What Is ICO in Crypto? A Beginner’s Guide to Invest in ICOs and Cryptocurrency

2023-09-20 06:43:15In the ever-evolving landscape of digital finance, the term “ICO” has become one of the most buzzed-about acronyms. If you’re curious about what it means and how it can be an investment opportunity, you've come to the right place. This guide delves deep into the world of ICOs.

What Does ICO in Crypto Mean?

In the ever-evolving landscape of cryptocurrencies, the term 'ICO' often surfaces as a pivotal mechanism for launching new projects and raising funds. ICO, or Initial Coin Offering, is analogous to an IPO in the stock market but operates within the decentralized world of blockchain and cryptocurrencies. This concept, which first gained traction in the early 2010s, has become a mainstream fundraising method for many startups in the crypto sector.

In 2013, the Initial Coin Offering (ICO) landscape began to take shape with software engineer J.R. Willet's introduction of a white paper named “The Second Bitcoin White Paper.” This was for the MasterCoin token, later rebranded as Omni Layer. This endeavor successfully amassed a sum of US$600,000. But what exactly is an ICO, and how does it differ from other terms such as IDO? Let's delve into its intricacies.

The Definition of ICO in the Cryptocurrency World

An ICO, or Initial Coin Offering, represents a fundraising method wherein a company or project issues a new cryptocurrency or token in exchange for established cryptocurrencies like Bitcoin or Ethereum. These tokens typically hold some utility within the project's ecosystem, often granting access to a specific service or acting as a form of "share" in the endeavor. The primary aim of an ICO is to raise capital to fund the development and maintenance of these blockchain-based projects. This fundraising method has proven to be particularly attractive because it circumvents traditional fundraising routes like venture capital.

Diving into the ICO Process: From Token Sale to Launch

The ICO process often starts with a whitepaper. This document outlines the project's goals, technical details, team members, and other relevant information, providing potential investors with a comprehensive understanding of the endeavor. Preceding the ICO, there is typically a pre-sale period, where tokens are sold at a discount to early backers. Following this, the official ICO begins, during which tokens are offered to the general public at a set price.

Once the ICO concludes and if it reaches its funding goal, the project will start its development phase. Investors usually hope that once the project becomes successful, the value of the tokens they hold will appreciate. It's worth noting, however, that not all ICOs succeed, and some may even be scams. Due diligence and thorough research are essential before investing in any ICO.

ICO VS IDO: Breaking Down the Differences

While ICOs have gained significant traction, another concept, IDO (Initial DEX Offering), has also started making waves in the crypto community. At its core, an IDO is a variant of an ICO, but with some distinct differences.

The primary distinction between an ICO and an IDO is the platform on which the token sale takes place. ICOs typically happen on the project's own platform or website, whereas IDOs are conducted on decentralized exchanges (DEXs). Given that DEXs are decentralized, they provide a more transparent and often quicker way of launching a new token. Moreover, IDOs offer immediate liquidity, as the tokens can be traded instantly on the DEX post-launch. In contrast, ICO participants might have to wait for the token to get listed on centralized or other decentralized exchanges before they can trade.

Initial Coin Offerings (ICOs) and Initial Public Offerings (IPOs) are both methods of fundraising, but they have several key differences. Firstly, an ICO involves raising funds by issuing tokens. This method is often less regulated, offering a more flexible and swift process. In contrast, an IPO involves a company issuing shares on the stock market, a procedure that is heavily regulated and notably more intricate. Secondly, ICO investors purchase tokens that represent certain rights or interests. These do not always equate to company equity. On the other hand, IPO investors acquire shares of a company, making them shareholders. Lastly, ICOs generally have a lower entry barrier and have a broader global reach. However, they come with increased risks. IPOs, facilitated through conventional financial institutions, tend to be more stable and transparent. Yet, they often entail higher entry requirements and associated costs.

Why ICOs are Gaining Popularity: The Advantages of Investing in ICOs

Initial Coin Offerings have emerged as a new method that is gaining rapid popularity. Let's explore why ICOs have become such a popular means of raising capital and the advantages they offer to both projects and investors.

