Miners Are Selling BTC As Incomes Decline According to Bitcoin On-Chain Statistics

2023-06-13 15:38:05

Since the beginning of June, Bitcoin miners have started selling BTC, potentially putting more pressure on the price of BTC.

Source: www.gobankingrates.com

The on-chain data for Bitcoin shows that miners are selling their holdings. Reduced revenues from a slowdown in Ordinals activity and record-high mining difficulty and hash rate might be the driving forces behind the selling push.

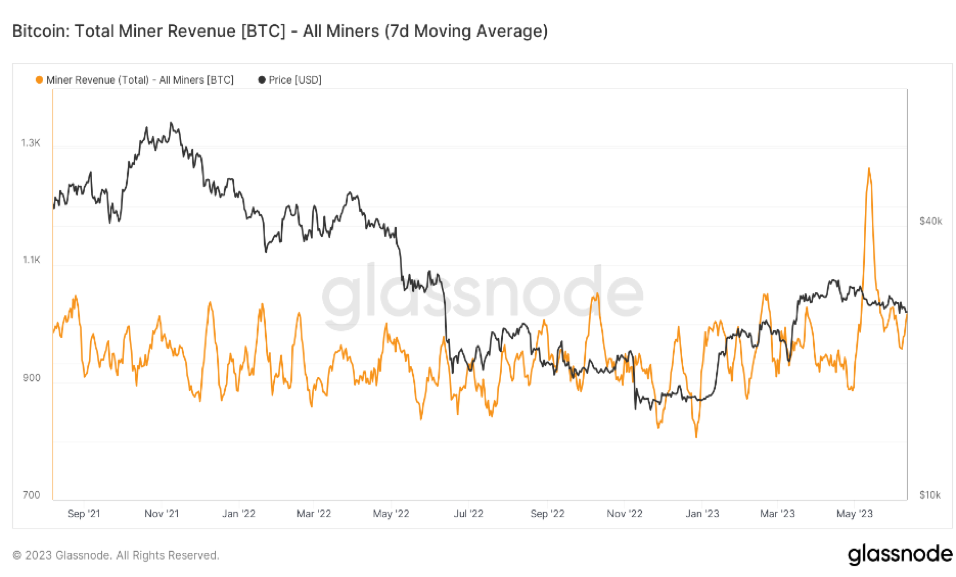

Glassnode, an organization that does on-chain monitoring, claims that miners have been sending a significant amount of coins to exchanges. According to Glassnode statistics, on June 3, Bitcoin mining activity surged to levels last seen in the early 2021 bull market, reaching a three-year high.

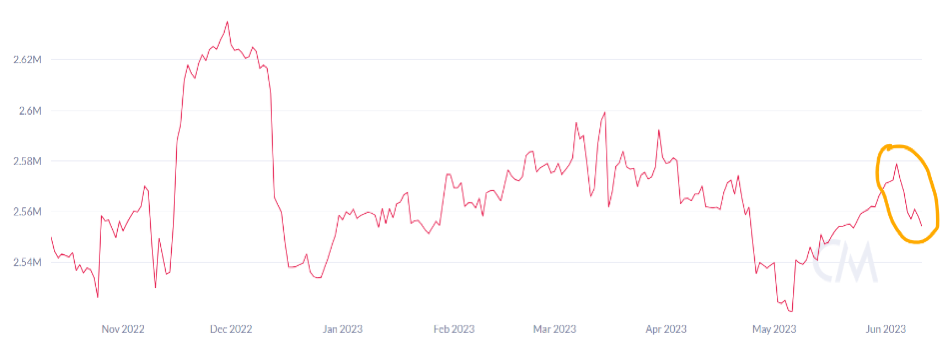

The one-hop supply statistic of miners, which gauges the amount of Bitcoin kept in addresses that receive coins from mining pools, has also decreased, according to data from Coin Metrics. Since May 2023, the indicator has shown an upward tendency in miner holdings; however, in the second week of June, the trend of accumulation was reversed.

Bitcoin mining supply on a single hop. Source: Coin Metrics

Mining Difficulty Has Increased While Activity for Ordinals Has Decreased

The measure of how challenging it is to discover a new block in the Bitcoin blockchain network, known as the mining difficulty, peaked around the beginning of June. To guarantee that new blocks are uploaded to the network on average every 10 minutes, Bitcoin difficulty is frequently adjusted. The network adapts to make mining more challenging as its computational capacity rises, and vice versa. Every 2,016 blocks, or about every two weeks, the difficulty is changed. It is dependent on the network's overall processing capacity, or hash rate. On May 31, there was a change that resulted in a 3.39% rise in overall difficulty.

The price of Bitcoin (black) and its 7-day moving average (orange) are shown. Source: Glassnode

Bitcoin miners' profits are eaten away by the rise in Bitcoin difficulty, potentially increasing their losses. Additionally, following the latest difficulty adjustment, there has been more rivalry among miners, resulting in the network's hash rate reaching an all-time high of 381 exchanges per second on June 11. This week's upcoming difficulty adjustment is anticipated to increase selling pressure.

May saw a fall in Bitcoin Ordinals activity, which cut miner revenues after previously increasing miner revenue. A two-month low was reached in the total fees paid for Ordinal inscriptions on Bitcoin, and non-fungible token exchange trade volumes followed a similar pattern.

The seven-day average profits for the miners fell from a record high of $33.9 million in May to $25.8 million on the first of June, according to Glassnode figures. Summer officially began in June, and because of the high temperatures in the Northern Hemisphere and the rising cost of power, several mining farms saw a huge load. Summer heat waves in 2022 forced Texas miners to briefly halt operations. According to reports, Texas has around 15% of the nation's mining capacity. In 2023, the heat waves may get harsher, which would lower the network's mining hash rate.

Disclaimer: FameEX makes no representations on the accuracy or suitability of any official statements made by the exchange regarding the data in this area or any related financial advice.