Top Bitcoin BRC20 Projects in 2024: Identifying High-Potential Investments

2024-02-08 13:14:10Key points:

As of January 22, 2024, a total of 23,521 BRC-20 tokens have been minted, and an additional 38,010 BRC-20 tokens are currently being minted.

Over the past 90 days, the top five BRC-20 tokens selected by the FameEX exchange—ORDI, SATS, MUBI, TRAC, and RATS—have experienced remarkable price increases of 1616.37%, 2378.40%, 3245.23%, 878.54%, and 242.54% respectively. These increases significantly outperform those of other cryptocurrencies.

Choosing high-quality BRC-20 tokens necessitates multi-dimensional analysis and discernment, covering aspects such as code audits, token issuance, technological innovation, brand management, the project's initial purpose, and prospects for future development. Only tokens that demonstrate genuine operational quality should be considered for investment to mitigate market instability. During volatile periods, this approach can help minimize potential losses.

If the rapid expansion of the Bitcoin ecosystem in 2023 serves as an indicator of the crypto market moving towards a bull market, then the SEC's approval of 11 Bitcoin spot ETFs in early 2024 marks an unquestionably explosive beginning. With the endorsement of regulatory compliance, an immense influx of market capital is poised to flow into Bitcoin, inevitably benefitting its wider ecosystem. The BRC-20 ecosystem is on the verge of experiencing a significant surge. Which Bitcoin BRC-20 projects should investors consider in 2024? Stay tuned to this article to discover the keys to unlocking wealth in the forthcoming bull market.

1. What is the Bitcoin Ecosystem?

The term "Bitcoin Ecosystem" describes the ecosystem encompassing a range of Bitcoin protocols, solutions, and crypto assets that originate from the Bitcoin blockchain network. The solidification of Bitcoin's codebase has indeed ensured its stability and reliability, but it has also rendered Bitcoin somewhat mundane. Previously, Bitcoin was at the forefront of innovation. However, this dynamism has now moved to newer blockchain generations designed to accommodate a broader range of applications and use cases.

The evolution of the Bitcoin ecosystem was a gradual process. Beginning in 2012, a group of developers introduced the Open Assets protocol, which leveraged the Bitcoin network for the issuance of encrypted assets, termed "Colored Coins." Following this, subsequent Bitcoin protocols, including Ordinals, Atomics, Runes, PIPE, and Taproot Assets, were developed, drawing on the insights of their predecessors. The primary goal behind the development of the Bitcoin protocol is to utilize the unique features of the Bitcoin network to issue a variety of encrypted assets, thereby enhancing the ecosystem's application diversity and network efficiency. Now, projects can issue tokens on the Bitcoin network with their security firmly rooted in the Bitcoin blockchain. What's more, the introduction of Ordinals didn't necessitate any modifications to Bitcoin's original code. Additionally, the BRC-20 standards are quickly advancing, setting them up to be a crucial new component of the BTC ecosystem moving forward.

The Bitcoin ecosystem also referred to as the BRC-20 or Inscription ecosystem, encompasses assets issued using the Bitcoin protocol as BTC-20 tokens or Inscription tokens. With prominent public blockchains like Ethereum and Solana adopting the issuance of Inscription tokens, the concept has expanded beyond the confines of the Bitcoin ecosystem, embracing a broader array of issuance methods and asset protocols. Nonetheless, the most popular or promising Inscription tokens predominantly originate from the Bitcoin ecosystem, underscoring the vast potential and innovative scope that Bitcoin Inscriptions offer.

2. Current Development of the Bitcoin Ecosystem

As we delve into the intricate dynamics of the Bitcoin ecosystem, it's imperative to acknowledge the transformative journey these BRC-20 tokens have embarked upon since its inception. The year 2023 marked a pivotal chapter in the evolution of Bitcoin, witnessing unprecedented developments that not only expanded its technological foundation but also solidified its position in the broader cryptocurrency market. These advancements have not only attracted a new wave of participants but have also significantly influenced the market's structure and the perception of digital currencies worldwide.

2.1. Overview of the Cryptocurrency Market

In 2023, the cryptocurrency market experienced its first wave of modest growth, triggered by a significant expansion in the Bitcoin ecosystem. Market data reveals that between March 10 and June 10, the total market capitalization of cryptocurrencies surged from an initial $925.25 billion to $1.04 trillion. It reached a peak market value of $1.27 trillion, marking an increase of 37.26%. This period coincided with the first major boom in the Bitcoin ecosystem.

