FameEX Weekly Market Trend | April 10, 2025

2025-04-10 10:06:52

1. Key Insights on Crypto Market Trends

From April 3 to April 9, the BTC spot price swung from $74,411.64 to $84,522.6, a 13.59% range. The decline during this period was mainly due to concerns about a global economic recession following the trade war triggered by Trump’s withdrawal and new U.S. tariff policies, as well as current uncertainty surrounding the Federal Reserve’s (Fed) interest rate cuts.

Over the past seven days, officials from the Fed and the European Central Bank (ECB) have made frequent public remarks:

1) On April 3, Fed Governor Kugler stated that the progress in combating inflation may have stalled.

2) On April 4, Fed Vice Chair Jefferson stated that there is no need to rush rate adjustments, and that the current policy rate is well-positioned to handle risks and uncertainties. He emphasized that thoroughly assessing the full impact of policy changes under Trump is of critical importance. He noted that rising goods inflation is partly due to trade policy, and that a decline in housing service prices may help offset overall inflation.

Fed Governor Cook remarked that it is appropriate to maintain the current policy for now while continuing to monitor incoming data. She added that a reduction in uncertainty and easing inflation would help pave the way for interest rate cuts. She also warned that tariff-related uncertainty could potentially weaken the economy.

3) On April 5, Fed Chair Jerome Powell said that the Fed would wait for clearer signals before considering a change in policy stance. He stated that, over the next year, as the effects of Trump’s policy changes become clearer, uncertainty is expected to decrease significantly. He also confirmed his intention to complete his full term as chair. Powell noted that potential tariffs could have lasting inflationary effects and that the economic impact of tariffs may be greater than previously anticipated. While downside risks have increased, he affirmed that the economy remains in good condition.

4) On April 7, Chair Powell reiterated that the Fed is not in a hurry to cut interest rates.

5) On April 8, Governor Kugler stressed that keeping inflation in check is a top priority. She warned of the “significant impact” of new U.S. tariffs and noted early signs of rising prices.

Goolsbee expressed concern that if tariffs are implemented at the levels announced—along with retaliatory tariffs—it could lead to a renewed wave of supply chain disruptions and high inflation.

Governor Kugler reiterated that preventing a rise in inflation remains a top priority. She mentioned that the Fed held a closed-door meeting to review the advance and discount rates.

6) On April 9, Goolsbee noted that the actual implementation of tariffs has significantly exceeded what previous economic models had forecast. He stressed that the Fed must adopt a long-term perspective rather than reacting to short-term market volatility, as is often the case with the stock market.

7) On April 3, ECB Governing Council Member Stournaras stated that U.S. tariffs would not be an obstacle to an interest rate cut in April. However, he warned that these tariffs would have a negative impact on eurozone GDP growth, with preliminary first-year estimates ranging from 0.3% to 0.4%.

Council Member Rehn remarked that inflation is gradually falling back on track, but the economic growth outlook has weakened.

8) On April 4, minutes from the ECB meeting indicated that inflation uncertainty could evolve in either direction. Some participants pointed out that potential shocks—including escalating trade tensions and broader uncertainties—could significantly weigh on economic growth. The minutes suggested that being cautious in the face of uncertainty does not necessarily imply a gradual rate-cut path, and it is no longer clear whether current policy remains restrictive.

9) On April 7, ECB Executive Board Member Schnabel stated that the level of uncertainty the ECB faces has increased sharply and could rise further.

Council Member Stournaras warned that Trump’s tariff policies could deliver a significant “demand shock” to the European economy. He estimated that the negative effect on eurozone growth could range from 0.5 to 1 percentage point.

Council Member Simkus said that a 25 basis point rate cut is needed in April.

Fed officials have expressed concerns about a potential economic recession, and Chair Powell’s statement that there is no urgency to cut rates has further reduced the likelihood of a rate cut in May. In contrast, statements from ECB officials have, on the whole, leaned more toward supporting an interest rate cut in April.

On April 3, the U.S. announced new trade policies:

① President Trump signed an executive order imposing a 10% minimum baseline tariff on all countries, along with retaliatory tariffs—EU (20%), Japan (24%), Vietnam (46%), South Korea (25%), and China (34%, totaling 54% with existing tariffs). NAFTA-exempt goods remain unaffected; non-exempt goods will face a 25% tariff.

