FameEX Weekly Market Trend | December 19, 2024

2024-12-19 11:01:00

1. BTC Market Trend

From December 16 to December 18, the BTC spot price swung from $1000,036.77 to $108,580.97, an 8.54% range.

The key recent statements from the European Central Bank (ECB) over the past three days are as follows:

1) On December 16, ECB Governing Council Member Wunsch stated that the ECB is generally reassured by market expectations for rate cuts. Governing Council Member Kazimir indicated that gradual 25-basis-point rate cuts are the most prudent strategy.

2) On December 17, ECB President Lagarde stated that more rate cuts are coming, and the direction is clear. Governing Council Member Rehn believed continuing the rate cut cycle into the new year is the right policy. Executive Board Member Schnabel supported gradual rate cuts to a “neutral level”.

3) On December 18, Governing Council Member Wunsch stated that rates are likely to be set at around 2%. He described four rate cuts as a meaningful and relatively appropriate scenario, adding that interest in holding Bitcoin reserves is minimal.

On December 17 local time, U.S. President-elect Donald Trump secured enough electoral votes during the Electoral College meetings in each state, officially winning the presidency. The Electoral College is a critical component of the U.S. presidential election system, requiring 270 out of 538 electoral votes to win. Final tallies show Trump secured 312 electoral votes. Next, the electoral results from each state will be sent to Congress. On January 6, Congress will formally count the votes in a joint session and announce Trump and Vance as the next President and Vice President, respectively. Trump and Vance will officially take the oath of office on January 20, 2025.

Coinbase disclosed in a transparency report that it received 10,707 requests from global law enforcement and government agencies over the past year, an 18% decrease compared to the previous reporting period. In contrast, requests from Singapore surged by 221%, rising from 34 in 2023 to 109 this year. This reflects heightened regulatory activity as the region establishes itself as a cryptocurrency hub. According to Coinbase, 81% of the requests came from six major jurisdictions: the United States, the United Kingdom, Germany, France, Spain, and Australia. Most of these requests pertained to criminal investigations involving illicit financial activities, fraud, or other criminal matters. Coinbase emphasized that each request undergoes review by a dedicated team of lawyers, analysts, and privacy experts. While Coinbase does provide certain customer details—such as names, IP addresses, and payment information—in response to valid requests, the company asserts that no government has direct access to its systems.

The UAE is emerging as a global hub for blockchain and cryptocurrency innovation, with key trends including Shariah-compliant services, Dirham-backed stablecoins, and international talent migration. At the Bitcoin MENA and Abu Dhabi Finance Week events, industry leaders discussed the future of the crypto industry in the Middle East. Blockdaemon’s Chief Revenue Officer, Vranjes, described the UAE as a launchpad for blockchain projects, citing clear regulations that attract talent from London, India, and the Asia-Pacific region. Demand for Shariah-compliant crypto services, particularly in decentralized finance (DeFi), is growing significantly. Core DAO's Bendjemil highlighted how this opens up opportunities for members of the Muslim community. Zurawinski noted that Dirham-backed stablecoins could strengthen the UAE’s local payment infrastructure. On October 18, a stablecoin issuer received preliminary approval from the UAE Central Bank.

From December 19 to December 22, for the BTC spot trading, sell orders at $169,400 and bottom-fishing buy orders at $73,970, $59,935, and $45,900 do not need to be canceled. Similarly, for the ETH spot trading, sell orders at $8,510, $7,840, and $5,040, along with bottom-fishing buy orders at $2,040 and $1,730, can remain. For altcoins, consider bottom-fishing spot trades to slightly increase your positions.

