FameEX Weekly Market Trend | September 2, 2024

2024-09-02 11:10:10

1. BTC Market Trend

From August 29 to September 1, the BTC spot price swung from $57,090.83 to $60,840.45, a 6.57% range. Over the past four days, significant statements from the Federal Reserve (Fed) and the European Central Bank (ECB) have been as follows:

1) On August 30, Fed’s Bostic stated that inflation is still far from the Fed’s 2% target.

2) On August 30, ECB Governing Council member Nagel said that caution is needed and policy rates should not be lowered too quickly.

Harris’ economic advisor Bharat Rama, during an interview on CNBC’s Squawk Box, confirmed Harris’ plan to tax unrealized gains. Earlier this month, Harris announced support for this tax proposal, initially put forward by President Biden. This measure would apply to individuals with an annual income of at least $100 million who have not paid at least 25% in taxes. Rama stated that “all revenue from this unrealized gains tax and other taxes in Harris’ plan will be used to create more opportunities,” but the host pointed out that the measure “could be unconstitutional”. Since its announcement, the plan has faced strong opposition. Analysts suggest that even if Harris wins the presidential election in November, getting the plan passed in Congress will be challenging.

Galaxy Research recently posted on X (formerly Twitter) stating that since its launch, the trading volume of Ethereum spot ETFs has been significantly lower than that of Bitcoin spot ETFs, both of which are far below the ETH/BTC CEX trading volume and market cap ratio. Several factors have contributed to this result, with the most important being that major trading platforms have not yet provided margin for ETH ETFs. To control some of these factors, such as the lack of margin availability, a comparison of the first 25 days of performance for each set of products can be made. During this period, the ratio of Ethereum ETF trading volume to Bitcoin ETF trading volume has continuously declined.

Microsoft cybersecurity researchers have discovered a zero-day vulnerability in the Chromium engine, which powers browsers like Chrome. This vulnerability has been exploited by a North Korean hacker group named Citrine Sleet, specifically targeting cryptocurrency users. Citrine Sleet used a rootkit malware called FudModule, creating fake cryptocurrency trading platform websites to lure users into downloading malware or weaponized cryptocurrency wallets, thereby gaining remote code execution permissions and stealing victims’ crypto assets. The vulnerability was patched on August 21, and users are urged to update their browsers promptly to ensure security. This is the third Chromium zero-day vulnerability exploited this year.

Mastercard is planning to eliminate traditional credit card numbers and adopt “tokenization technology” to combat cyber fraud. This technology replaces sensitive data like credit card numbers with randomly generated number sequences (tokens) to reduce the risk of data breaches. Mastercard’s CEO, Michael Miebach, announced that the company will expand the use of this technology and replace traditional passwords with biometric authentication methods, such as fingerprint or facial recognition. This measure is in response to the growing issue of online payment fraud, which is expected to exceed $91 billion by 2028. Miebach pointed out that the conventional approach of using passwords to protect data and transactions is gradually becoming a security vulnerability. However, “tokenization technology” replaces sensitive information with “tokens”, making it impossible to decipher real information even if the data is accessed illegally by hackers. Additionally, this technology helps companies comply with data protection regulations such as the EU General Data Protection Regulation (GDPR) and the Payment Card Industry Data Security Standard (PCI DSS). Mastercard expects that by the end of this century, all e-commerce transactions in Europe will be replaced by tokens.

From September 2 to September 4, sell orders placed at $4,700 for the ETH spot and buy orders at $1,850 for bottom-fishing do not need to be canceled. Similarly, sell orders for the BTC spot placed at $72,500, $77,500, and $92,000, as well as the buy order at $42,950 for bottom-fishing, should remain as they are. For other cryptocurrencies, it is recommended to focus primarily on bottom-fishing and buying.

Next, FameEX will continue to share methods for building a trading system that suits a trader’s current level. Providing services that exceed industry standards and even surpass customer expectations, while minimizing meaningless capital losses and consistently increasing profits, remains our ongoing goal.

