FameEX Weekly Market Trend | October 31, 2024

2024-10-31 10:32:25

1. BTC Market Trend

From October 28 to 30, the BTC spot price swung from $67,367.2 to $73,623.5, a 9.29% range. In the last three days, key statements from the European Central Bank (ECB) were as follows:

1) On October 29, ECB President Lagarde stated that trade fragmentation could reignite inflation.

2) On October 29, ECB Governing Council member Nagel indicated that the December meeting would take a wait-and-see approach.

3) On October 29, ECB Governing Council member Knot mentioned that if upward inflation risks arise, policy tightening may be more gradual.

Matthew Siegel, head of digital asset research at VanEck, stated that Bitcoin’s recent rise appears linked to political changes and global economic concerns. Factors such as the upcoming U.S. election, changes in money supply, and international developments in Bitcoin mining have influenced recent price trends. Regarding the impact of the November 5 U.S. presidential election results on Bitcoin’s price movements, he explained that historically, Bitcoin often reacts to changes in political sentiment, especially when candidates perceived as more supportive of digital assets show an advantage in polls.

The recent price movements align with the increased betting odds for Trump, a candidate who supports cryptocurrency. “We believe this is a very favorable setup for Bitcoin entering the election. We saw exactly the same pattern in 2020 when Bitcoin lagged with lower volatility,” Siegel said. “Once the winner is announced, we typically experience a high-volatility rebound as new buyers enter the market.” He also emphasized the importance of the long-term negative correlation between Bitcoin and the U.S. dollar, noting that periods of dollar weakness often coincide with rising Bitcoin prices as investors seek alternative value storage methods.

Another key factor mentioned by Siegel is the correlation between Bitcoin and the growth of the money supply, particularly M2, which tracks the supply of cash and near-money. He noted that recent policy adjustments by the Federal Reserve (Fed) have led to a resurgence in money supply growth, rekindling interest in Bitcoin. Furthermore, he discussed the impact of global developments on Bitcoin adoption, highlighting that some emerging markets, especially BRICS nations, are integrating government-supported Bitcoin mining operations. Looking ahead, Siegel indicated that global debt concerns could further drive interest in Bitcoin, as a credit rating downgrade for major economies, especially the U.S., may catalyze increased investments in Bitcoin as an alternative asset.

The sell order for BTC at $72,120 has been executed. Previously, we recommended placing a buy order at $54,000, which has now yielded a profit of 72,120/54,000-1=33.56%. Even earlier, we suggested placing a buy order at $52,800, which has yielded a profit of 72,120/52,800-1=36.59%%. Congratulations to users who placed orders at these price levels for securing their profits!

From October 31 to November 3, keep an eye on the ETH spot trading opportunities. Maintain the sell orders at $3,425 and $5,040, as well as the buy orders at $1,730 and $2,040. For the BTC spot, it is recommended to keep the sell orders at $79,870 and $96,820. In addition, maintain the buy orders at $36,720 and $45,900.