Bitcoin Global Market Cap, source: CoinMarketCap

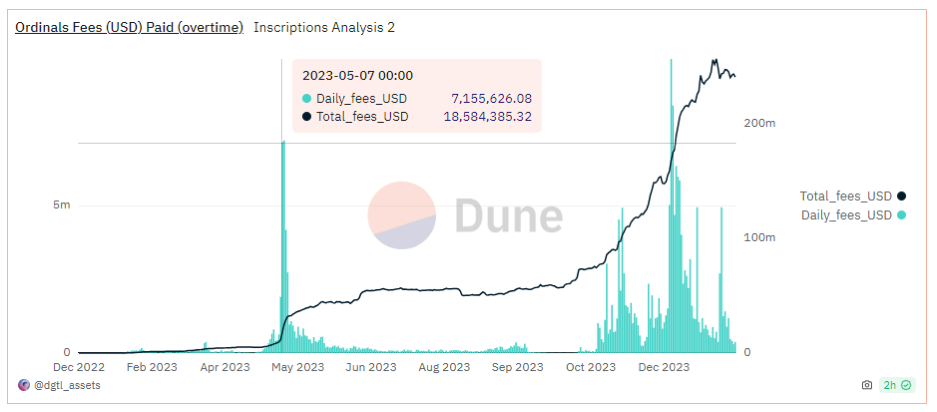

Since October 2023, the cryptocurrency market has experienced a significant resurgence with its total value soaring to a peak of $1.84 trillion. This remarkable upturn marks the most substantial performance the market has seen since 2022. Driven by ongoing market improvements, many investors and institutions have rapidly increased their investments in the BRC-20 sector. Initially, the Unisat wallet, along with leading exchanges, pioneered the Inscription trading market, significantly influencing market sentiment. Subsequently, numerous public blockchain platforms declared their involvement in the inscription sector. This expansion into the BRC-20 market not only broadened its scope but also heightened the fear of missing out (FOMO) among cryptocurrency investors. Therefore, the Bitcoin ecosystem witnessed a second surge in activity. An influx of capital poured into this ecosystem, coinciding with a prolific creation of inscriptions. As a result, both the BRC-20 token and mainstream cryptocurrencies experienced a dramatic increase in value.

Source: Dune

2.2. Bitcoin Market Overview

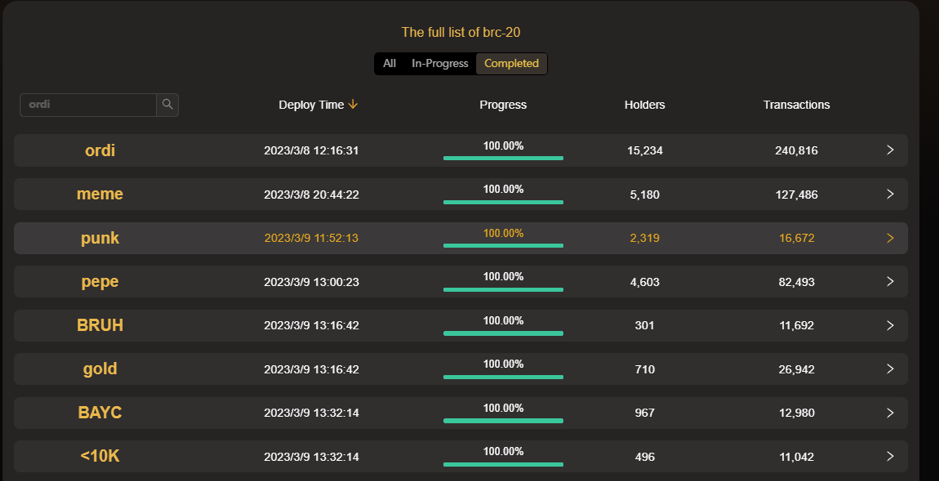

As of January 22, 2024, a total of 23,521 BRC-20 tokens have been minted with an additional 38,010 BRC-20 tokens currently in the process of being minted. This brings the cumulative total of tokens created in the Bitcoin network to 61,531. In comparison, the Ethereum network has issued a total of 1,288,807 tokens. Despite the significant disparity between the two, the Bitcoin ecosystem has introduced over 60,000 new tokens in just a few months. The sheer number of developers and the potential capital backing these tokens could potentially surpass all other public blockchain ecosystems, with the exception of the Ethereum network.