2. CMC 7D Statistics Indicators

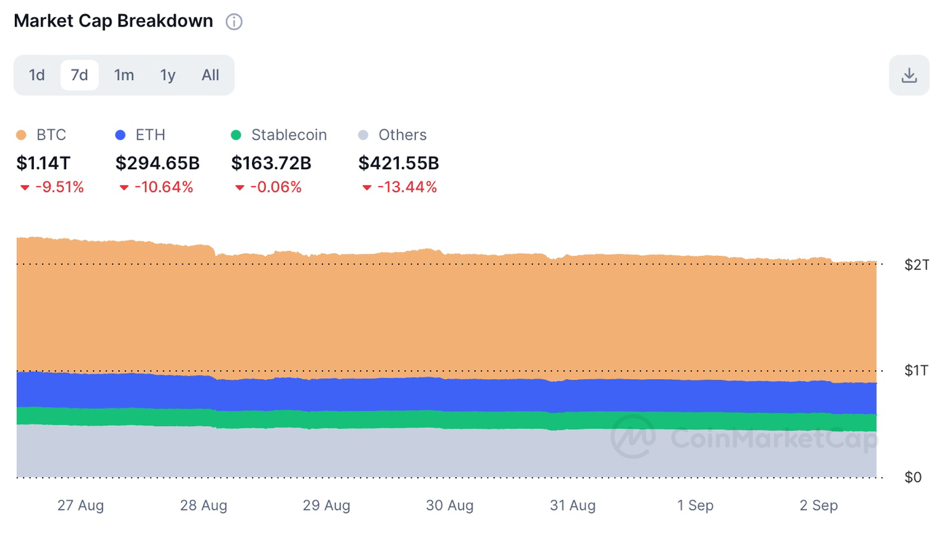

Overall market cap analysis, source: https://coinmarketcap.com/charts/

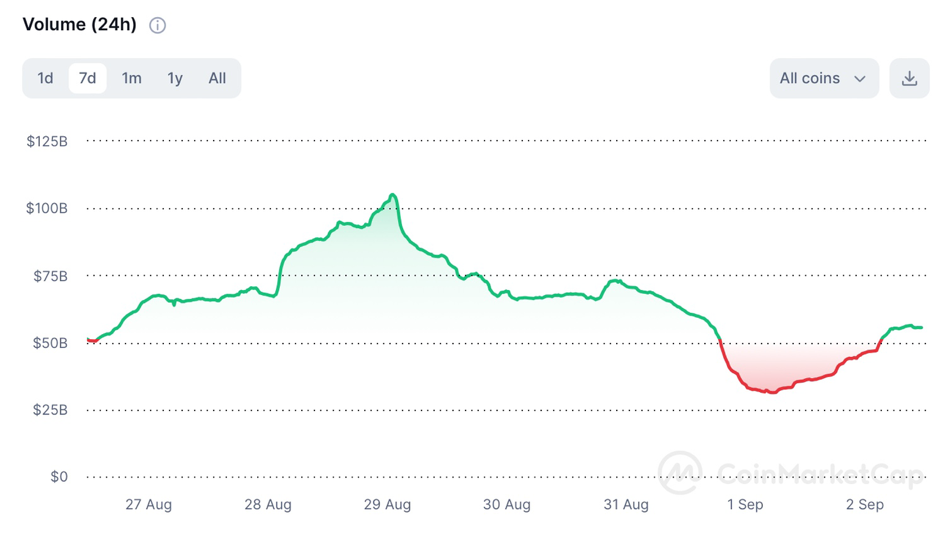

24h trading volume, source: https://coinmarketcap.com/charts/

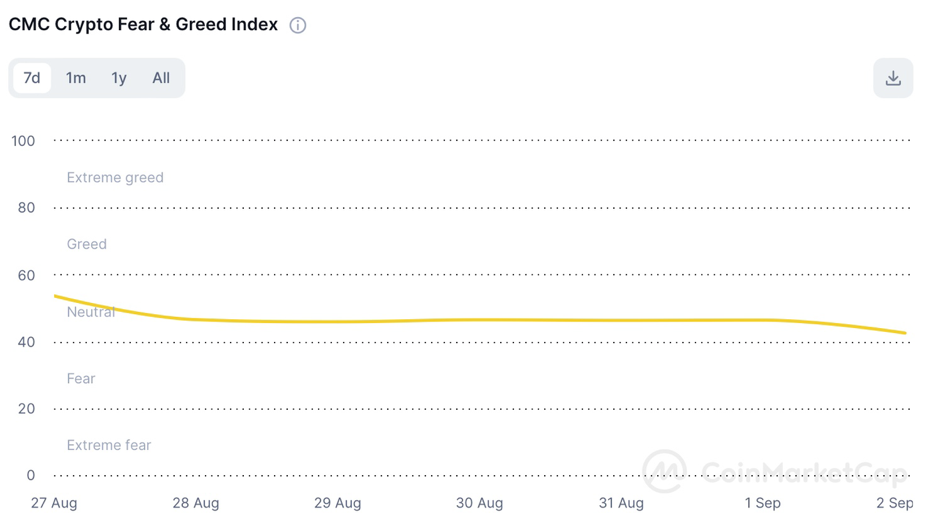

Fear & Greed Index, source: https://coinmarketcap.com/charts/

3. Perpetual Futures

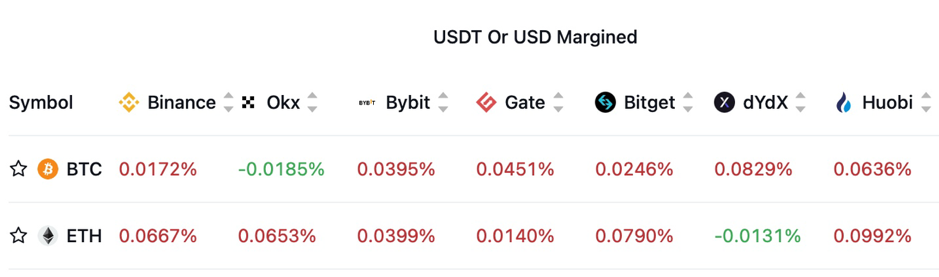

In general, the 7-day cumulative funding rates for the popular coins across major exchanges are positive, indicating that long leverages are relatively high.

