FameEX Weekly Market Trend | November 17, 2023

2023-11-18 01:56:55

1. Market Trend

From Nov. 13 to Nov. 16, the BTC price swung from $34,800.00 to $37,980.00, with a volatility of 9.13%. The earlier BTC trend showed a ladder-like ascent with limited retracements, mainly oscillating. However, recent days have seen a significant shift: increased volatility, more price spikes, and heightened pullback sentiments. In the 1-hour timeframe, BTC has dropped below the upward channel, now undergoing wide-ranging oscillation. During this time, BTC dipped below the crucial $35,000 level but swiftly rebounded with robust volume, fully recovering and striving to breach the $38,000 psychological threshold. This is the second attempt, with the prior one reaching $37,960 before retracting to around $35,500 with increased volume. The current phase involves retracement after the second $38,000 attempt, marked by oscillating declines, distinguishing it from the less voluminous and linear previous retracement. The same price trend but different retracement methods will demonstrate varying degrees of strength in the overall market, as well as the level of acceptance by investors at these points. Compared to linear declines, oscillating retracements are more accepted at the drop’s beginning. Another attempt at the same level might increase the chance of success. On the 4-hour timeframe, the trend remains within the upward channel with a healthy trend. The 99-day MA has withstood retracement, with a potential for continued operation above it. Currently, the crucial 34,500-point level has concentrated retail investors’ chips and served as a central point during BTC's extended oscillation.If BTC falls below $34,500 and fails to reclaim it within 4 hours, this level will become a significant resistance for BTC’s upward movement. The current viewpoint on the overall market remains consistent with the previous analysis report: holding positions and waiting for an uptrend is advisable, with a caution against frequent portfolio changes.

Source: BTCUSDT | Binance Spot

Between Nov. 13 and Nov. 16, the price of ETH/BTC fluctuated within a range of 0.05420-0.05735, showing a 5.81% fluctuation. Currently, the ETH/BTC trend is following BTC’s movements, lacking independent upward or downward trends. It is now in a state of wide-ranging oscillation. The distinguishing factor is that there are signs of a certain degree of breakdown in the 1-hour and 4-hour timeframes for ETH/BTC, while BTC only shows signs of breakdown in the 1-hour timeframe. Overall, the ETH/BTC trend appears weaker than BTC. The daily timeframe for ETH/BTC is also experiencing continuous retracement, with the next support level near the 25-day MA (around 0.05350). If it falls below this level and does not recover in a short period, the outlook may be less optimistic. Aggressive investors may consider buying a position near 0.05350 but should set stop-loss points. Conservative investors may choose to hold off on this currency for the time being.

Based on overall analysis, the current market environment has seen some changes compared to the recent past. Previously, there was an overall trend of oscillation followed by an upward surge. However, the recent trend is characterized by wide-ranging oscillation. One major factor contributing to this trend is BTC’s two failed attempts to surpass $38,000, resulting in significant retracement. To change this pattern, breaking through the 38,000-point level has become crucial. Recently, most altcoins in the market have experienced a pullback, and the amplitude is significant. When opening positions, it is essential to set stop-loss points. For investors who have not entered the market yet, it may be prudent to wait for BTC to break and stabilize above $38,000 before making entry decisions (applies to both major coins and altcoins). Overall, the bullish sentiment remains unchanged, but caution is advised for those considering short positions.

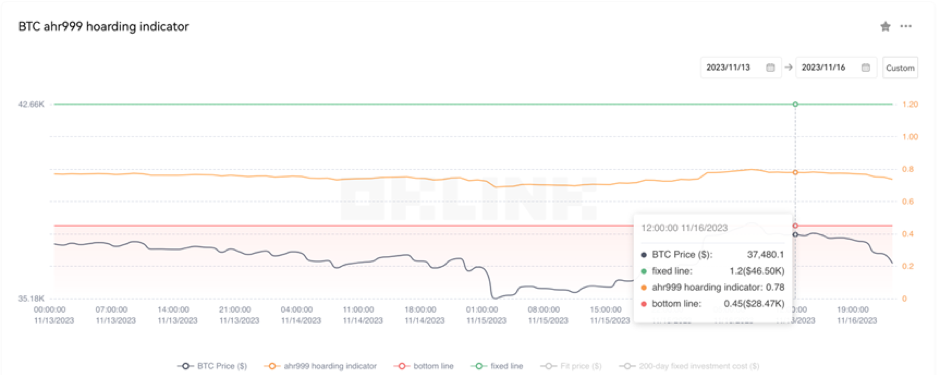

The Bitcoin Ahr999 index of 0.78 is between the buy-the-dip level ($28,470) and the DCA level ($46,500). Therefore, it is advised to purchase popular coins via DCA.