- 1. Speedy Fundraising: The blockchain and cryptocurrency technologies that underlie ICOs are inherently swift. With merely around 100 lines of code, an Ethereum-based token such as ERC-20 can be formed. This means that, in theory, a project can launch its own token and initiate a public sale within a concise timeframe.

- 2. Barrier-free Access: Traditional fundraising often involves intermediaries such as banks, venture capitalists, and other financial institutions. In contrast, ICOs allow projects to raise capital directly from any individual worldwide, provided they possess a crypto-wallet.

- 3. Building a Strong Community Base: By engaging in an ICO, a project can attract early believers, supporters, and adopters. These initial backers not only invest their capital but often become vocal advocates, creating a committed community rallying behind the project's success.

- 4. Global Liquidity: When tokens are introduced into the market through an ICO, they access a global platform that runs continuously, day and night. This 24/7 marketplace ensures liquidity and facilitates rapid trade and transactions.

- 5. Reduced Bureaucratic Hurdles: Traditional fundraising mechanisms can be paperwork-intensive, with extensive disclosures and regulatory commitments. ICOs can sidestep many of these, especially if they are utility tokens. However, the regulatory landscape for ICOs is evolving, and it's essential to keep abreast of changes.

- 6. Flexibility in Ownership Rights: An intriguing aspect of ICOs is the ability to define ownership parameters. Tokens, by default, don’t offer ownership or equity in a company. This is determined by the smart contract, and rights can be customized based on project requirements.

While ICOs offer numerous benefits and have democratized access to investment opportunities, they are not without challenges. The world of cryptocurrency and blockchain is competitive with lots of projects vying for attention and trust. Moreover, regulatory oversight is increasing, and projects must ensure compliance to foster trust and credibility. When executed with diligence and integrity, ICOs present a transformative method of capital generation in order to bring innovation and growth to the forefront of the global financial ecosystem.

How to Get Started with ICO Investments?

ICOs have reshaped the landscape of investment opportunities, offering the promise of high returns and a chance to be part of groundbreaking projects. As decentralized funding mechanisms, ICOs have ignited global interest and democratized investment in the crypto space. However, with myriad options and a history of volatile outcomes, delving into ICO investments requires rigorous research, analysis, and understanding. To equip potential investors with the necessary knowledge and tools, here's a deep dive into the world of ICO investments.

Researching ICOs: Finding the Gems in the Crypto Market

In a sea of ICOs, discerning the legitimate from the dubious is the first critical step. Start by exploring reputable crypto forums, industry websites, and ICO listing platforms. Prioritize projects that receive attention from experienced investors and industry insiders. Remember, a high-profile ICO isn't automatically a golden opportunity; it's crucial to differentiate between genuine interest and mere hype.

Analyzing Whitepapers: Unveiling the Potential of ICO Projects

A project's whitepaper is its blueprint. It outlines the technical details, the problem the project aims to solve, the solution it offers, and the token's role within this ecosystem. A well-constructed whitepaper should be transparent, comprehensive, and free from over-the-top marketing jargon. Analyzing the whitepaper can give insight into whether the project has a genuine utility or if it's just a well-packaged idea with little substance. A white paper should explain or include the following points:

- ・Overview of the project

- ・The objective the project aims to achieve upon finalization

- ・Funding required for the project

- ・Amount of virtual tokens retained by the founders

- ・Accepted modes of payment (accepted currencies)

- ・Duration of the ICO campaign

As part of its ICO campaign, the project has unveiled its white paper to inspire aficionados and backers to purchase its tokens. Typically, investors have the option to use either fiat or digital currency for these acquisitions with a growing trend of using cryptocurrencies like Bitcoin or Ethereum. These fresh tokens can be equated to shares offered to investors in an IPO.

Assessing the Team Behind the ICO: Importance of Trustworthiness and Expertise

The driving force behind any ICO is its team. Examine the credentials of the project’s founders, developers, and advisors. A strong team will have individuals with prior experience in blockchain technology, business development, and other relevant fields. Moreover, transparency is key: trustworthy teams will be open about their backgrounds, providing potential investors with confidence in the project's legitimacy.

