AAVE (Aave) Token Price & Latest Live Chart

2022-01-24 07:42:20

What is AAVE (Aave)?

Aave is a decentralized finance (DeFi) protocol that enables users to lend and borrow cryptocurrencies in a secure, permissionless, and transparent manner. Built on the Ethereum blockchain, Aave leverages smart contracts to facilitate these transactions without the need for a centralized intermediary in order to ensure that all operations are automated and governed by pre-defined code. The name "Aave" comes from the Finnish word for "ghost," symbolizing the protocol's focus on decentralization and invisibility in the financial system.

The platform allows users to deposit various cryptocurrencies into liquidity pools from which others can borrow. Lenders earn interest on their deposits, while borrowers provide collateral to secure their loans. The process is governed by smart contracts, which are self-executing contracts with the terms of the agreement directly written into code. These contracts handle all aspects of the transaction, from calculating interest rates to ensuring collateralization which makes Aave a trustless and efficient platform.

Aave is particularly known for its support of overcollateralized loans, where borrowers must provide collateral that exceeds the value of the loan. This system minimizes the risk for lenders, as the collateral can be liquidated if the value of the loaned assets decreases, ensuring that the lender's investment is protected. Additionally, Aave offers a native token, AAVE, which can be used within the platform for governance, staking, and earning rewards.

How does AAVE (Aave) work?

Aave operates by utilizing a system of smart contracts to automate and secure the lending and borrowing process. The protocol is based on the Ethereum blockchain, which means that all transactions are recorded on the blockchain to provide transparency and security. If you want to participate in Aave, users must connect a compatible digital wallet, such as MetaMask, to the Aave platform.

Once connected, users can deposit their cryptocurrency into Aave's liquidity pools. These pools are the backbone of the platform, as they provide the liquidity that is lent out to borrowers. When a user deposits an asset into a pool, they receive a corresponding amount of aTokens, which are interest-bearing tokens that accrue interest over time based on the borrowing demand for that asset. For example, if a user deposits Ether (ETH), they receive aTokens that represent their deposit and earn interest in ETH.

Borrowers, on the other hand, can take out loans by providing collateral. The amount a borrower can borrow is determined by the loan-to-value (LTV) ratio, which varies depending on the asset. Aave allows borrowers to take out loans in various cryptocurrencies, with the option to choose either a stable or variable interest rate. The borrowed funds are transferred directly to the borrower’s wallet, and interest begins to accrue immediately.

One of the most innovative features of Aave is its Flash Loans. Flash Loans allow users to borrow funds without providing collateral, as long as the loan is repaid within the same blockchain transaction. This feature is primarily used by developers for arbitrage opportunities, refinancing, or other complex financial maneuvers. If the loan is not repaid within the transaction, the entire transaction is reversed which can ensure the security of the loan.

