BTC (Bitcoin) Token Price & Latest Live Chart

2024-07-25 12:27:45

What is BTC (Bitcoin)?

Bitcoin is a groundbreaking digital currency in the world now that operates independently without any central banks or single administrators. It was introduced in 2009 by an unknown entity using the pseudonym Satoshi Nakamoto, whose vision was to create a decentralized system for electronic transactions that did not rely on trust in any single party. Bitcoin is the first successful implementation of a distributed ledger technology known as blockchain, which is essentially a publicly accessible and immutable database of all transactions updated and held by a network of computers, known as nodes.

The process of validating transactions and securing the network is known as mining. Miners use powerful computers to solve complex mathematical problems that validate and record transactions on the blockchain. As a reward for their contribution to the network's security and functionality, miners receive newly minted bitcoins. This process also introduces new bitcoins into the system at a predictable and decreasing rate. The limited supply is one of the factors that contribute to Bitcoin's perception which is often referred to as "digital gold."

Bitcoin's value proposition extends beyond its role as a medium of exchange. It is also seen as a store of value and an investment asset, with its price being determined by the interplay of supply and demand on cryptocurrency exchanges. The SEC's approval of the first spot Bitcoin ETFs in January 2024 marked a turning point in the regulatory stance on cryptocurrency investments. Bitcoin Spot ETFs are a significant development in the cryptocurrency space, offering investors a regulated and accessible investment vehicle to participate in the Bitcoin market without the complexities of direct cryptocurrency ownership. These ETFs hold actual Bitcoins and issue shares that correspond to the holdings in order to allow for easy trading through traditional brokerage accounts.

The cryptocurrency's decentralized nature, coupled with its potential for financial privacy and autonomy, has attracted a diverse user base, ranging from individuals seeking an alternative to traditional fiat currencies to businesses looking to leverage blockchain technology for new applications. However, its use in illicit activities, regulatory challenges, and the environmental impact of mining have been points of criticism and ongoing debate in the global financial community. Despite these challenges, Bitcoin remains the most well-known and widely used cryptocurrency, continually influencing the development of the broader digital asset ecosystem.

How does BTC (Bitcoin) work?

Bitcoin operates on a decentralized network of computers that work together to maintain a shared public ledger known as the blockchain. This blockchain is the backbone of Bitcoin, as it records every transaction that has ever occurred on the network in a chronological and immutable manner. Each block in the blockchain contains a list of transactions that are grouped together and validated by the network's participants, called nodes. These transactions are broadcast to the network, and through a process called consensus, the nodes agree on the validity of the transactions and their order within the blockchain.

The security and integrity of the Bitcoin network are maintained through a process called mining. Miners, equipped with specialized hardware, compete to solve a complex cryptographic puzzle that requires significant computational power. The first miner to solve the puzzle gets the right to add a new block of transactions to the blockchain. This process is intentionally resource-intensive to ensure that adding new blocks is both difficult and requires a substantial investment of time and electricity, thereby preventing malicious actors from easily manipulating the blockchain. As a reward for their efforts and to incentivize the continuation of this critical function, the successful miner receives a predetermined number of new bitcoins, known as the block reward, along with any transaction fees paid by users for faster processing of their transactions.

The Bitcoin protocol also includes a mechanism known as halving, which reduces the block reward by half approximately every four years. This event is programmed into the Bitcoin code to control inflation by slowing down the rate at which new bitcoins are created. The halving ensures that there will only ever be 21 million BTC in existence, with the final Bitcoins expected to be mined in the year 2140. This scarcity is a key feature of Bitcoin. Users interact with the Bitcoin network through digital wallets, which store the cryptographic keys necessary to sign transactions and access their holdings. These wallets can be software-based, hardware devices, or even paper copies, providing users with varying levels of security and convenience. Transactions are made by transferring bitcoins from one wallet to another, with the network ensuring that the sender has the necessary balance and that the coins haven't been spent elsewhere, a problem known as double-spending. The combination of cryptographic security, decentralized consensus, and a transparent ledger allows Bitcoin to function as a trustless, permissionless, and borderless monetary system.