Data source: Unisat

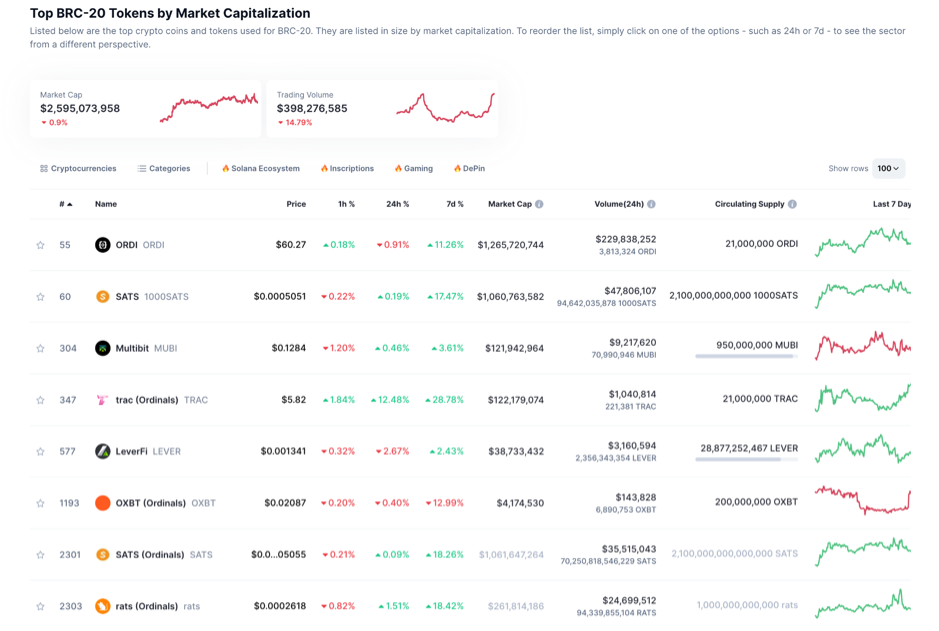

Regarding market value and trading volume, the total market cap of top BRC-20 tokens stands at $2,829,310,932 with a 24-hour trading volume of $439,890,944. Compared to its peak popularity, the market cap and trading volumes of BRC-20 tokens have significantly decreased. Nonetheless, the price performance of Ordinals (ORDI), a leading token in the Bitcoin ecosystem, remains impressive. This success is attributed to the continual creation of new BRC-20 tokens through the Ordinals protocol, enhancing their application value. The consistent interest from the capital market toward the Bitcoin ecosystem has resulted in a steady increase in the value of Ordinals and other high-quality related tokens.

Data source: CoinMarketCap

3. Reasons for BRC-20 Tokens Price Trends and Influential Factors

The price trends of BRC-20 tokens, akin to other assets in the cryptocurrency market, are influenced by a complex interplay of factors ranging. By exploring key elements below, we aim to provide a holistic view of the dynamics shaping the BRC-20 token market.

3.1. Historical Price Trends of Bitcoin BRC-20 Tokens

It is noteworthy that, among the top 20 BRC-20 tokens, 11 have seen their prices increase by more than 34% over the past 90 days. The five BRC-20 tokens selected by the FameEX exchange—ORDI, SATS, MUBI, TRAC, and RATS—have experienced remarkable 90-day price increases of 1616.37%, 2378.40%, 3245.23%, 878.54%, and 242.54% respectively from below chart. These increases significantly outperform those of other cryptocurrencies.

Table 2: Historical Growth Rates of the Top 5 Bitcoin BRC-20 Related Tokens by Market Cap (Sources: CoinGecko, FameEX)

3.2. Key Factors to Influence the Price of BRC-20 Tokens

Most BRC-20 tokens within the Bitcoin ecosystem are considered memecoins, and their price fluctuations are highly sensitive to market sentiment. This was evident in both the first wave of price increases starting in April 2023, and the second wave beginning in October, where the extent of the increases was as remarkable as the subsequent declines. For instance, during the second wave of price increases, the crypto market saw a general upturn in token prices, largely fueled by the positive impact of the Bitcoin spot ETF's approval. Among these, the BRC-20 token sector experienced the most significant growth with increases ranging from 200% to 3,500%.

