FameEX Weekly Market Trend | November 4, 2024

2024-11-04 10:44:00

1. BTC Market Trend

From October 31 to November 3, the BTC spot price swung from $67,276.35 to $72,625.71, a 7.95% range. The recent market fluctuations are primarily due to uncertainty surrounding the U.S. presidential election results. Important statements from the European Central Bank (ECB) over the past four days include:

1) On November 1, ECB President Christine Lagarde indicated that the inflation rate in the Eurozone is expected to reach the ECB's 2% target by 2025.

2) On November 1, ECB Executive Board Member Isabel Schnabel stated that a gradual approach to interest rate cuts remains appropriate, though there is significant uncertainty regarding the neutral rate.

3) On November 1, ECB Executive Board Member Fabio Panetta believed monetary conditions in the Eurozone remain tight, and interest rates need to be reduced.

What are the key points in the U.S. Presidential Election?

1) Popular Vote: Starting at 7:00 PM EST on November 5, each state’s popular vote results will gradually be announced. The candidate who wins the popular vote in each state secures all of that state’s electoral votes, with the exception of Nebraska and Maine, where some electoral votes are allocated by district.

2) Electoral Votes: A total of 538 electoral votes are available nationwide. A candidate needs 270 electoral votes to win. Current projections suggest Harris could secure 226 electoral votes and Trump 219, leaving 93 votes still in contention.

3) Key Swing States: Michigan, Pennsylvania, Wisconsin, Arizona, Georgia, Nevada, and North Carolina are critical battlegrounds. Pennsylvania, with 19 electoral votes, has the most electoral influence among these states.

4) If a Tie Occurs: In the event of a 269-269 tie, the House of Representatives would decide the presidency, while the Senate would choose the vice president. These processes are independent, so the president and vice president could potentially be from different parties.

5) House Vote: The voting takes place after the newly elected members of Congress are sworn in, with a total of 50 votes available. A candidate needs to receive 26 votes to win. If no candidate secures 26 votes by Inauguration Day, the vice president selected by the Senate will temporarily assume the duties of the president until a president is elected.

6) Historical Context: In 1800, a tie in the election led to changes in U.S. election rules. In 1824, no candidate received enough electoral votes, leading to the House's first and only presidential selection.

In an interview at Dubai Blockchain Week, CZ Zhao Changpeng stated, “I can’t predict the future, but I can analyze history. Historically, Bitcoin has shown a clear four-year cycle. 2013 and 2017 were bull market years. However, 2012 was actually a ‘recovery year’, a detail many overlook. 2016 was also a ‘recovery year’, leading to a strong bull market in 2017. Similarly, 2020 was a ‘recovery year’, with 2021 bringing a bull run. Based on this analysis, 2024 should also be a ‘recovery year’. While the events of next year are uncertain, I remain very optimistic about the industry’s long-term prospects.”

From November 4 to November 6, the sell orders for BTC at $79,870 and $96,820, as well as the buy orders for bottom fishing at $36,720 and $45,900, along with the sell orders for ETH at $3,425 and $5,040, and the buy orders for bottom fishing at $1,730 and $2,040, should all be retained.

2. Insights on Macro Trends & Crypto Trading Skills

When will the results of the next U.S. Presidential Election be known? Please refer to the overview of important election day processes.

Event Schedule:

1) November 5, 12:00 AM EST: Voters in two towns in New Hampshire will be the first to cast their votes.

2) November 5, 6:00 AM EST: Polling stations in most states across the U.S. will begin to open, particularly in the states on the East Coast, marking the start of the election.

3) November 5, 7:00 PM - 10:00 PM EST: Polling stations in various states will gradually close, followed by the start of ballot counting. Polling stations in seven key swing states, which significantly influence the election outcome, will also close during this time. The states that are expected to report preliminary results first are Georgia and North Carolina. Media organizations will begin to report and predict winners in certain states based on the counting results.

4) After 11:00 PM EST on November 5: As more states release their counting results, the overall election results will gradually become clearer. However, if the race is close, it may take longer to finalize the results.

