FameEX Weekly Market Trend | January 21, 2025

2025-01-21 05:35:05

1. BTC Market Trend

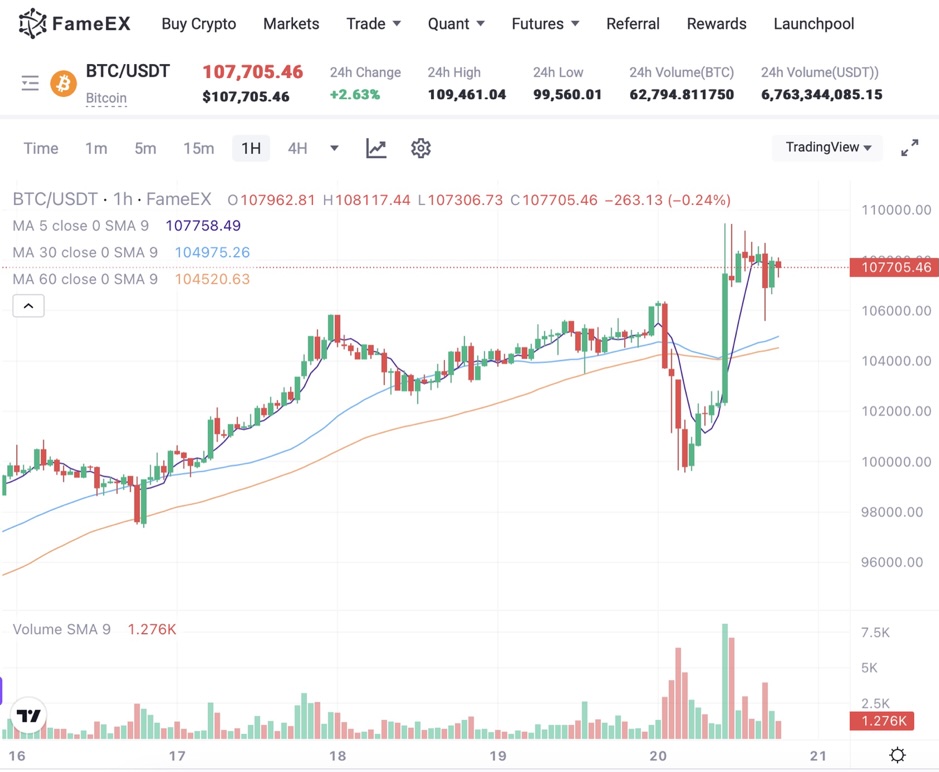

From January 16 to January 19, the BTC spot price swung from $97,213.83 to $106,341.14, a 9.39% range.

In the past four days, the Federal Reserve (Fed) and the European Central Bank (ECB) have made the following important statements:

1) On January 16, New York Federal Reserve President Williams indicated that the process of inflation easing is still ongoing, but the 2% target has not yet been reached. More time is needed to consistently achieve this goal.

On January 16, Richmond Federal Reserve President Barkin stated that newly released price data “continues to follow the trend we’ve seen, indicating that inflation is moving toward the target.” Policymakers need to complete the task. “I still believe we need to take action to reach the final mile and return to 2%.”

On January 16, Chicago Federal Reserve President Goolsbee stated that December’s consumer price index increase was below expectations. This data supports his view that price pressures are easing. The trend of improving inflation is continuing, and he remains optimistic for 2025, believing the U.S. economy can continue to grow and achieve a soft landing.

2) On January 17, Fed Governor Waller indicated that December’s inflation data was very good. If the data allows, the possibility of a rate cut in March cannot be ruled out.

On January 17, a New York Fed report showed that the Fed could continue reducing its balance sheet, as reserves are ample and there is no pressure to halt.

On January 17, the Atlanta Federal Reserve’s GDPNow model estimated U.S. Q4 GDP growth at 3.0%, up from the previously forecasted 2.7%.

3) On January 16, according to the ECB meeting minutes, members are increasingly confident that inflation will return to the target in the first half of 2025. If inflation baseline forecasts for the coming months and quarters are confirmed, it is considered appropriate to gradually ease policy restrictions.

