FameEX Weekly Market Trend | November 27, 2023

2023-11-27 11:51:10

1. Market Trend

From Nov. 23 to Nov. 26, the BTC price swung from $36,372.58 to $38,414.00, with a volatility of 5.61%. The previous analysis report mentioned a corrective pattern of BTC in the 4-hour timeframe, indicating a high probability of the third attempt to breach $38,000 in the coming days, with the potential for either another pullback or a successful breakthrough to reach $39,000 or $40,000. The current market affirmed this view when BTC briefly surpassed $38,000 on Nov. 24 around 11 p.m., though it did not sustain the gain. Subsequently, it retraced to around $37,500 (a linear retracement, usually the basic trend of the market after the first breakthrough of a resistance level), with a relatively large retracement.

Historically, when the market breaks through $38,000 for the second time, there is likely to be a retracement, but it will be less significant in speed and magnitude compared to the initial retracement, exhibiting an oscillating downward movement. Presently, the 1-hour timeframe shows a healthy wide-ranging oscillation, the 4-hour timeframe displays an upward oscillation within a clear channel, and the various moving averages are diverging upwards, signaling a typical bullish trend. The daily timeframe is concluding a correction, implying a demand for an upward breakthrough.

The current course of action remains unchanged – holding assets for an upward movement is sufficient, and there is no need for additional technical analysis to support this view (provided there is no disruptive trend, no market indicators or analysis can shake this view). Currently, we are waiting for the market’s second attempt to breach $38,000 (observing whether the market will oscillate downward to initiate a retracement or directly hold above $38,000).

Source: BTCUSDT | Binance Spot

Between Nov. 23 and Nov. 26, the price of ETH/BTC fluctuated within a range of 0.05480-0.05636, showing a 2.84% fluctuation. The prior analysis report mentioned that, from the current trend, ETH/BTC has successfully repaired its bottom and established a solid support (with synchronized volume and price rise, showing considerable strength). There is a high probability of an upward trend in the later period, and investors who have not entered the market can consider entering gradually at this point and await subsequent opportunities for an uptrend. Lately, ETH/BTC has shown minimal fluctuations, achieving new highs with mild retracements and sustaining elevated levels (reflecting a healthy state). The outlook suggests a probable continuation of an oscillating upward trend. The current advice remains consistent with the previous report, advocating for position building during dips and anticipating a breakthrough.

Based on overall analysis, the current market environment still maintains an overall trend of oscillating upward movement (the prevailing trend), but the overall upward momentum in the entire market has slowed down (both mainstream and altcoins exhibit this trend, with greater volatility in altcoins and increased downward pressure). At this point, allocating to leading coins is currently more cost-effective, linked to Bitcoin approaching the $40,000 psychological level. Market acceleration is expected when challenging $40,000, so there’s no need for anxiety or panic at this moment. The overall market is still in a healthy state. Increasing turnover and time consumption at this point will reduce the upward pressure and the intensity of the bull-bear struggle when Bitcoin approaches $40,000. Therefore, the overall strategy of this analysis report remains to hold assets for an upward movement, following the trend and going with the flow.

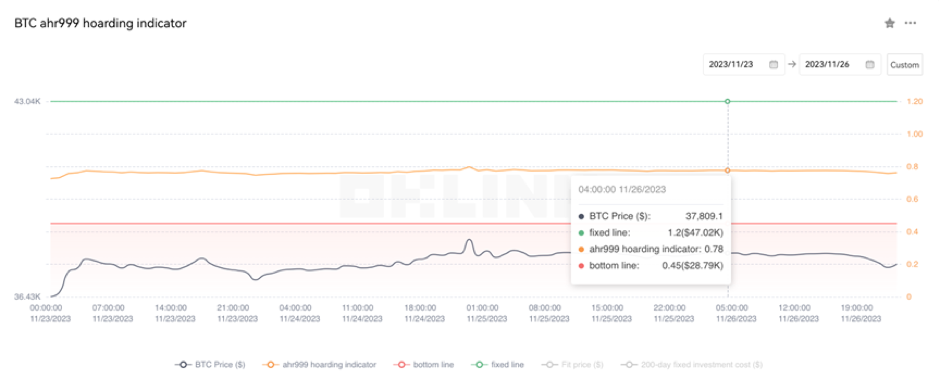

The Bitcoin Ahr999 index of 0.78 is between the buy-the-dip level ($28,790) and the DCA level ($47,020). Therefore, it is advised to purchase popular coins via DCA.

