FameEX Weekly Market Trend | September 16, 2024

2024-09-16 10:00:15

1. BTC Market Trend

From September 12 to September 15, the BTC spot price swung from $57,202.28 to $60,715.24, a 6.14% range.

Important statements related to the Federal Reserve (Fed) and the European Central Bank (EBC) over the past four days:

1) On September 12, the Fed Inspector General indicated that Atlanta Fed President Bostic violated trading rules, but no evidence was found of trading using confidential information.

2) On September 13, former New York Fed President Dudley expressed that the Fed should cut interest rates by 50 basis points in September.

3) On September 13, the Fed stated that U.S. household net worth rose to a record $163.8 trillion in Q2 2024.

4) On September 13, EC’s Nagel believed in moving in the right direction toward achieving inflation targets, with inflation expected to reach 2% by the end of next year.

5) On September 13, ECB’s Simkus suggested that inflation trends indicate that the ECB must further cut rates, and future rate cuts will depend on data.

6) On September 14, ECB’s Rehn indicated that current uncertainty underscores the reliance on the latest economic data and analysis.

Key points from the ECB’s Rate Decision and President Lagarde’s Press Conference:

Rate Decision: The ECB conducted the second rate cut of this cycle as expected and revised down the GDP growth forecasts for the next three years.

1) Interest Rate Levels: The deposit facility rate was cut by 25 basis points to 3.50%. The main refinancing rate and the marginal lending rate were cut by 60 basis points to 3.65% and 3.90%, respectively.

2) Rate Outlook: No specific rate path was pre-committed. Rates will be kept at sufficiently restrictive levels as needed, with a data-dependent and meeting-by-meeting policy approach.

3) Economic Assessment: The GDP growth forecast is 0.8% for 2024, 1.3% for 2025, and 1.5% for 2026 (previously 0.9%, 1.4%, and 1.6% in June).

4) Inflation Assessment: The inflation forecast remains at 2.5% for 2024, 2.2% for 2025, and 1.9% for 2026. The core inflation is expected to be 2.9% in 2024, 2.3% in 2025, and 2.0% in 2026 (previously 2.8%, 2.2%, and 2.0% in June).

5)Quantitative Tightening: The ECB reiterated its plan to end reinvestments under the Pandemic Emergency Purchase Program (PEPP) by the end of 2024, reducing PEPP holdings by €7.5 billion per month.

6) Market Impact: EUR/USD rose by over 10 points in the short term, Eurozone bond yields increased, and the STOXX 600 index gave up gains. Traders reduced their rate cut expectations for the ECB, now anticipating a further 36 basis point cut by year-end.

President Lagarde’s Press Conference: There were no pre-commitments regarding the October meeting. The inflation is expected to fall to 2% next year.

1) Rate Outlook: The timing and extent of rate cuts are undetermined. No pre-commitments were made for the October meeting.

2) Inflation Outlook: Lower inflation data is expected to be released in September, followed by a rise. The Inflation is projected to fall to 2% during 2025.

3) Economic Outlook: Risks to economic growth are skewed to the downside. The economic recovery still faces some headwinds but is expected to strengthen. The slowdown in the German economy was anticipated.

4) Labor Market: The labor market remains strong. Wage growth is expected to stay high and volatile. Overall labor cost growth is slowing.

5) Fiscal Policy: Fiscal and structural policies should aim to increase productivity. National governments must take robust measures in fiscal policy.

From September 16 to September 18, there is no need to cancel the sell orders for the ETH spot at $4,700 or the buy orders at $1,850, nor the sell orders for the BTC spot at $72,500, $77,500, and $92,000, or the buy order at $42,950. Significant market fluctuations are expected around the time of the Fed’s interest rate decision announcement on September 18, with a relatively higher probability of initiating this round of rate cuts.

2. Blockchain Mastery & Trading Tips

We will dive deeper into the essence of technical analysis. Technical analysis can be understood as the external manifestation of the statistical probabilities of various profit-making methods across different trading instruments, and it often exhibits a lag. In many cases, technical indicators are only formed after market movements have occurred, meaning that the outlook for price rises and falls is in a chaotic state during the occurrence of these movements. When using various technical indicators for forecasting and trading decisions, we rely more on our own related experience—and sometimes a bit of luck—rather than solely on the effectiveness of the technical indicators themselves. This understanding is crucial.

