FameEX Weekly Market Trend | December 5, 2024

2024-12-05 10:03:00

1. BTC Market Trend

From December 2 to December 4, the BTC spot price swung from $93,443.18 to $98,922.68, a 5.86% range.

The key recent statements from the Federal Reserve (Fed) and the European Central Bank (ECB) over the past three days are as follows:

1) On December 3, Waller (hawkish) favored a December rate cut, while Williams expected more cuts ahead.

2) On December 4, Daly indicated that a December rate cut is possible but not certain, advocating for an open approach to timing. The neutral rate is closer to 3%. Goolsbee predicted significant cuts next year. Cookler expected a rebound in Friday’s jobs report after last month’s data was affected by storms and strikes. Mousalem warned that easing too much or too quickly poses greater risks than easing too little, suggesting a potential pause on rate cuts in December or later.

3) On December 3, ECB Governing Member Rehn argued there is justification for further rate cuts this month.

4) On December 4, Holzmann indicated a potential 25-basis-point rate cut in December. President Lagarde emphasized no pre-commitment to a specific rate path and stated it is too early to discuss the optimal balance sheet size. Vujcic suggested that small rate hikes are more appropriate in uncertain circumstances.

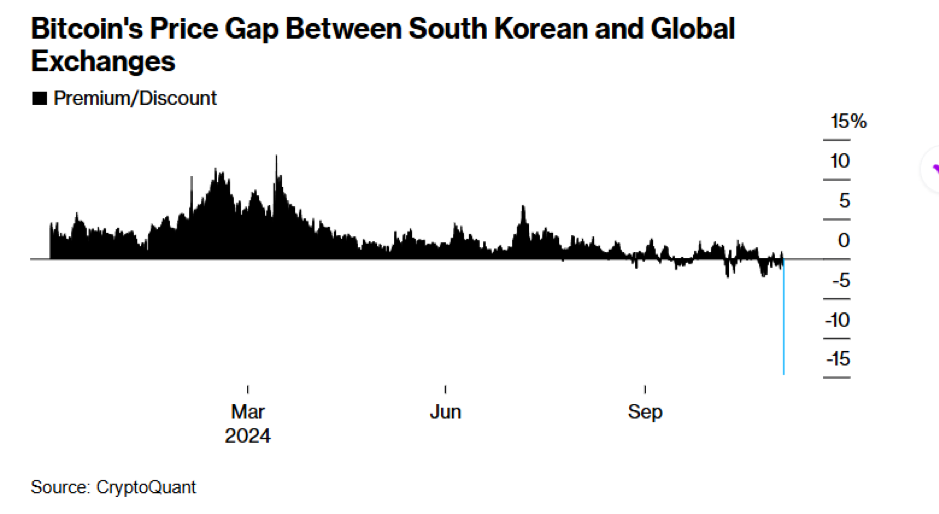

On December 3, following South Korean President Yoon Suk-yeol’s declaration of martial law amid a parliamentary political deadlock, cryptocurrency prices on South Korean exchanges experienced sharp volatility.

Most major digital assets saw price drops that day, with Bitcoin—a key market indicator—swinging significantly. Notably, digital assets on South Korean exchanges faced even steeper declines compared to global averages, exacerbated by traders leveraging the “Kimchi Premium” for long-term arbitrage. On December 3, Bitcoin prices on South Korean exchanges, paired with the stablecoin Tether (USDT), plunged as low as $62,182 at one point, with multiple exchanges experiencing service disruptions. Meanwhile, the global average price of Bitcoin hovered around $93,600. Reports suggest substantial capital flowed into South Korean exchanges for bargain buying during this period.

Note: The “Kimchi Premium” refers to the price difference of Bitcoin between global exchanges and South Korean exchanges.

“Kimchi Premium” in Bitcoin

Later, Yoon Suk-yeol announced that he would lift the state of emergency.