2. CMC 7D Statistics Indicators

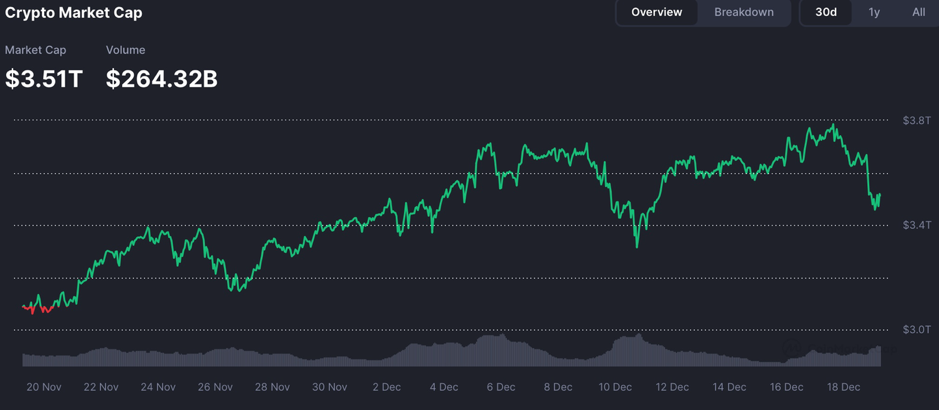

Overall market cap and volume, source: https://coinmarketcap.com/charts/

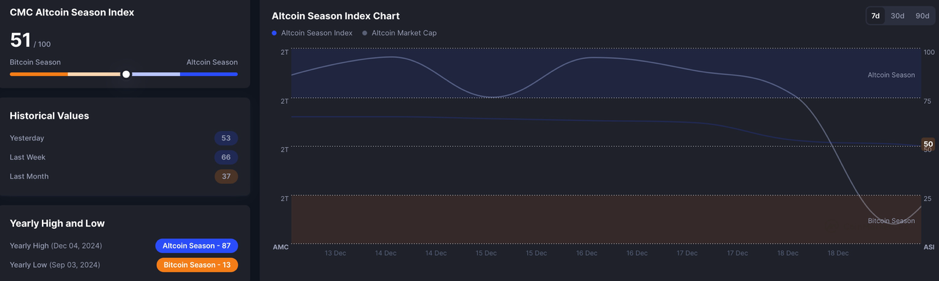

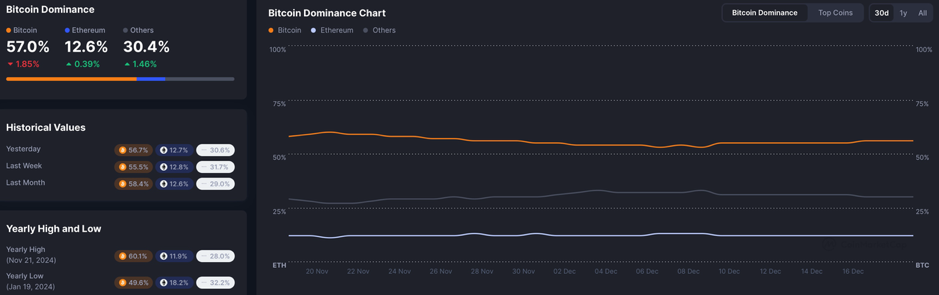

Altcoin Season Index and Bitcoin Dominance: https://coinmarketcap.com/charts/

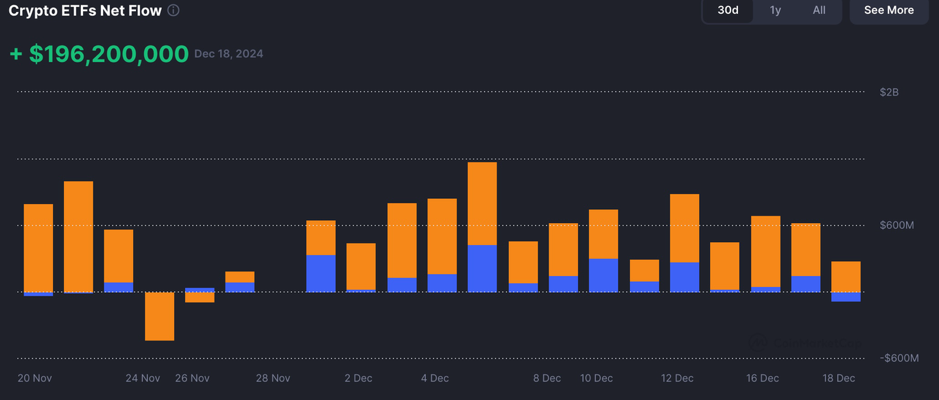

Crypto ETFs Net Flow: https://coinmarketcap.com/charts/

CoinMarketCap 100 Index: https://coinmarketcap.com/charts/cmc100/

(Used to measure the overall performance of the top 100 cryptocurrency projects by market capitalization on CoinMarketCap)