During the recent market correction, the drop in top cryptocurrency prices was relatively minor with some even experiencing price increases over the past 30 days. Additionally, most other cryptocurrencies within the top 200 by market capitalization saw a decline of less than 20% during the same period. In contrast, the majority of BRC-20 tokens have suffered losses exceeding 30% over the last 30 days with the most significant declines surpassing 70%. This trend indicates that BRC-20 tokens are highly susceptible to market sentiment which shows significant value bubbles in some of these tokens that are yet to be addressed. However, a few BRC-20 tokens, such as ORDI and SATS, remained relatively stable. Likely due to strong community support or their potential to offer long-term value to the Bitcoin inscription ecosystem.

4. Market Overview and Risk Evaluation of the Top 3 Bitcoin BRC-20 Tokens

The cryptocurrency landscape has evolved significantly over the past decade, leading to the emergence of a diverse range of cryptocurrencies beyond the original Bitcoin. Among these, Bitcoin BRC-20 tokens stand out as a noteworthy development, offering a blend of Bitcoin's core principles with the flexibility and functional richness of the BRC-20 standard. Through an analytical lens, we delve into the intricacies of these tokens that influence their valuation and adoption in the Bitcoin ecosystem.

4.1 Ordinals (ORDI)

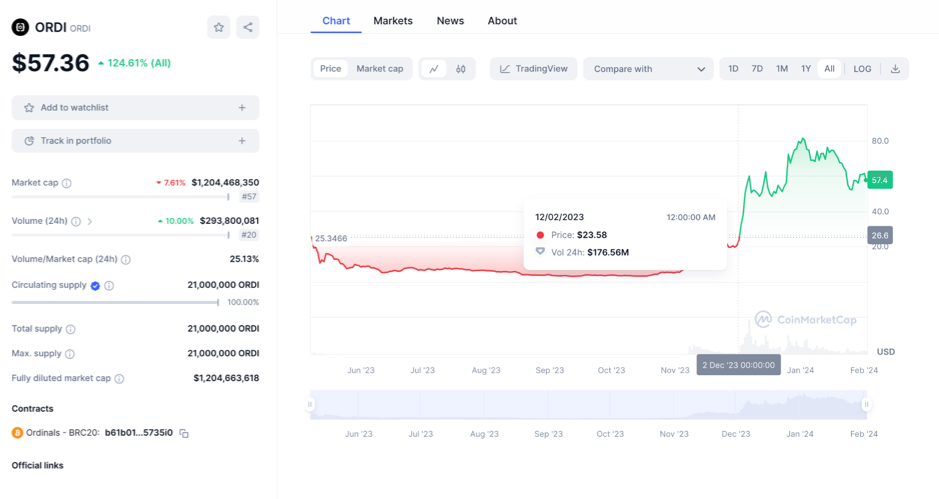

ORDI has quickly become a leading token on the Bitcoin blockchain, achieving a market value surpassing $1 billion since its initial minting in March 2023. This swift ascent underscores the significant interest in tokens and collectibles anchored to Bitcoin. Despite its popularity, ORDI and the foundational Ordinals technology it utilizes have encountered scrutiny regarding their effects on Bitcoin's scalability and debates over whether such tokenization is consistent with the core principles of Bitcoin.

Data source: CoinMarketCap

In the aspect of asset issuance, the Bitcoin BRC-20 ecosystem features wide ranges of protocols including Ordinals, Atomic Swaps, Runic Scripts, PIPE, and Taproot Assets. Among these, the Ordinals protocol (ORDI) stands out both in terms of adoption rates and transaction volumes. Currently, the ORDI token is ranked 55th in the global cryptocurrency market, boasting a total market capitalization of $1,315,383,558. This positions it in a similar status within the Bitcoin BRC-20 ecosystem as the ETH token holds in the Ethereum ecosystem. Given the rapid development anticipated in the Bitcoin ecosystem, both the Ordinals project and its ORDI tokens are expected to continue their strong performance.

