FameEX Weekly Market Trend | August 29, 2024

2024-08-29 10:11:45

1. BTC Market Trend

From August 26 to August 28, the BTC spot price swung from $57,723.23 to $64,600.82, a 11.92% range. The arrest of Telegram founder Pavel Durov, fueling fears of stricter global crypto regulation, is a key factor in the recent market downturn. Over the past three days, significant statements from the Federal Reserve (Fed) and the European Central Bank (ECB) have been as follows:

1) On August 27, Fed’s Barkin hinted at a 25bp rate cut in September and noted that the current “low hiring, low firing” approach by companies is unlikely to be sustainable.

2) On August 27, Fed’s Daly stated that it is too early to determine whether a 25bp or 50bp rate cut will occur in September and mentioned that the inflation-adjusted neutral rate could reach 1%.

3) On August 28, ECB’s Centeno remarked that the interest rate path seems relatively clear.

4) On August 28, ECB’s Knot suggested that as long as inflation falls to 2% by the end of 2025, a gradual easing of policies could be safely undertaken.

According to a new report, the number of global cryptocurrency millionaires has surged by 95% over the past year, driven by the rise of Bitcoin ETFs and other crypto assets. The report by New World Wealth and Henley & Partners revealed that 172,300 individuals now hold over $1 million in crypto assets, a significant increase from last year’s 88,200. The number of Bitcoin millionaires alone has more than doubled, reaching 85,400. The report also highlighted that there are now 325 crypto centimillionaires (holding $100 million or more in crypto assets) and 28 crypto billionaires. This surge reflects the rapid growth of Bitcoin ETFs, which have amassed over $50 billion in assets since their launch in January, sparking a wave of institutional participation. Bitcoin’s price has risen 45% this year, reaching around $64,000. As the value of other cryptocurrencies has also increased, the market capitalization of crypto assets has grown to $2.3 trillion, up from $1.2 trillion last summer. (CNBC)

Justin Bons, the founder of Cyber Capital, posted on the X (formerly Twitter) platform to claim that Ethereum is declining while Layer 2 (L2) networks are “dancing on its grave”. Bons pointed out that since the implementation of EIP-4844 (Proto-Danksharding), Ethereum’s fee revenue has significantly dropped and is unable to keep pace with inflation. Meanwhile, L2 networks have seen record usage and fee revenue, lobbying to keep Ethereum’s capacity low. Bons believed this constitutes a “parasitic relationship”. He argued that L2 networks are essentially stealing Ethereum’s users and fees by pretending to be “the same as Ethereum” to attract users. Bons predicted that L2 networks will eventually migrate or become independent L1 networks, leading to Ethereum’s gradual decline. He criticized Ethereum’s leadership for “selling out” to L2 networks, exposing systemic issues in governance. Bons warned that if Ethereum were to expand L1 capacity in the future, it could cause a collapse in the prices of all L2 network tokens and equity, giving L2 networks an incentive to prevent Ethereum’s expansion.

A report by The Economist projected that institutional investors will increase their allocation of digital assets in their portfolios to 7% by 2027 (up from the current 1-5%), with the market size of tokenized assets expected to exceed $10 trillion by the 2030s. The report noted that digital asset allocation in institutional portfolios has traditionally focused on cryptocurrency trading, with Bitcoin and Ethereum being the largest investment channels. However, institutional investors are showing greater optimism towards digital assets, fueled by the growing availability of investment tools beyond cryptocurrencies. Data showed that 51% of institutional investors are considering spot crypto allocations, 33% are considering staking digital assets, 32% are exploring crypto derivatives, and 36% are looking into funds that track cryptocurrencies.

From August 29 to September 1, the likelihood that the BTC spot daily candlestick chart will diverge from the downtrend of major global asset classes and instead hold its own independent sideways consolidation is slightly higher. There is no need to cancel any previously suggested BTC and ETH orders. For other trading pairs, the strategy should focus on buying the dip, with patience to wait for the results of the Fed meeting on September 18.

