FameEX Weekly Market Trend | September 7, 2023

2023-09-07 10:14:35

1. Market Trend

Between September 4 and September 6, the BTC price fluctuated between $25,540.00 and $26,135.00, with a volatility of 2.32%. Based on the one-hour chart, BTC’s recent price trend remained within a low-volatility range ($25,500-$26,500). Over the past 20 days since BTC’s significant drop on August 18, the closing price has consistently hovered around $25,800, briefly touching near $25,300 on three occasions ($25,300, $25,333, and $25,372), each time rebounding swiftly to recover from these declines. Combining the $25,500 range bottom, it’s a strong bullish support. If breached, it becomes a significant resistance. On the daily chart, BTC is in the third wave of its primary uptrend from $16,000. The second wave’s lowest point was $24,800. If BTC drops below $24,800 and doesn’t recover quickly, it signals a potential prolonged bearish trend, an unfavorable scenario. In summary, the strategy hinges on two key levels ($25,500 and $28,500) for both bullish and bearish actions.

Source: BTCUSDT | Binance Spot

Between September 4 and September 6, the price of ETH/BTC fluctuated within a range of 0.06290-0.06410, showing a 1.90% fluctuation. From the 1-hour chart, the 7-day, 25-day, and 99-day MAs are all crossing below the candlesticks, and this pattern is also observed on the 4-hour timeframe. For the ETH/BTC pair, the 99-day MA (daily timeframe) holds special significance. Typically, before the start of a new uptrend, breaking above and holding steady above the 99-day moving average is a top priority. Currently, ETH/BTC is just one step away from the 99-day moving average (0.06400), and it even touched it yesterday but failed to stabilize. In the current approach to ETH/BTC, it is viable to use the moving average rule (with the 7-day MA as the preferred choice). Use the moving average position as a supplementary entry point. Similarly, if it falls below the moving average and doesn’t recover the decline quickly, consider exiting and adopting a wait-and-see approach.

Based on overall analysis, most cryptocurrency pairs in the market are experiencing relatively low levels of volatility. The reason for this is the uncertainty surrounding the trend of Bitcoin (BTC). Large investors are mostly in a state of cautious observation. As a result, the overall market activity remains notably subdued, with trading volumes staying at relatively low levels for an extended period. It’s only when Bitcoin decides its direction, whether up or down, that the market will experience significant fluctuations and provide sufficient profit potential.

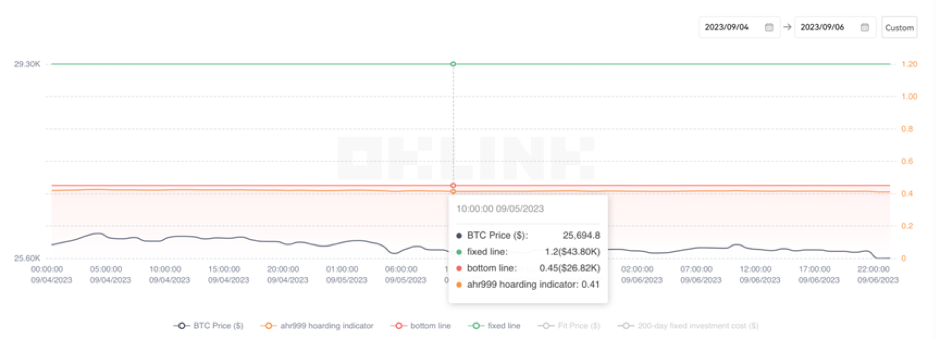

The Bitcoin Ahr999 index of 0.41 is below the buy-the-dip level ($26,820). Therefore, it is advised to purchase popular coins in the spot market.

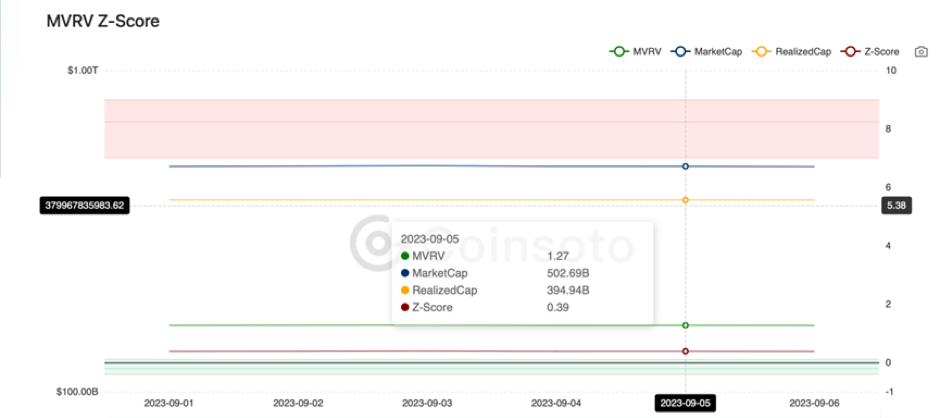

From the perspective of MVRV Z-Score, the value is 0.39. When the value is greater than 6, it enters the market tops, while a value below 2 indicates that it enters the market bottoms. Currently, the present value exceeds the buy-the-dip range (-0.36-0.06).