From December 5 to December 8, continue monitoring trading opportunities for ETH spot orders. Focus on sell orders placed at $8,510, $7,840, and $5,040, as well as buy-the-dip orders at $2,040 and $1,730. For the BTC spot, maintain sell orders at $169,400, along with buy-the-dip orders at $73,970, $59,935, and $45,900. Additionally, congratulations to the users who placed sell orders for Bitcoin at $102,980, securing their profits once again! It is still recommended that exposure to altcoins in the spot market be increased.

2. CMC 7D Statistics Indicators

Overall market cap and volume, source: https://coinmarketcap.com/charts/

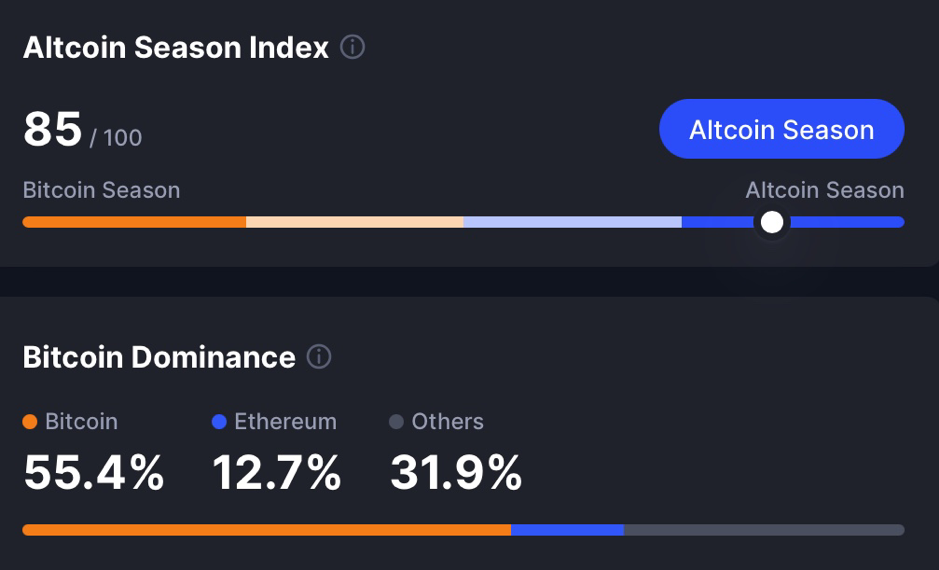

Altcoin Season Index and Bitcoin Dominance: https://coinmarketcap.com/charts/

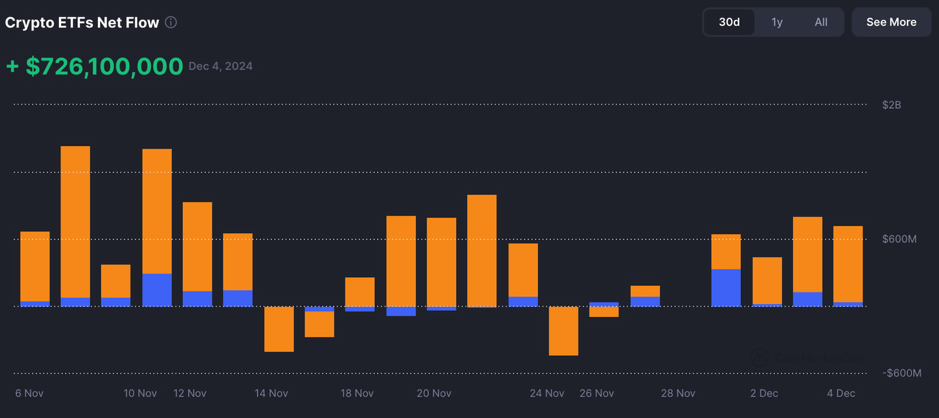

Crypto ETFs Net Flow: https://coinmarketcap.com/charts/

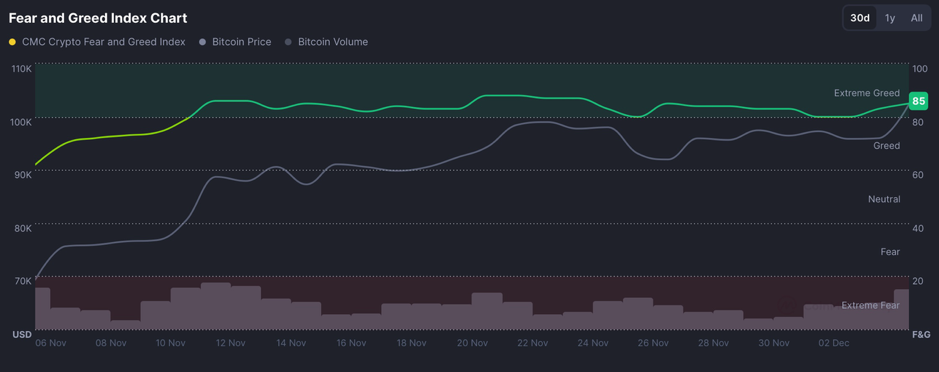

Fear & Greed Index, source: https://coinmarketcap.com/charts/

3. Perpetual Futures

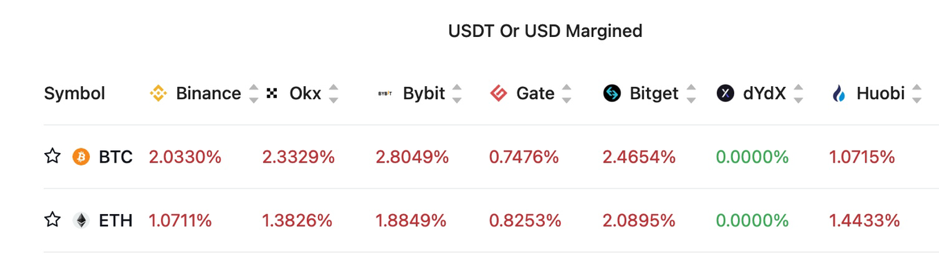

Funding fees for mainstream coins on major exchanges have generally remained positive over the past 7 days.

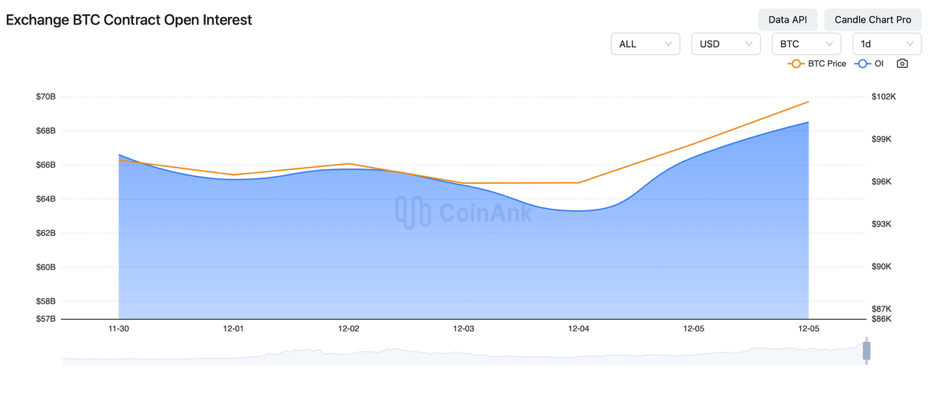

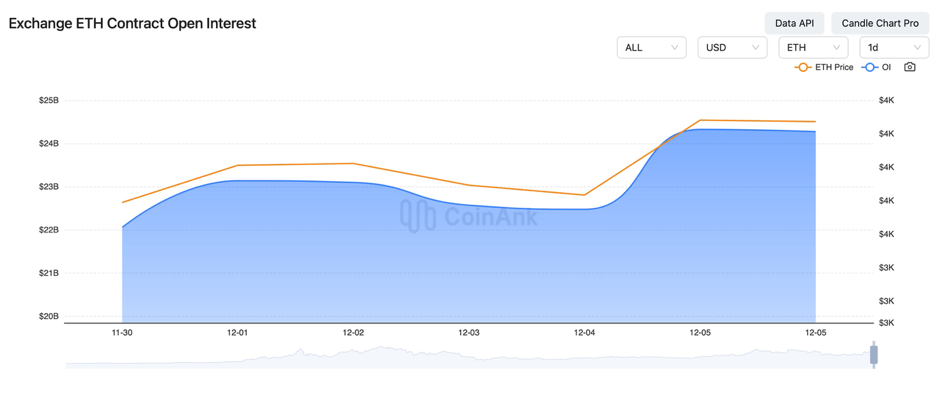

In the past three days, the open interest in BTC and ETH contracts has slowly decreased.