2. CMC 7D Statistics Indicators

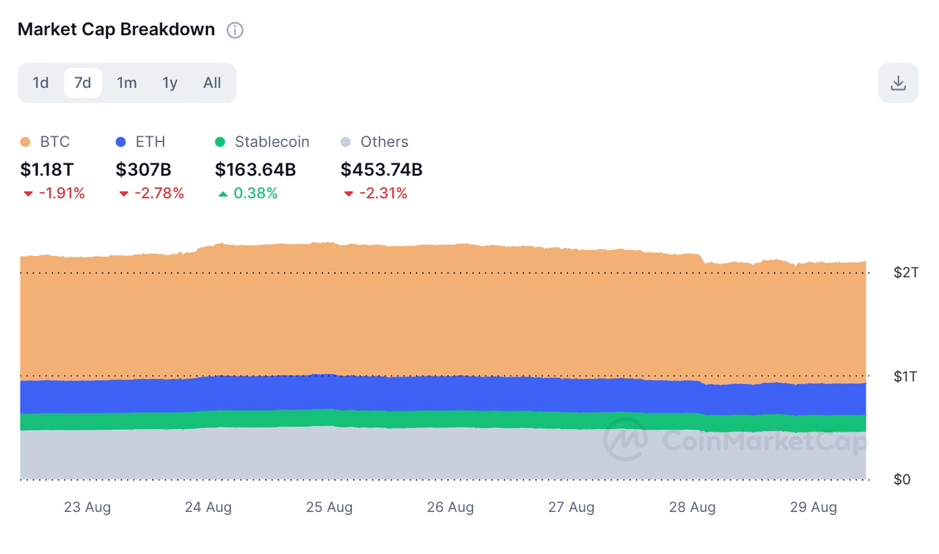

Overall market cap analysis, source: https://coinmarketcap.com/charts/

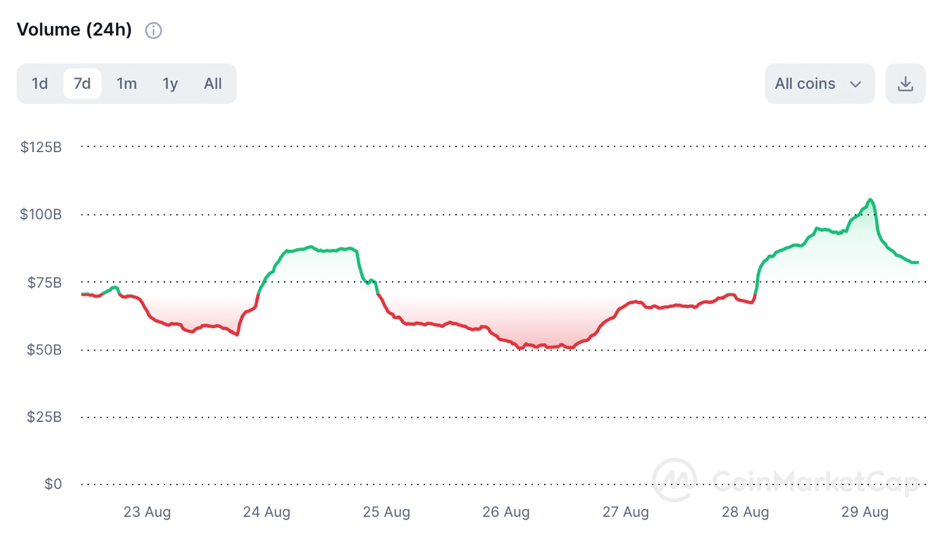

24h trading volume, source: https://coinmarketcap.com/charts/

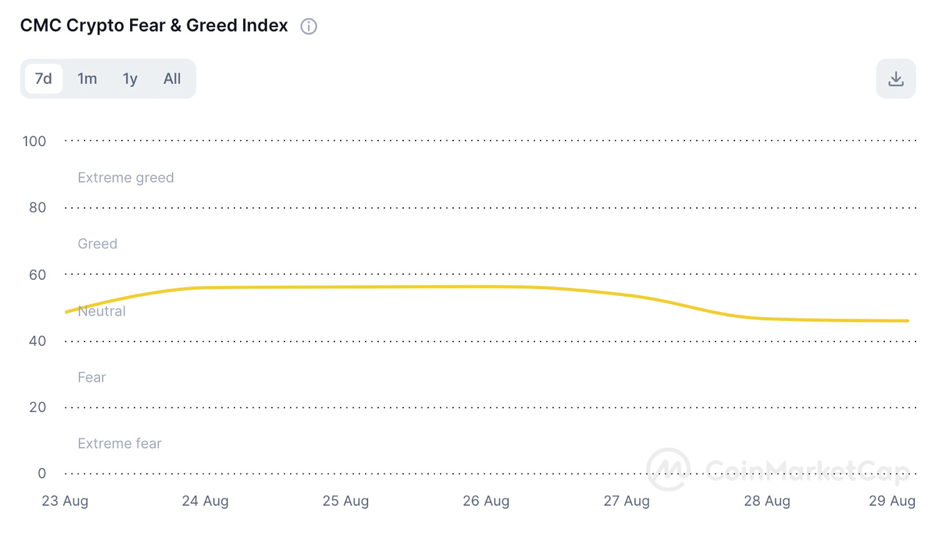

Fear & Greed Index, source: https://coinmarketcap.com/charts/

3. Perpetual Futures

