FameEX Weekly Market Trend | July 6, 2023

2023-07-06 10:32:55

1. Market Trend

Between July 3 and July 5, the BTC price fluctuated between $30,200 and $31,126, with a volatility of 3.06%. Based on the 1-hour candle chart, BTC formed a consolidation pattern, indicating an upcoming trend. In the early morning of July 4, the BTC price surged to $31,000 but couldn’t hold the gain and retraced to $30,200, staying above the $30,000 support level. The breakthrough and pullback situations from the previous attempts to reach the $31,000 level have confirmed the technical support for the consolidation pattern at this time. On higher timeframes (4 hours, 1 day), BTC has maintained a high-level sideways movement with converging moving averages and decreasing volatility. It is recommended to focus on the breakout above $31,500 and the support level at $29,500. Entry points may be considered near these two levels (please bear in mind that this is an individual opinion and does not constitute investment advice).

Source: BTCUSDT | Binance Spot

Between July 3 and July 5, the price of ETH/BTC fluctuated within a range of 0.06212 to 0.06435, showing a 3.6% fluctuation. From the one-hour candlestick chart, the ETH/BTC pair has tracked BTC’s trend after breaking out of a long-term downtrend channel. Currently, it lacks a significant independent rebound and remains relatively weak. There hasn’t been any upward recovery movement, so it is still advisable to have a more cautious approach and observe rather than actively engage in trading this currency pair.

Based on overall analysis, the market’s enthusiasm has cooled down compared to the previous few days. The trend has remained within the range of the previous high and support levels, hovering between $31,000 and $30,000 levels several times. Through continuous turnover among users, the consolidation period has been extended, potentially accumulating greater energy for the next breakthrough, whether it is upward or downward. The majority of cryptocurrencies in the market are also following the trend of BTC. Therefore, it is crucial to eye the breakout situations at the $29,500 and $31,500 levels for BTC.

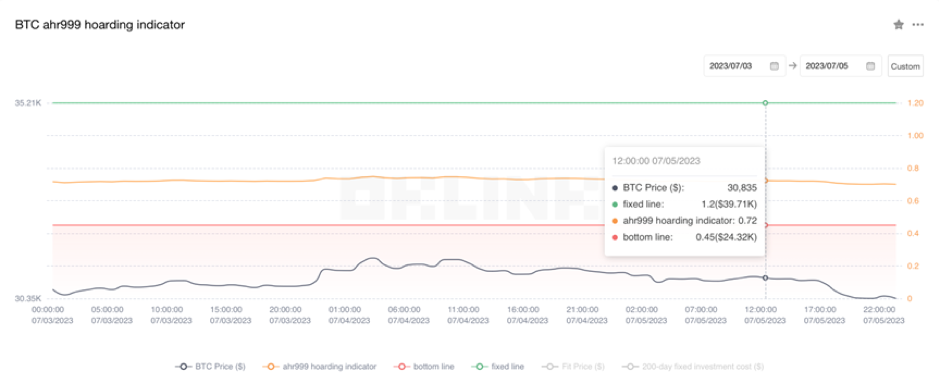

The Bitcoin Ahr999 index of 0.72 is above the buy-the-dip level ($24,320) but below the DCA level ($39,710). It is viable to purchase popular coins through DCA.

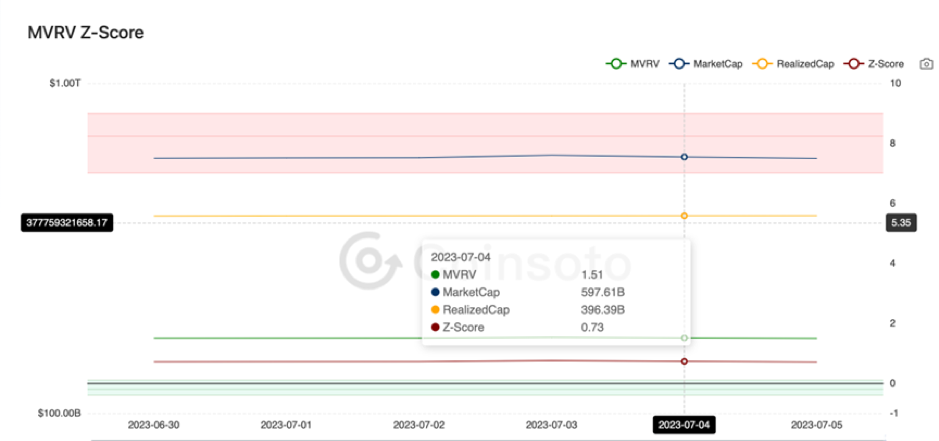

From the perspective of MVRV Z-Score, the value is 0.73. When the value is greater than 6, it enters the market tops, while a value below 2 indicates that it enters the market bottoms. Currently, the present value exceeds the buying-the-dip range (-0.42-0.17).