2. Perpetual Futures

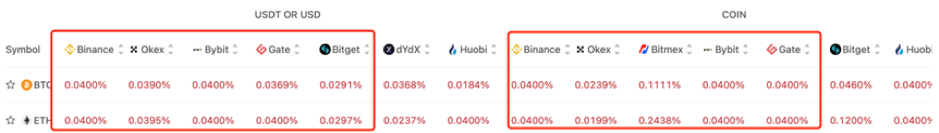

In general, the 7-day cumulative funding rates for the popular coins across major exchanges are positive, indicating that long leverages are relatively high.

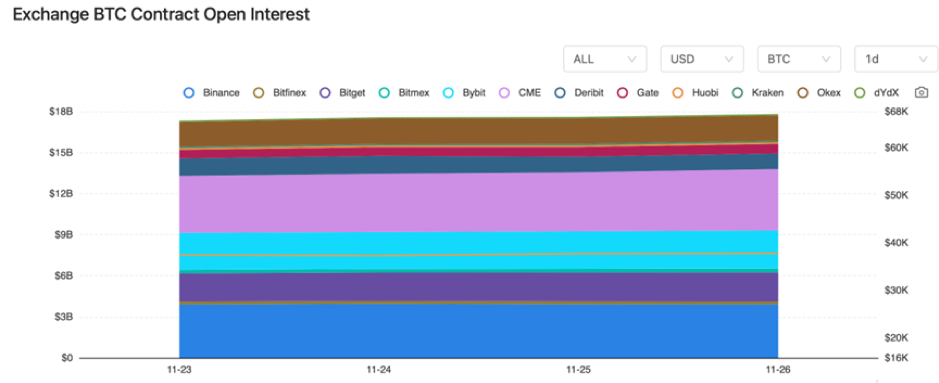

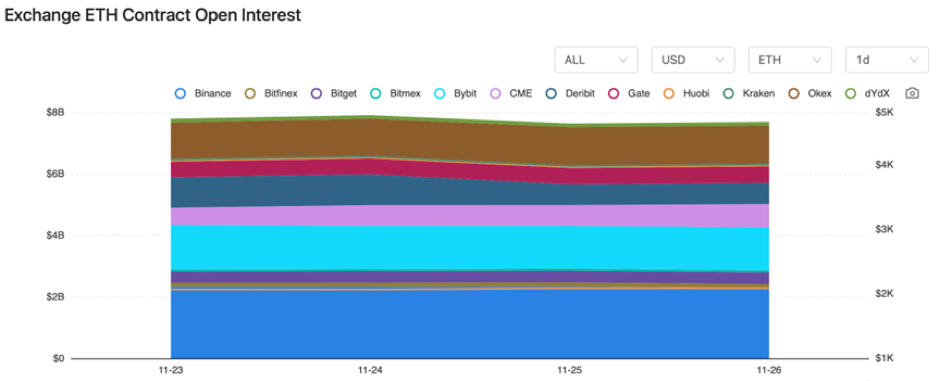

There were barely any changes in the BTC and ETH contract open interest from major exchanges.

Exchange BTC Contract Open Interest:

Exchange ETH Contract Open Interest:

3. Industry Roundup

1) On November 23, the Monetary Authority of Singapore (MAS) issued regulatory measures for digital payment token services, prohibiting the provision of financing, margin, or leveraged trading.

2) On November 23, after CZ’s resignation, there was no notable fluctuation in Binance’s Bitcoin wallet balance, with only a decrease of 1,117.04 BTC in the last 24 hours.

3) On November 23, the Prime Minister of Thailand stated that the digital wallet plan could promote economic growth in Thailand.

4) On November 24, El Salvador’s Bitcoin investment is currently at a floating loss of nearly $10 million.

5) On November 24, Raoul Pal mentioned that Bitcoin is the best-performing asset in history.

6) On November 24, a U.S. CFTC commissioner stated that the CFTC would actively investigate cryptocurrency exchanges violating trading laws.

7) On November 25, a Bloomberg ETF analyst reported that the Grayscale Bitcoin Trust (GBTC) discount rate has reached about 8.6%, the lowest since July 2021.

8) On November 25, a lawyer stated that CZ does not pose a flight risk.

9) On November 26, Huang Licheng deposited 3,000 ETH into Blast.

Disclaimer: FameEX makes no representations on the accuracy or suitability of any official statements made by the exchange regarding the data in this area or any related financial advice.