Evaluating Tokenomics: Understanding the Value of ICO Tokens

Tokenomics refers to the economic model underpinning the ICO's tokens. This includes understanding the total token supply, the distribution plan, and the token's utility within the ecosystem. A well-thought-out tokenomics structure ensures that tokens hold intrinsic value and are not just speculative assets. Look for tokens that have a clear purpose, such as granting access to a service or representing a stake in a project.

Understanding the Terms of the ICO and Ensuring Security

Investing in an ICO is a binding agreement. Familiarize yourself with the terms, including the potential risks and rewards. Ensure the ICO operates on a secure platform with measures like two-factor authentication, and investigate how funds will be stored post-investment. Remember, security breaches in the crypto space can lead to significant losses, so always prioritize your assets' safety.

While ICOs present exciting opportunities in the crypto world, they also come with their fair share of risks. It's imperative for potential investors to be well-informed, critical, and cautious to make sound investment decisions.

Participating in an ICO: How to Buy ICO Tokens Step by Step?

When considering Buying Into an ICO, it's crucial to be thorough and diligent. The initial step involves confirming the credibility and accountability of the individuals behind the ICO. Dive deeper into the history of the project leads, especially their experiences in the cryptocurrency and blockchain sectors. A lack of verifiable experience is a significant concern. Moreover, while the decentralized world of cryptocurrencies means anyone can technically launch an ICO, not everyone necessarily should. Businesses and individuals should introspectively evaluate if their ventures would truly benefit from an ICO.