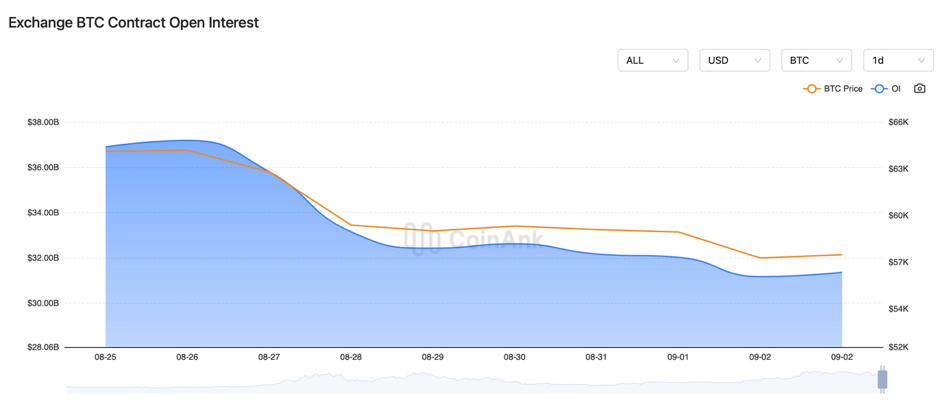

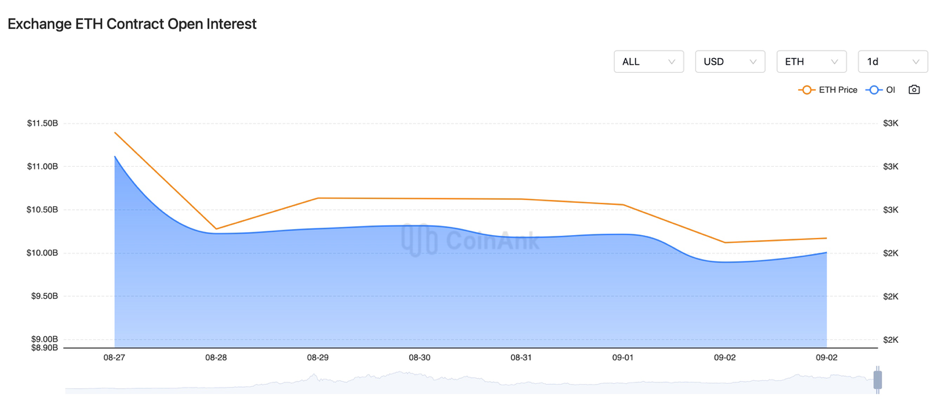

In the past four days, both BTC and ETH futures open interest has been gradually decreasing.

Exchange BTC Contract Open Interest:

Exchange ETH Contract Open Interest:

Note: All the above information is provided for reference purposes only and should not be construed as specific investment advice.

4. Industry Roundup

1) On August 29, U.S. initial jobless claims for the previous week recorded 231,000, slightly below expectations. The revised annualized GDP growth rate for Q2 was 3%, better than market expectations.

