FameEX Weekly Market Trend | September 30, 2024

2024-09-30 19:29:40

1. BTC Market Trend

From September 26 to September 29, the BTC spot price swung from $62,637.6 to $66,624.64, a 6.37% range.

In the last three days, important statements from the Federal Reserve (Fed) and the European Central Bank (ECB) were as follows:

1)September 26:

Federal Reserve President John Williams announced the launch of the Benchmark Rate Usage Committee, a new committee designed to help the market utilize and understand the benchmark interest rate.

Governor Christopher Waller expressed strong support for the Federal Reserve’s previous 50 basis point interest rate cut and emphasized that the Fed should focus more on employment.

2)September 27:

Federal Reserve Board Governor Lisa Cook stated that artificial intelligence may have a negative impact on employment and that she "wholeheartedly" supports a 50 basis point interest rate cut.

Governor Michelle Bowman noted that data shows the U.S. economy is still strong and expressed a desire for the Fed’s balance sheet to be as small as possible. She stated, "We are not responsible for ensuring that every bank can continue to exist." Bowman was the only official who dissented at the last FOMC meeting.

Vice Chair for Supervision Michael Barr mentioned that the bank liquidity leverage ratio is under review but there are currently no plans to adjust it.

Disagreement between Barr and Bowman: Barr is attempting to destigmatize the use of the discount window tool, while Bowman believes it should only be used in emergencies.

3)September 28:

Federal Reserve Chairman Jerome Powell stated that the Federal Reserve should cut interest rates "step by step." He added that if the labor market weakens, it may be appropriate to speed up the pace of interest rate cuts.

Putin Threatens Nuclear Response to Western Support for Ukraine

Russian President Vladimir Putin has issued a stern threat to Ukraine's NATO allies, stating that he will adjust Russia's nuclear weapons use policy to potentially cover an attack on Ukraine using advanced Western missiles. In a speech to the Security Council on September 25, Putin declared that Russia may use nuclear weapons if attacked by conventional weapons, and that Moscow will regard any attack on Russia supported by nuclear powers as a joint attack. Putin's threat sends a clear warning to Ukraine's Western allies, as the United States and Britain consider whether to allow Ukraine to use Western-made conventional missiles to strike targets deep inside Russia. While Putin said Russia could respond to a conventional attack with nuclear weapons, he did not specify whether it would do so if attacked by Western missiles. He also did not indicate which countries might be targets of Moscow's retaliation. These threats are expected to be incorporated into Russia's nuclear doctrine and represent one of Putin's most direct threats to use nuclear weapons since the full-scale conflict between Russia and Ukraine began in February 2022.

Altcoins Show Signs of Market Dominance with Significant Breakthroughs

According to Cryptoslate, several analysts have noted that altcoins are showing significant breakthroughs, suggesting that the market may be shifting to a stage dominated by altcoins. Technology and on-chain analyst Ali Martinez observed that while it's uncertain whether the full altcoin boom has arrived, current developments represent a good start. Analyst Caleb Franzen shared that altcoins, as measured by TradingView indices such as TOTAL3 and OTHERS, have surpassed important moving averages, specifically the 100-day and 200-day exponential moving averages (EMAs). Franzen highlighted that the last such breakout occurred in July 2023, during which altcoins used these EMAs as dynamic support to achieve higher highs.

Polygon Positions Itself as a Leader in the $16 Trillion Tokenization Race

Polygonis positioning itself as a major competitor in the upcoming $16 trillion tokenization battle. Increasing customer demand and regulatory clarity have prompted banks and financial institutions to experiment with issuing assets such as U.S. Treasury bonds, stocks, and private debt on public blockchains. Colin Butler, head of institutional capital at Polygon, said the trend will accelerate over the next six months. "People are still trying to figure out what is compliant," he told DL News. "Once something is accepted as collateral by big companies, I think others will follow suit. I believe that's when you'll see an L-curve of adoption." Tokenization promises to shorten asset transfer times, reduce costs, and update the fragile infrastructure that underpins much of the traditional financial system. The Boston Consulting Group estimates that asset tokenization will grow into a $16 trillion market by 2030. Consulting firm Bain & Company predicts that tokenization will generate $400 billion in additional revenue annually for asset managers. For blockchain companies that provide pipelines for asset tokenization, the next few months may represent a once-in-a-lifetime opportunity.

