FameEX Weekly Market Trend | September 23, 2024

2024-09-23 11:29:30

1. BTC Market Trend

From September 19 to September 22, the BTC spot price swung from $61,513.27 to $64,072.57, a 4.16% range.

In the last four days, important statements from the Federal Reserve (Fed) and the European Central Bank (ECB) were as follows:

1) On September 21, Fed Governor Bowman expressed concerns that significant rate cuts might be seen as prematurely declaring victory over inflation, stating that the inflation target has not yet been achieved, the economy remains strong, and the labor market is nearing full employment.

2) On September 21, Fed’s Harker indicated that the Fed is performing well in guiding the economy.

3) On September 21, Fed Governor Waller mentioned that if the job market deteriorates, he may consider a 50 basis point rate cut again.

4) On September 20, ECB’s Nagel stated that interest rates would not fall as quickly and dramatically as they rose. The intervals for rate adjustments may differ. Governing Council member Centeno suggested that the ECB may have to accelerate rate cuts. Executive Board member Panetta indicated that the ECB might speed up rate cuts in the coming months.

5) On September 21, ECB Governing Council member Knot said there is room for further rate cuts if the inflation outlook remains unchanged. Governing Council member Lane noted that the direction of Eurozone monetary policy is clearly easing; the pace of rate cuts depends on the latest data and analysis. Vice President Guindos mentioned that “we have fully opened the door, and more information will be available in December than in October.”

Vishal Sacheendran, head of a regional market at a leading exchange, stated in an interview at the Token2049 event that the upcoming U.S. presidential election will not significantly impact global digital asset industry regulations. Sacheendran emphasized, “Cryptocurrency regulation is entirely decentralized. Will the U.S. election affect how countries in the Middle East, Latin America, and Southeast Asia view the cryptocurrency market? These countries know what is most beneficial for them.” He pointed out that countries like Singapore, Thailand, Indonesia, and India have become important cryptocurrency markets, with leaders and regulators in these regions more willing to nurture Web3 talent. Sacheendran specifically mentioned, “Everyone knows that India is refining its regulatory framework, which will open the cryptocurrency market for its 1.5 billion population.”

Regarding regulatory measures in Southeast Asian countries, Sacheendran stated, “Thailand’s regulations and digital nomad visa policy are impressive. Indonesia’s regulations are also advancing, with regulators maintaining an open attitude and offering an affordable lifestyle. If other countries do not keep up with the trends, they will lose talent density, especially to these markets.”

On September 20, according to official news, the Solana ecosystem DEX aggregator Jupiter released several updates, including:

1) Metropolis API: Making development on Solana easier, with upgrades to the dialogue, token, and price APIs to enhance the user experience on partner platforms.

2) Jupiter RFQ: Enhancing liquidity on Solana. Market makers can provide pricing quotes directly to the routing engine.

3) Jupiter perps v2, which includes three updates:

· Limit orders;

· Dove oracle standard: Utilizing chaotic pricing data and using Pyth as a backup oracle;

· No Gas trading: Admins handle Gas, speeding up transaction times and enhancing the trading experience.

4) Jupiter Mobile: Attracting millions of users to Solana by eliminating friction. Exchanges can be made using Apple Pay, Google Pay, or credit cards.

5) Ape pro: Featuring two main functions, ape trading and ape mint.

According to CoinDesk, Bitcoin has risen by 7% in the past five days, breaking the $64,000 mark for the first time since August 26. Meanwhile, gold has set new historical highs over 30 times this year, surpassing $2,600 per ounce. Charlie Bilello, chief market strategist at investment management and financial planning firm Creative Planning, stated that this is the first time since Bitcoin’s inception in 2009 that both Bitcoin and gold have simultaneously become the best-performing assets of the year. Analyst James Van Straten noted that the strong performance of Bitcoin and gold is related to increased global liquidity, the expansion of central bank balance sheets, and the Fed’s recent rate cuts stimulating investment and economic activity. The Fed’s current balance sheet stands at $7.1 trillion, and although quantitative tightening is ongoing, the pace has slowed. The reduction in reverse repo balances, currently just above $300 billion, is releasing liquidity back into the financial system. This has a stimulative effect, increasing the availability of funds for loans, investments, and overall economic activity. From a broader perspective, the total balance sheet of the world’s 15 major central banks (including the U.S., EU, Japan, and China) is close to $31 trillion. While this figure itself is not the main focus, the trend shows a global recovery of central bank balance sheets since July, rising from around $30 trillion. This increase in liquidity particularly stimulates Bitcoin, as its movements often correlate with liquidity trends. Additionally, the Fed’s 50 basis point rate cut further supports the rise of both Bitcoin and gold.

