FameEX Weekly Market Trend | November 23, 2023

2023-11-23 11:26:01

1. Market Trend

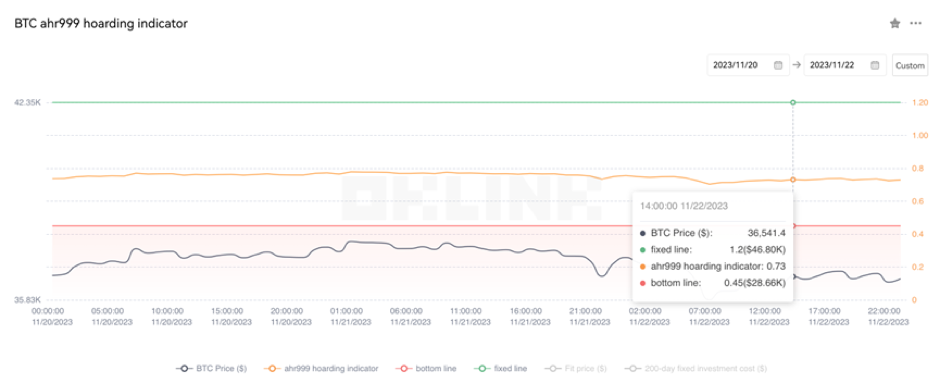

From Nov. 20 to Nov. 22, the BTC price swung from $35,632.01 to $37,750.00, with a volatility of 5.94%. The prior analysis report noted that the second push to $38,000 saw a smaller retracement and higher trading volume than the first, suggesting a quiet upward shift in the bottom position. Chip selling and investor shorting have eased. BTC has been steadily rising in the last few days, experiencing occasional significant fluctuations, while maintaining an overall upward trend. BTC’s primary resistance remains at $38,000. We await the third push to this level, observing post-reach changes, emphasizing factors like retracement size, level retention, breakthrough/retraction speed, and transaction volume. A healthy pullback ensures stability in subsequent rises, fortifying the foundation, and elevating prices with concentrated chips.

On November 22, Binance CEO Zhao Changpeng confessed upon appearing in the U.S. and posted a substantial bail, triggering a market decline, with BNB facing significant impact. On the 4-hour chart, it briefly dropped below the 99-day MA but swiftly rebounded. Therefore, this breach of the 99-day MA is considered ineffective, and the market quickly oscillated upward again. From this event, a robust bullish momentum is evident in the overall market. BTC is undergoing a pattern adjustment on the 4-hour chart, indicating a likely move in the next few days for the third push to $38,000 (possibly involving a retracement or breakthrough to $38,000, reaching $39,000 or $40,000). The current strategy is to hold, anticipate an increase, avoid short positions, and refrain from frequent position changes.

Source: BTCUSDT | Binance Spot

Between Nov. 20 and Nov. 22, the price of ETH/BTC fluctuated within a range of 0.05328-0.05575, showing a 4.63% fluctuation. From the current trend of ETH/BTC, it appears that the bottom has been successfully repaired and established (with simultaneous increases in volume and price, implying relative strength). There is a high probability of an upward trend in the later period. Therefore, investors who have not entered the market can consider entering in batches at this point, awaiting subsequent opportunities for an upward movement.

Based on overall analysis, the overall market trend remains in a range-bound upward movement (this is the main theme). Even if there are other developments in the news or technical aspects, they will eventually return to the main theme, indicating a strong market (the manner of returning to the main theme is characterized by range-bound upward movement). This reflects the mainstream mode of this rise, so it is advisable to avoid losing chips in the fluctuations.

CZ mentioned on X (formerly Twitter) that he will focus on blockchain investments in the future, and areas such as DeFi and Web3.0 will be key investment directions. Therefore, in recent days, some old DeFi projects have seen significant increases (such as UNI and AVAX). Investors interested in research can track the development of these currencies. Overall, the market remains bullish, with the strategy being to hold and await an increase, avoiding frequent position changes.

The Bitcoin Ahr999 index of 0.73 is between the buy-the-dip level ($28,660) and the DCA level ($46,800). Therefore, it is advised to purchase popular coins via DCA.

