FameEX Weekly Market Trend | December 2, 2024

2024-12-02 10:34:20

1. BTC Market Trend

From November 28 to December 1, the BTC spot price swung from $94,751.98 to $98,299.62, a 3.74% range. The key recent statements from the European Central Bank (ECB) over the past four days are as follows:

1) On November 28, ECB Executive Board Member Schnabel indicated that the room for further interest rate cuts is limited.

2) On November 28, ECB President Lagarde said that trade negotiations with the U.S. are preferable to retaliation; a trade war should be avoided.

3) On November 29, ECB Governing Council Member Villeroy stated that there are sufficient reasons for a rate cut in December, and the possibility of rates falling below neutral levels in the future cannot be ruled out. The inflation target may be achieved by early 2025.

Timeline of Bitcoin‘s Milestones from 2009 to Present:

1) End of 2009: The New Liberty Standard Exchange first enabled the exchange of Bitcoin for USD, at a rate of approximately one-tenth of a cent per Bitcoin.

2) May 22, 2010: The first real-world purchase made with Bitcoin: U.S. programmer Laszlo Hanyecz used 10,000 BTC (worth less than $40) to buy two large pizzas (worth $25).

3) In Early 2011, Bitcoin surpassed $0.4 for the first time, and by February 9, it broke $1. By June, it reached its highest point of the year, nearly $30, closing the year at $4.70.

4) In 2012, Bitcoin consolidated and slowly strengthened. In November, it experienced its first “halving” (occurring approximately every four years), and closed the year at $13.50.

5) In 2013, the world’s first Bitcoin ATM was launched in Vancouver. In early April, Bitcoin surpassed $100, and on November 28, it crossed $1,000 for the first time, peaking over $1,200 before closing the year at $805.

6) In 2014, after reaching $1,000 in January, Bitcoin plummeted to $111.60 on February 21, a nearly 90% drop, due to the Mt. Gox exchange hack. It closed the year at around $318.

7) 2017: Bitcoin’s breakthrough year. It surpassed $5,000, $6,000, and $10,000 (on November 28) and peaked at $19,000 in mid-December. Bitcoin futures began trading on the Chicago Board Options Exchange (CBOE), closing the year at $13,850.

8) In 2018, Bitcoin was on a downtrend, closing at $3,709, a 73% decline for the year. In 2019, after a rise, Bitcoin retraced, closing below $7,200.

9) 2020: Early in the COVID-19 pandemic, Bitcoin fell but later surged to nearly $20,000 in November, closing at $28,949 due to liquidity injections from the Federal Reserve (Fed) and the potential vaccine rollout.

10) In 2021, Bitcoin’s price surged, surpassing $30,000, $40,000, $50,000, and $60,000, peaking over $64,000 in mid-April. In June, El Salvador’s president proposed Bitcoin as the country’s legal tender. By the end of the year, the Fe announced plans to begin reducing its bond-buying program, leading to a downturn in Bitcoin’s price.

11) In March 2022, the Fed began raising interest rates, and Bitcoin fell in response. However, with expectations of interest rates peaking in October 2023 and rumors that the SEC would approve a Bitcoin spot ETF, Bitcoin began to rise again, closing over $42,000.

12) In January 2024, Bitcoin’s spot ETF was approved, leading to a surge in funds and a new all-time high of over $73,000 in March. In November, following Donald Trump’s re-election as U.S. President, Bitcoin surpassed $90,000, briefly approaching $100,000.

According to Cryptorank, Grayscale’s cryptocurrency holdings saw an 85% increase in market value over the past month. This growth was mainly driven by the token XLM, which surged over 469%, while XRP rose by over 262% in the same period. MANA ranked third in growth. Historically, XRP has shown significant growth approximately 228 days after Bitcoin's halving.

From December 2 to December 5, continue monitoring trading opportunities for ETH spot orders. Focus on sell orders placed at $8,510, $7,840, and $5,040, as well as buy-the-dip orders at $2,040 and $1,730. For the BTC spot, maintain sell orders at $169,400, $102,980, and $96,820, along with buy-the-dip orders at $73,970, $59,935, and $45,900. Additionally, congratulations to the users who placed sell orders for Bitcoin at $96,820, securing their profits once again! It is still recommended that exposure to altcoins in the spot market be increased.