Key Dates to Watch After Election Day:

1) November 6 to December 11: States will certify the election results.

2) December 17: The Electoral College will convene to cast its official votes.

3) January 6, 2025: The U.S. Congress will hold a session to tally and certify the electoral vote count.

4) January 20, 2025: The elected president of the United States will be officially sworn in.

3. CMC 7D Statistics Indicators

Overall market cap and volume, source: https://coinmarketcap.com/charts/

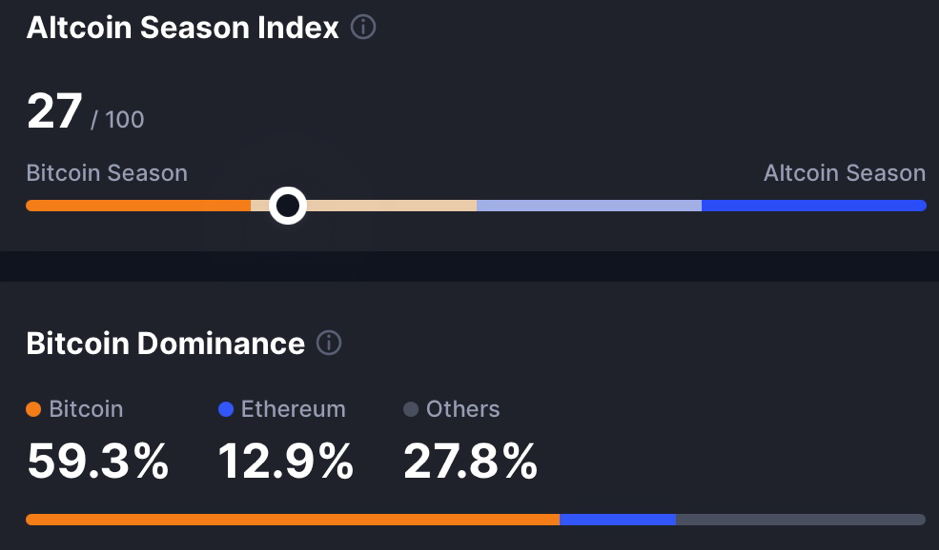

Altcoin Season Index and Bitcoin Dominance: https://coinmarketcap.com/charts/

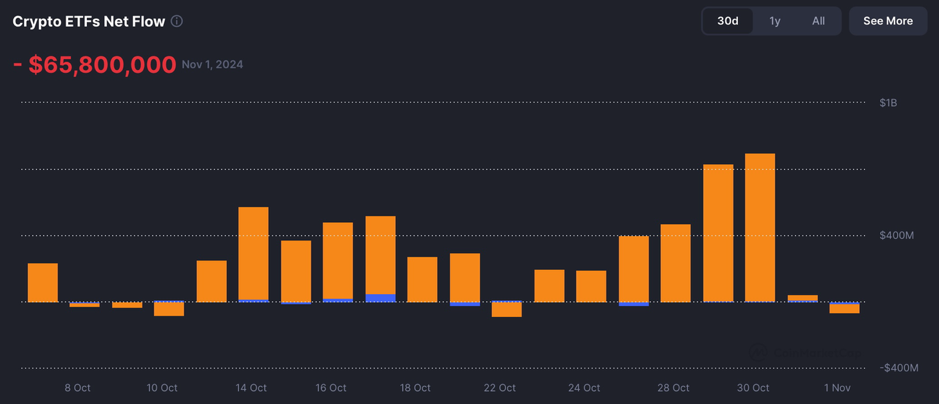

Crypto ETFs Net Flow: https://coinmarketcap.com/charts/

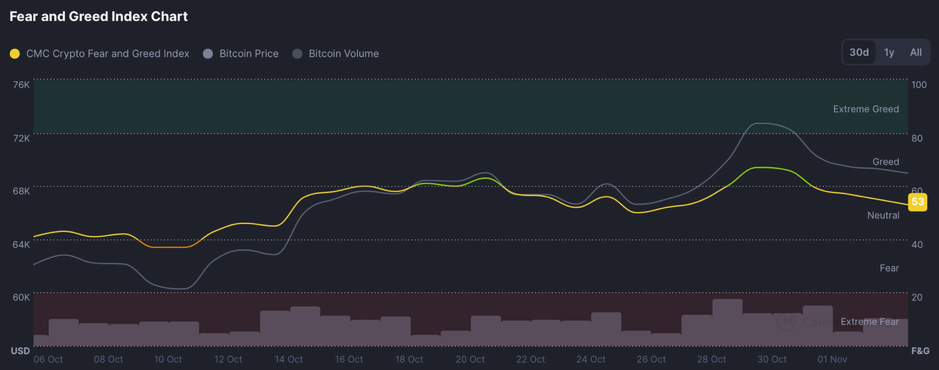

Fear & Greed Index, source: https://coinmarketcap.com/charts/

