FameEX Weekly Market Trend | November 14, 2024

2024-11-14 10:56:40

1. BTC Market Trend

From November 11 to November 13, the BTC spot price swung from $84,779.88 to $93,271.42, a 10.02% range.

The key recent statements from the Federal Reserve (Fed) and the European Central Bank (ECB) over the past three days are as follows:

1) On November 13, Fed’s Perli stated that strong evidence still suggests that reserve levels remain adequate.

2) On November 13, Fed Governor Waller indicated that stablecoins could bring benefits to the financial system but must be regulated to address the risk of a run.

3) On November 13, Fed’s Kashkari pointed out that there are no clear signs of rising inflation risks at the moment. The bigger risk is that the economy could fall into stagnation. If inflation unexpectedly rises before December, it could cause the Fed to pause rate cuts.

4) On November 13, Fed’s Logan indicated that the Fed is “very likely” to need further rate cuts, but should “proceed with caution”.

5) On November 13, Fed’s Barkin believed that the Fed is prepared to respond if inflation pressures rise or the job market weakens.

6) On November 13, the New York Federal Reserve Survey displayed that U.S. consumers’ one-year inflation expectations dropped to the lowest level in four years in October.

7) On November 11, ECB Governing Council Member Holzmann said there was no reason not to cut rates in December.

8) On November 11, ECB Governing Council Member Stournaras indicated that interest rates might be lowered to around 2% by September next year.

Confirmed list of key government officials nominated for Trump’s second term:

1. Pete Hegseth, a retired Army veteran, will serve as U.S. Secretary of Defense. He has hosted a program on Fox News for 8 years.

2) Elon Musk, the world’s wealthiest person, will lead the proposed Department of Government Efficiency (DOGE), tasked with “dismantling bureaucratic agencies, reducing excessive regulations, cutting wasteful spending, and restructuring federal agencies”.

3) John Ratcliffe will be appointed CIA Director. He is a former U.S. Director of National Intelligence.

4) Lee Zeldin will head the U.S. Environmental Protection Agency (EPA).

5) Kristi Noem will be nominated as Secretary of the Department of Homeland Security.

6) Susan Wills will become the White House Chief of Staff.

7) Tom Homan will be appointed “Border Czar”, responsible for managing border affairs.

8) Mike Waltz will serve as White House National Security Advisor.

9) William Joseph McKinley will be appointed White House Counsel.

10) Alice Stephanie will become the U.S. Ambassador to the United Nations.

11) Mike Huckabee will serve as the U.S. Ambassador to Israel.

The sell order at $3,425 for the ETH spot has been executed. The buy order we previously recommended at $2500 has already made a profit of 37% (3425/2500 - 1 = 37%). Congratulations again to those who placed orders at the suggested price levels. It's time to take your profits!

From November 14 to November 17, it is recommended to adjust the pending order prices:

1) Remove part of the sell orders for the BTC spot at $96,820, and place them at $102,980 and $169,400.

2) Completely cancel the buy orders for the BTC spot at $36,720 and place new ones at $73,970 and $59,935.

3) For the ETH spot, remove part of the sell orders at $5,040 and place them at $7,840 and $8,510.

4) Additionally, consider increasing the position allocation in altcoin spots.