2. CMC 7D Statistics Indicators

Overall market cap and volume, source: https://coinmarketcap.com/charts/

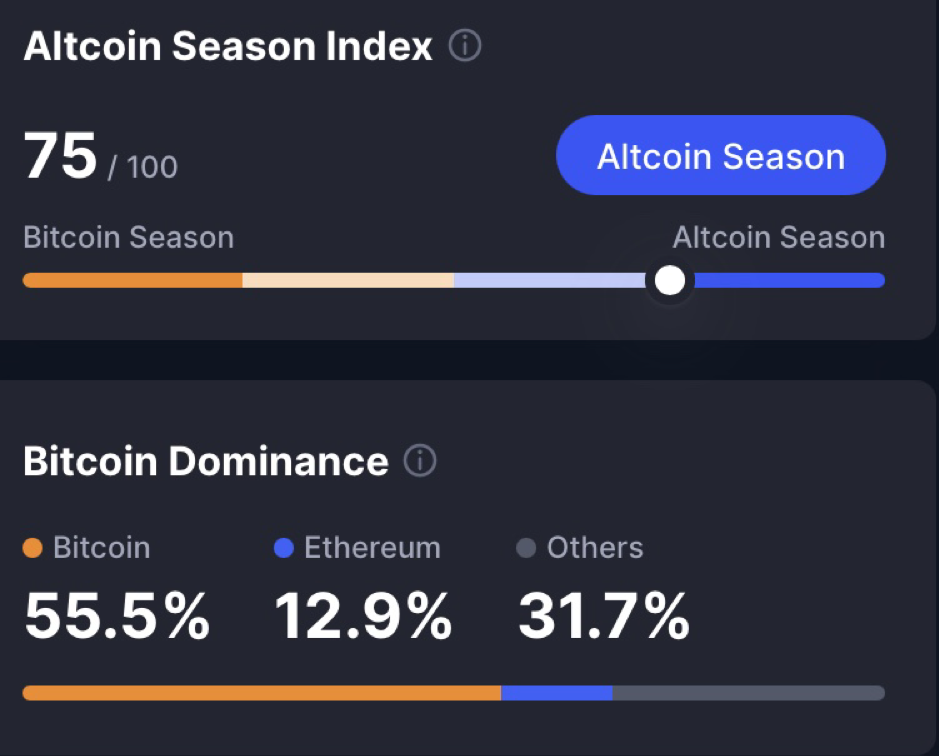

Altcoin Season Index and Bitcoin Dominance: https://coinmarketcap.com/charts/

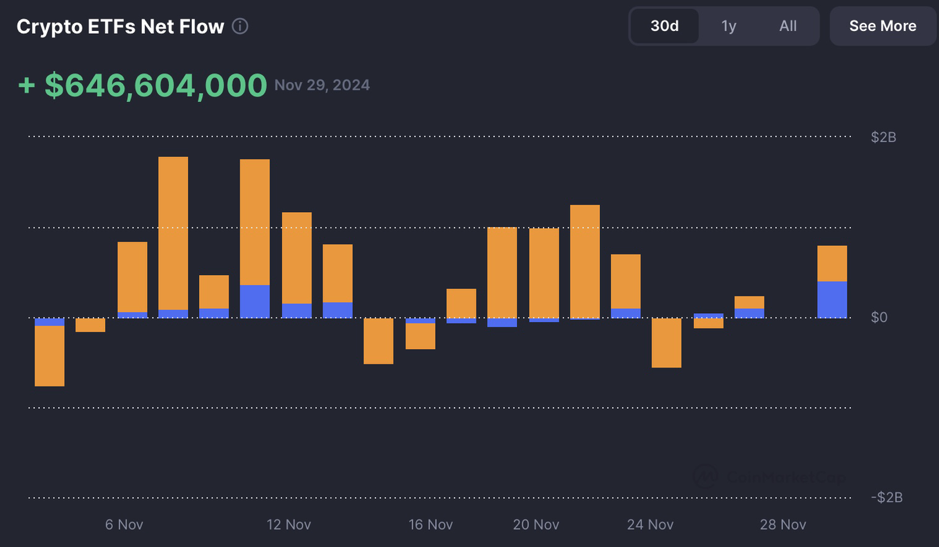

Crypto ETFs Net Flow: https://coinmarketcap.com/charts/

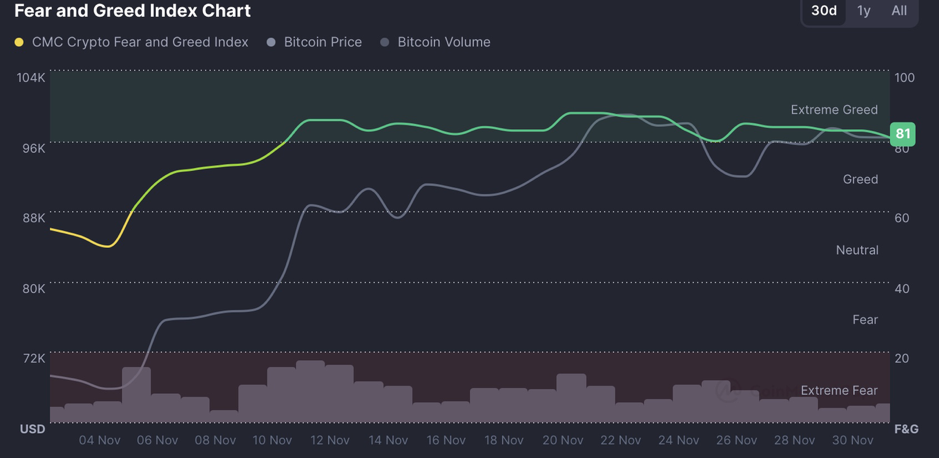

Fear & Greed Index, source:https://coinmarketcap.com/charts/