2. CMC 7D Statistics Indicators

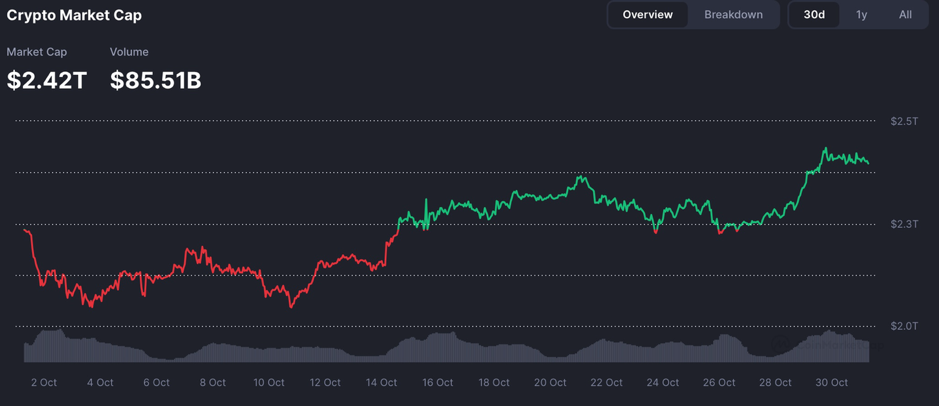

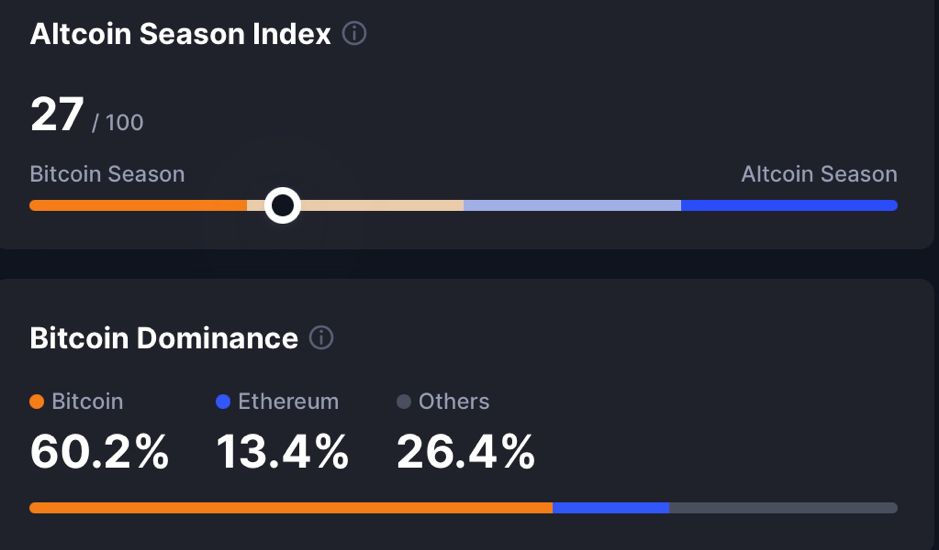

Overall market cap and volume, source: https://coinmarketcap.com/charts/

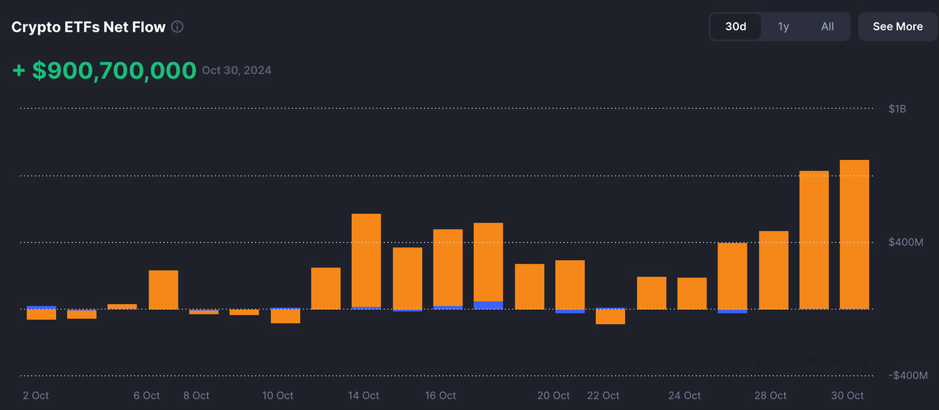

Crypto ETFs Net Flow: https://coinmarketcap.com/charts/

Crypto ETFs Net Flow: https://coinmarketcap.com/charts/

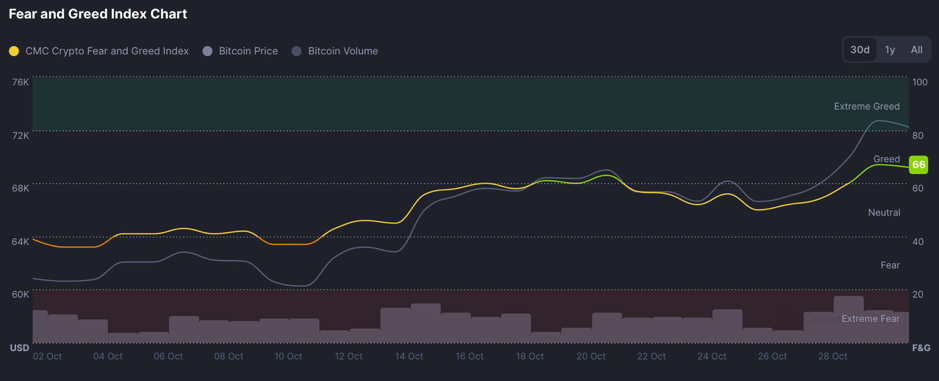

Fear & Greed Index, source: https://coinmarketcap.com/charts/