According to estimates from blockchain analytics platform Arkham Intelligence, “Crypto President” Trump saw his net worth soar to $28 billion overnight, thanks to the launch of his virtual currency, “TRUMP”, which increased his estimated net worth by 400%. The token reached $28, and Trump’s affiliates, CIC Digital LLC and Fight Fight Fight LLC, control 80% of the supply. The value of the cryptocurrency Trump personally holds surged to $22.4 billion. For context, Forbes estimated Trump's net worth at $5.6 billion last November.

On January 17, China’s National Bureau of Statistics released data:

The total GDP for 2024 reached 134.9084 trillion yuan, growing by 5% year-on-year.

The fourth quarter saw a year-on-year growth of 5.4%.

The per capita disposable income for residents in 2024 was 41,314 yuan, a nominal increase of 5.3% compared to the previous year.

The population in 2024 was 1.40828 billion, a decrease of 1.39 million compared to the end of the previous year.

The urbanization rate continued to rise.

From January 20 to January 22, keep monitoring ETH spot trading opportunities. The sell order at $5,125, along with the buy orders at $2,040 and $1,730, should remain active. For the BTC spot, maintain the sell order at $169,400 and the buy orders at $73,970, $59,935, and $45,900. It is recommended that the position allocation in altcoin spot trading continue to increase!