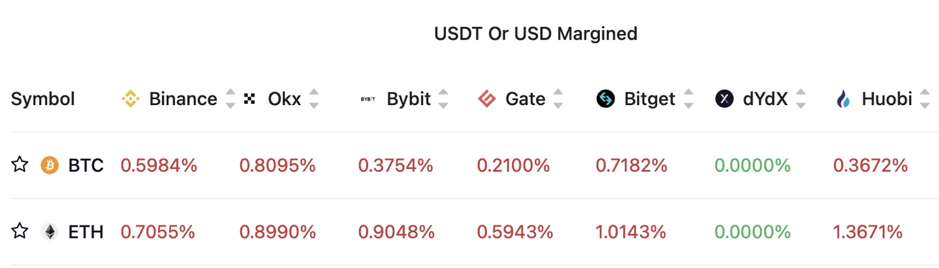

3. Perpetual Futures

Funding fees for mainstream coins on major exchanges have generally remained positive over the past 7 days.

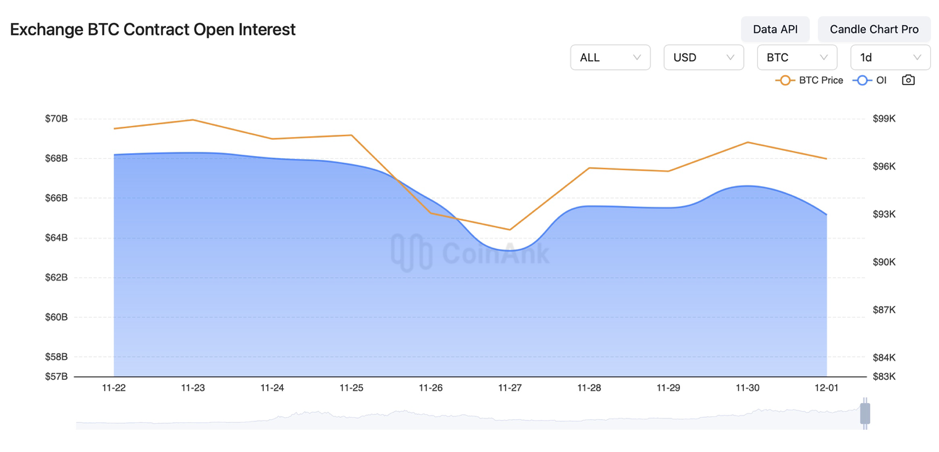

In the past four days, the Bitcoin contract open interest has slightly increased, while the Ethereum contract open interest has remained relatively stable.