2. Perpetual Futures

In general, the 7-day cumulative funding rates for the popular coins across major exchanges are positive, indicating that long leverages are relatively high.

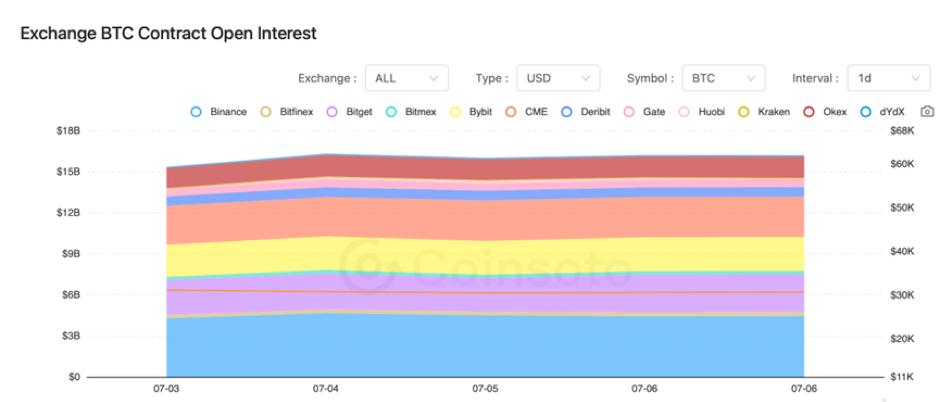

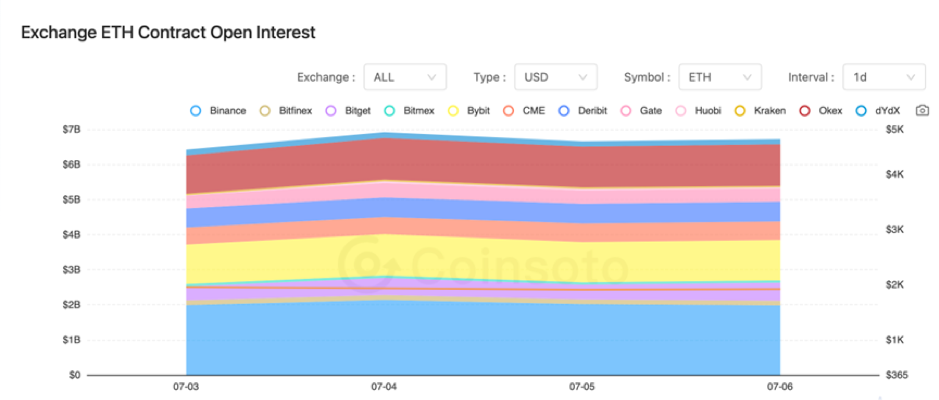

The contract open interest of BTC and ETH experienced a slight rise on July 4, followed by a relatively stable period thereafter.

Exchange BTC Contract Open Interest:

Exchange ETH Contract Open Interest:

3. Industry Roundup

1) On July 3, the grayscale GBTC premium rate narrowed down to 30%.

2) On July 3, members of the Azuki team were found selling their held Azuki NFTs, as discovered by the cryptocurrency community users.

3) On July 3, Singapore required cryptocurrency platforms to hold customer funds in trust.

4) On July 4, data showed a general decline in Bitcoin miner income and Ethereum staking rewards for June.

5) On July 4, South Africa announced that cryptocurrency exchanges should obtain licenses by the end of the year.

6) On July 4, Hong Kong’s first compliant hedge fund distributed approximately 70 million Hong Kong dollars in dividends to limited partners, including Li Lin (former Huobi’s founder).

7) On July 5, it was said that tax loopholes related to cryptocurrency and NFTs might soon come to an end.

8) On July 5, Huaseng Securities stated that it has become one of the first licensed virtual asset financial institutions in Hong Kong.

9) On July 5, CZ (Changpeng Zhao) stated that Bitcoin ETF applications from large asset management companies pose no threat to decentralization.

10) On July 5, the Danish regulatory authority ordered Saxo Bank to cease cryptocurrency trading activities.

Disclaimer: FameEX makes no representations on the accuracy or suitability of any official statements made by the exchange regarding the data in this area or any related financial advice.