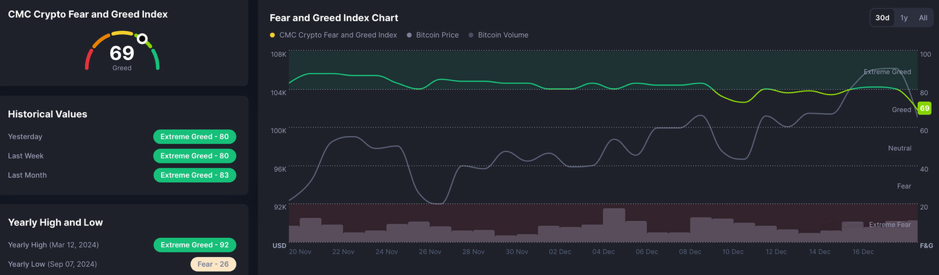

Fear & Greed Index, source: https://coinmarketcap.com/charts/

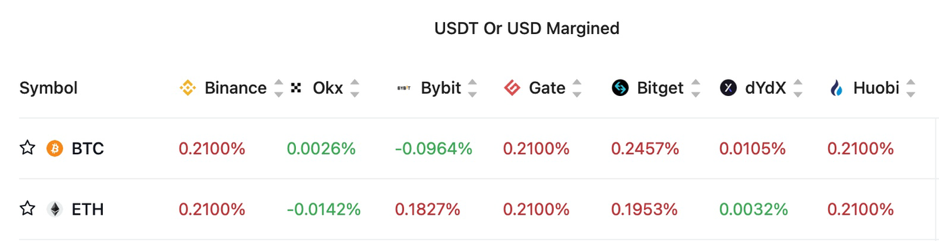

3. Perpetual Futures

The 7-day cumulative funding rates for major exchanges' mainstream cryptocurrencies are generally positive, indicating a high level of leverage among market bulls.

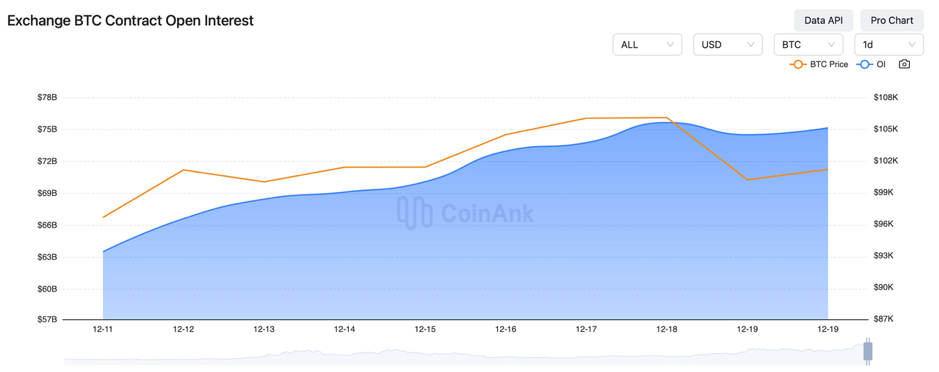

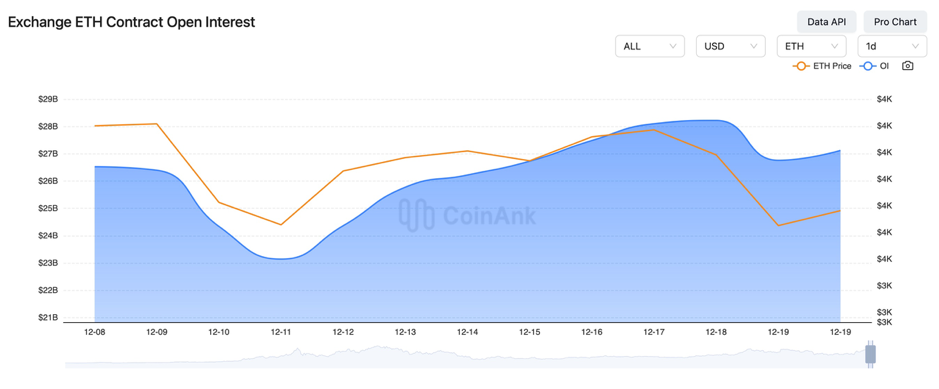

In the past three days, the open interest in BTC and ETH contracts has increasingly risen.