2. Perpetual Futures

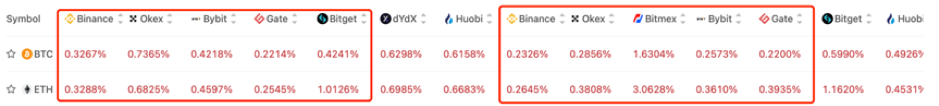

In general, the 7-day cumulative funding rates for the popular coins across major exchanges are positive, indicating that long leverages are relatively high.

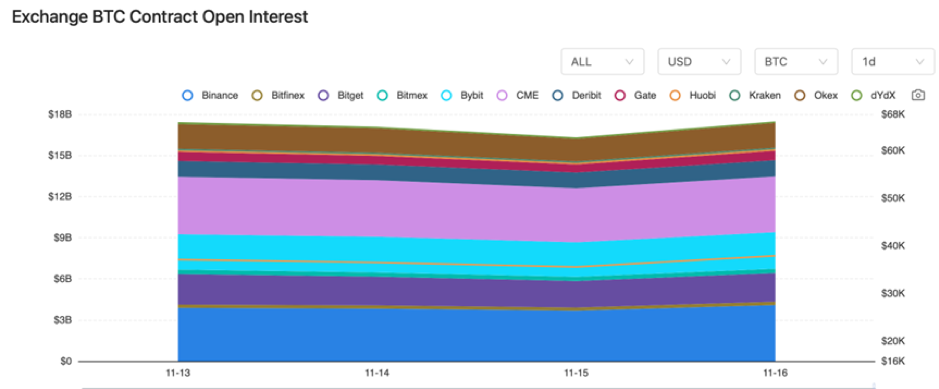

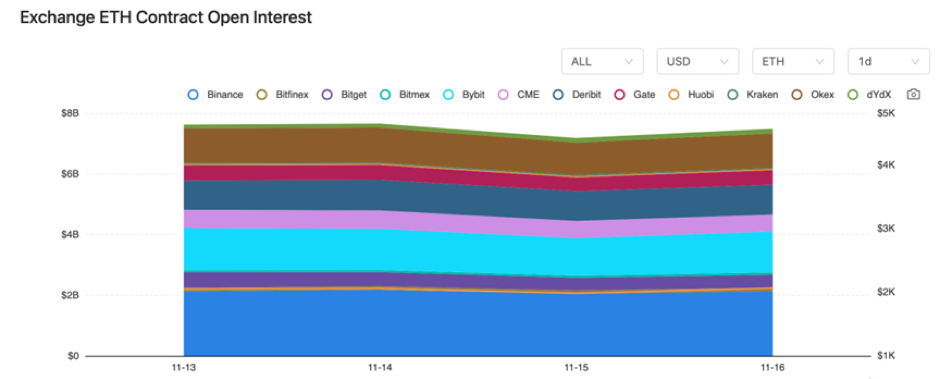

The BTC and ETH contract open interest both experienced a slight decline, followed by a moderate rebound.

Exchange BTC Contract Open Interest:

Exchange ETH Contract Open Interest:

3. Industry Roundup

1) On November 13, 48 OECD countries agreed to share cryptocurrency tax data.

2) On November 13, CoinShare reported a $293 million inflow into digital asset investment products last week.

3) On November 13, JPMorgan stated that the impact of Bitcoin halving is unpredictable and already priced in.

4) On November 14, APEC finance ministers would share their perspectives on cryptocurrencies at a meeting in San Francisco.

5) On November 14, Reuters reported that ransomware LockBit claimed China Construction Bank had paid a ransom.

6) On November 14, Crypto.com obtained a cryptocurrency license in Dubai.

7) On November 15, the SEC issued nearly $5 billion in fines within a year to the cryptocurrency industry and others.

8) On November 15, data showed the crypto market experienced net inflows for the first time in 17 months.

9) On November 16, the SEC delayed a decision on Grayscale’s proposed Ethereum futures ETF rule change.

10) On November 16, the U.S. Treasury Secretary Yellen announced plans to discuss cryptocurrency regulation at the APEC meeting.

Disclaimer: FameEX makes no representations on the accuracy or suitability of any official statements made by the exchange regarding the data in this area or any related financial advice.