AAVE (Aave) market price & tokenomics

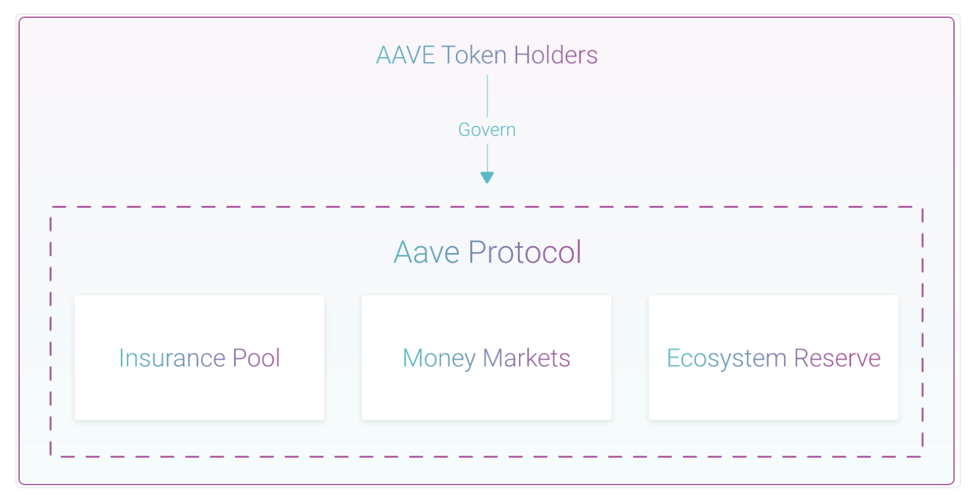

The AAVE token serves multiple purposes within the Aave ecosystem. It acts as a governance token, allowing holders to vote on changes to the protocol, and as a utility token for staking and earning rewards. The tokenomics of AAVE are designed to incentivize participation in the governance and security of the protocol.

AAVE Token Holders Govern Aave Protocol, Source: AAVE

The total supply of AAVE is capped, and the token is deflationary which means that the supply decreases over time through token burns. This mechanism helps to increase the value of the remaining tokens as the platform grows and demand for AAVE increases. Stakers can lock their AAVE tokens in the protocol's Safety Module, a reserve fund designed to cover shortfalls in the protocol. In return, stakers earn a portion of the fees generated by the platform. That’s why this provides them with a steady income stream. As of now, AAVE (Aave) is ranked #31 by CoinMarketCap with market capitalization of $3,954,146,118 USD. The current circulating supply of AAVE coins is 15,061,295.

The market price of AAVE is influenced by various factors, including the overall demand for DeFi services, the adoption of the Aave platform, and broader market trends in the cryptocurrency space. During August 2024, DeFi is showing signs of a resurgence with Aave recording a new all-time high in weekly active borrowers. This surge is attributed to the introduction of new lending markets, with the Base ecosystem accounting for nearly 30% of the unique wallets on Aave V3, then followed by Arbitrum and Polygon. The platform's weekly depositors are also nearing peak levels, as evidenced by a spike in Aave depositors earlier in the month. Aave operates across 12 chains to facilitate overcollateralized loans through smart contracts. Despite being the third-largest DeFi protocol by TVL, Aave's TVL is still below its October 2021 peak.

Why do you invest in AAVE (Aave)?

Investing in the Aave project offers the opportunity to engage with one of the top DeFi platforms that has established itself as a leader in the crypto lending space. By utilizing smart contracts, Aave provides an automated and secure environment for borrowing and lending cryptocurrencies. The platform's overcollateralized loan structure ensures that lenders are protected from defaults, while borrowers can access liquidity without relying on traditional financial intermediaries. Additionally, Aave's native token (AAVE) serves not only as a tradable asset but also as a means to participate in the platform's governance and earn rewards through staking.

The growing adoption of Aave, particularly in emerging Layer-2 blockchain networks, reflects the platform's ability to innovate and adapt within the rapidly evolving DeFi landscape. With billions in liquidity locked across multiple markets, Aave has proven its resilience and utility in providing decentralized financial services. As the broader DeFi sector shows signs of recovery, Aave's position as a top-tier protocol makes it a compelling investment choice for those looking to capitalize on the future of decentralized finance.

Is AAVE (Aave) a good Investment?

AAVE token is often considered a strong investment within the cryptocurrency space, particularly for those interested in the DeFi sector. The platform's consistent innovation, such as the introduction of Flash Loans and the expansion into Layer-2 solutions, demonstrates its commitment to staying at the forefront of the DeFi movement. Aave's large user base and significant TVL further underscore its importance in the ecosystem.

However, like all investments, AAVE comes with risks. The volatility of the cryptocurrency market, potential regulatory changes, and the technical risks associated with smart contracts and DeFi protocols should all be carefully considered. Despite these risks, AAVE's strong fundamentals, coupled with its innovative approach to the DeFi sector make it a potentially rewarding investment for those willing to navigate the complexities of the crypto market. Investors should also keep in mind that while AAVE stands out as a leading DeFi protocol with a robust platform, a growing user base, and a token that offers both utility and governance benefits, the inherent risks of cryptocurrency investments should not be overlooked. It is crucial to conduct thorough research and consult with a financial advisor to fully understand these risks before making any investment decisions.