FameEX Weekly Market Trend | November 11, 2024

2024-11-11 09:56:20

1. BTC Market Trend

From November 7 to November 10, the BTC spot price swung from $74,226.95 to $81,371.99, a 9.63% range.

Summary of the latest Federal Reserve (Fed) FOMC statement and key points from Powell’s press conference

FOMC statement:

1) Rate Decision: Cut rates by 25 basis points to 4.50%-4.75%, marking the second consecutive rate cut.

2) Voting Ratio: The rate decision was unanimously approved with a 12-0 vote, compared to an 11-1 vote in September.

3) Inflation Outlook: Replaced the phrase “more confident” with “made progress”.

4) Employment Assessment: Adjusted from “slowing job growth” to “broad easing in labor market conditions”.

Powell’s press conference

1) Rate Outlook: Decisions will be data-driven, adjusting the pace of rate cuts according to economic conditions, with possible changes to targets. Rate hikes are not planned, but no possibilities are ruled out a year in advance. Prefers to avoid excessive forward guidance and may slow rate cuts as the neutral rate is approached. The election will not influence short-term policy.

2) Inflation Assessment: High inflation has eased significantly, though core inflation remains elevated. Confident inflation will gradually reach the 2% target. While previous inflation data exceeded expectations, the omission of “confidence” in the statement does not imply concerns over persistent inflation.

3) Economic Outlook: Unemployment remains low, and the labor market is robust, with data impacted by strikes and storms. Overall, economic performance remains strong.

4)Trump Victory: Powell stated that he would neither resign if Trump is re-elected nor step down voluntarily. No comments on fiscal policy, which is not factored into current models.

5) Market Reaction: Between the decision announcement and Powell’s speech, the dollar rose then fell, gold and silver followed the reverse trend, U.S. stocks held steady and rose, and the 2-year Treasury yield initially rose 3 basis points before leveling off.

6) Latest Expectations: CME data indicated a 70.5% probability of a 25 basis point rate cut in December and a 28.6% probability of holding rates steady, with more rate cut bets expected later.

Blueport Interactive founder Wang Feng expressed on X (formerly Twitter) that with the arrival of the Trump cryptocurrency era, the prices of infrastructure in the crypto world are poised for a revival. He emphasized that the great resurgence of crypto assets relies not only on memecoins and low-value coins but also on establishing infrastructure and protocol-level assets to build long-term consensus. Wang highlighted key areas driving market rebound:

Resonant rebound in Ethereum and DeFi sectors

Renewed momentum in the Bitcoin ecosystem

Concept assets combining AI

Emergence of leading projects in real-world asset (RWA) tokenization

He is convinced that growth in these areas is crucial for the future of the cryptocurrency market.

Spot On Chain summarized 11 promises Trump has made regarding Bitcoin and cryptocurrency:

· Dismiss SEC Chair Gary Gensler on his first day in office.

· Establish a “National Bitcoin Reserve”.

· Make the U.S. the “global Bitcoin and cryptocurrency capital”.

· Retain the U.S. government’s current holdings of 203,650 BTC ($14.95 billion).

· Eliminate capital gains tax on Bitcoin.

· Support Bitcoin mining in the U.S.

· End regulatory crackdown (the “anti-crypto movement”).

· Create a “Presidential Advisory Committee on Bitcoin and Cryptocurrency”.

· Protect individuals’ rights to self-custody digital assets.

· Reject the issuance of a Central Bank Digital Currency (CBDC).

· Commute the double life sentence of Silk Road founder Ross Ulbricht.

The sell order at $79,870 for the BTC spot has been executed. Previously, we recommended placing a buy order at $54,000, which has now gained 47.91% ((79,870 / 54,000) - 1). Even earlier, we suggested a buy order at $52,800, which has gained 51.27% ((79,870 / 52,800) - 1). Congratulations once again to our users who followed the recommended price levels and secured their profits!

From November 11 to November 13, continue to watch for trading opportunities in the ETH spot. Keep sell orders at $3,425 and $5,040, and buy orders for dips at $1,730 and $2,040. For the BTC spot, maintain sell orders at $96,820 and buy orders for dips at $36,720 and $45,900.