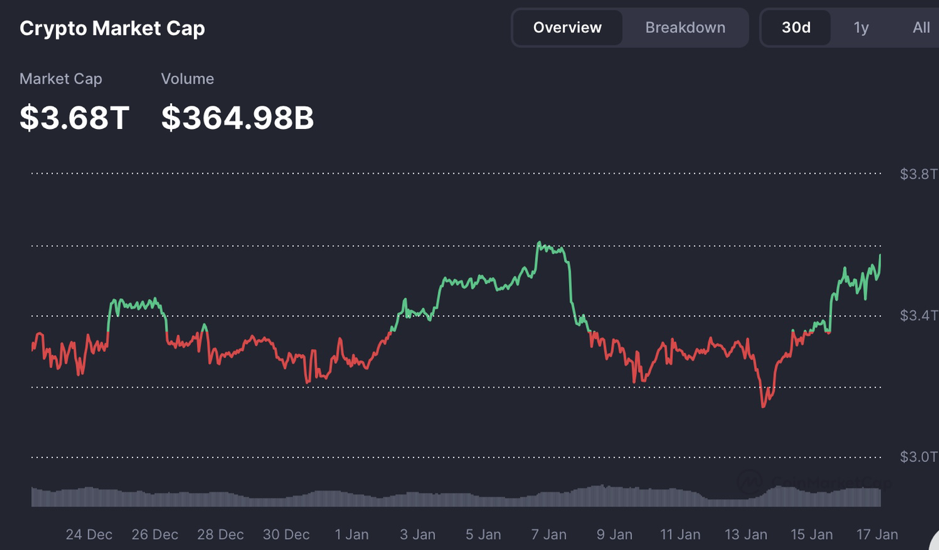

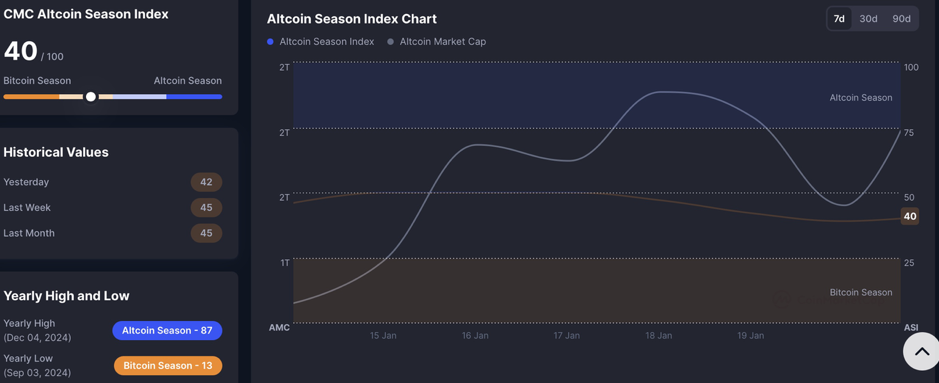

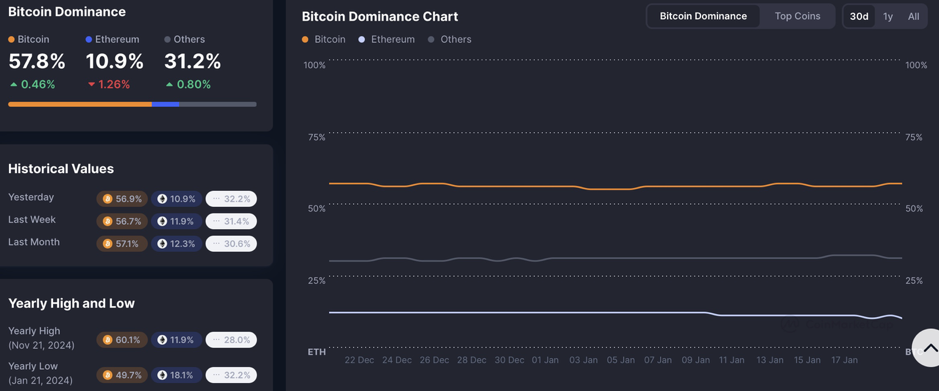

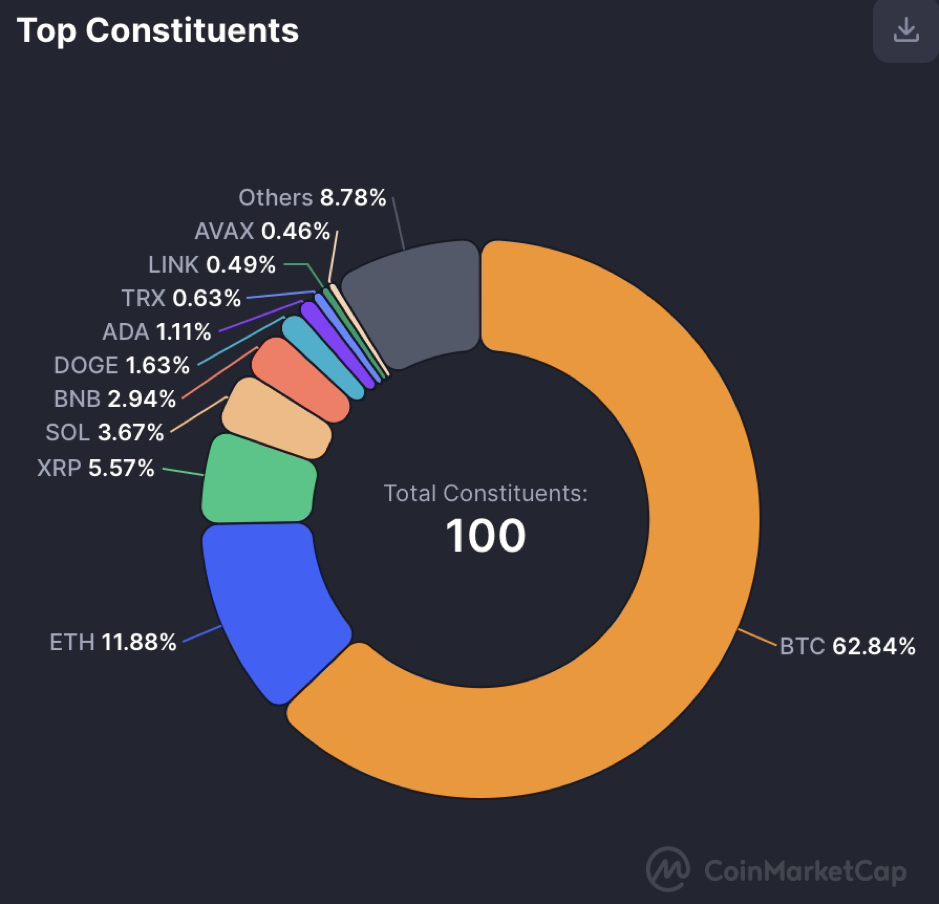

2. CMC 7D Statistics Indicators

Overall market cap and volume, source: https://coinmarketcap.com/charts/

Altcoin Season Index and Bitcoin Dominance: https://coinmarketcap.com/charts/

Crypto ETFs Net Flow: https://coinmarketcap.com/charts/

CoinMarketCap 100 Index: https://coinmarketcap.com/charts/cmc100/

(Used to measure the overall performance of the top 100 cryptocurrency projects by market capitalization on CoinMarketCap)