Data source: Internet

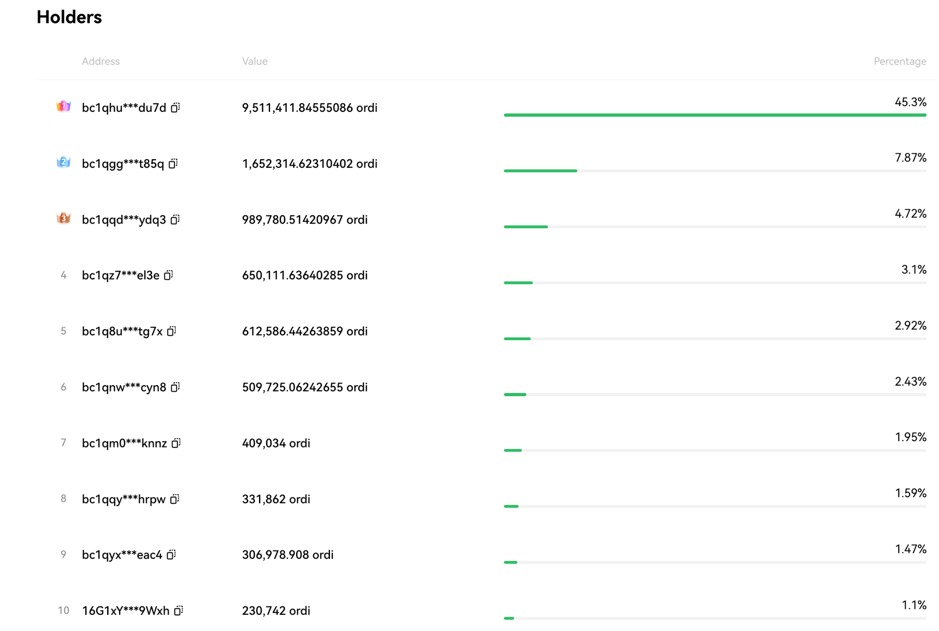

It is important to highlight that while the ORDI token boasts an impressive average daily trading volume of $177,361,332, indicating strong performance, its average daily on-chain trading volume is merely around 0.2 BTC. This discrepancy suggests that the on-chain activity for ORDI is relatively low. Furthermore, the total number of addresses holding Ordinals (ORDI) stands at 15,240, with a significant 70.96% of the token's total holdings concentrated within the top ten addresses. Such a high degree of centralization shows a considerable risk of market manipulation.

>> Click here to buy ORDI directly <<

4.2 SATS (SATS)

SATS are a new token using the BRC-20 standard, while "sats," short for satoshis, denote the tiniest division of Bitcoin, named in honor of its enigmatic founder, Satoshi Nakamoto. A single Bitcoin is comprised of 100 million satoshis, cementing sats as a crucial element of Bitcoin's framework. In contrast to SATS, sats do not represent an independent token but rather a fractional component of Bitcoin, pivotal for small-scale transactions and boosting Bitcoin's capacity for handling transactions.

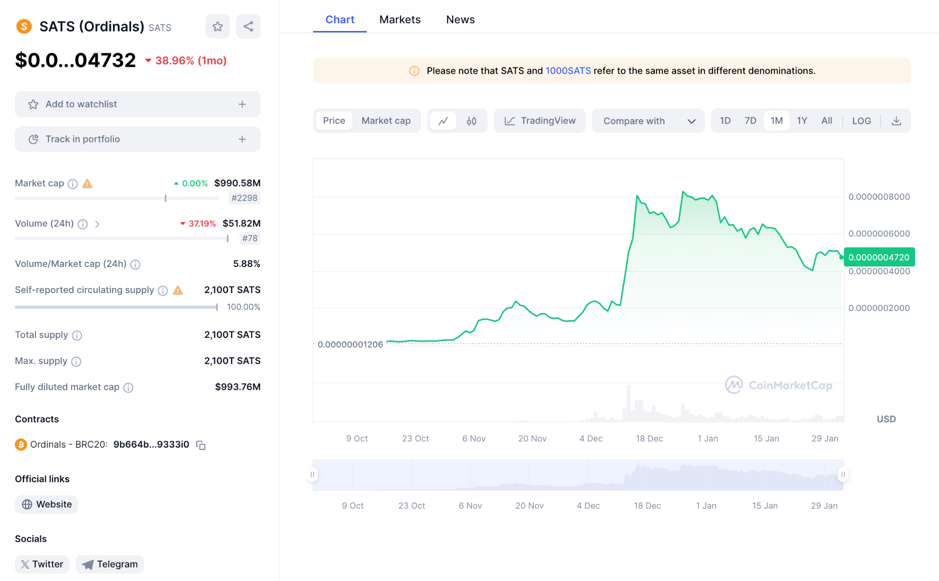

Data source: CoinMarketCap

SATS is one of the earliest renowned BRC-20 tokens alongside ORDI. It holds the second position on the BRC-20 token list, boasting a 24-hour trading volume of $1,053,075,567. As the first BRC-20 token to gain recognition and be listed on prominent exchanges like Binance, OKX, and FameEX, SATS distinguishes itself through its level of token distribution, the number of wallet addresses holding the currency, investor interest, and unity within its community, surpassing other BRC-20 tokens.

