FameEX Weekly Market Trend | December 11, 2023

2023-12-11 11:49:50

1. Market Trend

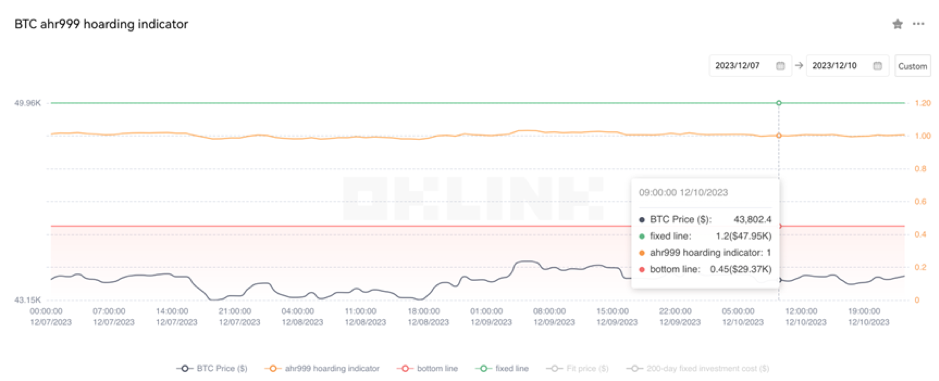

From Dec. 7 to Dec. 10, the BTC price swung from $42,821.10 to $44,700.00, with a volatility of 4.38%. The last analysis mentioned that the current steep upward slope, distant from the MA30 moving average (MA), suggested a need for a technical correction, with the potential for the price to gradually converge towards the MA30. Therefore, investors considering entry shouldn’t worry about missing out. A strategic approach involves establishing positions in the $43,000-$43,200 range, either on dips or waiting for BTC to surpass $44,500 for further gains. Recent days saw BTC in a fluctuating phase with new highs, but the accompanying trading volume appears insufficient. It’s crucial to focus on healthy trends involving proper retracement to repair moving averages and control candlestick slopes rather than creating new highs at this point.

In the upcoming week, there will be important events such as interest rate decisions by various central banks (including the Fed). In the event of negative news, historical patterns suggest the possibility of market corrections, often accompanied by notable volatility. Nevertheless, the recovery tends to be swift, underscoring the importance of placing stop-loss orders concurrently with opening positions. The current market theme is oscillation with a focus on repairing MAs, accompanied by a decrease in trading volume. This indicates that a turning point may be on the horizon (there hasn’t been a significant depth of retracement so far, but caution is advised against such scenarios). Therefore, it is still recommended to prioritize long positions at lower prices.

Source: BTCUSDT | Binance Spot

Between Dec. 7 and Dec. 10, the price of ETH/BTC fluctuated within a range of 0.05088-0.05491, showing a 7.92% fluctuation. In the past few days, ETH/BTC reached a new low and broke out of a clear downtrend channel. Starting at noon on Dec 7, there was a substantial rebound with increased trading volume, ultimately stabilizing around 0.05330. This pattern formed a double bottom on the daily chart, with strong support around 0.05000. On the 4-hour chart, the 99-day MA (trendline) acted as resistance to its upward movement. Although there was a brief breakthrough during the rebound, it ended below the MA, suggesting a failed breakout and indicating the end of the rebound trend. Personally, it is recommended to gradually enter long positions near 0.05200–0.05250, with a stop-loss below 0.05000.

Based on overall analysis, the market’s fund situation has shown a net inflow status for several days, providing the fundamental fuel for the overall market’s upward movement. However, there is a decreasing trend in trading volume compared to previous days (worthy of attention). As mentioned earlier, traditional cryptocurrencies like ADA, DOT, ENS, etc., have not experienced significant gains. It’s worth keeping an eye on them in the future. In recent days, ADA has surged over 35%, and DOT has risen by 19%. Similarly, traders can look for emerging or slow-starting sectors and identify key cryptocurrencies within them for investment. The recent oscillations in BTC have impacted altcoins to some extent. Their resilience and stability are not on the same level as BTC. Subsequently, it’s essential to set strict profit-taking and stop-loss points for altcoins. The overall strategy remains focused on prioritizing long positions at lower prices, building positions on dips, respecting the market, and avoiding financial losses caused by emotional reactions.

The Bitcoin Ahr999 index of 1.00 is between the buy-the-dip level ($29,370) and the DCA level ($47,950). Therefore, it is advised to purchase popular coins via DCA.