2. Perpetual Futures

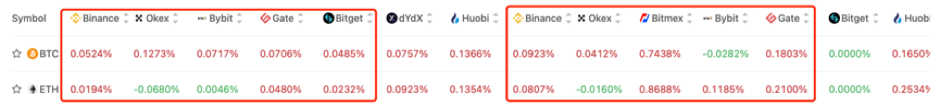

In general, the 7-day cumulative funding rates for the popular coins across major exchanges are positive, indicating that long leverages are relatively high.

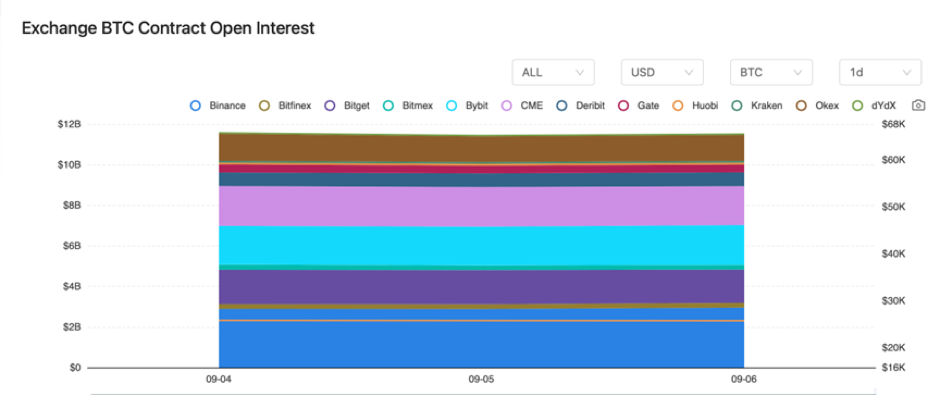

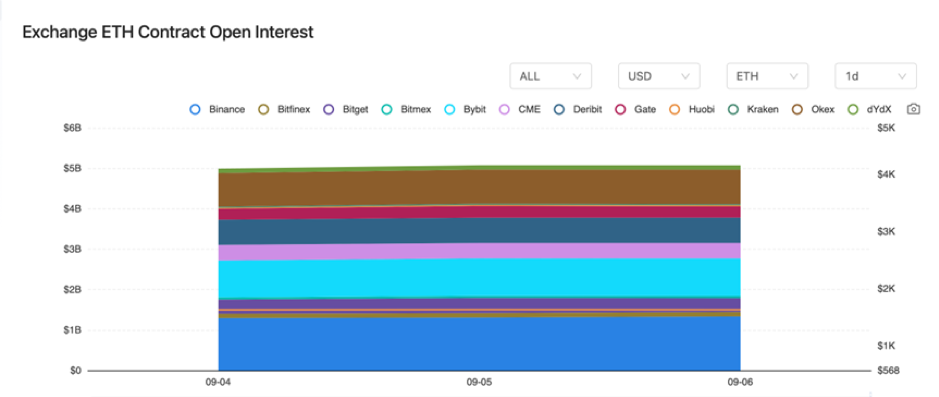

There were barely any changes in the BTC and ETH contract interest from major exchanges.

Exchange BTC Contract Open Interest:

Exchange ETH Contract Open Interest:

3. Industry Roundup

1) On September 4, Elon Musk’s new biography might confirm that he has been secretly funding the development of Dogecoin.

2) On September 4, according to the OKX Chief Business Officer, the preparation for OKX HK’s regulatory license application in Hong Kong entered its final stages, aiming to obtain it by June next year.

3) On September 4, data revealed that the number of Bitcoin hodlers has exceeded the total population of Spain.

4) On September 5, the Fed’s Mester stated that the Fed might need to “raise rates a bit” in the future.

5) On September 5, data showed that Bitcoin miner balances decreased by approximately 4,000 BTC last week.

6) On September 5, a report stated that CEX’s monthly Bitcoin spot trading volume has dropped to the lowest level since October 2020.

7) On September 5, data indicated that major exchanges had 20 times higher trading volumes in derivatives compared to spot trading.

8) On September 6, Grayscale declared that the SEC has no reason to reject the conversion of GBTC into a spot ETF.

9) On September 6, Base officially affirmed that all funds are secure.

10) On September 6, insiders revealed that AntChain was set to release a new Web3 product.

Disclaimer: FameEX makes no representations on the accuracy or suitability of any official statements made by the exchange regarding the data in this area or any related financial advice.