BitMEX Co-Founder Predicts Continued Federal Reserve Interest Rate Cuts Amid Volatility

Arthur Hayes, co-founder of BitMEX, wrote that based on the Federal Reserve’s historical response to "high volatility," we know that once they start cutting interest rates, they usually continue to lower them until rates are close to 0%. Additionally, we understand that the growth of bank credit must accelerate alongside interest rate cuts.

The Fed will continue to cut interest rates, and the banking system will continue to release more dollars. No matter who wins the U.S. presidential election, the government will continue to borrow to gain popular support. The European Central Bank will respond to the economic downturn by lowering euro interest rates. At the same time, governments will begin forcing banks to lend more to local businesses in order to provide jobs and rebuild crumbling infrastructure. The dollar will weaken as the Federal Reserve cuts interest rates and U.S. banks extend more credit. This allows the Chinese government to increase credit growth while maintaining a stable dollar-yuan exchange rate. If the Fed prints money, the People's Bank of China can do the same. This week, the People's Bank of China announced a series of interest rate cuts, and that's just the beginning.

If other major economies are now easing monetary policy, there will be less pressure on the Bank of Japan to raise interest rates quickly. The governor of the Bank of Japan has made clear that he will normalize interest rates, but given that rates in other countries are falling to the low levels he has set, he doesn't have to catch up so quickly. The world's major economies are once again trying to curb the volatility of their countries or economic groups by lowering currency prices and increasing currency quantities. If you're already fully invested in cryptocurrencies, relax and watch the fiat value of your portfolio soar.

From September 30th to October 2nd, traders can keep an eye on ETH spot trading opportunities with sell orders at $3,425 and $5,040, and buy orders at $1,730 and $2,040. For BTC, there are sell orders at $67,900, $79,870, and $96,820, and buy orders at $36,720 and $44,370. For other cryptocurrencies, it is recommended to prioritize short-term selling opportunities.