Data source: Internet

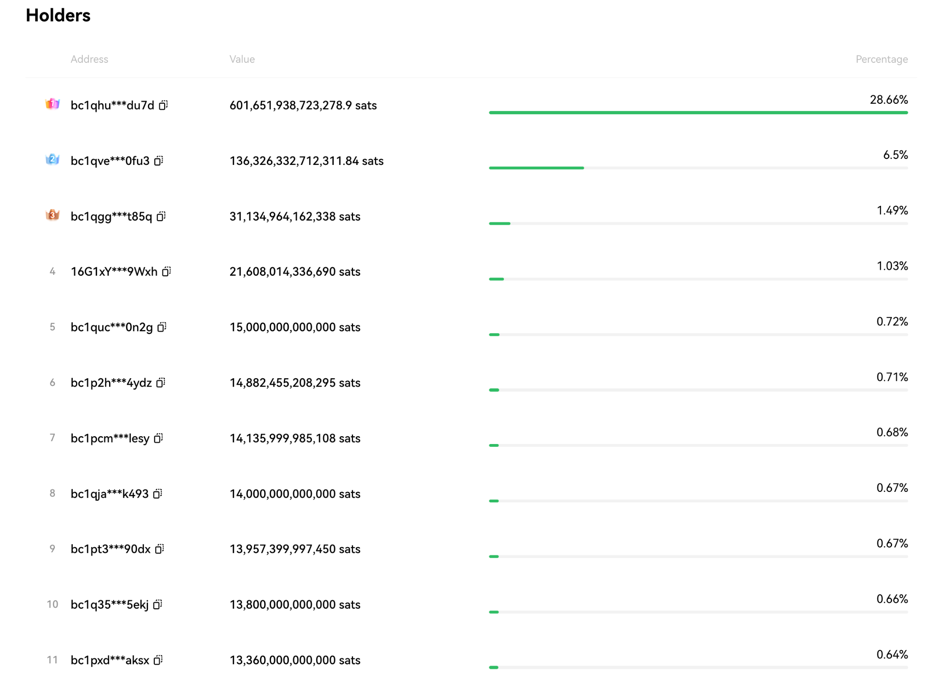

From the on-chain data, the total number of addresses in holding SATS stands at 46,402, which is threefold the number for ORDI. The top ten token holders account for approximately 40.84% with 7 of these being individual holders. This indicates a gradual increase in the token's decentralization and suggests a diminished likelihood of market manipulation by market makers. However, early SATS holders have not realized profits through sales, resulting in a significant holding of low-priced tokens in the market. It is advisable to wait until these low-priced tokens are sold before contemplating a purchase.

>> Click here to buy SATS directly <<

4.3 Multibit (MUBI)

Between the Bitcoin blockchain and networks utilizing the Ethereum Virtual Machine (EVM) in Ethereum and BNB blockchains, MultiBit facilitates the conversion of tokens from Bitcoin's BRC-20 standard to ERC-20 tokens on Ethereum and BEP-20 tokens on BNB. This process aims to enhance liquidity and foster the growth of the Bitcoin ecosystem.

