FameEX Weekly Market Trend | October 17, 2024

2024-10-17 09:31:20

1. BTC Market Trend

From October 14 to 16, the BTC spot price swung from $62,252.79 to $68,285.56, a 9.69% range. In the last three days, key statements from the Federal Reserve (Fed) were as follows:

1) On October 15, Fed’s Daly said that monetary policy remains restrictive, with efforts to lower inflation underway.

2) On October 15, Fed’s Waller said future rate cuts should be more cautious than September’s, with hurricanes and strikes possibly cutting 100,000 jobs in October. Cuts may adjust based on conditions.

3) On October 15, Fed’s Kashkari noted that monetary policy remains tight, with further “moderate” rate cuts likely.

4) On October 16, the Fed dot plot suggested one more 25bp rate cut this year.

5) On October 16, Daly suggested 3% as a potential neutral rate and expected one or two more cuts this year.

6) On October 16, Fed’s Bostic predicted another 25bp rate cut this year after September’s 50bp cut, expecting inflation to fluctuate while employment stays strong, and ruled out a recession.

A top economic advisor to Trump dismissed claims that if reelected, Trump would weaken the dollar or reduce trade. He emphasized that Trump wants to maintain the dollar’s status as the world’s currency and uses tariffs as a negotiation strategy. Scott Bessent, a 62-year-old hedge fund manager known for his successful bets on the yen and pound while working for George Soros, is a key advisor to Trump on economic and financial matters. Bessent is often considered a potential Treasury Secretary if Trump returns to the White House.

In an interview, Bessent said he expects a new Trump administration to support a strong dollar policy, consistent with decades of U.S. policy, and will not intentionally devalue the dollar. Bessent added that Trump “strongly supports the dollar’s role as a reserve currency”, and while fluctuations may occur, he believes the sound economic policy will naturally lead to a strong dollar. He also noted that Trump would appoint a new Fed Chair when Powell’s term ends in 2026 but would not interfere with the Fed’s independence, addressing concerns that Trump might politicize the Fed if reelected. “He will express his views,” Bessent said. “But Trump is different because he’s a businessman — he understands economics.”

Unlike previous bull markets, this one is led by Bitcoin. Over 50% of the market’s funds are often concentrated in BTC spot and BTC futures, making it easier to push BTC prices higher. Meanwhile, other top cryptocurrencies, including ETH, have not surpassed their previous highs, with some remaining at low prices. This trend may be hard to change before the bull market ends next year.

The sell order for the BTC spot at $67,900 has been filled, and the buy order we suggested at $54,000 has yielded a profit of 25.74%. The earlier buy order at $52,800 has gained 28.6%. Congratulations to those who profited by following these orders!

From October 14 to October 16, keep an eye on ETH spot trading opportunities. Maintain the sell orders at $3,425 and $5,040, as well as the buy orders at $1,730 and $2,040. For the BTC spot, it is recommended to adjust half of the sell order at $79,870 to $72,120 for short-term gains and move the buy order from $44,370 to $45,900 to improve the chance of execution in the next two months. In addition, maintain the sell order at $96,820 and the buy order at $36,720 and consider placing a new buy order at $45,900 with funds from the $67,900 sale to continue capturing low-risk gains from market fluctuations.