2. CMC 7D Statistics Indicators

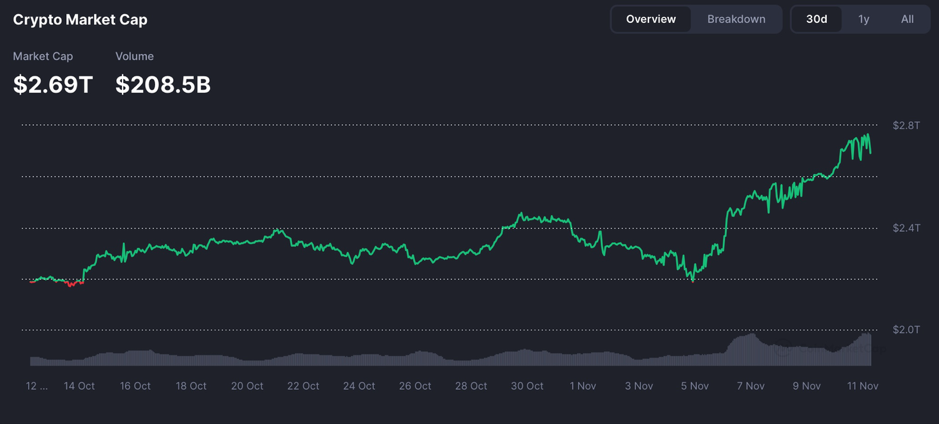

Overall market cap and volume, source: https://coinmarketcap.com/charts/

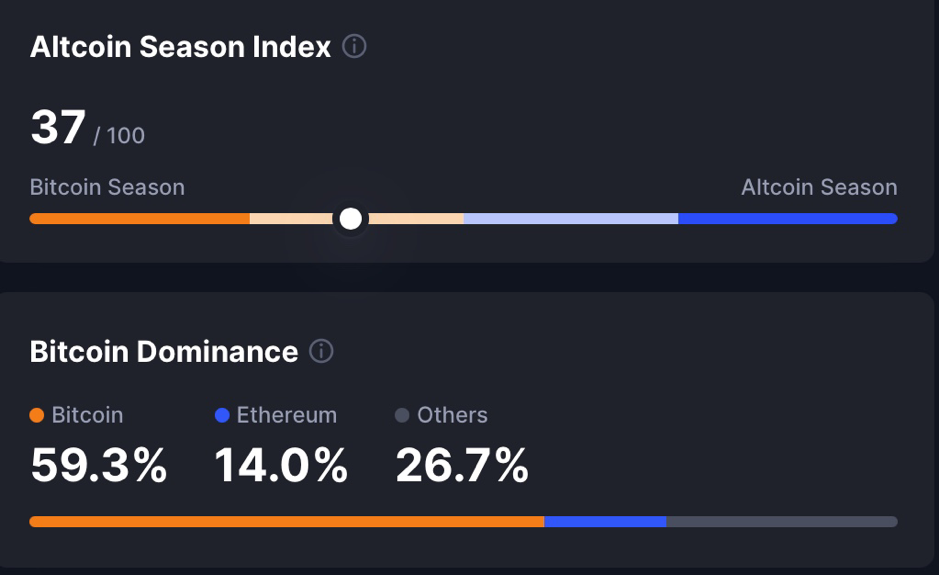

Altcoin Season Index and Bitcoin Dominance:https://coinmarketcap.com/charts/

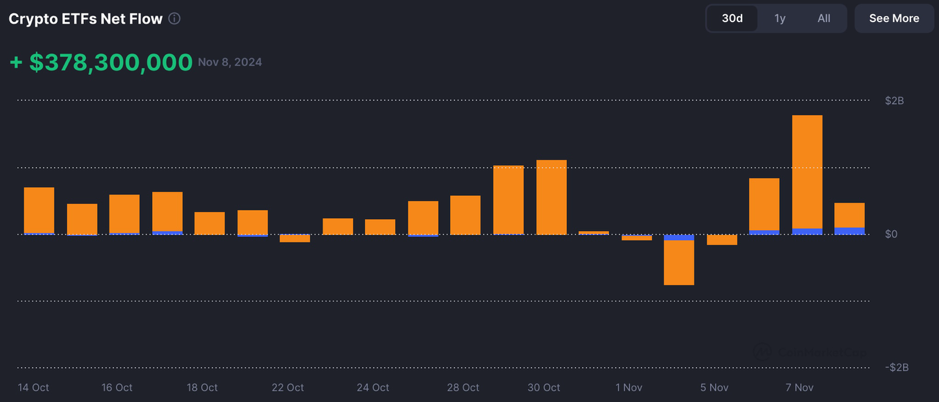

Crypto ETFs Net Flow: https://coinmarketcap.com/charts/

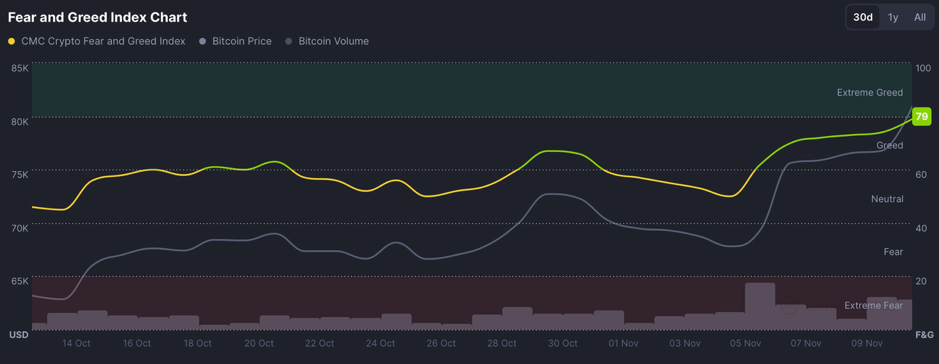

Fear & Greed Index, source: https://coinmarketcap.com/charts/

3. Perpetual Futures

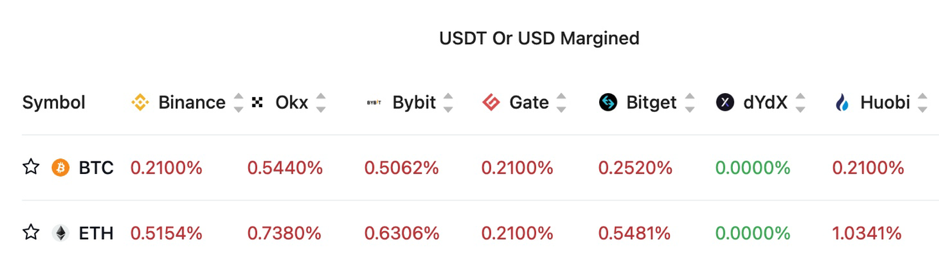