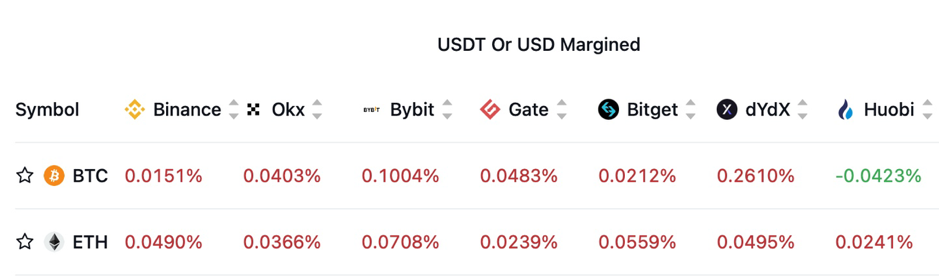

In general, the 7-day cumulative funding rates for the popular coins across major exchanges are positive, indicating that long leverages are relatively high.

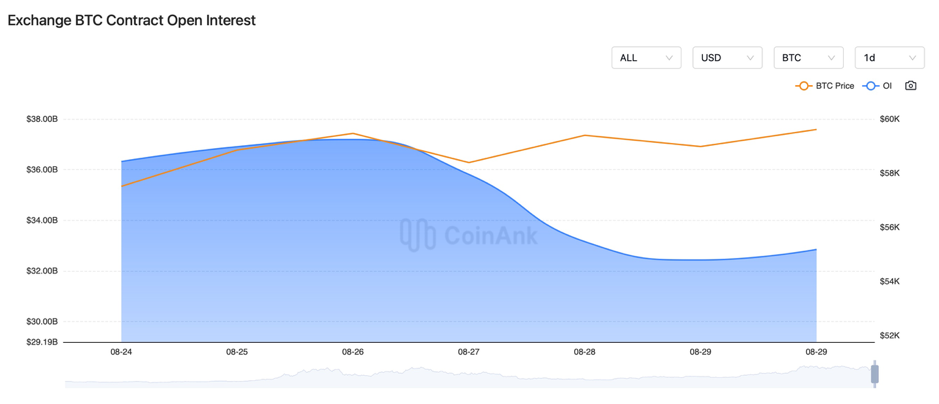

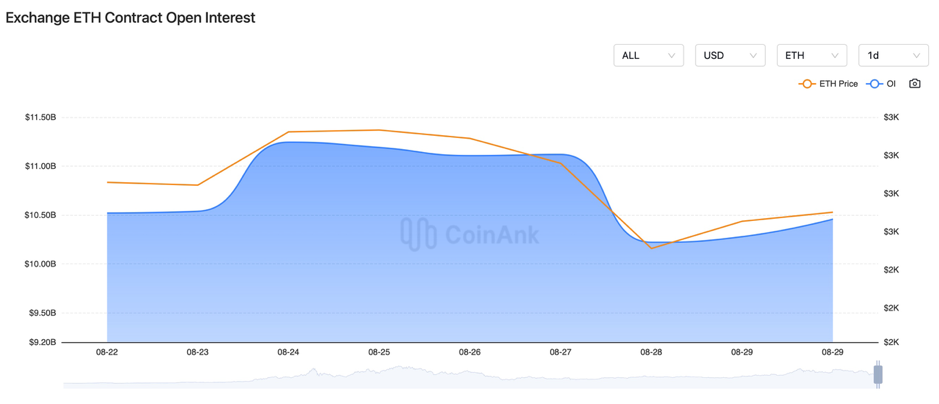

In the past three days, both BTC and ETH futures open interest has been decreased significantly.

