FameEX Weekly Market Trend | December 25, 2023

2023-12-25 11:13:35

1. Market Trend

From Dec. 21 to Dec. 24, the BTC price swung from $43,230.17 to $44,398.26, with a volatility of 2.7%. The last analysis indicated a low probability of a market pullback, given strong upward momentum and substantial fund inflow. The market is expected to reach $45,000 soon, potentially setting a new high. Despite BTC not rapidly reaching this level in recent days, there hasn’t been a significant pullback. It has entered a new accumulation phase. On the 1H chart, the upward channel is intact, and moving averages are gradually rising. As long as the short-term stays above $42,500 and the long-term above $40,500, BTC fluctuations can be ignored. Holding positions for a rise is advisable, and buying or adding positions can be considered after a solid establishment above $45,000. On the 4H and 1D charts, the market steadily follows MA25, indicating a healthy trend. In bull markets, any fluctuations, unless breaking key levels or quickly recovering if breached, are considered disturbances (spot markets, excluding futures). These movements often target futures, so futures investors should manage positions and leverage, as well as plan stop-loss/take-profit points carefully.Based on the recent trend, this report maintains the same viewpoint: follow the mainstream trend and hold positions for an upward movement.

Source: BTCUSDT | Binance Spot

Between Dec. 21 and Dec. 24, the price of ETH/BTC fluctuated within a range of 0.04977-0.05366, showing a 7.81% fluctuation. After falling below 0.0500, ETH/BTC initiated a rebound, reaching a peak near 0.05300. However, the current candlestick pattern of ETH/BTC still indicates a descending channel. The situation will be evaluated after ETH/BTC breaks through 0.05450 to assess stability. Only upon a substantial and stable breakthrough of 0.05450, considering entry or not will be plausible. Currently, the original stance is maintained: staying away from this cryptocurrency.

Based on overall analysis, the current market is entering a period of accumulation. Often, when BTC experiences minimal fluctuations, other currencies tend to exhibit strong upward trends. In recent days, typical currencies demonstrating this characteristic include OP, ARB, and DOT. Therefore, in such situations, one can carefully observe the market, strategically invest in these currencies, and wait for returns. BTC hodlers need not worry; holding and awaiting an upward trend is advised unless there is a disruptive structural change.

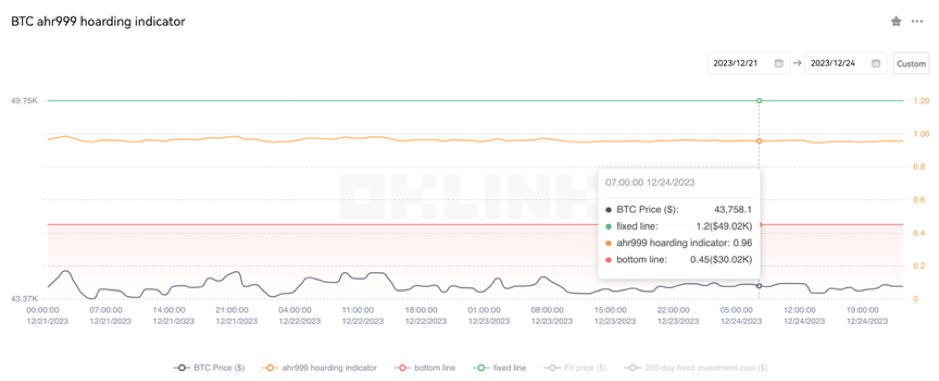

The Bitcoin Ahr999 index of 0.96 is between the buy-the-dip level ($30,020) and the DCA level ($49,020). Therefore, it is advised to purchase popular coins via DCA.

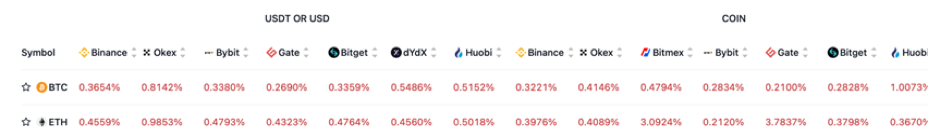

2. Perpetual Futures

In general, the 7-day cumulative funding rates for the popular coins across major exchanges are positive, indicating that long leverages are relatively high.