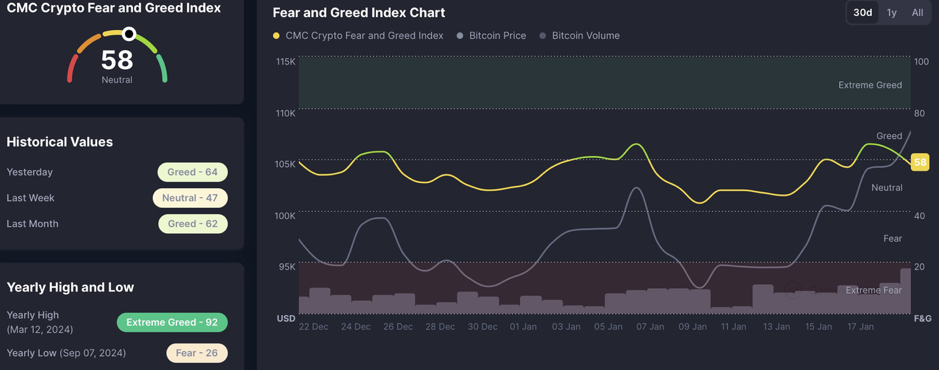

Fear & Greed Index, source: https://coinmarketcap.com/charts/

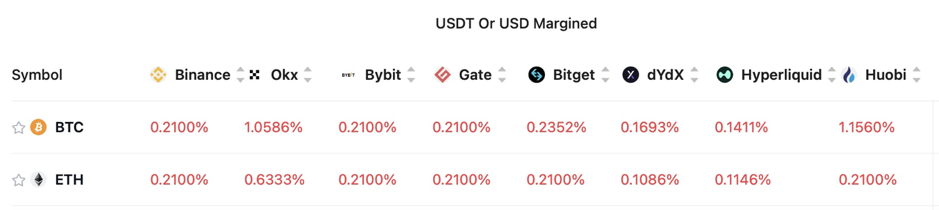

3. Perpetual Futures

The 7-day cumulative funding rates for major exchanges’ mainstream cryptocurrencies are generally positive.

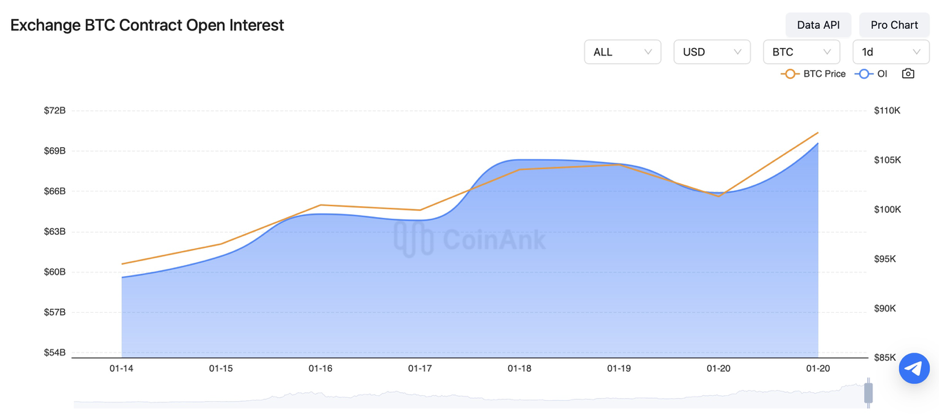

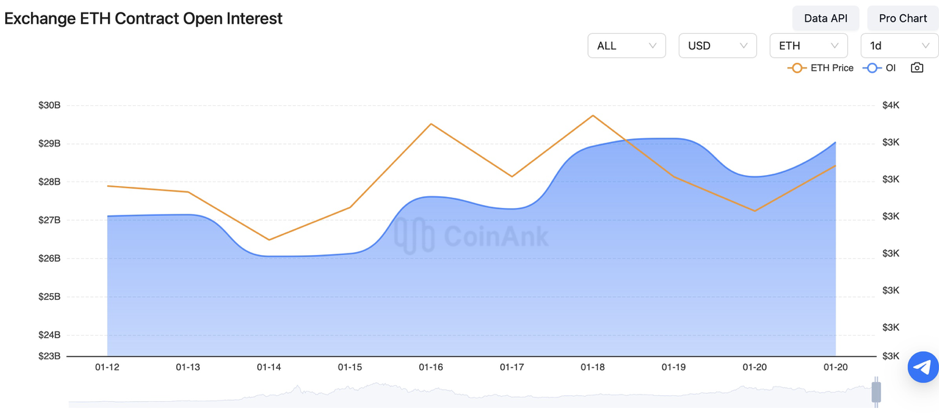

In the past three days, the contract open interest for both BTC and ETH has been continuously increasing.