2. CMC 7D Statistics Indicators

Overall market cap and volume, source: https://coinmarketcap.com/charts/

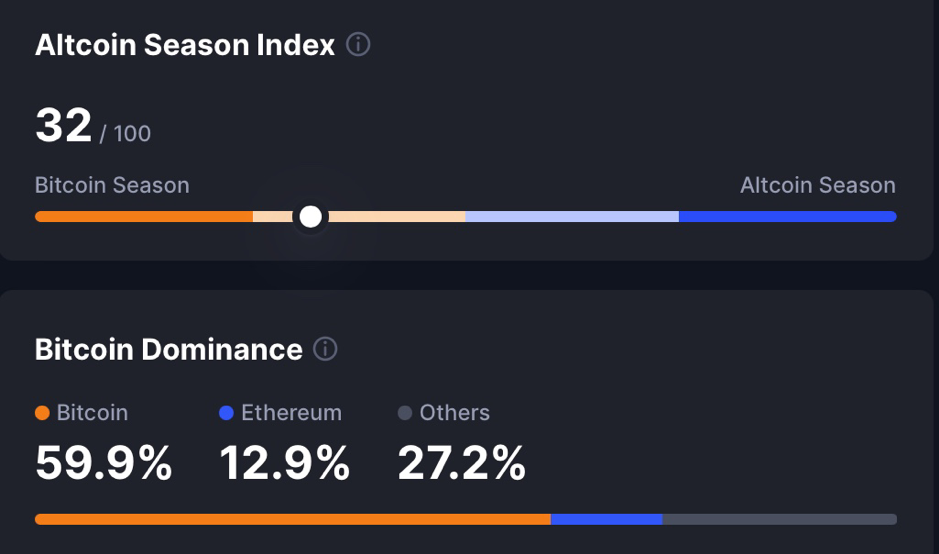

Altcoin Season Index and Bitcoin Dominance: https://coinmarketcap.com/charts/

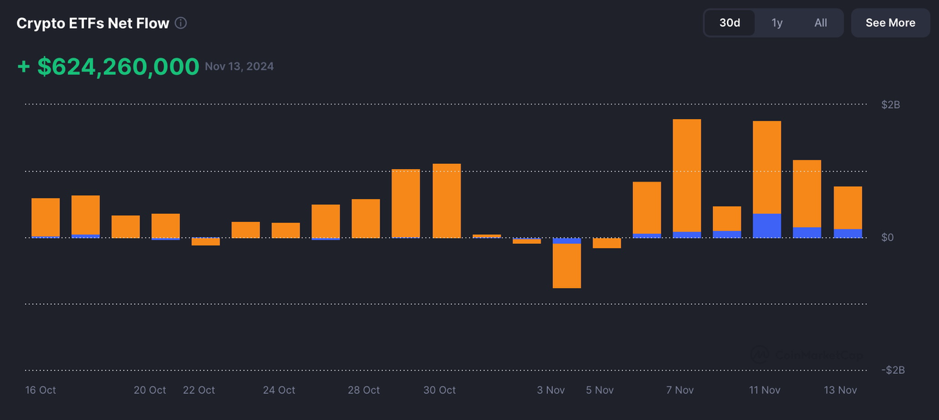

Crypto ETFs Net Flow: https://coinmarketcap.com/charts/

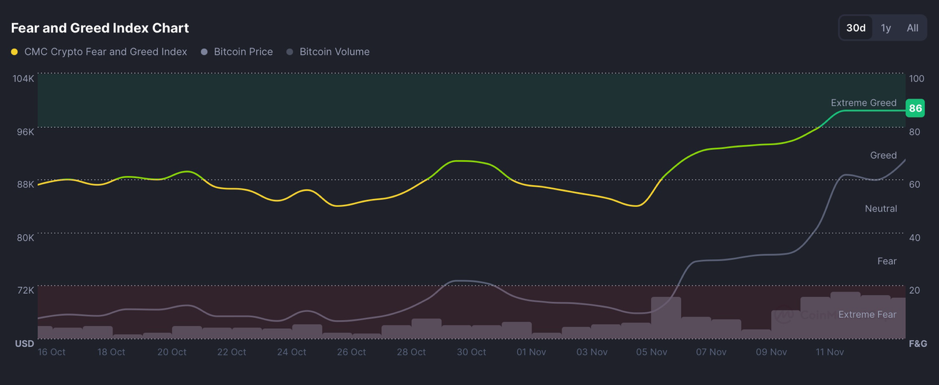

Fear & Greed Index, source: https://coinmarketcap.com/charts/

3. Perpetual Futures

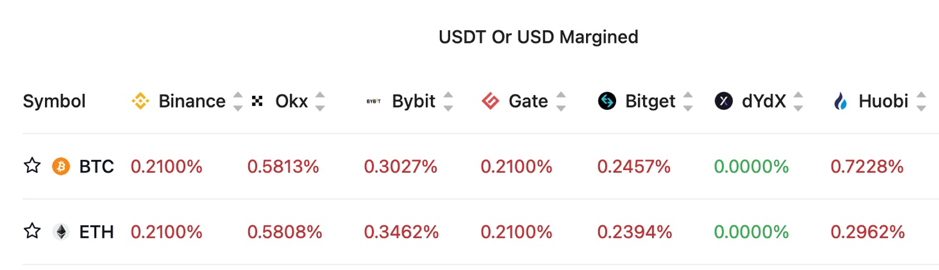

Funding fees for mainstream coins on major exchanges have generally remained positive over the past 7 days.