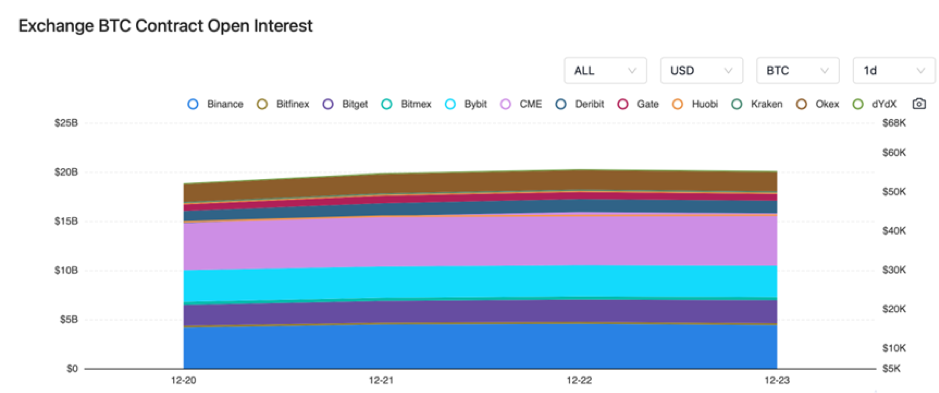

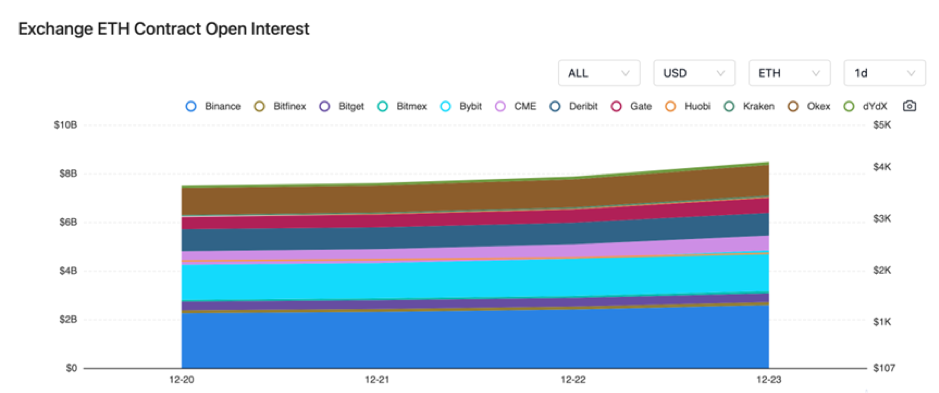

The BTC and ETH contract open interest both showed an upward trend.

Exchange BTC Contract Open Interest:

Exchange ETH Contract Open Interest:

3. Industry Roundup

1) On December 21, Three Arrows Capital estimated a creditor asset recovery rate of 46%.

2) On December 21, Sun Yuchen declared that as long as the cryptocurrency industry continues to innovate, there is an opportunity.

3) On December 21, the CFTC suggested strengthening commodity swap regulation, requiring reporting of relevant data on crypto assets, etc.

4) On December 22, the probability of the Fed lowering interest rates in February next year was 14.5%.

5) On December 22, Coinbase’s CEO stated that cryptocurrency is the future of currency.

6) On December 22, a report from the Hong Kong Monetary Authority indicated that more asset tokenization products are expected to emerge.

7) On December 23, OSL announced its application for approval to expand the range of tradable currencies on the platform.

8) On December 23, Ordinals Inscription accumulated fee income surpassed 4,800 bitcoins.

9) On December 24, according to the Hong Kong Securities and Futures Commission, virtual asset spot ETFs are only allowed to be traded on futures exchanges regulated by the Securities and Futures Commission.

10) On December 24, a report showed that AI agents will dominate the blockchain in 2024.

Disclaimer: FameEX makes no representations on the accuracy or suitability of any official statements made by the exchange regarding the data in this area or any related financial advice.