② The U.S. Treasury urged other countries not to retaliate.

③ The baseline tariff took effect on April 5, retaliatory tariffs on April 9, 25% auto tariffs on April 3, and tariffs on auto parts will take effect on May 3.

④ Gold bars, copper, pharmaceuticals, semiconductors, and wood products are exempt from retaliatory tariffs.

On April 9, Trump’s retaliatory tariffs on dozens of countries officially took effect, heightening fears of a global trade war, though he signaled willingness to negotiate with some nations. The aggressive tariff measures have disrupted decades of global trade norms, raising recession concerns and triggering a sharp global stock market sell-off. Since the tariff announcement a week ago, the S&P 500 has lost nearly $6 trillion, marking its worst four-day drop since its inception in the 1950s and nearing bear market territory.

2. CMC 7D Statistics Indicators

Overall market cap and volume, source: https://coinmarketcap.com/charts/

Altcoin Season Index and Bitcoin Dominance: https://coinmarketcap.com/charts/

Crypto ETFs Net Flow: https://coinmarketcap.com/charts/

CoinMarketCap 100 Index: https://coinmarketcap.com/charts/cmc100/

(Used to measure the overall performance of the top 100 cryptocurrency projects by market capitalization on CoinMarketCap)

Fear & Greed Index, source: https://coinmarketcap.com/charts/

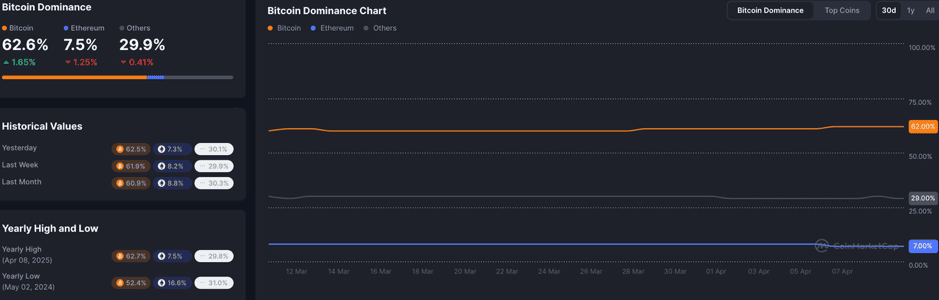

Over the past seven days, the total cryptocurrency market cap and trading volume have continued to decline, with market activity dropping sharply. Altcoins have seen panic selling, while Bitcoin’s market dominance has remained steady.

ETF funds have continued to see net outflows, reflecting a serious lack of market confidence. Even major coins and large-cap altcoins have not been spared. The current Fear and Greed Index stands at 25, already in a recent bottom range.

3. Perpetual Futures

The 7-day cumulative funding rates for BTC and ETH on the top 8 exchanges are 0.826% and 0.8284%, respectively, indicating a strong bullish sentiment across the market, with expectations of a continued uptrend.

Exchange BTC Contract Open Interest:

Exchange ETH Contract Open Interest:

Over the past seven days, BTC contract open interest has slightly declined, while ETH contract open interest has dropped significantly, indicating a strong risk-off sentiment among high-risk appetite market participants.

4. Global Economic and Crypto Sector Developments

Macroeconomy

1) On April 3, Trump stated that some of the tariffs imposed this week could help the government raise over $1 trillion around next year, aiding in reducing national debt and potentially offsetting some income taxes.

2) On April 3, the Eurozone’s February PPI (Producer Price Index) rose 0.2% month-on-month, above the expected 0.1% but below the previous 0.8%.

3) On April 3, U.S. Senate President pro tempore Chuck Grassley and Senator Maria Cantwell proposed legislation requiring Congress to approve all new tariffs within 60 days.

4) On April 4, IMF Managing Director Kristalina Georgieva stated that U.S. tariffs pose a significant risk to the global outlook.

5) On April 5, the U.S. unemployment rate for March stood at 4.2%, slightly higher than the expected 4.1% and up from the previous 4.1%. Seasonally adjusted non-farm payrolls increased by 228,000, well above the expected 135,000. However, the previous figures for January and February were revised down by a combined 48,000 jobs.