Funding fees for mainstream coins on major exchanges have generally remained positive over the past 7 days.

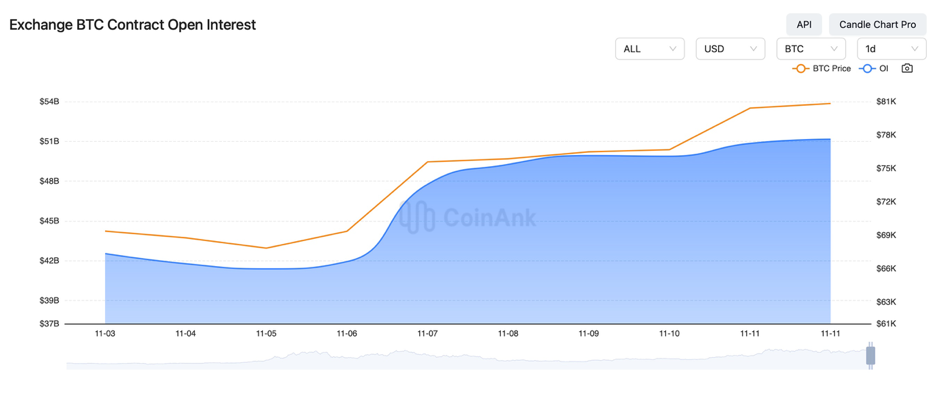

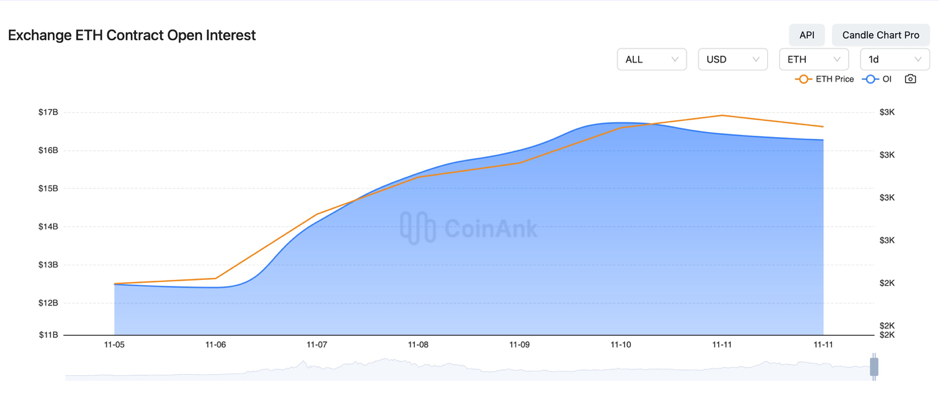

In the past four days, both BTC and ETH contract open interest have been significantly increasing, with the market consensus widely expecting that the bull market is entering its second half.

Exchange BTC Contract Open Interest:

Exchange ETH Contract Open Interest:

Note: All the above information is provided for reference purposes only and should not be construed as specific investment advice.