However, this does not mean that technical analysis is unimportant. In the fields of cryptocurrency trading, as well as forex, commodities, and stock index futures trading, technical analysis plays a fairly important role. In contrast, its impact is relatively smaller in the stock and bond markets. For beginners who access cryptocurrency, forex, commodities, and stock index futures trading, mastering the basics of technical analysis is a must. It is the foundation, and the deeper it is, the better. Without a solid base, even a modest structure risks collapsing under pressure from market volatility.

The more people learn a particular method of technical analysis, the easier it becomes for traders who are truly proficient in that method to profit. This is because all investors using the same technical analysis method tend to make the same buy/sell decisions, which are within the understanding and control of the proficient traders. Many market makers in cryptocurrency, stocks, commodities, and other sectors need to master at least one or two widely-used technical analysis methods to make real profits. From a game theory perspective, these market makers can intentionally create misleading technical patterns to deceive and ultimately exploit other institutional investors and retail traders. This phenomenon is most prominent and frequent in cryptocurrency DEX trading.

The three most widely-used technical indicators are candlestick and moving averages (K-line and MA), volume (volume-price analysis), and moving average convergence divergence (MACD). Following these are Bollinger Bands (BBs), the Fibonacci sequence (golden ratio), and wave theory. It’s important to note that wave theory’s effectiveness varies, as different people often interpret it differently, resulting in what’s called “a thousand analysts, a thousand waves”. Among these technical indicators, none are inherently the most or least effective. What sets them apart is the user’s level of proficiency. Every trader will typically find at least one technical indicator that works best for them.

To find the technical indicator that suits you best, begin by widely studying the basics of various technical analysis methods. Once you understand them well, you can use each indicator on its own to make ultra-short-term trading decisions. For instance, use the K-line and MA, volume-price analysis, or MACD for five or ten trades, and then assess based on the number of profitable trades combined with your profit ratios. In practice, it’s better to focus on mastering a few indicators rather than using too many. Adopting three at most is usually sufficient—for example, using K-line and MA as primary indicators, and MACD or the Fibonacci sequence as secondary indicators. Using too many can create ineffective distractions, as different technical indicators may give conflicting signals for the same time period.

On cryptocurrency exchanges, whether trading spot, futures, or options with an order book interface, technical indicators corresponding to different time frames can generally be divided as follows:

1) Indicators for 1-minute, 3-minute, 5-minute, 15-minute, 30-minute, and 1-hour charts are mainly suitable for ultra-short-term investments where positions are held for up to 7 days.

2) Indicators for 15-minute, 30-minute, 1-hour, 4-hour, and 8-hour charts are primarily for short-term investments with positions held for 7 to 30 days.

3) Indicators for 1-hour, 4-hour, 8-hour, daily, and weekly charts are mainly used for medium-term investments with positions held for 30 to 365 days.

4) Indicators for 4-hour, 8-hour, daily, weekly, and monthly charts are best suited for long-term investments with positions held for 365 days to 3 years.

5) Indicators for daily, weekly, monthly, quarterly, and yearly charts are used for ultra-long-term investments where positions are held for over 3 years.

