FameEX Weekly Market Trend | July 8, 2024

2024-07-08 19:14:05

1. BTC Market Trend

From July 4 to 8, the BTC spot price dropped as expected, swinging from $53,442.19 to $60,532.82, a 13.27% range. BTC fell to $54,000, just five days later than predicted in the previous FameEX Weekly Market Trend analysis.

From July 4 to July 7, the main factors contributing to the decline were the market’s assessment of a potential U.S. economic recession and the recent large-scale sale of BTC by the German government.

Recently, significant statements from the Federal Reserve (Fed) and the European Central Bank (ECB) included:

1) On July 4, Fed’s Williams indicated that the justification for the rise in the long-term neutral rate is not yet clear; it’s important to try to understand where the long-term neutral rate is.

2) On July 4, ECB Governor Vasle stated that the ECB must be cautious about inflation risks and should not rush to lower interest rates.

3) On July 5, ECB Governor Makhlouf warned that government measures could exacerbate inflation.

4) ECB Governor Stournaras indicated that We may cut rates once or twice more this year.

5) ECB Chief Economist Lane suggested that companies are telling us that wage pressures are easing.

A recent market analysis report released by an industry research institute noted:

1. The crypto market experienced a significant downward trend in June, leading to an 11.4% drop in total market capitalization. In July, Mt.Gox announced it would repay over 140,000 BTC, causing a sharp BTC decline. Notably, the U.S. and German governments are simultaneously transferring large amounts of BTC to centralized exchanges, exacerbating negative market sentiment.

2. Since November 2023, miners have been net sellers of Bitcoin, marking the longest continuous net selling period since 2017. This has brought miners’ Bitcoin balances to a 14-year low, driven in part by the April Bitcoin halving event. As block rewards account for a large portion of miners’ revenue, many miners are forced to sell their Bitcoin holdings to survive. Additionally, the industry has seen a wave of transactions and mergers, including deals involving Hut 8, CleanSpark, and Core Scientific.

3. Over the past month, activity within the TON ecosystem has continued to increase, reaching a historic high of nearly 578,000 daily active addresses on June 14. Notable drivers and developments include the ongoing success of The Open League and Pantera Capital announcing a new funding plan to increase investment in TON.

4. EigenLayer's market share fell to a low of 92.2%, indicating increased competition in the re-staking sector. Karak and Paradigm-backed Symbiotic, though smaller in scale, have achieved significant growth: Symbiotic reached its initial $200 million deposit cap in one day, while Karak’s TVL exceeded $1 billion for the first time. Despite this, EigenLayer’s first-mover advantage means that Karak and Symbiotic still have a long way to go to further develop in this rapidly evolving subfield.

Grayscale Investments announced that its three major digital asset funds—Grayscale Digital Large Cap Fund, Grayscale DeFi Fund, and Grayscale Smart Contract Platform ex-Ethereum Fund—completed restructuring after a review in the second quarter of 2024. The updated fund portfolios include maintaining the weight of major assets like Bitcoin and Ethereum in the Digital Large Cap Fund, while the DeFi Fund increased its holdings of leading decentralized finance platforms such as Uniswap and MakerDAO. Meanwhile, the Smart Contract Platform ex-Ethereum Fund adjusted its portfolio by removing Polygon (MATIC). These adjustments aim to flexibly respond to changes in the crypto asset market according to their respective index methodologies.

On-chain data analytics platform Arkham announced that its team created a dashboard to display the most tagged governments on Arkham, including the United States, the United Kingdom, Germany, and El Salvador. For each country, users can view their current BTC holdings, historical balance charts, and recent transaction information in real time.

In June, the U.S. nonfarm payrolls, seasonally adjusted, reached 206,000, with an expectation of 190,000 and a previous value of 272,000. The U.S. unemployment rate in June was 4.1%, with an expected rate of 4.00% and a previous rate of 4.00%. Next week, on Thursday, July 11, the U.S. June CPI data will be released, followed by the U.S. June PPI data on Friday, July 12.