Exchange BTC Contract Open Interest:

Exchange ETH Contract Open Interest:

Note: All the above information is provided for reference purposes only and should not be construed as specific investment advice.

4. Industry Roundup

1) On December 16, Nigerian authorities conducted a surprise raid on a crypto scam hub, arresting nearly 800 suspects, including foreign nationals.

2) On December 16, the U.S. Financial Accounting Standards Board issued new guidelines on “Accounting and Disclosure for Crypto Assets”.

3) On December 16, Bitcoin set a record with its longest seven-week rally since 2021.

4) On December 16, it was reported that South Korea’s Constitutional Court is set to hear the impeachment case against President Yoon Suk-yeol. Approval requires six judges, with only six currently seated. Political parties are seeking to fill the three vacant seats to restore the nine-member panel.

5) On December 16, SoftBank CEO Masayoshi Son planned to announce a $100 billion investment in the U.S. during a meeting with Donald Trump.

6) On December 16, the People’s Bank of China announced plans for moderately loose monetary policies next year, including timely reserve requirement and interest rate cuts to maintain ample liquidity.

7) On December 16, the chairman of the Korea Exchange called for the institutionalization of cryptocurrencies to secure an international competitive edge.

8) On December 16, Hong Kong committed to implementing a crypto asset reporting framework, aiming to complete necessary legislative revisions by 2026.

9) On December 17, a cybersecurity firm reported a sharp increase in password-stealing attacks targeting crypto wallets, especially among macOS users.

10) On December 17, Hong Kong media reported that Chinese investors are flocking to Ethiopia for cryptocurrency mining projects, with Bitmain among the participants.

11) On December 17, the UK FCA released a transparency plan for the crypto market, inviting industry feedback.

12) On December 17, the Bitcoin-to-gold ratio hit an all-time high: 1 BTC = 40 ounces of gold.

13) On December 17, Canada’s November CPI remained at 0%, below the expected 0.1% and previous 0.4%.

14) On December 17, UK November unemployment claims fell by 0.03 million, with the previous data revised from 26,700 to -10,900. The ILO unemployment rate for the three months ending October was 4.3%, as expected.

15) On December 17, UK November CPI rose by 0.1% month-on-month, matching expectations but below the previous 0.6%.

16) On December 17, U.S. Bitcoin spot ETFs surpassed their gold ETF counterparts in scale.

17) On December 18, the Bitcoin Policy Institute drafted an executive order to designate Bitcoin as a strategic reserve asset.

18) On December 18, Donald Trump met with the CEO of Crypto.com to discuss personnel appointments in the crypto sector.

19) On December 18, Binance’s He Yi clarified that rumors of Binance Alpha launching five projects were not from official sources. Binance Alpha will focus on supporting BNB Chain ecosystem projects, while most meme coins are expected to go to zero. Over 100 trending projects will be added to Binance Alpha's watchlist.

20) On December 18: The Eurozone’s November CPI monthly final value was -0.3%, matching the expected and previous value. The Eurozone’s November CPI annual final value was 2.2%, slightly below the expected 2.3%, with the previous value revised from 2.3% to 2.0%.

21) On December 18, a cryptocurrency company executive in Connecticut, USA, was sentenced to four years in prison for embezzling $4.46 million.

22) On December 18, the European Securities and Markets Authority issued final guidelines for implementing MiCA crypto regulations. The UK FCA launched a consultation on crypto regulation.

23) On December 18, China’s National Immigration Administration extended visa-free transit stays for foreigners to 240 hours, added 21 ports of entry and exit, and expanded the scope of stay activities.

24) On December 18, MicroStrategy purchased approximately 15,350 Bitcoin with $1.5 billion in cash.

Disclaimer: FameEX makes no representations on the accuracy or suitability of any official statements made by the exchange regarding the data in this area or any related financial advice.