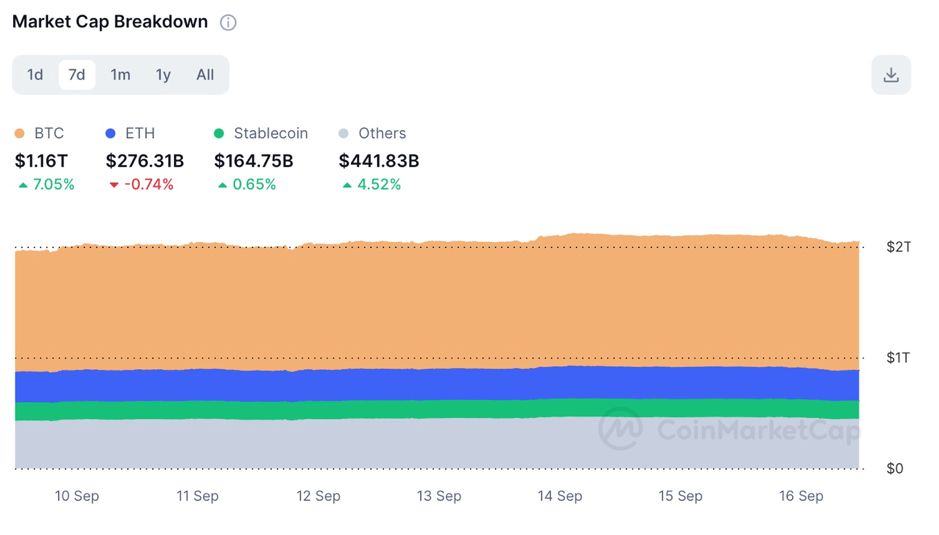

3. CMC 7D Statistics Indicators

Overall market cap analysis, source: https://coinmarketcap.com/charts/

24h trading volume, source: https://coinmarketcap.com/charts/

Fear & Greed Index, source:https://coinmarketcap.com/charts/

4. Perpetual Futures

The 7-day cumulative funding rates for major mainstream coins on various exchanges are generally negative, indicating that short positions have higher leverage at the moment.

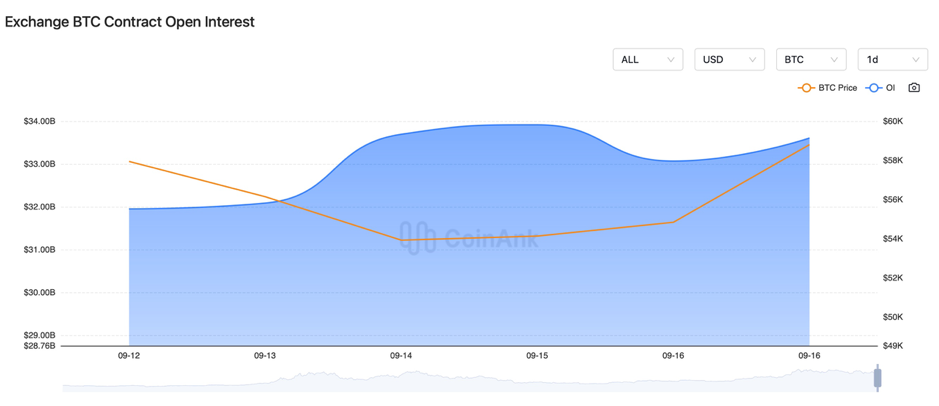

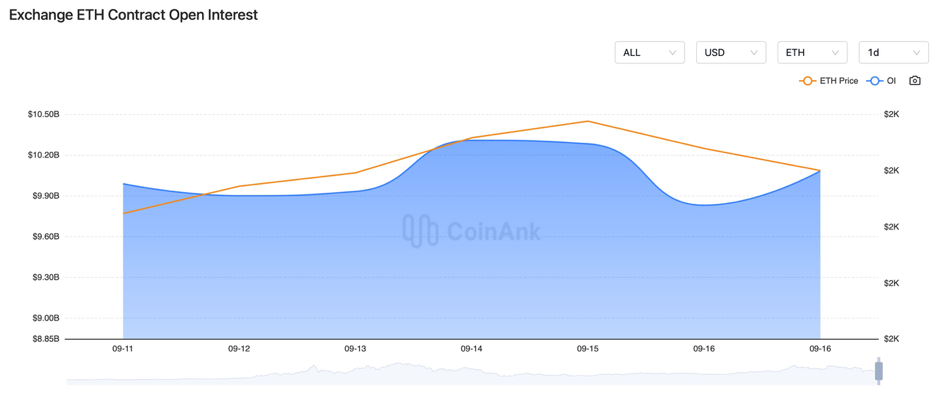

In the past four days, both the BTC and ETH contract open interest has slightly risen.

Exchange BTC Contract Open Interest:

Exchange ETH Contract Open Interest:

Note: All the above information is provided for reference purposes only and should not be construed as specific investment advice.

5. Industry Roundup

1) On September 12, the U.S. Initial Jobless Claims for the week ending September 7 reached 230,000, in line with expectations of 230,000, while the previous figure was revised from 227,000 to 228,000.

2) On September 12, the U.S. August year-on-year unadjusted CPI came in at 2.5%, lower than the market expectation of 2.6%. The unadjusted core CPI monthly rate was recorded at 0.3%, higher than the expected 0.2%.