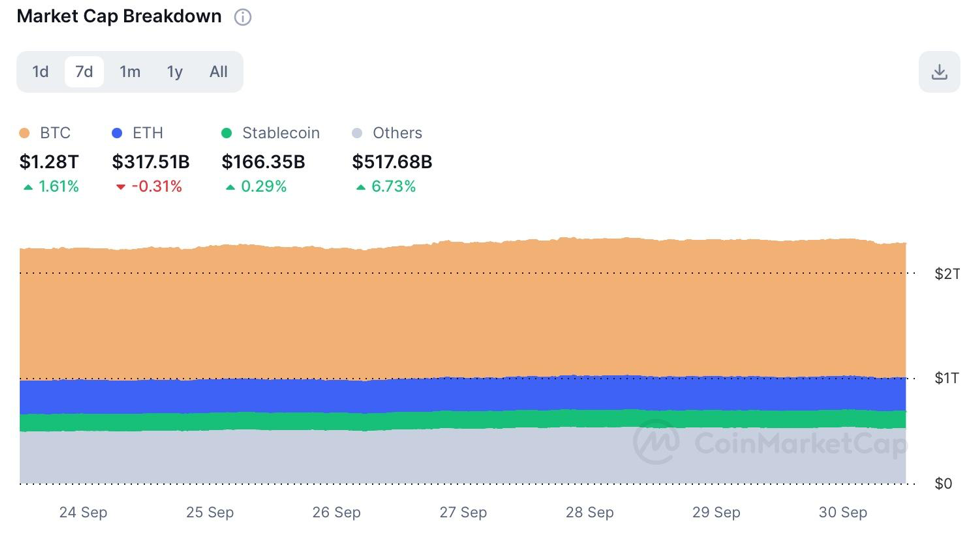

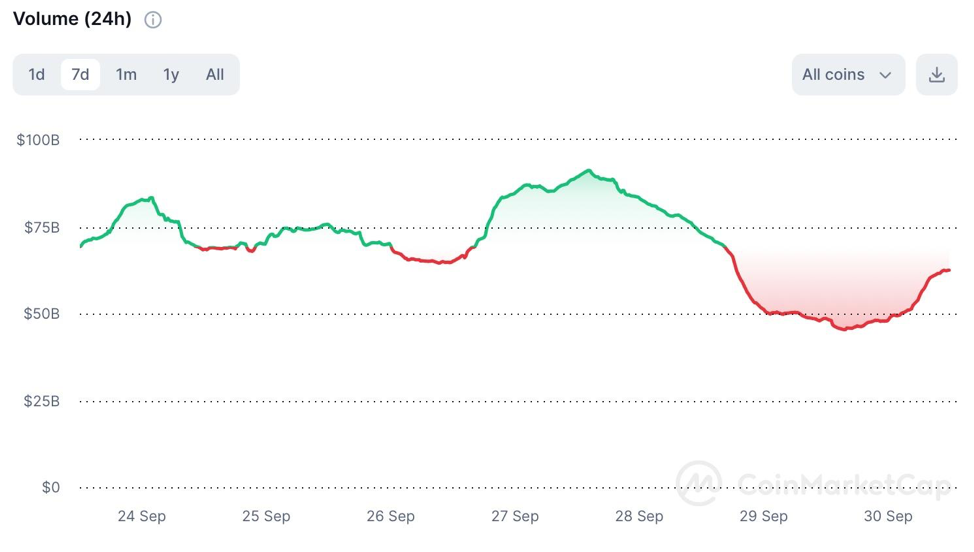

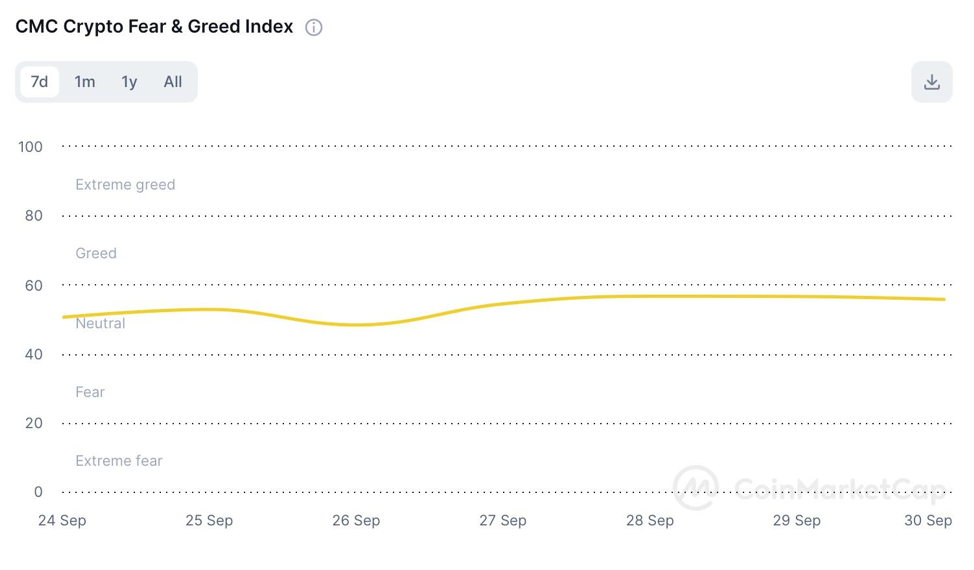

2. CMC 7D Statistics Indicators

Overall market cap analysis, source: https://coinmarketcap.com/charts/

24h trading volume, source: https://coinmarketcap.com/charts/

Fear & Greed Index, source: https://coinmarketcap.com/charts/

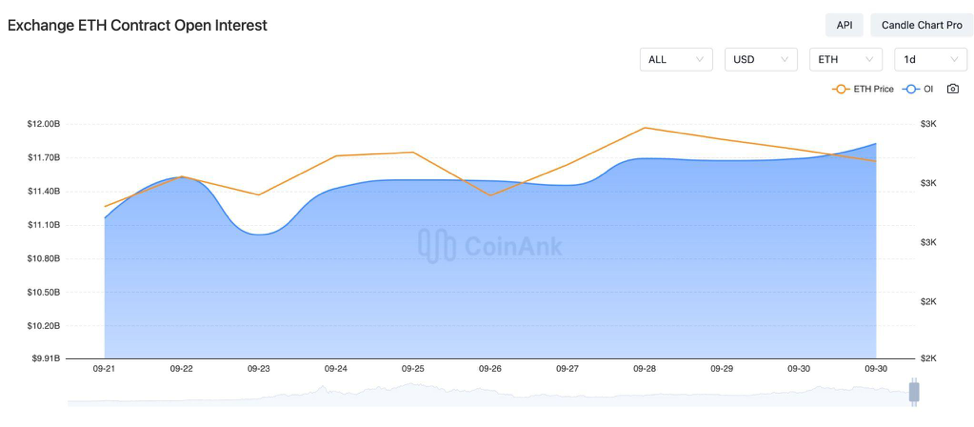

3. Perpetual Futures

The 7-day cumulative funding rates for mainstream cryptocurrencies across major exchanges are generally positive, clearly indicating that the overall market sentiment is bullish.