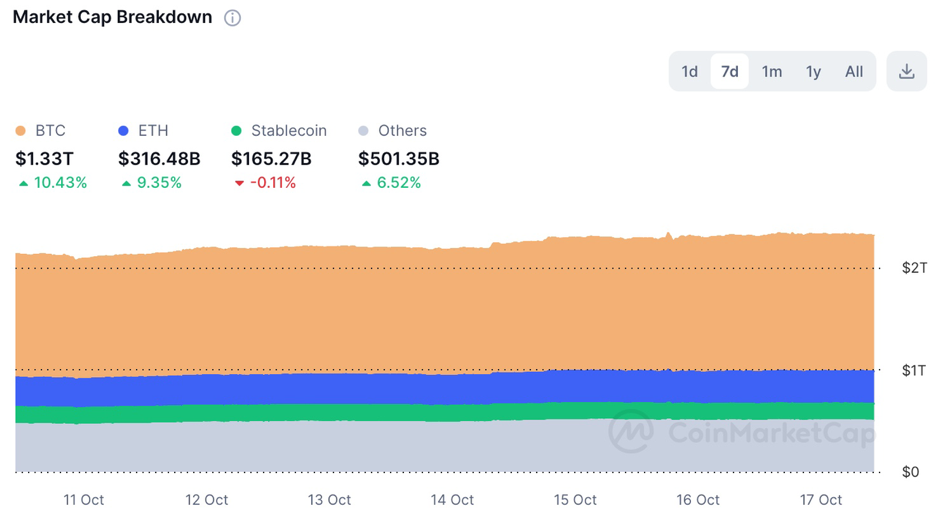

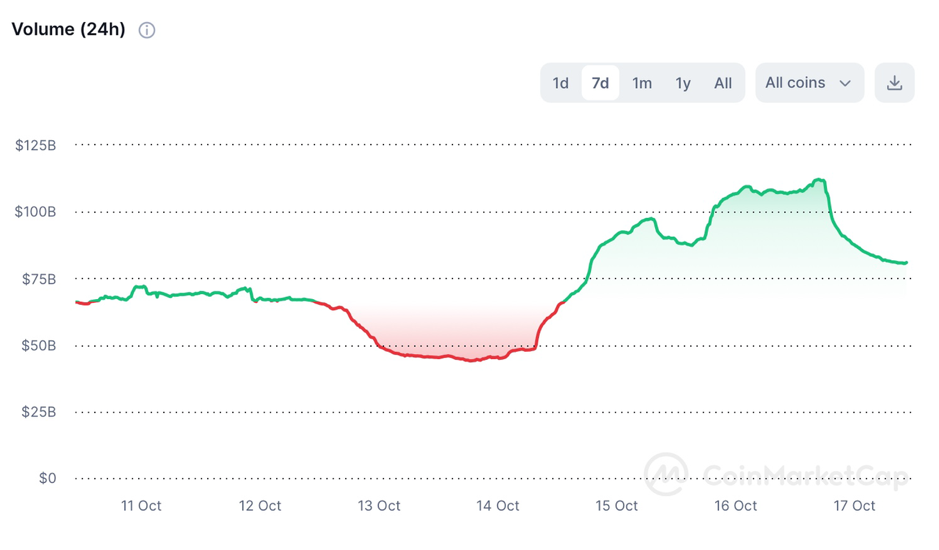

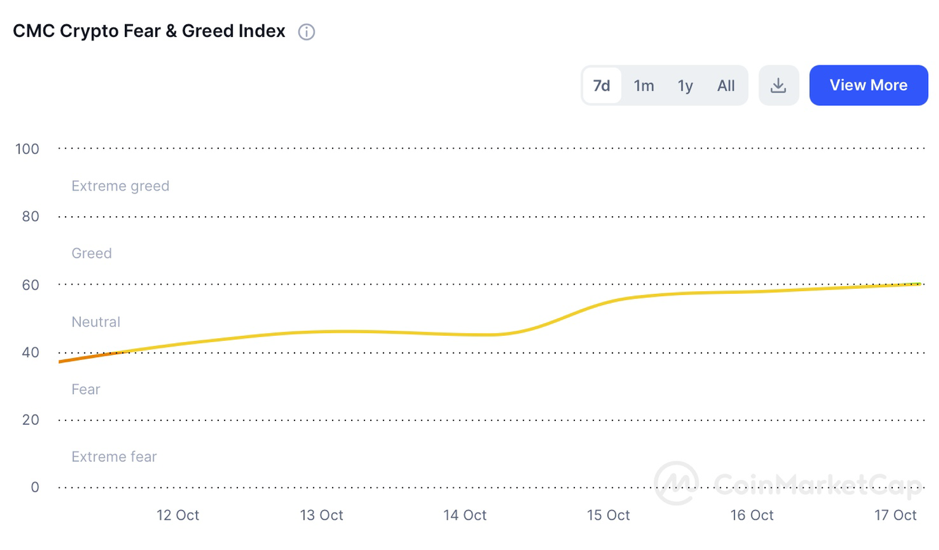

2. CMC 7D Statistics Indicators

Overall market cap analysis, source: https://coinmarketcap.com/charts/

24h trading volume, source: https://coinmarketcap.com/charts/

Fear & Greed Index, source: https://coinmarketcap.com/charts/

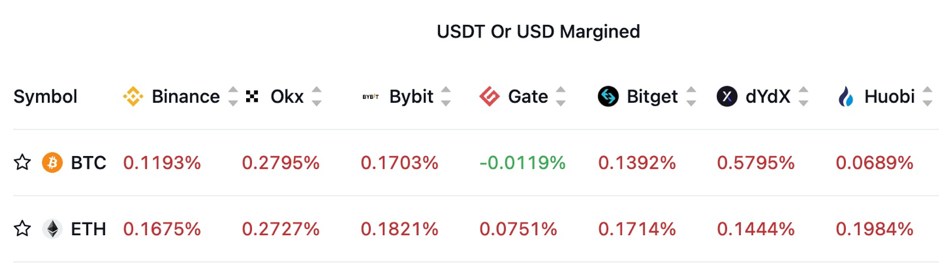

3. Perpetual Futures

The 7-day cumulative funding rates for mainstream cryptocurrencies across major exchanges are generally positive, indicating that the market is still dominated by the bulls.

