Despite Year Highs, Investors' Primary Focus Is Still Bitcoin

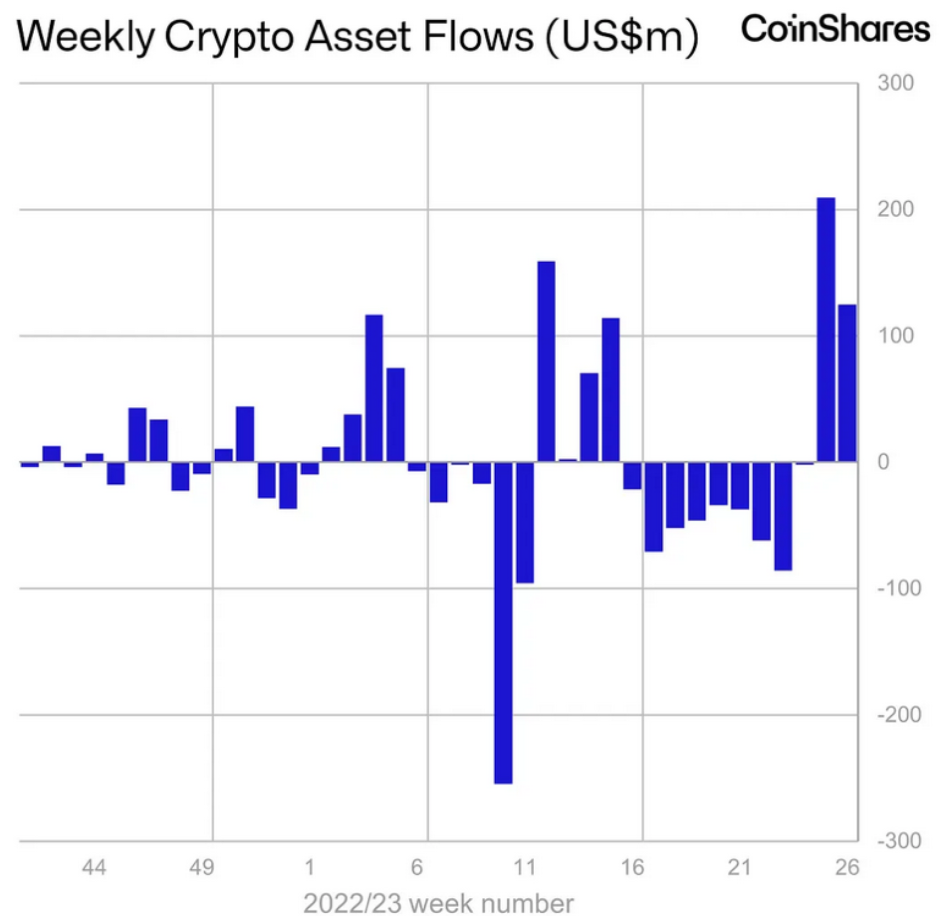

2023-07-04 08:32:20The previous two weeks have seen inflows of $310.6 million into Bitcoin investment instruments.

Source: www.bitcoinsistemi.com

According to Coinshares, institutional investors' primary focus over the past two weeks has been on Bitcoin (BTC), as the cryptocurrency keeps setting new 2023 price highs. James Butterfill, the head of research at CoinShares, said in a study dated July 3 that inflows into Bitcoin-related goods totaled $310.6 million over the previous two weeks, accounting for the vast bulk of inflows into crypto products.

Bitcoin continued to be the major focus of investors, accounting for 98% of all digital asset transactions during the previous two weeks from Butterfill. The nine weeks in a row of outflows have been reversed by the past two weeks of inflows. Over the last week, short Bitcoin products also had a little outflow of $0.9 million.

It coincides with a rise in Bitcoin's price and dominance, and marks the second time this year that Bitcoin products have accounted for 98% of investment flows into cryptocurrencies. This increase is mostly attributed to BlackRock's June 15 application for a spot Bitcoin ETF, which was followed by similar files from companies including Fidelity, Invesco, Wisdom Tree, and Valkyrie.

Over the past two weeks, Bitcoin contributed for 98% of investment product inflows into digital assets. Source: CoinShares

After the filing, the cost of one bitcoin has risen 25.2%, to a current price of $31,131. Data shows that Bitcoin's dominance, which measures its market cap in relation to the overall market value of all cryptocurrencies, has increased to 51.46%. The second week of inflows, which have stopped a protracted outflow trend, saw $2.7 million inflows into Ethereum investment products.

Why Allowing a Bitcoin ETF Might Cause $18 Billion Worth of Sell Pressure

On June 26, Fireblocks CEO Michael Shaulov told Cointelegraph that institutional investors have shown a fair amount of interest in key cryptocurrencies like Bitcoin and Ethereum, but less so in alternative cryptocurrencies. The narrative surrounding Bitcoin, according to Shaulov, has been less explicit, but he points out that the majority of investors feel a need to keep the cryptocurrency.

Disclaimer: FameEX makes no representations on the accuracy or suitability of any official statements made by the exchange regarding the data in this area or any related financial advice.