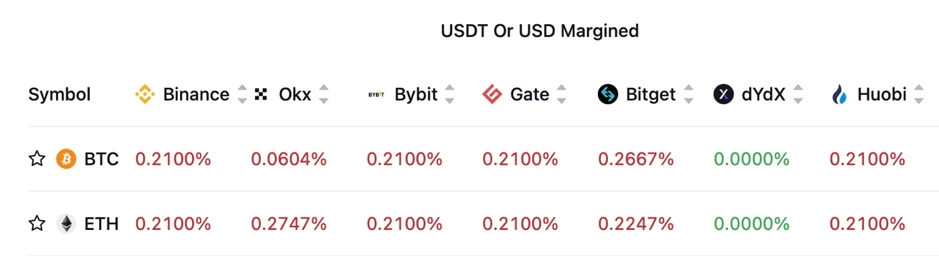

3. Perpetual Futures

Funding fees for mainstream coins on major exchanges have generally remained positive over the past 7 days, indicating an overall optimistic market sentiment.

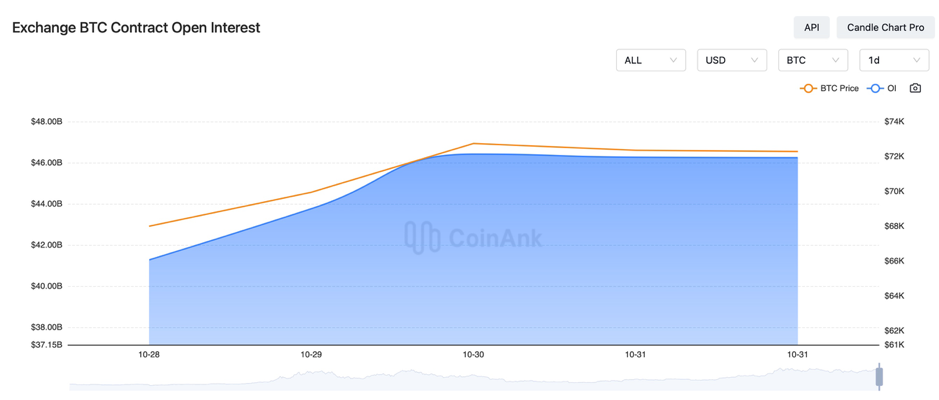

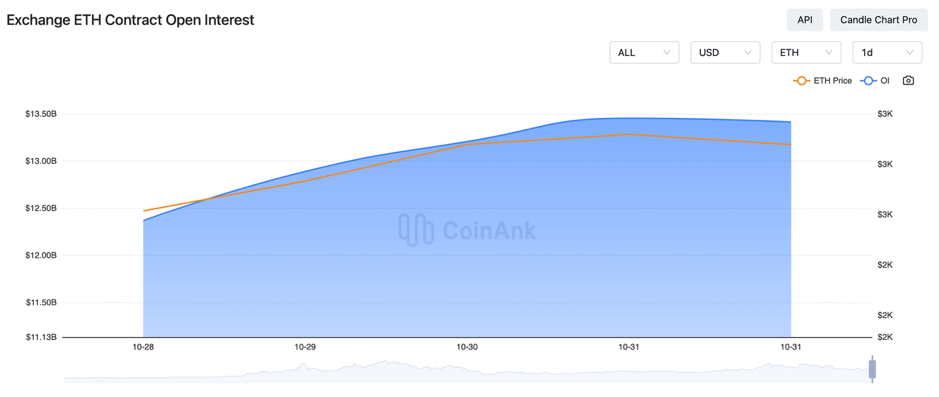

In the past three days, the open interest for BTC and ETH contracts has been continuously increasing, indicating a rise in market risk appetite.