Exchange BTC Contract Open Interest:

Exchange ETH Contract Open Interest:

Note: All the above information is provided for reference purposes only and should not be construed as specific investment advice.

4. Industry Roundup

1) On December 2, Ethereum returned to the top 30 in the global asset market capitalization. XRP surpassed USDT and Solana, ranking third in cryptocurrency market capitalization.

2) On December 2, the ECB advanced its digital euro offline payment plan.

3) On December 2, Foundry, the world’s largest Bitcoin mining pool operator, laid off 27% of its staff.

4) On December 2, a dormant address containing 2,700 BTC, after 11 years of inactivity, was reactivated, now valued at $254 million.

5) On December 2, digital payment provider dtcpay announced that from 2025, it will focus on stablecoin payments and gradually stop BTC and ETH services.

6) On December 2, South Korea expanded its investigation into cryptocurrency price manipulation to include individual investors. It will delay the 20% cryptocurrency tax for the third time. Starting next year, South Korea will allow universities and local governments to open cryptocurrency accounts and gradually ease corporate trading restrictions.

7) On December 3, South Korea’s political disputes escalated, and President Yoon Suk-yeol declared “emergency martial law” late at night, the first since 1980. He stated that the government paralysis was due to the opposition party’s actions. South Korean assets plunged, and the KRW/USD exchange rate dropped to a two-year low.

8) On December 3, Israeli Defense Minister Katz stated that if the ceasefire agreement breaks down, Israel will no longer differentiate between Lebanon and Hezbollah.

9) On December 3, four asset management companies filed applications with the US SEC to launch Bitcoin ETFs with different protection levels.

10) On December 3, Cambodia blocked 16 cryptocurrency trading websites, including Binance and Coinbase.

11) On December 3, Bitcoin mining difficulty increased by 1.59% to 103.92T, setting a new historical high.

12) On December 3, Satoshi Act Fund co-founder stated that 10 US states are considering introducing “strategic Bitcoin reserve” legislation.

13) On December 3, CryptoQuant reported that Bitcoin exchange reserves have dropped to their lowest levels in years.

14) On December 3, the Trump administration may allow more crypto companies to go public via IPOs.

15) On December 4, according to Yonhap News Agency, six opposition parties in South Korea jointly filed for the impeachment of President Yoon Suk-yeol at 2:40 PM local time.

16) On December 4, the Iranian Foreign Minister stated that if Damascus requests, Iranian forces could be sent to Syria. US officials reported that US military forces carried out at least one self-defense strike in Deir ez-Zor, Syria.

17) On December 4, Grayscale applied to the SEC to convert Grayscale Solana Trust into a Solana ETF.

18) On December 4, sources reported that Paul Atkins, the SEC chair nominee from the Trump administration, was unwilling to accept the position.

19) On December 4, the US SEC appointed Jorge Tenreiro as Chief Litigation Counsel to strengthen cryptocurrency regulation.

20) On December 4, Bank of England Governor Bailey stated that the UK is expected to cut interest rates four times next year.

21) On December 4, the US ADP November employment number was 146,000, below the expected 150,000, with the previous value revised from 233,000 to 184,000.

22) On December 4, the Eurozone’s October PPI monthly rate was 0.4%, in line with expectations, compared to the previous -0.6%.

23) On December 4, real estate prices in crypto hub Dubai surged by 20% this year, with institutions predicting that the bullish trend will continue next year.

Disclaimer: FameEX makes no representations on the accuracy or suitability of any official statements made by the exchange regarding the data in this area or any related financial advice.