3) On September 12, the U.S. August PPI annual rate was 1.7%, below the forecast of 1.8%, while the previous figure was revised from 2.20% to 2.1%. U.S. PPI and core PPI monthly rates were recorded at 0.2% and 0.3%, respectively, both higher than expected, but the previous values were revised down.

4) On September 12, Naoki Tamura of the Bank of Japan said that by the latter half of the long-term forecast period for the fiscal year 2026, short-term interest rates must be pushed up to about 1%. He added that a rate hike in 2024 is possible but not guaranteed. Junko Nakagawa noted that even with a rate hike, financial conditions would remain accommodative. The Bank of Japan may review its bond-buying plan, and there is no pre-set path or pace for future rate hikes.

5) On September 12, Cyvers warned that Bitcoin ETFs could become a target for the North Korean hacker group Lazarus Group.

6) On September 12, it was reported that Hong Kong plans for the Securities and Futures Commission to co-regulate virtual asset OTC trading with Hong Kong Customs.

7) On September 13, the UAE Central Bank approved a risk insurance product for digital asset custody, and the Central Bank of Russia planned to achieve broad use of the digital ruble by July 2025.

8) On September 13, Grayscale announced the launch of the first U.S. XRP Trust, paving the way for a potential ETF.

9) On September 13, SWIFT introduced a system to streamline tokenized asset trading (RWA).

10) On September 13, Nigeria’s EFCC froze over $330,000 in crypto user funds, accusing them of illegal forex trading. The U.S. Treasury sanctioned Cambodian tycoon Lee Yong Phat, accusing him of involvement in crypto scams and human trafficking.

11) On September 13, Singapore banned the use of cryptocurrencies in casinos to curb illegal money laundering activities.

12) On September 13, U.S. lawmakers introduced a new bill to establish a Joint Digital Asset Advisory Committee between the SEC and CFTC. Republican legislators accused the SEC Chair of recruitment violations.

13) On September 13, Brazil’s federal police targeted a $9.7 billion cryptocurrency money laundering scheme, and Taiwan police uncovered a cryptocurrency fraud ring involving around NT$100 million.

14) On September 13, the UK government submitted a bill to define NFTs, RWAs, and other crypto assets as new forms of property. The UK High Court ruled in a crypto case that USDT is classified as property.

15) On September 14, Tether reported a record-high net profit of $1.3 billion in Q2. A U.S. consumer protection group raised concerns over the transparency of Tether’s reserves.

16) On September 14, it was reported that SynFutures would host a summit at TOKEN2049, with notable attendees including partners from Dragonfly and Founders Fund.

17) On September 14, China’s Ministry of Finance fined PwC RMB 116 million and confiscated illegal gains related to audits of Evergrande in 2018, 2019, and 2020. The China Securities Regulatory Commission fined PwC RMB 297 million for negligence in auditing Evergrande’s annual reports and bond issuances, amounting to a total of RMB 325 million.

18) On September 14, eight U.S. Democratic lawmakers held a private roundtable with crypto industry leaders to discuss Bitcoin-related issues.

19) On September 14, Visa released its first cryptocurrency research report titled “Stablecoins: The Emerging Market Story”.

20) On September 15, the U.S. Treasury announced draft rules to impose a 15% corporate alternative minimum tax on companies with annual profits exceeding $1 billion, which would affect 100 large U.S. companies.

21) On September 15, U.S. Vice President Harris urged former President Trump to continue participating in presidential election debates. Trump said he would not debate Harris again.

22) On September 15, U.S. Treasury officials announced that for the first time, interest expenses on public debt exceeded $1 trillion in fiscal year 2024 to date.

23) On September 15, Solana co-founder questioned ZKsync’s claim that its governance system was not multi-signature, expressing concerns over centralization risks.

24) On September 15, Shanghai, China, announced plans to promote the innovative use of digital yuan in financial markets, digital trade, and cross-border payments. The Shanghai headquarters of the People’s Bank of China will explore a new model for cross-border tax remittances using blockchain technology, and the Shanghai Financial Regulatory Bureau will support institutions using AI and blockchain to offer more customized financial products.

Disclaimer: FameEX makes no representations on the accuracy or suitability of any official statements made by the exchange regarding the data in this area or any related financial advice.