In the past four days, the holdings for BTC and ETH position has slightly risen.

Exchange BTC Contract Open Interest:

Exchange ETH Contract Open Interest:

Note: All the above information is provided for reference purposes only and should not be construed as specific investment advice.

4. Industry Roundup

1) Market News on September 26: The United States and the European Union are close to reaching an agreement to use frozen Russian assets to provide $50 billion in aid to Ukraine. Additionally, sources indicate that the United States has prepared $8 billion worth of weapons for Ukraine and is supporting President Zelensky’s visit and assistance programs.

2) U.S. Economic Data on September 26: The annual core PCE (Personal Consumption Expenditures) rate in the United States for August rebounded slightly to 2.7%, while the monthly core PCE rate fell back to 0.1%. Initial jobless claims for the week ending September 21 were 218,000, below the expected 225,000. The first-digit revision adjusted initial claims from 219,000 to 222,000. The final annualized quarterly rate of U.S. real GDP for the second quarter was 3%, meeting expectations and the previous value of 3.00%. The annualized quarterly rate of the U.S. core PCE price index for the second quarter was 2.8%, in line with expectations and the previous value of 2.80%.

3) Global Debt and U.S. Politics on September 26: According to the Institute of International Finance, global debt reached a record $312 trillion, driven by increasing debt between China and the United States. The U.S. Congress passed a three-month short-term spending bill to avoid a government shutdown at the end of the month. Vice President Harris stated that the United States should become a leader in the blockchain field and reiterated its support for digital assets.

4) On September 26 in China: The Chinese Ministry of Foreign Affairs urged Japan not to interfere in Sino-Japanese relations and to maintain peace and stability across the Taiwan Strait. Additionally, the Chinese Rocket Force successfully launched an intercontinental ballistic missile into the Pacific Ocean, achieving a range of over 12,000 kilometers.

5) On September 26 in Switzerland and the UK: The Swiss National Bank lowered its benchmark interest rate by 25 basis points to 1.00%, marking the third consecutive rate cut and aligning with general market expectations. Mark Green, a member of the Bank of England’s Monetary Policy Committee, suggested that the neutral interest rate may have risen.

6) Cryptocurrency Trading on September 26: Between July 2023 and June 2024, the Middle East and North Africa accounted for 7.5% of global cryptocurrency trading volume. Additionally, PayPal is allowing U.S. merchants to buy, hold, and sell cryptocurrencies directly from PayPal business accounts.

7) On September 26 in South Korea: South Korea established a digital asset protection fund to help recover user funds from collapsed crypto exchanges. South Korean regulatory agencies have stated that those involved in crypto fraud with profits exceeding $4 million could face life imprisonment.

8) Cryptocurrency Market on September 26: The correlation between Bitcoin and global liquidity was stronger than that of gold and stocks. The Dogecoin founder stated that he has not participated in the development of any other cryptocurrencies except Dogecoin. A report indicated that only two new currency projects have been launched this year, with a 12% realized price increase. Deribit reported that Bitcoin’s $5.8 billion quarterly options are expiring, which may cause market fluctuations.

9) Middle East Conflict on September 26: President Biden promoted a new ceasefire plan for Lebanon, while Israel hinted at launching a ground attack. Iran’s Foreign Minister stated that if a full-scale war breaks out in Lebanon, Iran would not remain neutral.

10) U.S. SEC and Cryptocurrency on September 27: U.S. SEC Chairman Gary Gensler declared that Bitcoin is not a security and stated that the crypto industry will not survive long without investor protection. The Bank of New York Mellon was approved by the U.S. SEC to provide cryptocurrency custody services.

11) Tether and Law Enforcement on September 27: Tether assisted Dutch and U.S. law enforcement agencies in combating cryptocurrency money laundering. Tether collaborated with the U.S. Department of Justice to freeze more than $6 million in proceeds from cryptocurrency fraud.

12) On September 27 in Morocco and Russia: Morocco plans to invest $1.1 billion to promote AI and blockchain, aiming to become a global digital hub by 2030. An underground cryptocurrency mine in Russia caused a fire in a local substation, resulting in power outages in some areas for several days.

13) On September 27in Palestine and Israel: Palestinian President Abbas stated that Palestinians refuse to establish an Israeli buffer zone. Israel announced it will receive an $8.7 billion aid package, including $3.5 billion for necessary war procurement and $52 billion earmarked for air defense systems.