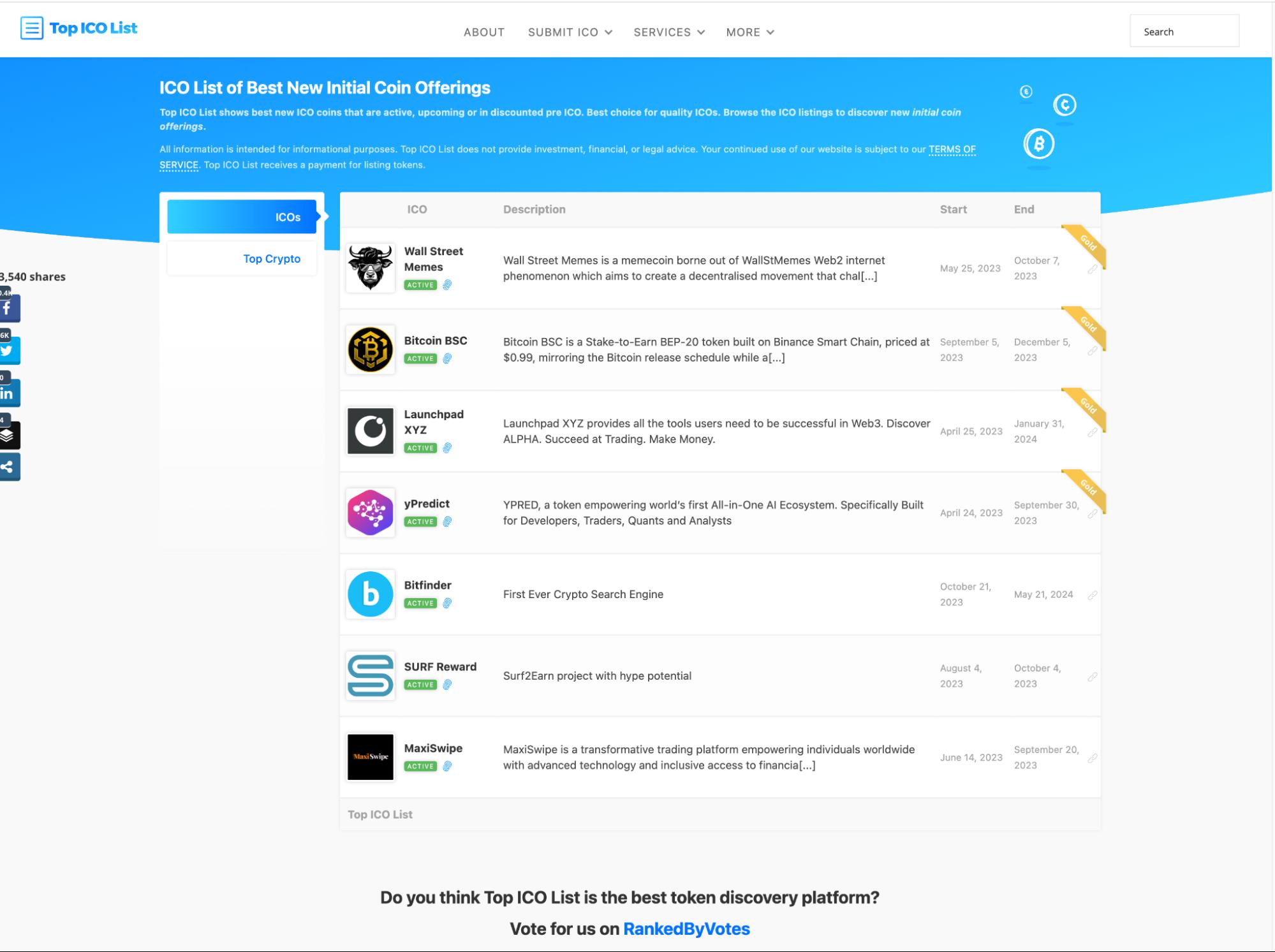

1. Research and Selection of ICO Token: Start by extensively researching potential ICO tokens to buy. Dive deep into the project's whitepaper, its roadmap, and tokenomics. Special Considerations also play a pivotal role in the ICO landscape. For instance, there was a marked decline in ICO activity post-2019, largely attributed to the ambiguous legalities surrounding them. Yet, for those keen on discovering new ICO opportunities, platforms like TopICOlist.com and other comparison sites offer valuable insights.

New ICO projects, Source: TopICOlist.com

New ICO projects, Source: TopICOlist.com

Risk management is a cornerstone when Participating in ICOs. Investors should ensure that project developers are articulate and clear about their objectives. Successful ICOs typically have lucid whitepapers that detail their goals in understandable terms. Furthermore, transparency is non-negotiable. Companies launching ICOs should be forthcoming about all aspects of their venture. Given that traditional regulatory oversight might be absent or limited, the onus falls on investors to scrutinize the ICO's legal terms and conditions. To add an extra layer of security, it's wise to ensure that ICO funds are stored in an escrow wallet, which offers protection against potential scams. Some ICOs might require investments through another cryptocurrency, so investors should be prepared for this possibility.

2. Establish a Crypto Wallet: Once you've settled on a particular ICO project, you'll need to set up a digital wallet to store and manage your cryptocurrencies. MetaMask is a widely-used choice, especially among newcomers to the crypto space.

3. Acquire Supported Cryptocurrencies: Next, you must get your hands on the cryptocurrency that the chosen ICO accepts. For instance, some projects preferred to accept Ethereum and Tether. Acquire one of these tokens, then transfer them into your MetaMask wallet.

4. Purchase and Retrieve ICO Tokens: Navigate to the project’s website. Connect your MetaMask wallet to the site. Decide on the number of tokens you're keen on buying and validate your decision. The requisite amount will be subtracted from your MetaMask wallet. After the ICO period concludes, remember to collect your tokens.

Understanding the Risks and Regulations in Investing in ICOs

In recent years, the ICO landscape has dramatically evolved as they have garnered increasing attention from both retail and institutional investors. With this heightened interest, regulatory bodies around the world began to take a closer look.

In 2017, the U.S. Securities and Exchange Commission (SEC) issued a statement addressing the sale of digital assets. They emphasized that if a digital token bears characteristics of a security—like ownership rights or the expectation of profit—it must conform to U.S. securities laws or face legal consequences. Gary Gensler has taken an even firmer stance, suggesting that all ICOs could be classified as securities. This sentiment has raised concerns of potential future class-action lawsuits against non-compliant ICOs. However, the U.S. is not alone in its concerns. Other countries, including Australia and the U.K., have also sounded alarms, cautioning retail investors about the inherent risks of ICOs. Some nations, such as South Korea and China, have taken more extreme measures by banning ICOs entirely. Meanwhile, Thailand temporarily halted token sales as it revisited its legal framework around digital asset offerings.