4. Perpetual Futures

Funding fees for mainstream coins on major exchanges have generally remained positive over the past 7 days.

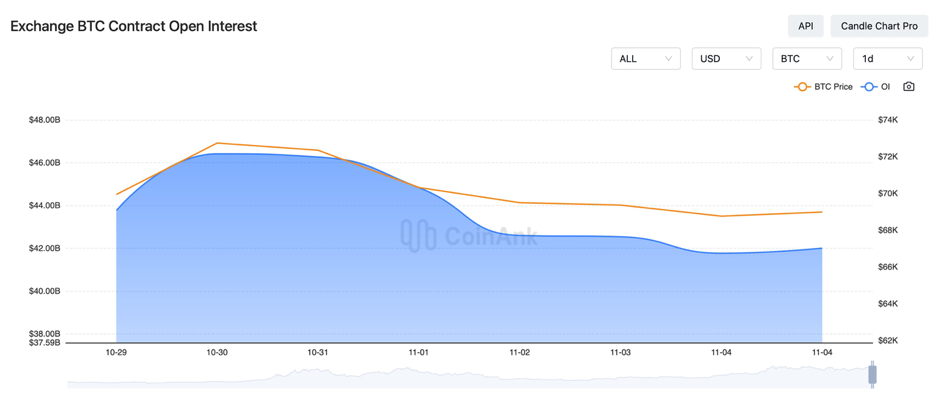

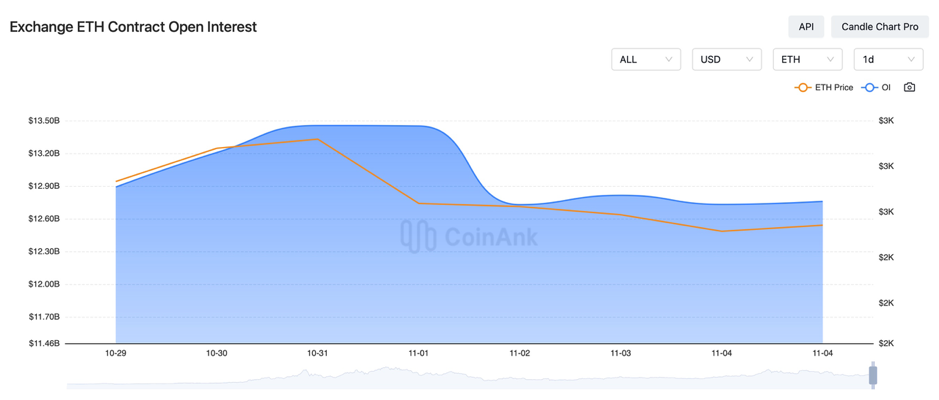

In the past four days, the open interest for BTC and ETH contracts has decreased.

Exchange BTC Contract Open Interest:

Exchange ETH Contract Open Interest:

Note: All the above information is provided for reference purposes only and should not be construed as specific investment advice.

5. Industry Roundup

1) On October 31, Moody’s modeling predicted Harris has a 55.5% chance of winning the election.

2) On October 31, YouTube influencer MrBeast was investigated for connections to over 50 potential insider trading-related crypto wallets, which collectively profited more than $23 million.