14) U.S. Politics and DeFi on September 27: U.S. Treasury Secretary Yellen mentioned that dollar intervention is conceivable under extreme circumstances. Mark Cuban is considering serving as the head of the SEC or HHS in the Harris administration. U.S. lawmakers proposed the "Assessing DeFi Opportunities Act," calling DeFi "crucial to the future of capital markets." Wall Street giant Guggenheim tokenized $20 million in commercial paper on Ethereum. Analyst Shenyu stated that DeFi carry trades will see massive growth, potentially disrupting the pattern of treasury bonds as the main income source.

15) Tokenization and Digital Morocco on September 27: Swiss encryption management platform Taurus partnered with Aktionariat for tokenization business. Morocco launched the "Digital Morocco 2030" strategy, planning to invest $1.1 billion in AI and blockchain development. The Telegram wallet was temporarily blocked in the UK due to restructuring user access.

16) U.S. SEC Developments on September 27: The SEC will continue to promote changes in the definition of "exchanges" and alternative trading systems. SEC Chairman Gary Gensler stated that the Bank of New York Mellon’s custody model can be expanded beyond Bitcoin and Ethereum ETFs. A New York judge ordered that the criminal case against Tornado Cash developer Roman Storm proceed to trial.

17) SEC and Cryptocurrency Cases on September 27: The SEC partially won a $600,000 ICO case against the blockchain company Opporty. A man from Long Island, USA, was convicted of participating in multi-million dollar cryptocurrency-related crimes. The U.S. Department of Justice seized $2.5 billion in illegal transactions related to crypto exchange domain names.

18) Vitalik Buterin and Ethereum on September 27: Vitalik Buterin published a new article titled "Making the Alignment of Ethereum Clearly Visible." He stated that robot market-making DEXs are a cross-use case of encryption and artificial intelligence with broad prospects. Vitalik also mentioned that a major challenge for the Ethereum ecosystem is to integrate decentralization and cooperation.

19) U.S. ETFs and Crypto on September 27: Total assets of U.S. ETFs surpassed the $10 trillion mark for the first time. Zhu Su stated that the $16 billion allocated to FTX creditors will partially return to the market, acting as a significant incremental fund. Miner Swan Bitcoin accused several former employees of stealing trade secrets and copying its business model under Tether’s direction. The New York Department of Financial Services director welcomed federal encryption legislation but stated that states should retain regulatory responsibilities.

20) FTX Bankruptcy on September 27: FTX’s bankruptcy distribution plan has not yet been approved, and compensation will not begin on September 30. FTX creditors may only be able to recover 10-25% of their cryptocurrency.

21) Middle East Conflict Update on September 28: Israel announced a death toll list, and the top leaders of Hezbollah in Lebanon were nearly eliminated. President Biden supported Israel's "beheading" operation amid criticism and concern. Iran’s supreme leader is reported to have moved to a safe location and strengthened security measures.

22) European and Canadian Crypto Regulations on September 29: The Dutch Authority for the Financial Markets (AFM) stated that the Crypto Asset Market Supervision Regulation will take effect on December 30. The Canadian Securities Administrators extended the compliance period for crypto exchanges to the end of 2024 due to stablecoin risk factors. HSBC utilized distributed ledger technology to complete the issuance of HK$1 billion in digital bonds. A Northern Trust survey found that 34% of professional investors in London have invested or plan to invest in digital assets.

23) U.S. Tax Rules and Web3 on September 29: New U.S. tax rules that could “destroy the DeFi dream” are about to be introduced. CryptoQuant founder stated that well-regulated cryptocurrencies and Web3 are not scams. Startale Labs CEO announced that Masaaki, the former head of Japan’s Web3 project team Taira, is expected to become Japan's digital minister next week.

24) Upcoming Economic Data Releases on September 29: Next Wednesday, the unemployment rate in the Eurozone for August and the ADP employment numbers in the United States for September will be released. Next Thursday, the monthly Producer Price Index (PPI) rate in the Eurozone for August and the initial jobless claims in the United States for the week ending September 28 will be released. The U.S. seasonally adjusted non-farm payrolls and unemployment rate for September will be released next Friday.

25) Token Unlocks on September 29: According to Token Unlocks data, SUI, OP, IMX, ZETA, DYDX, MAV, ADA, GAL, MANTA, and LQTY will experience significant token unlocks next week, totaling approximately $295.7 million.

Disclaimer: FameEX makes no representations on the accuracy or suitability of any official statements made by the exchange regarding the data in this area or any related financial advice.