From July 8 to July 10, based on the daily candlestick trends of major global assets, the probability of an upward trend in BTC spot prices remains slightly higher. Hence, there is no need to cancel the sell orders for ETH at $4,700 and the buy orders at $2,500, nor the sell orders for BTC at $72,500 and $77,500 and the buy orders at $42,950.

The crypto market’s performance in the second half of this year is unlikely to see the same growth as in the first half and may even perform much worse before the U.S. officially lowers interest rates. Therefore, it is important not to be overly optimistic. Historically, the BTC spot price will reach its highest after the current U.S. rate cuts, so this crypto bull market is expected to end next year.

2. Perpetual Futures

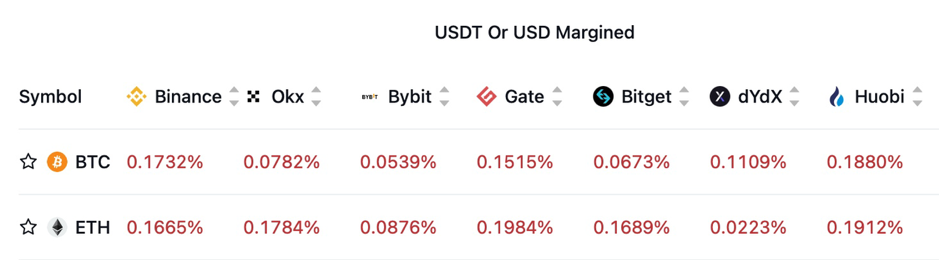

In general, the 7-day cumulative funding rates for the popular coins across major exchanges are positive, indicating that long leverages are relatively high.

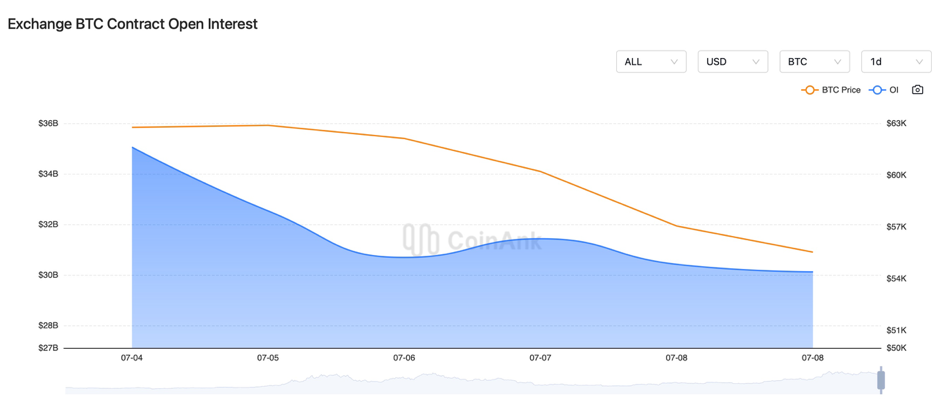

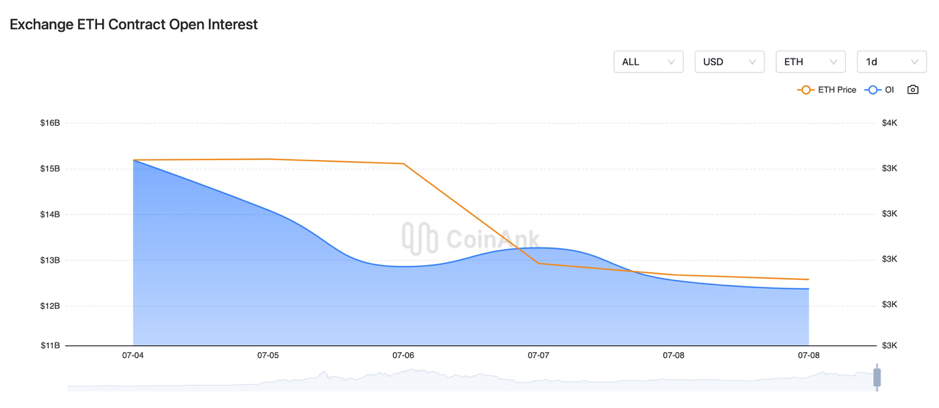

Recently, both the BTC and ETH contract open interest has been slowly decreasing, indicating that overall market sentiment is becoming more panicked and cautious.