The Fed’s 50 basis point rate cut exceeded market expectations, representing a significant macroeconomic positive. To adapt to the new market conditions and help users secure profits more quickly, we have optimized our order suggestions as follows:

For the previously suggested BTC spot buys at $54,000, $52,800, and other price levels where users have purchased, we recommend placing sell orders at $67,900, $79,870, and $96,820, respectively. Additionally, place some buy orders to catch the bottom at $44,370 and $36,720.

For the previously suggested ETH spot buys at $2,500 and other price levels where users have purchased, we recommend placing sell orders at $3,425 and $5,040, respectively. Additionally, place some buy orders to catch the bottom at $2,040 and $1,730.

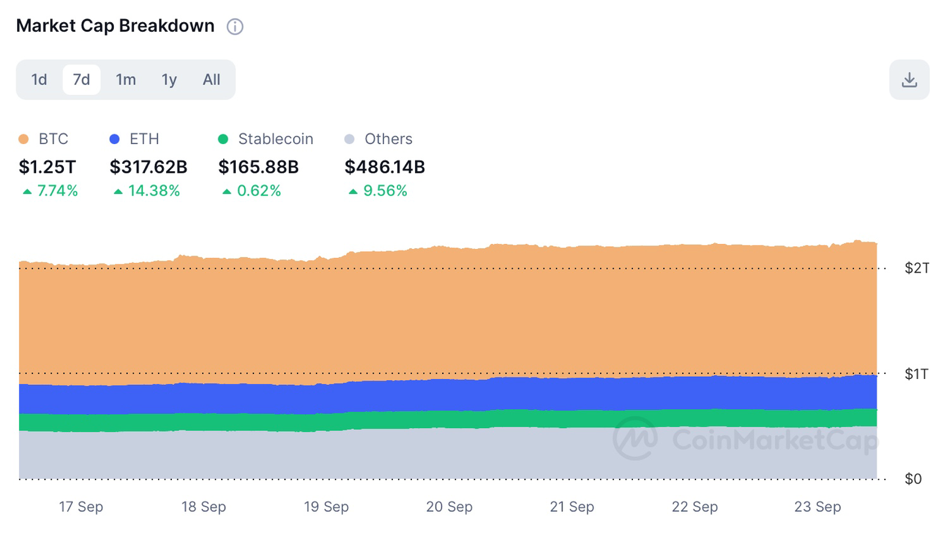

2. CMC 7D Statistics Indicators

Overall market cap analysis, source: https://coinmarketcap.com/charts/

24h trading volume, source: https://coinmarketcap.com/charts/

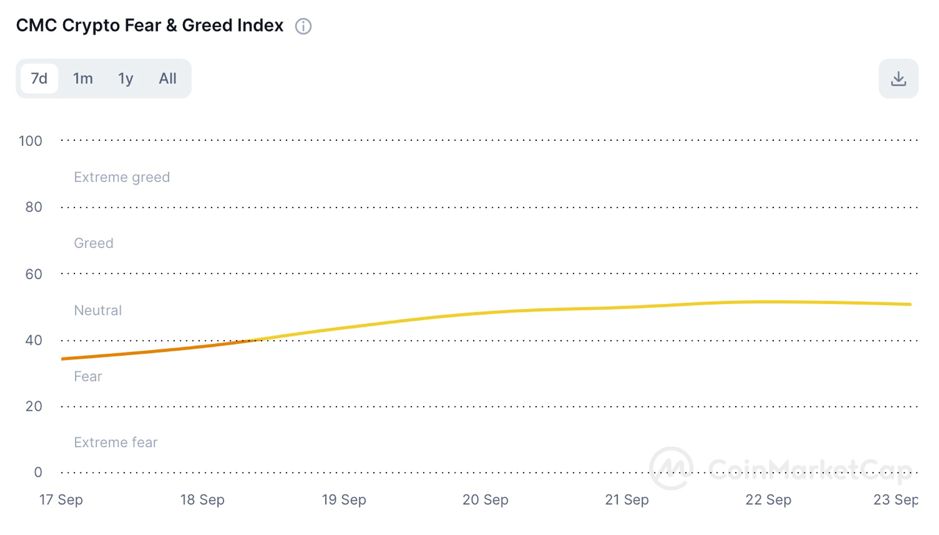

Fear & Greed Index, source: https://coinmarketcap.com/charts/

3. Perpetual Futures

The cumulative funding rates for major mainstream cryptocurrencies across major exchanges over the past seven days are generally positive, indicating that the current market is dominated by long leverage.