Exchange BTC Contract Open Interest:

Exchange ETH Contract Open Interest:

Note: All the above information is provided for reference purposes only and should not be construed as specific investment advice.

4. Industry Roundup

1) On October 28, Elon Musk posted Shiba Inu-related images on the X (formerly Twitter) platform in connection with the U.S. elections. Musk claimed that U.S. government annual spending could be reduced by $2 trillion. The co-founder of Dogecoin criticized the Biden administration, calling its actions against Trump dictatorial.

2) On October 28, FTX filed a lawsuit to recover over $50 million in assets allegedly withheld by KuCoin. FTX reached a $228 million settlement with Bybit, accelerating the process of returning customer funds.

3) On October 28, sources indicated that Sequoia Capital may profit over $100 million from its acquisition of Bridge from Stripe.

4) On October 28, hackers continued to post meme messages through the X account of the Truth Terminal founder, alerting users to potential risks.

5) On October 28, the Monetary Authority of Singapore established the Global Financial and Technology Network (GFTN), which will pilot digital assets and tokenization, as well as promote AI adoption in its first phase.

6) On October 28, it was reported that the Hong Kong Securities and Futures Commission (SFC) is expected to issue the first batch of formal licenses to applicants for virtual asset trading platforms by the end of this year.

7) On October 29, analysts noted that deficit spending and declining interest rates are driving an increase in global liquidity, benefiting Bitcoin and related markets. Tyr Capital predicted Bitcoin might rise before the U.S. elections, but could face profit-taking afterward, while maintaining a bullish mid-term outlook.

8) On October 29, Japan’s unemployment rate for September was 2.4%, below the expected 2.5% and previous value of 2.5%.

9) On October 29, FV Bank launched a new VISA debit card for cryptocurrency holders.

10) On October 29, a security researcher discovered a serious vulnerability while reviewing Cosmos documentation and earned a $150,000 bug bounty.

11) On October 29, the U.S. Treasury Department released a financial inclusion strategy that mentioned cryptocurrency only once, raising comparisons to the vice presidential campaign stance.

12) On October 29, Florida’s CFO proposed using Bitcoin to diversify the state’s pension fund.

13) On October 30, a Hong Kong judge ruled in favor of the plaintiff in the JPEX case, awarding 240,000 USDT or 1.85 million HKD, stating that accepting cryptocurrency qualifies as “property”.

14) On October 30, regarding the Middle East situation, Iran planned to increase its military budget by 200%. Hezbollah appointed Naim Qassem as the new leader. Israeli officials stated that new ceasefire negotiations for Gaza would be held this week. Netanyahu was reportedly convening a meeting to seek a diplomatic solution to the Lebanon issue.

15) On October 30, the probability of Trump winning on Polymarket surpassed that of Harris.

16) On October 30, the U.S. SEC Chairman admitted to political pressure from the cryptocurrency industry.

17) On October 30, the preliminary annualized quarterly growth rate of the U.S. GDP for the third quarter was recorded at 2.8%, with the core PCE price index at 2.2%, compared to an expected 2.1% and a previous value of 2.8%.

18) On October 30, U.S. ADP employment figures for October showed an increase of 233,000, the largest increase since March 2024.

19) On October 30, the preliminary annual GDP growth rate for the Eurozone in the third quarter was 0.9%, above the expected 0.8% and previous value of 0.6%.

Disclaimer: FameEX makes no representations on the accuracy or suitability of any official statements made by the exchange regarding the data in this area or any related financial advice.