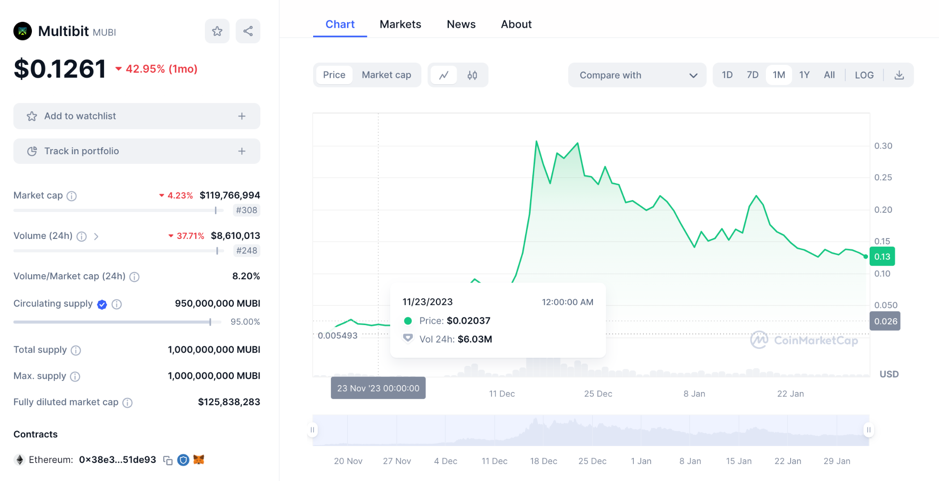

Data source:CoinMarketCap

Multibit (MUBI) stands out as one of the most significant tokens within the Bitcoin ecosystem in 2024. As the cryptocurrency landscape expands, it becomes increasingly important to evaluate the long-term potential of a currency based on the unique value it contributes to the crypto market and its growth potential. The principle is straightforward: the greater the value a token provides, the more its price is likely to increase. Similarly, a BRC-20 token's potential for growth also influences its price positively. Multibit exemplifies this through its pioneering role as the first cross-chain bridge project between BRC-20 and ERC-20 tokens. It facilitates interoperability between the Bitcoin and Ethereum networks, showcasing its significant contribution to enhancing connectivity and utility across these major blockchain platforms.

Therefore, despite being launched less than three months ago, the MUBI token has swiftly ascended the ranks to become one of the leading BRC-20 tokens, boasting a total market capitalization of $130,548,618 and an impressive total price surge of 3417.47%. Over the long term, Multibit exhibits significant potential for expansion. It has the capability to integrate various public blockchains, including Solana, Optimism, and others. By expanding its ecosystem and applicability through the Bitcoin network, this positions it as a notable BRC-20 token that warrants attention.

>> Click here to buy MUBI directly <<

5. Will Bitcoin BRC-20 Tokens Become a New Investment Opportunity in 2024?

As the Bitcoin halving is coming soon, we're on the cusp of a vibrant spring for the Bitcoin blockchain. Both Bitcoin and BRC-20 tokens stand to gain significantly from this event, attracting substantial capital inflow. During this period, BRC-20 tokens that show greater potential are likely to experience noteworthy gains. Consequently, keeping an eye on, researching, and investing in BRC-20 tokens in 2024 could be an exceptionally wise decision.

Before confirming an investment, crypto investors must thoroughly evaluate various aspects, including code audits, token issuance, technological innovation, brand management, the project's original purpose, and future development prospects. Only those cryptocurrencies that demonstrate smooth operational excellence should be considered for inclusion in an investment portfolio. This approach helps mitigate significant losses during market volatility.

FAQ

Q: What Are the Common BRC-20 Tokens in the Bitcoin Network?

A: Several popular BRC-20 tokens are notable in the Bitcoin ecosystem, including SATS, ORDI, MUBI, TRAC, RATS, MEME, CSAS, and PIZA. These tokens represent a variety of types, such as meme coins, on-chain tokens, and protocol tokens. Investors are advised to conduct a detailed analysis of each token's performance and characteristics to inform their investment strategies effectively.

Q: What Is the Difference Between the Bitcoin Ecosystem and the Ethereum Ecosystem?

A: Currently, the Bitcoin ecosystem is in its nascent stages, with its on-chain applications being restricted to a few categories, including BRC20 tokens, Bitcoin scalability solutions, and Bitcoin-based protocols. In contrast, the Ethereum ecosystem presents a mature application landscape, encompassing a wide range of industry chain elements such as crypto assets, Ethereum protocols, and decentralized applications (DApps). The Bitcoin network is limited to transmitting basic information and supporting simple interactions. On the other hand, Ethereum has introduced a smart contract development environment, enabling developers to execute more complex data processing tasks. This advanced functionality is not available within the Bitcoin ecosystem.

Disclaimer: The information provided in this article is intended only for educational and reference purposes and should not be considered investment advice. For more information, please refer to here. Conduct your own research and seek advice from a professional financial advisor before making any investment decisions. FameEX is not liable for any direct or indirect losses incurred from the use of or reliance on the information in this article.