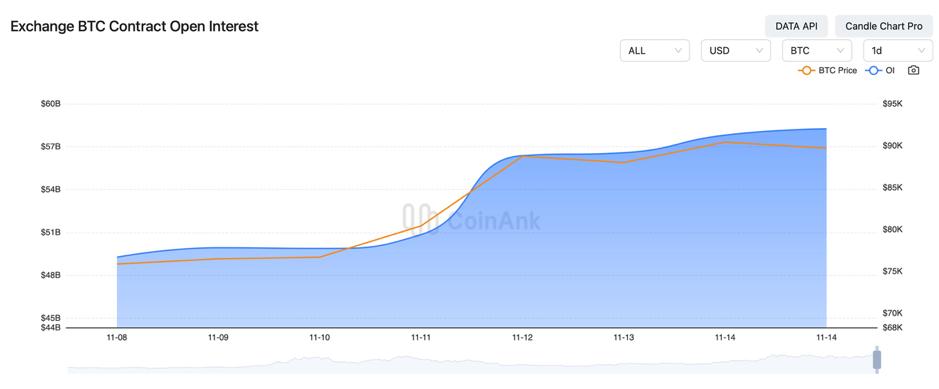

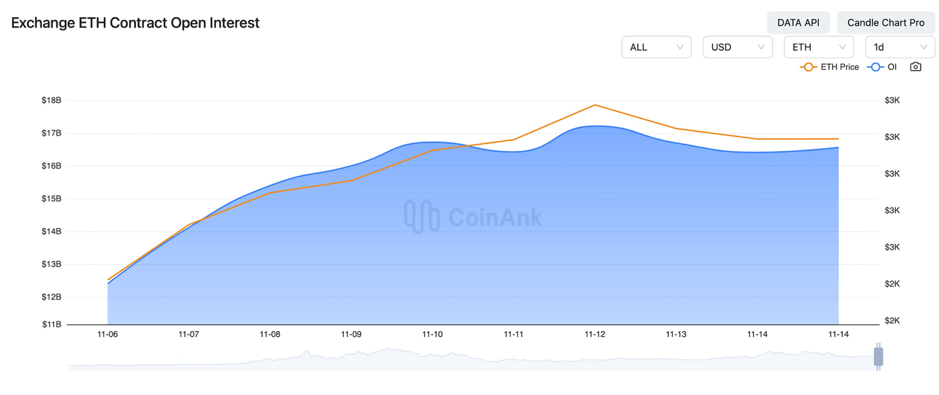

In the past three days, the BTC contract open interest has significantly increased, while the ETH contract open interest has experienced a slight decline.

Exchange BTC Contract Open Interest:

Exchange ETH Contract Open Interest:

Note: All the above information is provided for reference purposes only and should not be construed as specific investment advice.

4. Industry Roundup

1) On November 11, according to a Forbes reporter, in the 32 states with Senate elections, only 8 Senate candidates have higher approval ratings than Trump.

2) On November 11, top trader Eugene stated, “The breakout of DOGE means the market cap ceiling of all other memecoins will rise proportionally. The previous $1 billion valuation was the ceiling, but now it’s just the starting point.”

3) On November 11, JPMorgan stated that the Fed is expected to end quantitative tightening in Q1 2025, rather than by the end of 2024.

4) On November 11, Russian President Putin proposed establishing a digital asset platform within the BRICS alliance.

5) On November 11, it was reported that Iran’s banking payment system would officially connect with Russia’s banking payment system.

6) On November 1, Bitcoin futures basis yield surged to a seven-month high.

7) On November 12, the UK ILO unemployment rate for the three months to September was 4.3%, expected 4.1%, prior value 4%.

8) On November 12, UK October unemployment claims were 26,700, with the previous value revised from 27,900 to 10,100. The UK October unemployment rate was 4.73%, previous value 4.71%.

9) On November 12, Trump planned to push for the U.S. government to ease cryptocurrency regulations, scouting crypto-friendly candidates for key positions.

10) On November 12, the global cryptocurrency market cap hit an all-time high, surpassing $3 trillion for the first time in three years.

11) On November 12, FTX sued Binance and its former CEO, Changpeng Zhao (CZ), seeking to recover $1.8 billion.

12) On November 13, a user’s mistake locked $25 million worth of crypto assets permanently, urgently seeking hacker assistance for recovery.

13) On November 13, Trump announced Musk’s new government position, causing Dogecoin to skyrocket.

14) On November 13, China and Russia hold strategic security consultations.

15) On November 13, Bitcoin broke the $90,000 mark for the first time, doubling in price within the year.

16) November 13: U.S. October seasonally adjusted CPI monthly rate was 0.2%, in line with expectations and the prior value. The unadjusted core CPI annual rate for October was 3.3%, matching forecasts and the previous value.

17) November 13: U.S. October seasonally adjusted core CPI monthly rate was 0.3%, as expected, the same as the prior value. The unadjusted CPI annual rate for October was 2.6%, in line with expectations, up from 2.4% previously.

Disclaimer: FameEX makes no representations on the accuracy or suitability of any official statements made by the exchange regarding the data in this area or any related financial advice.