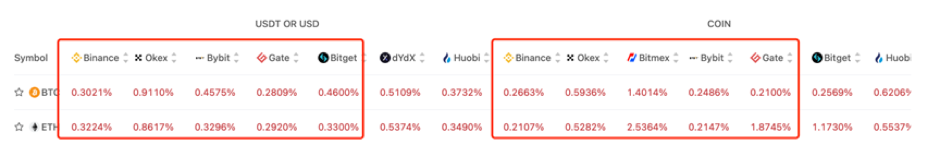

2. Perpetual Futures

In general, the 7-day cumulative funding rates for the popular coins across major exchanges are positive, indicating that long leverages are relatively high.

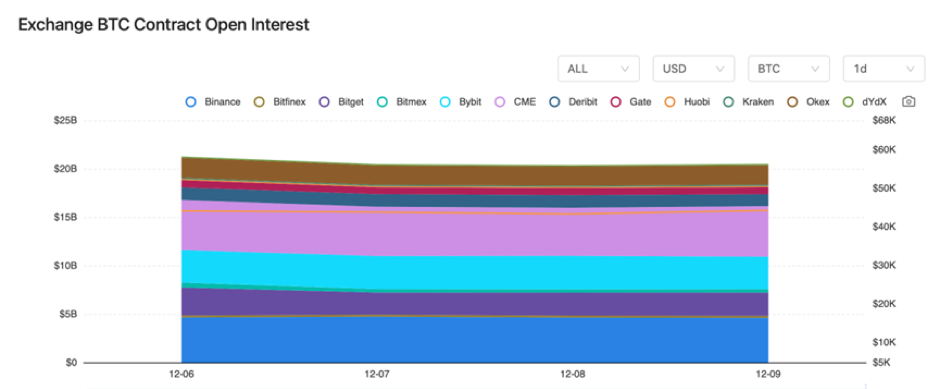

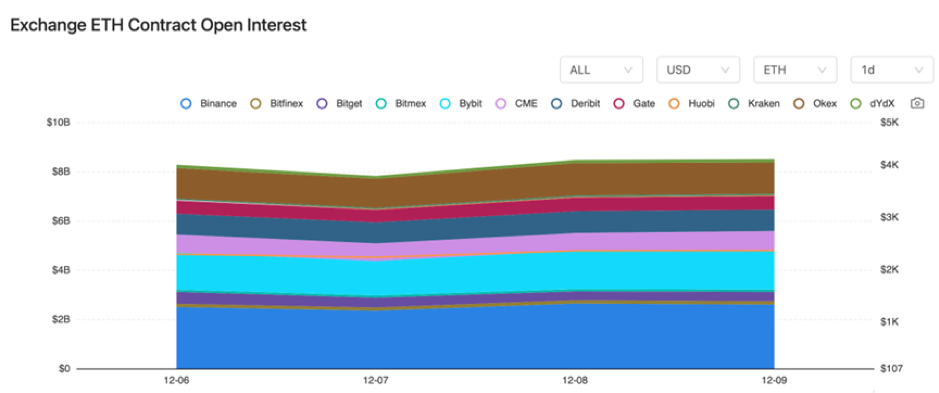

The open interest in BTC and ETH futures contracts is generally maintaining balance, with no significant fluctuations.

Exchange BTC Contract Open Interest:

Exchange ETH Contract Open Interest:

3. Industry Roundup

1) On December 7, the State Council announced to orderly advance the pilot of the digital RMB.

2) On December 7, the EU would achieve a milestone artificial intelligence regulatory act.

3) On December 7, BlackRock’s latest submission for the revision of the spot Bitcoin ETF mentioned the possibility of classifying Bitcoin as a security.

4) On December 8, the U.S. added 199,000 non-farm payrolls in November.

5) On December 8, El Salvador launched a new “citizenship investment program”, where investing $1 million in BTC or USDT can secure Salvadoran citizenship.

6) On December 9, the U.S., South Korea, and Japan discussed North Korea’s cryptocurrency theft issue in a trilateral meeting.

7) On December 9, the U.S. SEC declared that despite the Department of Justice (DoJ) settling, the Binance case should still proceed.

8) On December 9, the total crypto market cap surpassed $1.7 trillion, reaching a new high for the year.

10) On December 10, Bitcoin’s market cap ranked 9th globally, exceeding $850 billion.

11) On December 10th, Google updated its cryptocurrency advertising policy for the year 2024.

Disclaimer: FameEX makes no representations on the accuracy or suitability of any official statements made by the exchange regarding the data in this area or any related financial advice.