Yet, the international community lacks a cohesive approach. No global consensus exists on whether to introduce new legislation or modify current laws to better address the challenges posed by ICOs.

Risks of investing in ICOs

It's crucial for potential investors to recognize that ICOs inherently carry significant risks. Due to the lack of strict regulation, the ICO market is vulnerable to scams. A startling statistic from a 2018 Satis report highlighted that nearly 80% of ICOs were suspected of fraudulent sales. After an ICO, tokens often get listed on cryptocurrency exchanges, offering another window of opportunity for investors. But it's worth noting the behavior post-ICO: many investors look to quickly capitalize on their investments, leading to rapid sell-offs. This "pump and dump" tactic has contributed to a decline in the popularity of ICOs. A 2018 study found that over half of ICOs ceased to exist within just four months post-launch, with numerous tokens joining the growing list of failed ICOs, also termed “dead coins.”

As with any investment opportunity, there are inherent risks that every stakeholder should be aware of. The lack of a standardized regulatory framework, coupled with the dynamic nature of the cryptocurrency sector, makes ICOs a particularly precarious venture. The current state of the cryptocurrency market reveals an under-regulated landscape. For those looking to invest in ICOs, a spectrum of challenges awaits:

- ・Unproven Teams and Business Models: Many ICOs are spearheaded by nascent teams pursuing experimental business strategies. The combination of inexperience and untested models amplifies the risk of default.

- ・Absence of Regulatory Safety Nets: Without robust regulations in place, ICO investors often lack the legal recourse available in traditional investment avenues.

- ・Opacity in Project Reporting: Limited transparency on project milestones, potential pitfalls, and overall progress can leave investors in the dark.

- ・Scams and Manipulative Schemes: The ICO ecosystem is rife with potential scams, including the notorious "pump and dump" strategies.

- ・Inadequate Pre-Investment Information: Grasping the complete essence of an ICO can be challenging, potentially leading investors to make uninformed decisions.

- ・Volatility of Token Value: ICO tokens can exhibit extreme price volatility, often driven by speculation rather than intrinsic utility.

- ・Disparity Between Hype and Utility: The promotional buzz surrounding an ICO might overshadow its actual potential, leading to misaligned expectations and investments.

While ICOs present unique investment opportunities, the path is fraught with pitfalls. Prospective investors and project organizers alike must exercise caution, continually educate themselves, and prioritize thorough research before venturing into this domain.

Conclusion

In the fast-evolving landscape of cryptocurrency, ICOs have emerged as a groundbreaking method for startups and projects to raise capital. For the beginner investor, ICOs present both vast opportunities and inherent risks. By understanding the basic principles of what ICOs are, how they function, and the crucial aspects to consider before investing, one can navigate this new terrain with increased confidence and prudence. As with all investment avenues, due diligence, thorough research, and a well-informed approach are pivotal. The world of cryptocurrency and ICOs is exciting, dynamic, and holds the promise of reshaping the financial landscape, but as always, it's essential to tread with caution and awareness.

FAQ About ICO Crypto

Q: Is There a Difference Between ‘ICO’ and ‘Token Sale’?

A: No, they refer to the same process. A token sale or ICO is when tokens are sold to early backers of a project.

Q: Why ICO Is Better Than IPO?

A: An ICO is not necessarily better than an IPO, but it offers more accessibility and fewer regulatory hurdles. However, it also carries a higher risk.

Q: Is Buying ICO Profitable?

A: While some ICOs have yielded massive returns, others have failed or been scams. As always, investments come with risks.

Q: How Do I Get ICO Cryptocurrency?

A: You can get ICO cryptocurrency by participating in a token sale on a project's official website or platform.

Q: Why Do Companies Use ICO and How Does It Help in Raising Capital?

A: Companies use ICOs as they offer a quicker route to raise capital without the need for traditional financial intermediaries. By selling tokens, they gain funds to develop their projects.

The information on this website is for general information only. It should not be taken as constituting professional advice from FameEX.