4. Industry Roundup

1) On November 7, Shan Hanes, former CEO of Heartland Tri-State Bank, was sentenced to 293 months for embezzling $47 million in a “pig butchering” scam.

2) On November 7, Wall Street investment bankers met with cryptocurrency executives, seeking IPO opportunities for crypto companies after the election.

3) On November 7, U.S. Justice Department officials began evaluating how to end two federal criminal cases against Trump before his inauguration, in line with the policy that a sitting president cannot be prosecuted.

4) On November 7, a dormant Ethereum whale address, inactive for over 8 years, started selling over 11,000 ETH. Tether minted $2 billion USDT on Ethereum.

5) On November 7, U.S. weekly jobless claims were recorded at 221,000, in line with expectations, with the previous figure revised to 218,000 from 216,000.

6) On November 7, as of this date, according to Stand With Crypto Alliance, 281 pro-crypto candidates have secured seats in the U.S. Congress. 263 were elected as Representatives, and 18 as Senators.

7) On November 8, Canada’s October employment data showed 14,500 new jobs, below the expected 25,000, and a revision from the previous figure of 46,700.

8) On November 8, the Fed’s balance sheet fell below $7 trillion, the first time since 2020, with a $2 trillion reduction. Musk supported Trump’s intervention with the Fed.

9) On November 8, multiple Middle Eastern countries followed the Fed’s rate cuts. Hong Kong’s monetary authority lowered rates by 25 basis points and approved the first Bitcoin and crypto structured product license.

10) On November 8, the Bank of England cut rates by 25 basis points to 4.75%, in line with market expectations. Governor Bailey stated that rate cuts should not be made too quickly or excessively. Additionally, the House of Lords supported the Digital Assets Property Bill.

11) On November 8, it was reported that Detroit become the largest U.S. city to accept cryptocurrency for taxes and fees.

12) On November 8, Chinese authorities dismantled a major underground money laundering network involving virtual currencies, with an estimated value of 38 billion RMB.

13) On November 9, Ethereum broke the $3,000 mark for the first time since August 3. The Ethereum Foundation reported $970 million in reserves for 2024.

14) On November 9, China’s October CPI year-on-year was 0.3%, below the expected 0.4%, and the previous value was 0.4%.

15) On November 9, the U.S. Justice Department accused Iran of plotting to murder Trump before the election. Trump planned to impose stricter sanctions on Iran and curb its oil sales.

16) On November 9, CoinShares stated that Trump’s most favorable impact on crypto would come from a Bitcoin bill.

17) On November 9, President Biden had a conversation with Trump and assured him that the government would collaborate with Trump’s team. Russian President Putin noted that Trump’s desire to restore relations with Russia and promote an end to the Ukraine crisis is worth attention. U.S. media reported that Elon Musk participated in a call between Trump and Zelensky, possibly hinting at his future important role. Putin signed legal documents to approve the Comprehensive Strategic Partnership Treaty previously signed with North Korea.

18) On November 9, Bitcoin Magazine CEO stated the current Bitcoin bull market cycle might last 3 to 4 years.

19) On November 10, California revoked the lending license of the bankrupt crypto lending platform BlockFi.

20) On November 10, BlackRock was negotiating to acquire a minority stake in hedge fund Millennium. In just 10 months, its Bitcoin ETF assets have exceeded its Gold ETF. UBS launched its blockchain payment system “UBS Digital Cash”.

21) On November 10, Dune Analytics launched a new dashboard revealing over 5,500 blockchain crime events.

22) On November 10, Bitcoin surpassed $80,000, and Ethereum broke $3,200. The global cryptocurrency market capitalization surpassed $2.8 trillion.

23) On November 10, next Monday, China will release its October M2 money supply year-on-year, Japan’s central bank will publish the summary of opinions from its October monetary policy meeting, and Japan will hold a special Diet session for the Prime Minister’s nomination election. On Wednesday, the U.S. will release its October CPI data.

24) On November 10, next Thursday, the U.S. will release initial jobless claims for the week and October PPI data. Fed officials including Musalem, Schmidt, Barkin, and Kugler will deliver speeches. On Friday, Fed Chair Powell and Vice Chair Williams will speak, along with Bank of England Governor Bailey. Additionally, China’s State Council Information Office will hold a press conference on national economic performance.

25) On November 10, several tokens, including APT, ENA, STRK, CKB, ADA, ARB, PRIME, APE, and AVAX, will unlock next week.

Disclaimer: FameEX makes no representations on the accuracy or suitability of any official statements made by the exchange regarding the data in this area or any related financial advice.