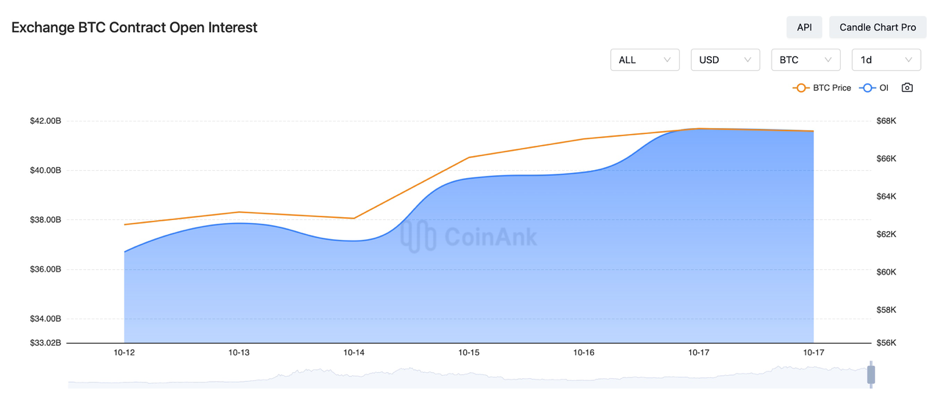

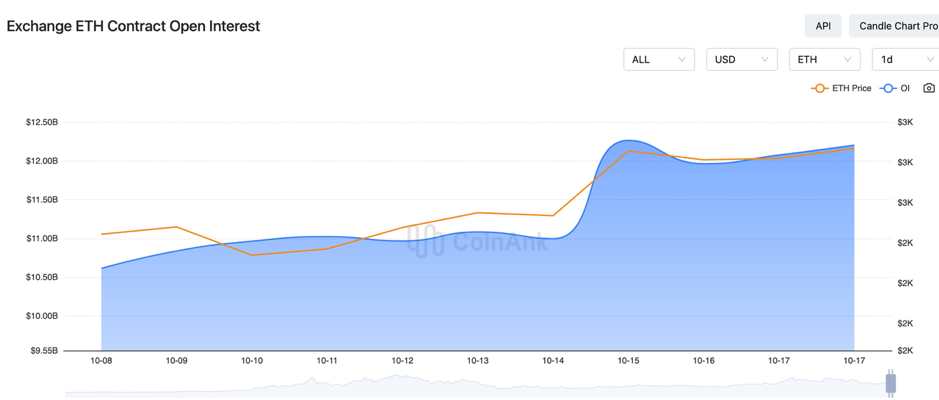

In the past four days, the BTC contract open interest has seen a significant increase, while the ETH contract open interest has slightly risen, indicating that new market funds are primarily invested in BTC.

Exchange BTC Contract Open Interest:

Exchange ETH Contract Open Interest:

Note: All the above information is provided for reference purposes only and should not be construed as specific investment advice.

4. Industry Roundup

1) On October 14, the EU Foreign Ministers’ meeting passed a resolution to impose sanctions on Iran for “providing ballistic missiles to Russia for attacks on Ukraine”.

2) On October 14, China’s M2 money supply year-on-year for September was 6.8%, exceeding expectations of 6.4% and the previous value of 6.3%.

3) On October 14, Indian central bank governor Shaktikanta Das stated that central bank digital currencies (CBDCs) are another area with the potential to enhance efficient cross-border payments; India is one of the few countries to launch both wholesale and retail CBDCs simultaneously.

4) On October 14, Slow Mist Technology reported a new AI-themed MEV bot scam that uses fake smart contracts to steal ETH.

5) On October 14, South Africa’s tax authority plans to incorporate cryptocurrency into its compliance program.

6) On October 14, the Saudi-China Special Economic Zone is set to begin construction in 2025.

7) On October 15, it was reported that Lebanon may be placed on the FATF gray list due to insufficient anti-money laundering efforts.

8) On October 15, the Deputy Governor of the Russian Central Bank indicated that another rate hike may occur at the next meeting.

9) On October 15, the number of unemployment claims in the UK for September was 27,900, with the previous value revised from 23,700 to 3,000; the ILO unemployment rate for the three months ending in August was 4%, with expectations at 4.1% and a previous value of 4.10%.

10) On October 15, an economic advisor to Trump stated that a potential new government would support a strong dollar and may limit the rise of cryptocurrencies.

11) On October 15, FinCEN accused TD Bank of failing to report suspicious cryptocurrency activities as part of a $3 billion money laundering penalty.

12) On October 15, the Sui Foundation stated that the seller of $400 million in SUI tokens is not an insider but may be an infrastructure partner.

13) On October 15, India and Canada expelled each other’s diplomats.

14) On October 16, approximately 1.4 million youth alliance members and students in North Korea enlisted or re-enlisted; North Korea demolished parts of the inter-Korean communication routes, prompting the South Korean military to respond with fire south of the military demarcation line.

15) On October 16, Coinbase requested a court ruling for the SEC to provide cryptocurrency securities regulation documents.

16) On October 16, Hong Kong police dismantled a scam group posing as a “cryptocurrency investment” scheme, involving HK$360 million.

17) On October 16, the UK’s annual inflation rate for September dropped from 2.2% in August to 1.7%, exceeding expectations, marking the first time overall inflation has fallen below 2% since April 2021, with a monthly rate of 0%.

18) On October 16, the Philippine Central Bank cut rates by 25 basis points to 6%, while Thailand’s central bank also reduced rates by 25 basis points to 2.25%.

19) On October 16, Bitcoin Cash margin futures open interest reached a historic high of $25.5 billion.

20) On October 16, the “Network State” project Praxis secured $525 million to build crypto-friendly cities.

Disclaimer: FameEX makes no representations on the accuracy or suitability of any official statements made by the exchange regarding the data in this area or any related financial advice.