BTC (Bitcoin) market price & tokenomics

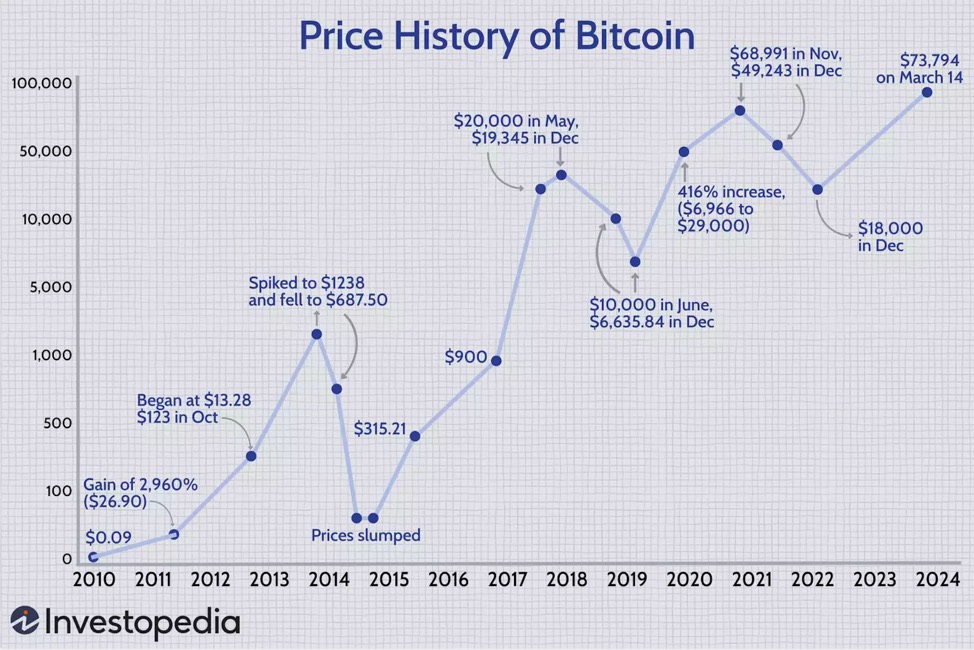

Since its introduction in 2009, Bitcoin has experienced a tumultuous price history characterized by rapid increases and sharp declines. Bitcoin's value has seen dramatic surges, such as reaching nearly 30 in 2011, over 1,000 in 2013, and an all-time high of $75,830 in March 2024. These price movements are largely driven by investor enthusiasm, market demand, and the cryptocurrency's scarcity. The asset's volatility is also impacted by the creation of Bitcoin investment instruments, regulatory decisions like the launch of Bitcoin spot ETFs, and the emergence of competing cryptocurrencies. Despite its original intent as a digital currency for daily transactions, Bitcoin has evolved into a speculative investment and a potential hedge against inflation and economic uncertainty.

Bitcoin Price History, Source:Investopedia

Bitcoin's tokenomics are characterized by a fixed maximum supply of 21 million coins, a feature that is significantly different from fiat currencies which can be printed without a cap. This limited supply is further reinforced by the Bitcoin halving event, which occurs approximately every four years and reduces the rate of new BTC entering the market by halving the block reward given to miners. The most recent halving, which occurred in April 2024, reduced the block reward from 6.25 BTC to 3.125 BTC. This deflationary mechanism is designed to mimic the scarcity and value preservation of precious metals like gold, and it contributes to Bitcoin's perception as a digital store of value.

Bitcoin halving refers to the reduction by half of the block reward provided to miners for their role in validating transactions and securing the network. This event is hardcoded into Bitcoin's protocol and serves to control inflation by slowing down the issuance of new coins. Historically, halving events have had a significant psychological impact on the market, often preceded by increased speculation and followed by a period of price volatility. While not guaranteed, the reduction in new supply, coupled with increasing demand, has historically led to upward pressure on Bitcoin's price. As of now, BTC (Bitcoin) is ranked #1 by CoinMarketCap with market capitalization of $1,283,635,159,259 USD. The current circulating supply of BTC coins is 19,726,796.

>> Further Reading: What Will the 2024 Bitcoin Halving Mean for Cryptocurrency Markets?

Why do you invest in BTC (Bitcoin)?

Investing in Bitcoin is often driven by the belief in its potential to revolutionize the financial system by providing a decentralized alternative to traditional fiat currencies. Proponents of Bitcoin view it as a means to achieve financial inclusion, allowing individuals worldwide to participate in economic activities without the need for conventional banking services. Its scarcity, evidenced by a capped supply of coins, is seen as an attractive feature that could make it a hedge against inflation, particularly in times when central banks are increasing the money supply.

Furthermore, Bitcoin's borderless nature and ability to facilitate fast, secure, and low-cost cross-border transactions make it an appealing option for remittances and international trade. The cryptocurrency's resilience and security, underpinned by its robust blockchain technology, offer a level of censorship resistance and financial sovereignty that is difficult to achieve with fiat currencies. Investors are drawn to Bitcoin for its growth potential and the possibility of significant returns on investment, especially as the digital asset continues to gain recognition and integration into various sectors of the global economy.

Is BTC (Bitcoin) a good Investment?

Whether Bitcoin represents a good investment opportunity is contingent upon an individual's risk profile, investment objectives, and the evolving financial ecosystem. Proponents of Bitcoin highlight its growing adoption for transactions, its perceived role as a safeguard against inflationary pressures, and its strengthening economic fundamentals post-halving and with the advent of Bitcoin ETFs. These developments, alongside advancements like the Lightning Network, paint an optimistic picture for Bitcoin.

Conversely, potential investors must also weigh the inherent risks associated with Bitcoin. These encompass regulatory fluctuations, concerns over the long-term sustainability of the network's security as block rewards diminish, the environmental impact of mining operations, and the potential for restrictive government policies. The inherently volatile nature of cryptocurrencies exacerbates these risks, making it imperative for investors to conduct meticulous research and understand their own risk tolerance before committing to invest in Bitcoin.

Find out more about BTC (Bitcoin):

Explorer: Blockchain.com