2. Perpetual Futures

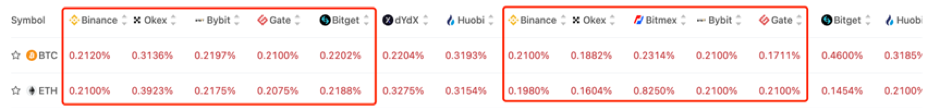

In general, the 7-day cumulative funding rates for the popular coins across major exchanges are positive, indicating that long leverages are relatively high.

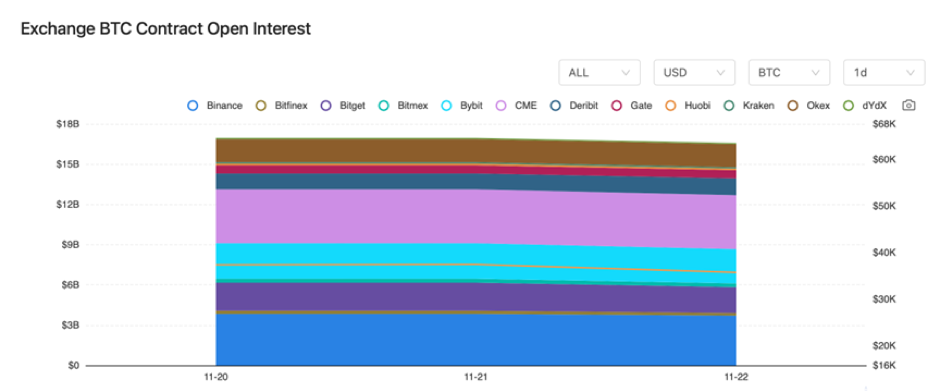

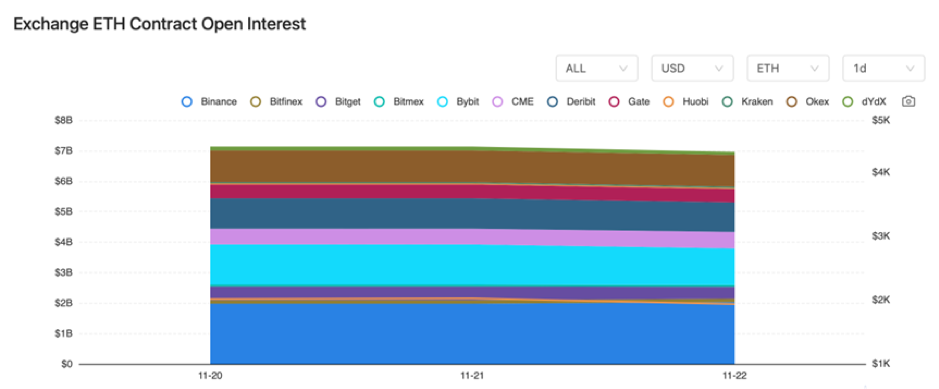

There were barely any changes in the BTC and ETH contract open interest from major exchanges.

Exchange BTC Contract Open Interest:

Exchange ETH Contract Open Interest:

3. Industry Roundup

1) On November 20, Bloomberg analysts reported that ARK has once again updated its Bitcoin spot ETF application.

2) On November 20, OKX submitted a virtual asset trading platform license application to the Hong Kong Securities and Futures Commission.

3) On November 20, 490 OpenAI employees signed a joint protest, demanding the reinstatement of Sam Altman.

4) On November 21, Bittrex Global would cease operations, shutting down all trading activities from December 4.

5) On November 21, Sam Altman stated that he would work with the OpenAI leadership team in some capacity.

6) On November 21, a partner at a16z claimed 100% devotion to the crypto sector, having raised nearly $7.5 billion for the field.

7) On November 22, according to Forbes, Binance CEO Zhao Changpeng might consider resigning after the conclusion of a criminal investigation.

8) On November 22, WSJ reported that Zhao Changpeng agreed to resign and admitted to the charges, with most of the ownership to be retained.

9) On November 22, Binance declared that it has reached a resolution with U.S. regulatory authorities, with the settlement agreement excluding embezzlement or market manipulation.

10) On November 22, the U.S. Treasury will retain access to Binance’s books, records, and systems for up to five years.

Disclaimer: FameEX makes no representations on the accuracy or suitability of any official statements made by the exchange regarding the data in this area or any related financial advice.