6) On April 5, China announced a 34% tariff on all imported goods originating from the United States.

7) On April 6, European Commission President Ursula von der Leyen said the EU is ready to reach a good deal with the U.S. but is also prepared to take countermeasures. EU Chief Trade Negotiator Maroš Šefčovič announced that the first round of EU tariffs will be imposed starting April 15, with a second round following on May 15.

8) On April 7, the Japanese Prime Minister stated that Japan would not retaliate against U.S. tariffs.

9) On April 8, the EU proposed a 25% tariff on selected U.S. products, to be implemented in two phases.

10) On April 8, the U.S. Treasury Secretary said it is unlikely that trade agreements with any country will be reached before April 9, noting that nearly 70 countries are seeking negotiations.

11) On April 9, European stock index futures continued to plunge: Euro Stoxx 50 futures fell 4.3%, Germany’s DAX futures dropped 4.3%, and the UK’s FTSE 100 futures declined 2.9%.

12) On April 9, China’s Ministry of Foreign Affairs responded to escalating U.S. tariff threats, stating that if the U.S. insists on a tariff and trade war, China will fight to the end.

Cryptocurrency Industry Updates:

1) On April 3, Fidelity launched a zero-fee crypto retirement account, supporting investments in BTC, ETH, and LTC.

2) On April 4, Australia shut down a crypto scam network linked to global losses totaling $35 million.

3) On April 6, cryptocurrency ownership in Singapore rose to 26%, with younger users dominating payment app usage.

4) On April 7, a memo revealed that the U.S. Department of Justice had disbanded its National Cryptocurrency Enforcement Team.

5) On April 9, it was announced that China is set to release its March M2 money supply and CPI year-on-year data this Thursday. The U.S. will also release March CPI (unadjusted and seasonally adjusted) and weekly jobless claims data as of April 5. Additionally, the Fed will publish the minutes from its March monetary policy meeting.

Regulation & Crypto Policy:

1) On April 3, U.S. federal agencies were required to report their crypto holdings to the Treasury Secretary, though the audit results may not be made public. On the same day, the Georgia House of Representatives passed a resolution recommending that the State Department of Education incorporate “blockchain, cryptocurrency, and Web3” into the curriculum.

2) On April 6, the U.S. SEC stated that certain types of stablecoins are not considered securities, and minting or redeeming them does not require registration. The acting SEC chair also instructed a review of crypto-related statements to determine whether any should be revised or withdrawn.

3) On April 9, the U.S. Department of Justice dissolved its cryptocurrency enforcement unit, as former President Trump moved to further ease regulations on digital assets.

Other News:

1) On April 3, DeepSeek was used for the first time in international earthquake rescue efforts, overcoming Myanmar’s language barrier in just seven hours.

2) On April 5, the Governor of California voiced opposition to the U.S. government’s tariff policy. Meanwhile, U.S. media reported that Treasury Secretary Bessent was fed up with the Trump administration’s “absurd retaliatory tariff formula” and was considering resignation.

3) On April 7, Dmitry Medvedev, Deputy Chairman of Russia’s Security Council, stated that the current global situation makes nuclear disarmament unlikely for decades. He added that more destructive weapons would be developed, and new countries would acquire nuclear capabilities.

4) On April 8, Elon Musk publicly opposed the new tariffs, directly urging Trump to cancel them—but was rejected. Musk has lost $134.7 billion so far this year.

5. Market Outlook

From April 10 to April 16, the medium-term trading strategy will still be applied: for the BTC spot, maintain the sell order at $169,400 and the buy orders at $73,970, $59,935, and $45,900, respectively.

The ETH spot buy order at $1,730 has been filled. It is recommended to place a sell order at $5,125 for ETH spot, and set the remaining bottom-fishing buy orders at $1,240.

In the current market, it’s crucial to closely monitor the impact of the new U.S. tariff policies on global economies, as well as the EU and other countries’ countermeasures and responses.

Risk Reminder: The cryptocurrency market is highly volatile, and investors are advised to control their positions and implement stop-loss strategies. The above content is for reference only and does not constitute specific investment advice from this exchange.

Disclaimer: FameEX makes no representations on the accuracy or suitability of any official statements made by the exchange regarding the data in this area or any related financial advice.