Exchange BTC Contract Open Interest:

Exchange ETH Contract Open Interest:

Note: All the above information is provided for reference purposes only and should not be construed as specific investment advice.

4. Industry Roundup

1) On November 28, the U.S. SEC approved the first exchange to allow 5X 23-hour trading.

2) On November 28, the U.S. October Core PCE Price Index rose 2.8% year-on-year, marking the largest increase since April 2024.

3) On November 28, Trump’s new government nominees were announced, with over five being “crypto enthusiasts”. Cryptocurrency supporter Atkins became a leading candidate for SEC Chairman.

4) On November 28, the U.S. Treasury Report indicated that low-income households are using cryptocurrency earnings to apply for mortgage loans to purchase homes. Vancouver’s mayor planned to launch a “Bitcoin-Friendly City” initiative. The UK’s FCA reported that 12% of British adults own cryptocurrency.

5) On November 28, Japan’s October unemployment rate was 2.5%, as expected, compared to 2.4% in the previous month.

6) On November 29, the U.S. Bitcoin Spot ETF saw net inflows of $6.2 billion in November, setting a new monthly record.

7) On November 29, Elon Musk announced plans to establish an AI gaming studio, stating: “Let’s make gaming great again”.

8) On November 29, Japanese Prime Minister Ishiba Shigeru said that 30 years ago, Japan’s GDP accounted for 18% of global GDP; by 2023, this had dropped to 4%.

9) On November 29, UK Prime Minister Starmer pledged to quickly introduce a plan to reduce immigration.

10) On November 29, the Eurozone’s November CPI year-on-year initial estimate was 2.3%, in line with expectations, up from 2.0% the previous month. The month-on-month CPI initial estimate for November was -0.3%, slightly below the expected -0.2%, compared to a 0.3% increase in the prior month.

11) On November 29, Canada’s September GDP growth was 0.1%, below the expected 0.3%.

12) On November 30, Ukrainian President Zelenskyy expressed readiness to end the conflict in exchange for NATO membership, even if Russia does not immediately return the territory it controls. The Ukrainian Ministry of Foreign Affairs is in discussions with Western allies about lowering the conscription age to 18. Meanwhile, President Putin stated that Russia is open to dialogue with the U.S.

13) On November 30, Ethereum broke $3,700, reaching its highest level since June 10 this year.

14) On November 30, South Korea’s FSC Chairman indicated that strong measures would be taken to prevent virtual assets from becoming loopholes in the anti-money laundering system.

15) On November 30, 16 listed crypto mining companies spent $3.6 billion on plant, property, and equipment upgrades this year.

16) On November 30, according to Cointelegraph, XRP’s price surged 232% in the past 30 days, with on-chain indicators showing a strong recovery.

17) On November 30, it was said that only 0.01% of listed companies globally hold Bitcoin, indicating that the market is still in an “elite experimental phase”.

18) On December 1, China’s Ministry of Defense stated that the China-Russia joint aerial strategic patrols are routine and unrelated to the current international and regional situation.

19) On December 1, next Wednesday, the U.S. will release the November ADP Employment Report; next Thursday, Fed Chairman Powell will be interviewed at the DealBook Summit hosted by The New York Times.

20) On December 1, next Friday, Canada will release its November employment data, along with the U.S. November unemployment rate and seasonally adjusted non-farm payrolls. On Saturday, China will release its November Foreign Exchange Reserve data.

21) On December 1, cryptocurrency hackers stole $71 million in November, bringing the total for the year to $1.48 billion.

22) On December 1, Hong Kong lawmakers passed a proposal allowing retail investors to participate in more types and cryptocurrencies of virtual asset trading.

Disclaimer: FameEX makes no representations on the accuracy or suitability of any official statements made by the exchange regarding the data in this area or any related financial advice.