Exchange BTC Contract Open Interest:

Exchange ETH Contract Open Interest:

Note: All the above information is provided for reference purposes only and should not be construed as specific investment advice.

4. Industry Roundup

1) On January 16, the number of initial jobless claims in the U.S. for the week ending January 11 was 217,000, higher than the expected 210,000. The previous value was revised from 201,000 to 203,000.

2) On January 16, the UK’s GDP for the three months ending November remained flat at 0%, in line with expectations, with the previous value revised from 0.10% to 0%.

3) On January 16, OpenAI CEO Sam Altman stated that in the future, “the ability to ask questions” will be more important than “intelligence”.

4) On January 16, U.S. President Biden delivered a farewell speech, focusing on AI, the climate crisis, and social media regulation.

5) On January 16, the CoinGecko 2024 Report displayed that the total market capitalization of the crypto market reached a historic high of $3.91 trillion.

6) On January 16, a survey found that 52% of Americans have sold traditional assets like stocks or gold to invest in Bitcoin.

7) On January 17, the U.S. imposed a new round of sanctions on Russia aimed at combating sanctions evasion. U.S. Treasury Secretary nominee Becerra stated that the budget deficit issue seriously supports the Fed’s independence.

8) On January 17, the Bank of Canada planned to halt its balance sheet reduction in the first half of the year and begin purchasing government bonds in Q4.

9) On January 17, the UK appointed Emma Reynolds as Minister for Economic Affairs to oversee cryptocurrency policies.

10) On January 17, Google’s CEO stated that Gemini’s capabilities have “outpaced competitors”, with a goal of reaching 500 million users by the end of the year.

11) On January 17, Trump planned to make cryptocurrency a national priority. Foreign media reported that Trump is open to the idea of a digital currency strategic reserve based in the U.S. His Treasury Secretary nominee Becerra expressed no reason to support central bank digital currencies.

12) On January 17, the Financial Times reported that several pension funds in the UK and Australia have recently made small allocations to Bitcoin.

13) On January 18, Russia and Iran signed a comprehensive strategic partnership agreement.

14) On January 18, the IMF forecasted global economic growth of 3.3% in 2025, slightly higher than the October prediction of 3.2%. Global growth is expected to remain at 3.3% in 2026.

15) On January 18, the Eurozone December CPI annual rate final value was 2.4%, in line with expectations, and the previous value was also 2.4%. The Eurozone December CPI monthly rate final value was 0.4%, as expected, with the previous value also 0.4%.

16) On January 18, Chinese President Xi Jinping spoke with Trump over the phone, emphasizing the importance of bilateral interactions and expressing hopes for a positive start for the U.S.-China relations during the new U.S. presidential term. Both sides aim for greater progress in the relationship.

17) On January 18, the Thai Prime Minister revealed he was a victim of a telecom scam, where the scammers impersonated a leader from an ASEAN country.

18) On January 18, Texas State Senator Charles Schwertner introduced SB 778, a bill to establish a state-level Bitcoin strategic reserve.

19) On January 19, Trump launched a virtual currency, causing his net worth to soar by 400% overnight. Trump’s team is reviewing pending SEC crypto cases and may freeze lawsuits not involving fraud allegations.

20) On January 19, South Korean President Yoon Suk-yeol was officially detained, becoming the first sitting president in the country’s history to be incarcerated.

21) On January 19, TikTok incident: The app stopped providing services to U.S. users today, and it’s no longer available for download in the U.S. Apple App Store. Trump announced he would sign an executive order next Monday to prevent TikTok from being shut down.

22) On January 19, next Monday, Trump will be sworn in as the new U.S. President. Next Tuesday, Canada will release the December CPI monthly rate. Next Thursday, the U.S. will release initial jobless claims for the week ending January 18.

23) On January 19, next Friday, Japan’s central bank will announce its interest rate decision and economic outlook report, followed by a press conference from Bank of Japan Governor Ueda Kazuo on monetary policy.

Disclaimer: FameEX makes no representations on the accuracy or suitability of any official statements made by the exchange regarding the data in this area or any related financial advice.