FameEX Weekly Market Trend | October 26, 2023

2023-10-26 11:38:40

1. Market Trend

From Oct. 23 to Oct. 25, the BTC price fluctuated between $29,714.28 and $35,280.00, with a volatility of 18.73%. The prior report noted that BTC’s earlier rise around $30,000 marked the start of an upward trend. Personal opinions were confirmed by recent market conditions. Once BTC surpassed $30,000, trading volume increased at all levels, and prices rose steadily, indicating a strengthening bullish sentiment. After breaking $31,000, the market saw a change in the price surge pattern, with BTC rapidly ascending and breaking $35,000. A minor retracement happened after surpassing $35,000, and the price essentially maintained itself above $34,000. The presence of these traits signals BTC’s exceptional strength, implying institutional investors’ reluctance to return BTC chips to retail traders. BTC prices are unlikely to revisit this range, and if they do, they’ll quickly surge, possibly for profit-taking, effectively serving as a position cleanup strategy. Investors desire retail traders to hold chips acquired at higher levels to minimize the need for a significant cleanup (elevated chip prices can weaken retail traders’ resolve to hold) before the next price surge, allowing for the harvesting of profitable chips and supporting a smoother upward trend. The present market situation implies that technical indicators are suitable for short-term signals but not for long-term assessments, given that bull markets typically feature more substantial shakeouts than bear markets. Nonetheless, as long as critical levels remain intact, prices are likely to recover (futures traders should be vigilant about setting take-profit and stop-loss orders). Those who joined at lower price levels should hold their positions and await price increases, while those who have not yet entered should closely watch the market and contemplate entry during market pullbacks (around $34,000). It is crucial to avoid adopting a pessimistic perspective.

Source: BTCUSDT | Binance Spot

Between Oct. 23 and Oct. 25, the price of ETH/BTC fluctuated within a range of 0.05100-0.05567, showing a 9.15% fluctuation. ETH/BTC has continued to establish new lows in recent days. Our current view on ETH/BTC remains the same as in previous analysis reports – this cryptocurrency is relatively weak. It is advisable to stay away from this currency.

Based on overall analysis, as BTC continues to rise, the number of traders keeps reaching new highs, leading to a continuous influx of capital. This has significantly increased the trading volumes of most cryptocurrencies in the market. Recently, over 95% of the cryptocurrencies in the top 100 by market capitalization have shown substantial gains (compared to the past few months). However, when looking at the overall price development trend, the gains are still not significant and can be considered as being in the early stages. What is needed in the near term is to hold your positions firmly, not getting shaken off easily, and for investors who haven’t entered yet, a strategy of buying during pullbacks.

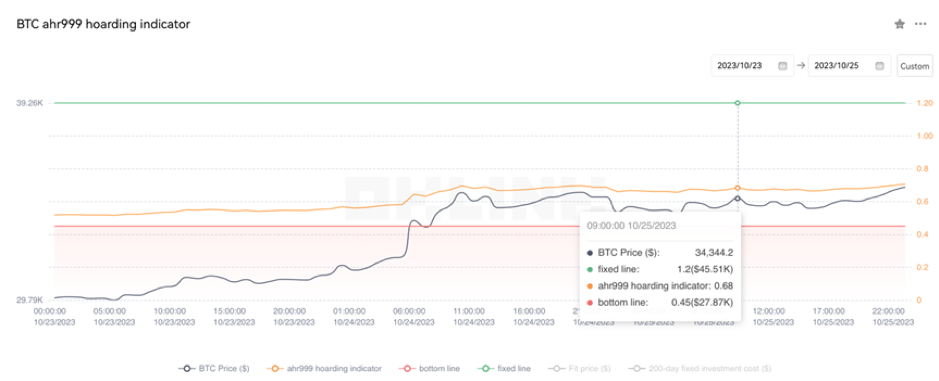

The Bitcoin Ahr999 index of 0.68 is between the buy-the-dip level ($27,870) and the DCA level ($45,510). Therefore, it is advised to purchase popular coins via DCA.

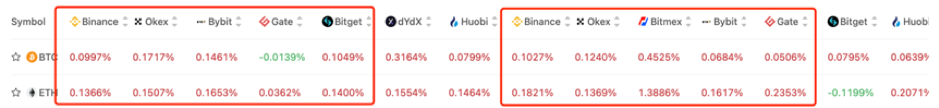

2. Perpetual Futures

In general, the 7-day cumulative funding rates for the popular coins across major exchanges are positive, indicating that long leverages are relatively high.