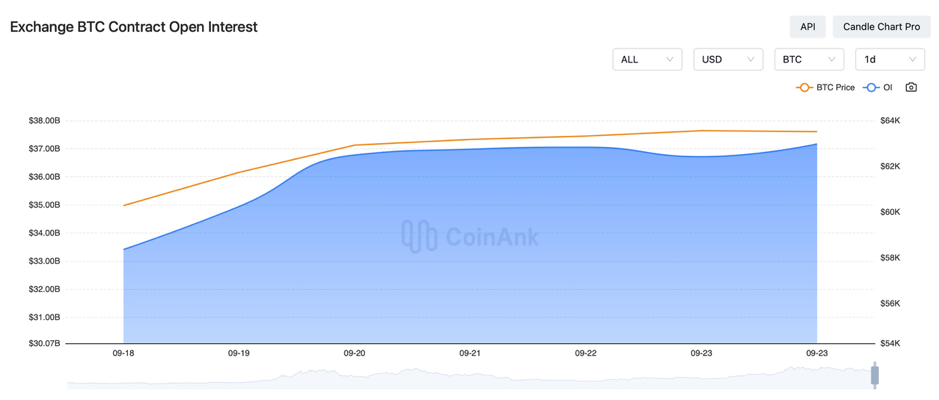

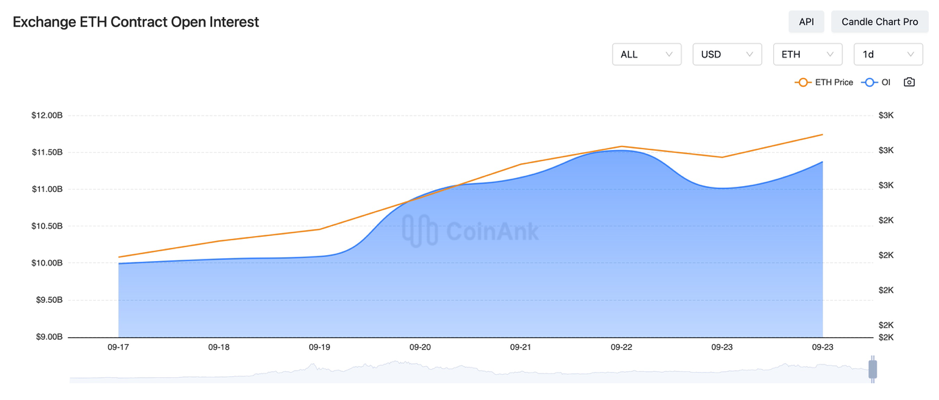

In the past four days, the open interest for BTC and ETH contracts has significantly increased, with ETH experiencing a faster growth rate. This is primarily because its price is relatively low and this current bull market has not yet broken past highs.

Exchange BTC Contract Open Interest:

Exchange ETH Contract Open Interest:

Note: All the above information is provided for reference purposes only and should not be construed as specific investment advice.

4. Industry Roundup

1) On September 19, the number of initial unemployment claims in the U.S. for the week ending September 14 was recorded at 219,000, the lowest since the week of May 18, 2024.

2) On September 19, the Bank of England decided to maintain the interest rate at 5%, in line with expectations; Bank of England Governor Bailey stated that caution is needed, and rates should not be cut too quickly or too much.

3) On September 19, following the Fed’s 50 basis point rate cut, U.S. President Biden stated that the decline in inflation and interest rates marks an “important moment" in the economic recovery post-COVID; Vice President Harris remarked that this is good news for Americans facing high prices; Trump commented that this indicates the “economy is very bad,” or that the Fed is “playing politics.”

4) On September 19, Inception Capital’s founder in China reemerged after months of disappearance, agreeing to relinquish some key responsibilities at the company. Shezmu temporarily recovered 282 ETH after a hacking incident, and is currently suspending DApp interactions. Blockchain detective ZachXBT accused three criminals of stealing $243 million from a single Genesis creditor.

5) On September 19, the Ethereum Pectra hard fork was confirmed to be executed in two phases. A Blockdaemon executive mentioned that Hong Kong may approve including staking services in Ethereum spot ETFs this year; BNB Chain announced integration with Telegram.

6) On September 19, the Bank of Canada officially suspended its “digital Canadian dollar” CBDC plan. The government of Louisiana is now accepting Bitcoin payments.

7) On September 19, Arkham data revealed that the top four countries holding BTC are: the U.S.: $12.16 billion, the UK: $3.67 billion, Bhutan: $780 million, El Salvador: $350 million.