Exchange BTC Contract Open Interest:

Exchange ETH Contract Open Interest:

Note: All the above information is provided for reference purposes only and should not be construed as specific investment advice.

3. Industry Roundup

1) On July 4, ECB June meeting minutes revealed that the assumption of benign inflation by 2026 is highly uncertain, and concerns about policy excessively suppressing economic growth have eased.

2) On July 4, IMF Europe Department Director Kammer stated that New Eurozone inflation data confirms that the ECB has room for further rate cuts.

3) On July 4, Fed meeting minutes indicated that the vast majority believe that economic growth is gradually cooling. The Fed is waiting for “more information” to gain confidence in cutting rates. Several participants indicated that if inflation remains high or rises further, it may be necessary to raise rates. May’s CPI provided more evidence of inflation progress.

4) On July 4, the EU and the US emphasized cooperation in crypto regulation.

5) On July 4, South African regulators investigated 30 cases of unlicensed cryptocurrency operations and issued 63 licenses to crypto asset service providers.

6) On July 4, Taurus cooperated with UAE’s first digital bank Zand for digital asset custody and tokenization.

7) On July 4, UK Prime Minister Sunak announced his resignation, effective early Friday local time, with UK voters calling on candidates to focus on cryptocurrency issues.

8) On July 4, the documentary “Vitalik: The Story of Ethereum” was released schedule.

9) On July 4, Russia considered permanently legalizing stablecoins for cross-border payments.

10) On July 5, data showed that after recent Bitcoin sales, the German government still holds over 40,000 Bitcoins worth more than $2.3 billion.

11) On July 5, New Zealand tax authorities warned cryptocurrency traders to declare income.

12) On July 5, Hamilton launched tokenized US Treasury bonds on Bitcoin’s layer-2 network.

13) On July 5, according to Baanx, the development of Web3 infrastructure, such as account abstraction, has driven the adoption of crypto debit cards.

14) On July 5, Web3 users hit a historic high of 10 million in Q2 this year.

15) On July 5, Tangem launched a crypto wallet integrated with Visa.

16) On July 6, Bitfinex stated that it would refund investors for the failed El Salvador Hilton hotel project.

17) On July 6, ECB meeting minutes indicated that the assumption of benign inflation by 2026 is highly uncertain, and there should not be an overreaction to adverse data from a single month.

18) On July 6, the Fed’s semi-annual monetary policy report showed that the inflation is slowing, and the job market is tight but not overheated.

19) On July 6, US President Biden stated that wage growth is outpacing prices, but there’s still more work to do. Top Democratic donors are increasing pressure, with over a hundred wealthy individuals signing a letter urging Biden to withdraw from the race.

20) On July 6, South Korea strengthened cryptocurrency regulation, cracking down on trading fraud, and delayed virtual asset tax regulations to 2025.

21) On July 7, since June 19, the German government has transferred a total of 13,466 BTC and still holds 39,826 BTC.

22) On July 7, Thai police arrested scammers using a fake program called Tidex to defraud cryptocurrency.

23) On July 7, the North Carolina Governor vetoed a Central Bank Digital Currency (CBDC) ban bill.

24) On July 7, the Hong Kong Securities and Futures Commission warned the public to beware of seven entities, including XTCQT, CEG, and BTEPRO, suspected of engaging in virtual asset-related fraud.

Disclaimer: FameEX makes no representations on the accuracy or suitability of any official statements made by the exchange regarding the data in this area or any related financial advice.