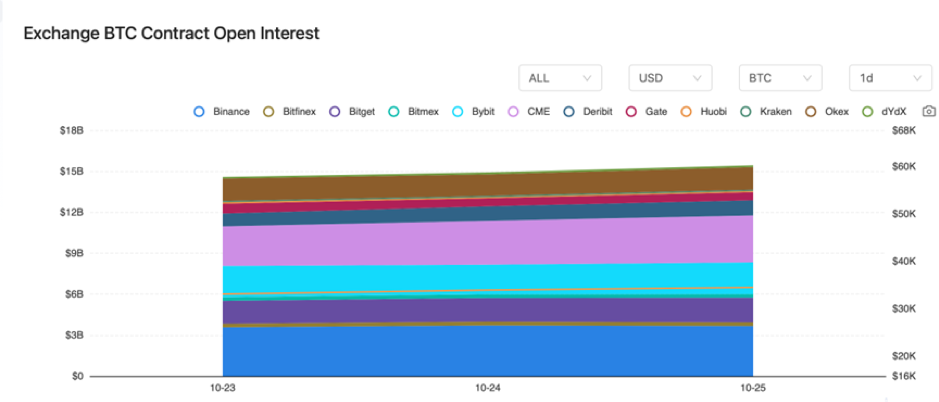

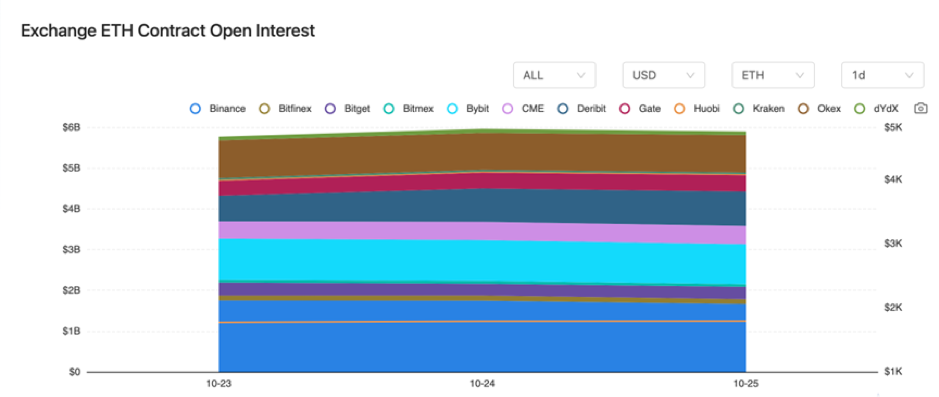

BTC contract interest experienced a slight climb, while the ETH contract interest on major exchanges remained relatively stable.

Exchange BTC Contract Open Interest:

Exchange ETH Contract Open Interest:

3. Industry Roundup

1) On October 23, Standard Chartered Bank and Deutsche Bank executed stablecoin payments through the UDPN blockchain.

2) On October 23, the total market capitalization of cryptocurrencies returned to over $1.2 trillion for the first time since August 2023.

3) On October 23, tokens such as CTSI, YGG, and AGIX unlocked over $8 million in one go.

4) On October 24, a public Bitcoin ETF fund saw a daily inflow of $43 million, accounting for 10% of this year’s total inflow.

5) On October 24, Bloomberg analysts suggested that the SEC might have given a favorable signal to BlackRock for a publicly listed ETF.

6) On October 24, the U.S. SEC accepted Grayscale’s application for a spot ETF.

7) On October 25, BlackRock’s spot Bitcoin ETF was relisted on the DTCC.

8) On October 25, Paul Chan Mo-po announced that Hong Kong would use blockchain technology to issue and verify various electronic licenses and certificates.

9) On October 25, the UK Financial Conduct Authority expanded its regulatory authority to include the promotion of crypto assets.

10) On October 25, FTX founder SBF provided testimony in his fraud trial.

Disclaimer: FameEX makes no representations on the accuracy or suitability of any official statements made by the exchange regarding the data in this area or any related financial advice.