Exchange BTC Contract Open Interest:

Exchange ETH Contract Open Interest:

Note: All the above information is provided for reference purposes only and should not be construed as specific investment advice.

4. Industry Roundup

1) On August 26, the Reserve Bank of India (RBI) recommended developing plug-and-play cross-border payment systems to enhance interoperability between countries.

2) On August 26, the official Telegram channel for the Trump family’s new crypto project was renamed “World Liberty Financial”. Special Counsel filed new charges against former U.S. President Trump related to the 2020 election.

3) On August 26, Mark Zuckerberg admitted that the Biden administration pressured his team to censor content on the platform.

4) On August 26, the U.S. SEC charged the Adam brothers with running a $60 million crypto Ponzi scheme, which included a non-existent crypto trading bot. Crypto lender Abra settled with the SEC over unregistered securities.

5) On August 26, MicroStrategy founder said that after adopting a Bitcoin strategy for four years, the company’s performance has outpaced other companies in the S&P 500.

6) On August 27, China’s court website reported that a virtual currency platform’s collapse left investors unable to recover millions, and the court ruled that losses must be borne by the investors.

7) On August 27, a UAE investment firm planned to launch a $500 million fund, DEI, to invest in blockchain and DePIN sectors.

8) On August 27, Singapore company A&A’s chairman Yang Bin was sentenced to six years in prison for allegedly organizing a crypto mining investment scam.

9) On August 27, the UK’s Financial Conduct Authority has not approved any crypto company registration applications for six consecutive months.

10) On August 27, a man in Liyang, Jiangsu Province, China, was sentenced to six months in prison with a one-year probation and fined 2,000 RMB for laundering over 5,000 RMB through virtual currency.

11) On August 27, Firn Protocol froze 80 ETH deposited by an attacker and handed it over to ZachXBT, who will return it to the victims.

12) On August 27, ETHGlobal Members stated that the Ethereum Foundation’s internal expenses account for about 38%, and external expenses about 62%. Vitalik Buterin’s salary is 182,000 SGD per year. Some believe the Ethereum Foundation's annual budget of $100 million is “insignificant” compared to the ETF market cap.

13) On August 27, Japanese Prime Minister Fumio Kishida stated that Web3 and blockchain technology are fundamental to solving social issues.

14) On August 28, Nasdaq partnered with CF Benchmarks to apply to the SEC for launching Nasdaq Bitcoin Index Options. The SEC approved a rule change requiring funds to report portfolio holdings monthly instead of quarterly.

15) On August 28, Ukrainian President Volodymyr Zelenskyy said the Russia-Ukraine conflict would ultimately end through dialogue, but Kyiv must be in a strong position. The Russian Foreign Minister warned that the West is “playing with fire,” which could trigger World War III.

16) On August 28, the U.S. State Department stated that about 40% of North Korea’s WMD development funds are obtained through stolen virtual assets.

17) On August 28, a report revealed that Australian investors lost $122 million to crypto scams over the past 12 months.

18) On August 28, China’s Supreme People’s Court issued a call for major judicial research projects for 2024, including the study of handling virtual currency cases.

19) On August 28, the California legislature passed an AI training data transparency bill, pending the governor’s signature.

20) On August 28, a spokesperson from the U.S. Department of Labor stated that a technical glitch caused the August 21 employment data delay. The Bureau of Labor Statistics has implemented new safeguards to ensure equal access to data.

21) On August 28, the governor of Indonesia’s central bank predicted that the Fed will begin cutting rates this year, reducing rates by 75 basis points to 4.25% by the end of 2025, which will support the rupiah’s appreciation in 2025.

22) On August 28, it was reported that the crypto political advocacy group Stand With Crypto would begin a tour next week in several key U.S. states.

23) On August 28, several French government websites were crippled by DDoS attacks, believed to be in response to the arrest of Telegram founder Pavel Durov in France. Pavel Durov is set to appear before a French judge.

24) On August 28, TON officially responded to the network block production interruption, stating that abnormal load caused validator consensus loss, but user assets are safe.

Disclaimer: FameEX makes no representations on the accuracy or suitability of any official statements made by the exchange regarding the data in this area or any related financial advice.