FameEX Weekly Market Trend | February 5, 2024

2024-02-05 10:46:35

1. Market Trend

From Feb. 1st to Feb. 4, the BTC price swung from $41,889.95 to $43,745.10, with a volatility of 4.43%. The last analysis report mentioned that the Bitcoin spot ETF fund has seen continuous inflows of funds, further stabilizing the price of BTC. BTC’s current bottom zone is $41,200-$41,800. This range presents a good buying opportunity, anticipating a strong stabilization around $43,000 for a new upward trend. Despite missing the expected bottom, consider adjusting the entry point higher to $42,300 (with a stop-loss at $41,500) based on a fundamental analysis perspective. On the 1st day, BTC surged to $43,880, then experienced a swift decline, briefly breaking $42,000, before gradually consolidating around $43,000. This phenomenon indicates that although the BTC price has been oscillating around $43,000 for a considerable period, there is still a certain level of intense speculation between bulls and bears (not excluding artificial factors).

Despite the recent decline, the prolonged oscillation around $43,000 is a positive market indicator. On a higher timeframe (1D), closing prices consistently remain above MA10, MA20, and MA30, indicating strong support effects. With the trend of moving averages turning upward, as the market transition nears (likely this week), there is a relatively high probability of BTC prices moving upward.

Source: BTCUSDT | Binance Spot

Between Feb. 1st and Feb. 4, the price of ETH/BTC fluctuated within a range of 0.05325-0.05415, showing a 1.7% fluctuation. In the previous report, it was mentioned that the risk of entering ETH/BTC remains high until it breaks and firmly stabilizes above 0.05450. Currently, it’s wise to wait for ETH/BTC to exceed 0.05450 before considering a bullish entry. Despite recent weakness and not reaching 0.05400, on the 1-hour timeframe, ETH/BTC is gradually breaking out of the downtrend channel into a consolidating trend. Given the challenge of establishing an independent trend, it’s recommended to assess ETH/BTC’s relative strength compared to the overall market after BTC’s direction is determined. Only then decide on entering (consider purchasing a position for a strategic ambush if ETH/BTC stabilizes above 0.05400 before BTC's direction is chosen).

Based on overall analysis, most cryptocurrency pairs in the current market are in a consolidating trend, with few exhibiting a one-sided or independent movement. Market funds continue to maintain a net inflow status, particularly with the recent approval of spot Bitcoin ETF funds, providing some support to BTC prices. Many pairs have experienced recent highs followed by declines, stemming from BTC price fluctuations, resulting in overall instability in the market trends of most pairs. In such market conditions, the probability of floating losses is often higher. Therefore, the approach to the overall market at present requires a simple strategy: wait for BTC to determine its direction, and once the direction is chosen, move in line with the trend.

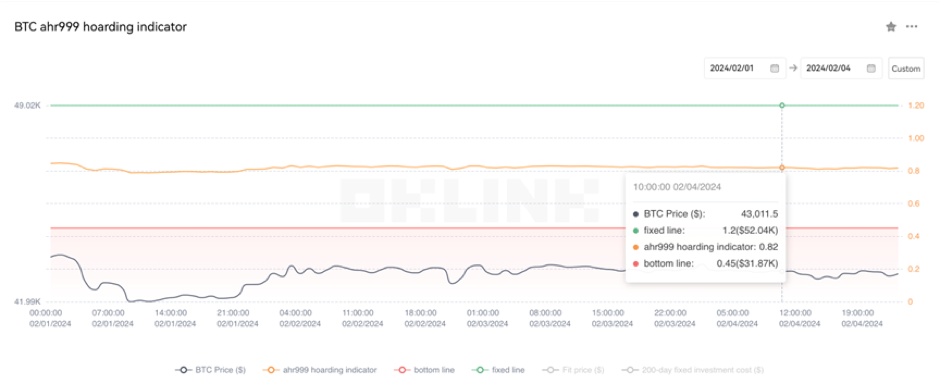

The Bitcoin Ahr999 index of 0.82 is between the buy-the-dip level ($31,870) and the DCA level ($52,040). Therefore, it is advised to purchase popular coins via DCA.

2. Perpetual Futures

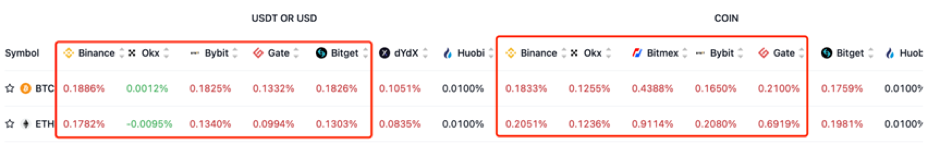

In general, the 7-day cumulative funding rates for the popular coins across major exchanges are positive, indicating that long leverages are relatively high.

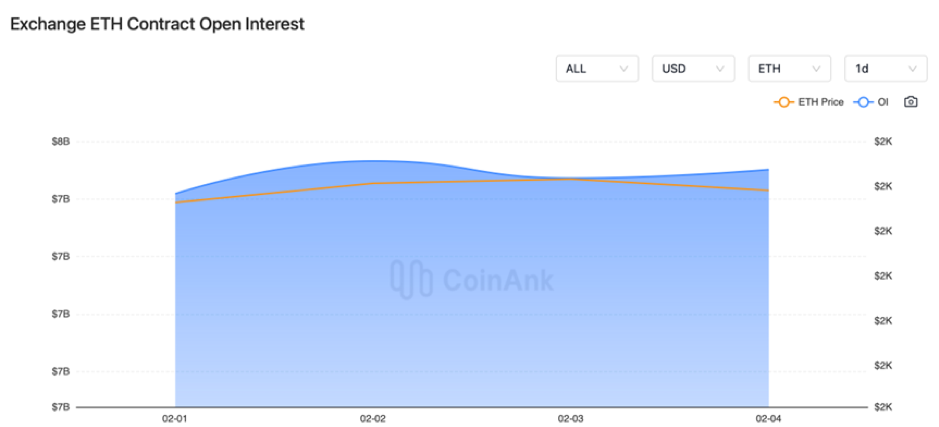

The open interest for BTC and ETH contracts on major exchanges has shown relative stability.

Exchange BTC Contract Open Interest:

Exchange ETH Contract Open Interest:

3. Industry Roundup

1) On February 1st, Jupiter founder stated that the team will not sell tokens for the next 7 days.

2) On February 1st, Binance Web3 Wallet launched the Inscription Market.

3) On February 1st, Germany’s DZ Bank expected the initiation of the Bitcoin retail trading pilot phase this year.

4) On February 2nd, as of the closing of the US stock market, the daily trading volume of BlackRock’s spot Bitcoin ETF surpassed GBTC for the first time.

5) On February 2nd, 800 million XRP tokens were locked in Ripple’s custody.

6) On February 2nd, the Biden administration initiated an “emergency” investigation into the electricity usage of Bitcoin miners.

7) On February 3rd, the circulating supply of USDC increased by $800 million in the past week.

8) On February 3rd, the zkSync bridge held a total value close to 3 million ETH.

9) On February 4th, Ordinals Inscription accumulated fee income exceeding 6,000 BTC.

10) On February 4th, BlackRock updated IBIT holding data, with the market value of Bitcoin holdings surpassing $3 billion as of February 2nd.

Disclaimer: FameEX makes no representations on the accuracy or suitability of any official statements made by the exchange regarding the data in this area or any related financial advice.