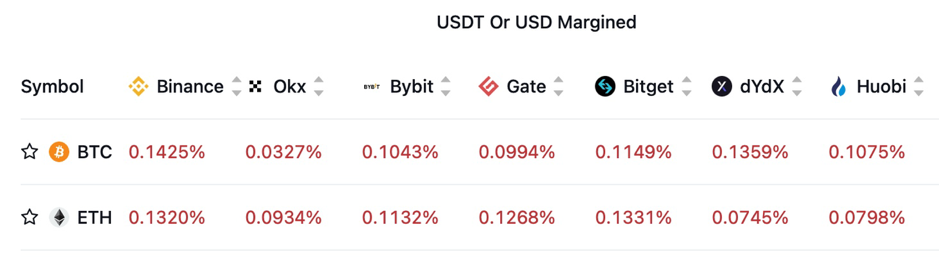

In general, the 7-day cumulative funding rates for the popular coins across major exchanges are positive, indicating that long leverages are relatively high. This suggests that the market overall perceives the current bull market phase to be ongoing.

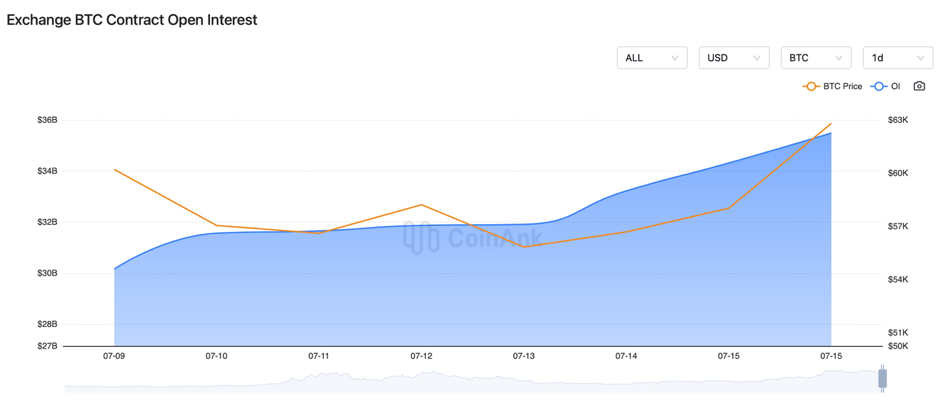

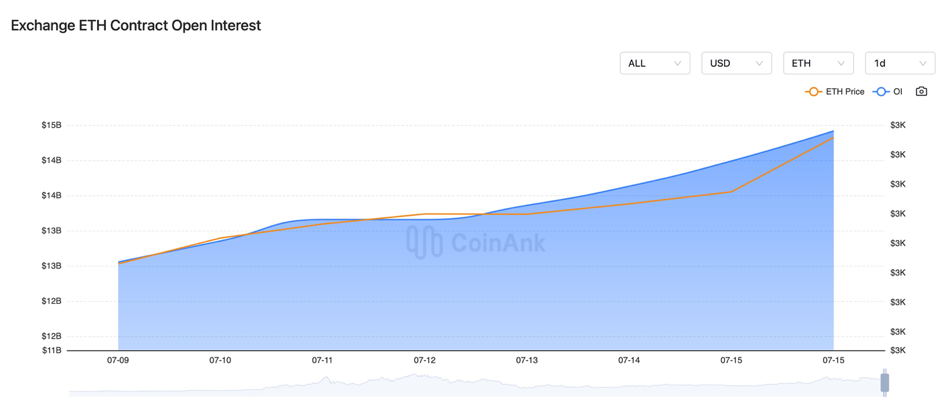

Over the last four days, the BTC and ETH contract open interest has been sharply rising, indicating that recent market panic has been largely alleviated. This suggests a higher probability of further increases in the next three days.

Exchange BTC Contract Open Interest:

Exchange ETH Contract Open Interest:

Note: All the above information is provided for reference purposes only and should not be construed as specific investment advice.

4. Industry Roundup

1) On July 11, the initial jobless claims in the US for the week ending July 6th were 222,000, lower than the expected 236,000 and down from the previous 238,000.

2) On July 11, Elon Musk donated to Trump, aiming to influence the 2024 US elections. Biden emphasized he will not withdraw from the race.

3) On July 11, US regulatory agencies urged swift action on cryptocurrencies. Multiple federal agencies including CFTC, DOJ, and FBI would combat crypto fraud together.

4) On July 11, the SEC dropped an investigation into Paxos, determining BUSD is not a security, and also ended an investigation into Bitcoin L2 developer Hiro.

5) On July 11, Thailand’s Prime Minister announced a digital wallet plan to stimulate underdeveloped areas’ economies.

6) On July 11, a Fox reporter stated that the CFTC Chair is willing to place crypto markets under CFTC jurisdiction. The CFTC Chair confirmed an Illinois court recognized BTC and ETH as digital commodities.

7) On July 12, the US June PPI year-on-year was 2.6%, exceeding the expected 2.3% and the previous 2.2%. The US June PPI month-on-month was 0.2%, above the expected 0.1% and the previous -0.2%.

8) On July 12, the IMF predicted the Fed would cut rates later this year, advising the US to control debt levels.

9) On July 12, the US House failed to overturn Biden’s veto on the SAB 121 resolution. Senator Cynthia Lummis said the US might hold Bitcoin reserves to strengthen the dollar.

10) On July 12, data showed that 90% of US crypto holders are likely to vote for candidates supporting cryptocurrencies. Coindesk reported Donald Trump’s GOP officially supports a crypto platform.

11) On July 12, the Ethereum ICO controversy marked its tenth anniversary: investigations into double-spending Bitcoin manipulation strategies.

12) On July 12, the UK sold confiscated Monero from drug dealers.

13) On July 13, the German government sold its remaining Bitcoin holdings, bringing Germany’s government Bitcoin holdings to zero.

14) On July 13, the Ethereum spot ETF would approved, possibly launching next week.

15) On July 13, FTX reached a settlement with CFTC, prioritizing $4 billion in claims after creditors and interest.

16) On July 14, during a campaign rally in Pennsylvania, shots were fired while Donald Trump was speaking. Trump was injured in the right ear with blood visible. One person died and two were injured among the audience. The gunman was shot dead by the Secret Service. As a result of the incident, Trump memecoins experienced a significant surge in value.

17) On July 14, Biden expressed relief that Trump is safe and stated the US will not tolerate such violence. Biden suspended all campaign activities and would remove all TV campaign ads soon.

18) On July 14, the Bitcoin Magazine CEO indicated that Trump confirmed his attendance and speech at the 2024 Bitcoin conference. Meta planned to end the ban on Trump’s Facebook and Instagram accounts in the coming weeks.

19) On July 14th, according to ZachXBT, in the DMM Bitcoin hack, over $35 million was laundered to Huione Guarantee.

20) On July 14, SHIB was scheduled to change leadership by the end of the year and transfer the project control to the community.

21) On July 14, it was announced that next week CYBER, STRK, OP, RNDR, AXS, APE, MANTA, PIXEL, ENA, and ARB are scheduled to experience substantial unlocks, totaling over $170 million.

22) On July 14, it was announced that next Thursday, July 18, the Fed will release the Beige Book on economic conditions. The ECB will announce its interest rate decisions, and President Lagarde will host a monetary policy press conference.

Disclaimer: FameEX makes no representations on the accuracy or suitability of any official statements made by the exchange regarding the data in this area or any related financial advice.