8) On September 19, the Central Cooperative Bank of Germany will offer cryptocurrency trading through collaboration with the Stuttgart Stock Exchange. The German government closed 47 cryptocurrency exchanges suspected of illegal activities.

9) On September 20, market news reported that Franklin Templeton, with $1.3 trillion in assets under management, plans to launch a co-managed fund on Solana. Silvergate Capital, the parent company of crypto-friendly bank Silvergate, has filed for Chapter 11 bankruptcy protection in a Delaware court.

10) On September 20, it was reported that DePIN projects such as CESS would attend an event on Capitol Hill on October 2 to showcase DePIN technology to congressional members. Magic Eden’s CEO announced new features allowing users to trade assets across multiple chains.

11) On September 20, for the first time since 2009, wallets from the Satoshi era transferred 250 BTC. A dormant miner’s address that had been inactive for 15.6 years transferred out 50 BTC worth $3.19 million.

12) On September 20, the Fed’s dot plot indicates that the Fed expects the federal funds rate to be 4.4% by the end of 2024. Top trader Eugene stated that the price movements in the coming days will determine Bitcoin’s mid-term and long-term direction.

13) On September 20, Japan’s August core CPI year-on-year was 2.8%, matching expectations of 2.80%, up from a previous value of 2.70%. The Bank of Japan’s rate decision maintained the benchmark interest rate at 0.25%, in line with market expectations. BoJ Governor Ueda stated that despite two rate hikes, Japan’s rates may still be below neutral levels.

14) On September 20, breaking news revealed that a liquidity aggregator on Solana announced the acquisition of the Solana browser SolanaFM. Phantom announced the launch of an embedded wallet to help developers streamline the new user registration process.

15) On September 21, the SEC filed charges against five companies accused of operating a crypto “pig-butchering” scam. The FBI arrested defendants involved in fraud and money laundering conspiracies, with two individuals in Miami and Los Angeles accused of a $230 million cryptocurrency scam.

16) On September 21, hackers stole documents from Seattle Airport and demanded a $6 million Bitcoin ransom, which the operator refused to pay. Members of Banana Gun responded to the “theft”, stating that the team was investigating and that robot services were suspended.

17) On September 21, ZachXBT indicated that an investigation involving over $100 million will be disclosed soon. A U.S. judge ordered a California man to pay $36 million for cryptocurrency and forex fraud; analysts noted that Three Arrows Capital and Alameda will need three years to liquidate their WLD holdings.

18) On September 21, SkyBridge’s founder stated he is collaborating with Harris to help formulate digital asset policy for the U.S. presidential election. In August, Harris’s campaign raised more than four times what Trump did, reaching $189 million.

19) On September 21, several individuals were charged by the Chinese prosecutor’s office for assisting in trading USDT on a black market trading platform. Police in Linyi, Shandong Province, cracked a case involving a gambling app that used virtual currency, seizing over 10 million yuan in illicit funds.

20) On September 21, Visa partnered with Singapore’s dtcpay to launch a cryptocurrency/fiat exchange card. A survey indicated that technical complexity remains a major barrier to the widespread adoption of cryptocurrency.

21) On September 22, the next Solana Breakpoint will be held on December 11, 2025, in Abu Dhabi. Payment solution DePlan launched DePlan 2.0 on Solana, supporting buy now, pay later.

22) On September 22, Cyvers Alerts reported that the BingX hacking incident had resulted in losses exceeding $52 million. The yield protocol Shezmu paid a 20% bounty and recovered stolen funds.

23) On September 22, the Fed’s balance sheet size fell to around $7.1 trillion, having contracted by $1.39 trillion this year. BlackRock noted that Bitcoin’s appeal as a reserve asset has increased due to the U.S. federal deficit and debt situation.

24) On September 22, data from Token Unlocks indicated that the total value of all tokens unlocking in the mainstream market within the next week is $101 million, including tokens like Venom, Ygg, SingularityNET, ENA, and OP.

25) On September 22, next Monday, Fed’s Bostic will speak on the economic outlook, and Fed’s Goolsbee will participate in a fireside chat. Next Thursday, speeches will be given by Fed’s Williams and Governor Barr, along with ECB President Lagarde, Vice President Guindos, and Chair Buch. On Friday, the U.S. will release the August core PCE price index and personal spending data. Kashkari and Barr will participate in another fireside chat, with additional remarks from Collins and Cook. Japan’s ruling party, the Liberal Democratic Party, will hold a party leader election.

Disclaimer: FameEX makes no representations on the accuracy or suitability of any official statements made by the exchange regarding the data in this area or any related financial advice.