3) On October 31, investors transferred $34 billion in cryptocurrency to the UAE, which does not impose income tax, from June to date, an increase of nearly 42% compared to the same period last year.

4) On October 31, the U.S. Core PCE year-on-year rate was flat compared to last month, while the month-on-month Core PCE rose to its highest level since March.

5) On October 31, Canada’s GDP month-on-month for August was 0%, in line with expectations, while the previous value was revised from 0.2% to 0.1%.

6) On October 31, the Eurozone’s preliminary year-on-year CPI for October was 2%, expected at 1.9%, and the previous value was 1.7%. The month-on-month CPI for October was preliminarily 0.3%, expected at 0.2%, while the previous value was -0.1%. The unemployment rate in the Eurozone for September was 6.3%, expected at 6.4%, with the previous value revised from 6.4% to 6.3%.

7) On November 1, the U.S. Treasury reported concerns about the growth of stablecoins and recommended central bank digital currencies (CBDCs) to replace private stablecoins.

8) On November 1, the deputy governor of the Bank of England stated that the rapid development and application of generative AI could impact the financial system.

9) On November 1, the U.S. Treasury reported that blockchain technology will enhance financial market infrastructure. Florida’s CFO stated the state holds $800 million in crypto investments.

10) On November 1, the Bank of Japan maintained its policy rate at 0.25%, in line with market expectations, and largely kept price expectations unchanged.

11) On November 1, the founder of crypto market maker Gotbit was charged with market manipulation, facing up to 20 years in prison if convicted of telecom fraud.

12) On November 1, U.S. non-farm payrolls in October were virtually unchanged, with an increase of only 12,000 jobs, and the unemployment rate remained at 4.1%, marking the smallest increase since December 2020. The non-farm payroll figures for August and September were revised down by a total of 112,000 jobs.

13) On November 2, Fitch Ratings stated that the “real number” of non-farm employment in the U.S. for October could be an increase of 119,000. The yield on the 10-year U.S. Treasury rose to 4.341%, the highest level since July 5 of this year.

14) On November 2, a Thai man of Chinese descent was extorted by some Thai police officers during a false enforcement action, who demanded a settlement of 10 million USDT.

15) On November 2, cryptocurrency surpassed real estate to become the third most popular investment tool in Turkey. Italy plans to raise the capital gains tax on cryptocurrencies to 42%.

16) On November 2, Daylight Saving Time began in North America. The IRS stated that cryptocurrency rewards received before account freezing must be taxed in the year they are received.

17) On November 2, Trump stated that inflation is destroying the nation and pledged to mass deport illegal immigrants. Musk again endorsed DOGE, claiming it and Trump would solve the issue of illegal immigration in the U.S.

18) On November 3, the Blockchain Association reported that the U.S. digital asset industry has spent over $400 million to fight the SEC under Chairman Gensler’s leadership.

19) On November 3, UBS launched its first tokenized investment fund based on Ethereum. The Central Bank of Brazil is considering taxing remittances in stablecoins and may issue special licenses for trading platforms.

20) On November 3, Maria Shen, a partner at Electric Capital, released a global report on the distribution of cryptocurrency developers. The analysis of over 110,000 developer profiles revealed that Asia has surpassed North America in terms of the share of cryptocurrency developers.

21) On November 3, the Governor of the Central Bank of Russia stated that they are in the process of recovering frozen Russian assets. Recent agreements between North Korea and Russia indicate that dialogue will continue at multiple levels.

22) On November 3, the 12th meeting of the Standing Committee of the 14th National People’s Congress of China will be held in Beijing from November 4 to 8. On November 5, the U.S. will hold the 2024 presidential election. On November 7, the Bank of England will announce its interest rate decision and meeting minutes. On November 8, China will release the year-on-year M2 money supply for October. Canada will release October employment figures. The Federal Reserve will announce its interest rate decision, and Chairman Powell will hold a monetary policy press conference. On November 9, China will release the year-on-year CPI for October.

Disclaimer: FameEX makes no representations on the accuracy or suitability of any official statements made by the exchange regarding the data in this area or any related financial advice.