2) On August 29, Hong Kong police cracked down on three virtual currency money laundering syndicates involving over HKD 300 million. Crypto Intelligence Orange reported that key personnel from the “NonFungible” platform team have been under investigation by Chinese police in Inner Mongolia for more than six months.

3) On August 29, the UK issued its first cryptocurrency ATM prosecution, accusing a resident of using an illegal ATM to launder £300,000.

4) On August 29, Sony Blockchain Soneium partnered with Transak to provide global fiat deposit services.

5) On August 29, Haru Invest CEO Lee Hyung-soo was stabbed in the neck by a former Haru Invest client during an $800 million fraud trial at the Seoul Southern District Court.

6) On August 29, the Japan Crypto Asset Business Association proposed reducing the maximum personal income tax on crypto assets from 55% to a flat 20%.

7) On August 29, the Telegram-linked TON blockchain suffered another outage, with developers blaming the surge in DOGS Meme tokens; DOGS will add two new token claim options to reduce network load and speed up processes.

8) On August 30, Trump announced plans to turn the U.S. into a global “crypto capital”. He also warned Zuckerberg that if he interferes with the U.S. presidential election again, he will face severe consequences.

9) On August 30, it was reported that the U.S. House of Representatives plans to hold multiple cryptocurrency hearings in September, discussing issues like DeFi and SEC enforcement.

10) On August 30, the Xuhui District People’s Procuratorate in Shanghai handled 23 criminal cases involving virtual currencies over the past three years, involving 45 people, with illegal gains averaging over 1 million yuan.

11) On August 30, the number of crypto companies registered with the UK’s FCA has decreased by 51% over the past three years, with 186 companies withdrawing their applications.

12) On August 30, data showed that over 110 companies are operating Bitcoin-related businesses in Africa. U.S. digital currency platform Coinflip has expanded its cryptocurrency ATM services to Mexico.

13) On August 31, the Brazilian government banned the X platform, threatening citizens with daily fines of $8,900 if they use it. U.S. Vice President Harris supported Brazil’s decision to shut down the X platform, stating that social media should comply with government censorship.

14) On August 31, Oasys partnered with Japanese traditional financial giant SBI Holdings to promote blockchain gaming. Starbucks in El Salvador began accepting Bitcoin as a payment method.

15) On August 31, a report revealed that cryptocurrency ATMs have processed $160 million in illegal funds since 2019. Bankruptcy cases in the crypto industry have generated about $751 million in revenue for law firms.

16) On August 31, a dormant address holding 23 BTC was activated after 13.1 years.

17) On August 31, Telegram’s balance sheet showed $400 million in cryptocurrency holdings. Financial Times reported that Telegram’s team consists of about 50 very young people, with annual salaries reaching $500,000.

18) On August 31, footballer Mbappé’s X account was hacked, and a pump token named MBAPPE was posted. A user spent 2 SOL to buy 1.1 million tokens, after which another user bought 7,156 SOL and immediately sold the 1.1 million tokens, making a profit of $210,000 in eight seconds.

19) On August 31, Bitcoin has been trading at a premium in South Korea since October 30, 2023. Starting today, Russia permits the use of cryptocurrency for international trade.

20) On August 31, the U.S. core PCE price index for July recorded a year-on-year increase of 2.6%, in line with the previous value and slightly below the expected 2.7%. The month-on-month increase was 0.2%, matching expectations and the previous value.

21) On August 31, the final U.S. one-year inflation rate expectation for August was 2.8%, lower than the expected 2.9% and the previous value of 2.9%, marking the lowest level since 2020.

22) On September 1, the crypto sector lost over $300 million due to attacks in August. Immunefi reported that cryptocurrency hackers have stolen over $1.2 billion in 2024.

23) On September 1, the U.S. Department of Justice charged Geoffrey K. Auyeung with a $64 million cryptocurrency money laundering scheme. Musk and Tesla won the dismissal of a lawsuit accusing them of manipulating Dogecoin.

24) On September 1, Kaiko reported that Mt. Gox still has over $2 billion in BTC to be distributed to creditors, putting BTC under potential selling pressure from the U.S. and UK.

25) On September 1, Vitalik Buterin stated that both Optimism and Arbitrum meet the voting threshold for the Security Council.

Disclaimer: FameEX makes no representations on the accuracy or suitability of any official statements made by the exchange regarding the data in this area or any related financial advice.